Equities are continuing to plunge this morning in response to hawkish rhetoric by the U.S. Federal Reserve (Fed), the European Central Bank (ECB) and the Bank of England (BOE). Hitting the market especially tough were the Fed’s Summary of Economic Projections, which showed a higher terminal rate than previously reported and no rate cuts in 2023. This morning’s weak U.S. retail sales data threw salt on the already wounded sentiment with investors increasingly concerned that consumption is declining at a time when global central banks are continuing to tighten monetary policy.

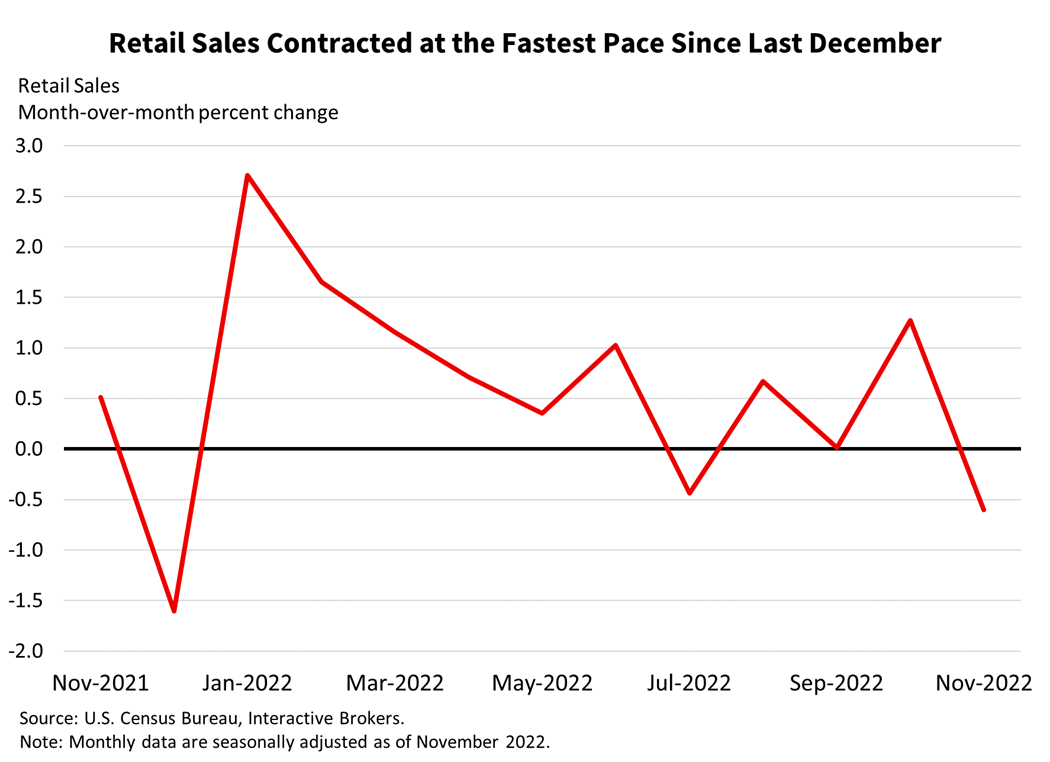

This morning’s November retail sales report was the weakest for the year, featuring the sharpest month-over-month (m/m) contraction since December of 2021. Retail sales declined 0.6%, worse than market expectations of a 0.1% contraction and much softer than October’s 1.3% gain. Declines were generally broad based with department stores, auto dealers, furniture stores, building materials dealers and electronics and appliance stores leading the losses with m/m contractions of 2.9%, 2.6%, 2.6%, 2.5% and 1.5% respectively. Food at home and at dining establishments continue to experience strong traffic however, with gains of 0.9% and 0.8% during the period. Overall, this significant decline in consumption comes at a time when prices are still climbing, with last week’s Consumer Price Index report showing 0.1% m/m and 7.1% year-over-year (y/y) price increases. Investors can now pick their poison. Should they worry about tighter liquidity conditions or declining revenues? In this environment, certainly both.

The inflation component of stagflation has powerful tailwinds that aren’t likely to ease in the near future. Wage pressures are strong due to a shortage of workers, business costs are increasing as companies’ onshore operations, interest rates remain stubbornly high, supply chains remain uncertain and energy commodity prices are high relative to a slowing economy while governments continue to engage in deficit spending.

Equity prices dropped during and following Fed Chairman Jerome Powell’s press conference yesterday. On a positive note, he said the Fed decided that a 50-basis-point (bp) fed funds rate increase, which was anticipated by investors, was appropriate with the central bank succeeding in slowing inflation, at least moderately. The increase brings the target rate to 4.25% to 4.5%. He added that after raising rates aggressively, the Fed will likely have to stay at the terminal rate for some time to cool inflationary pressures for good. The dot plot anticipates a target rate between 5% and 5.25%, implying 75 basis points of increases in 2023. In the Fed’s September meeting, officials had anticipated raising rates to approximately 4.6% by the end of next year. Powell also said Fed officials don’t expect to cut rates next year, a harsh blow to a market that prior to yesterday’s meeting expected rate cuts in 2023 and continues to expect them today. Is the market in denial or is the Fed going to buckle amidst recessionary pressures? Time will tell.

Powell also emphasized that inflation could rear its ugly head if the central bank cuts rates prematurely, like in the 1970s and 80s. As with past presentations, he implied that goods inflation has moderated and that housing services is likely to show price moderation as new leases reflect Americans choosing less expensive housing. The non-housing services category, however, continues to have high inflation because the category is labor intensive. For now, wage pressure continues to contribute to inflation with lower participation rates creating a shortage of workers that is pressuring employers. With the new expectations of higher rates, less optimism about potential rate cuts next year and 2023 earnings estimates falling, equity prices are plunging.

The S&P 500 has declined more than 2% this morning and most other broad indexes are also in a free fall as the economy, consumers and businesses face considerable challenges. While GDP growth is weakening and consumption is declining, businesses are struggling with higher financing costs, considerable wage pressures, rising input costs and supply chain issues. These factors are expected to cause corporate earnings to decline materially. As investors revalue equities to reflect lower earnings, they are also assessing tighter liquidity conditions and if the Fed has and/or will overtighten.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.