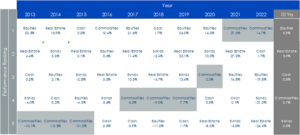

Commodities have been enjoying a strong revival in recent years, with broad commodities returning 27% in 2021 and 15% in 2022 (Figure 1). A combination of fiscal and monetary support in the early phases of the COVID-19 pandemic helped to soften the damage to demand from one of the deepest economic shocks in modern times. As COVID-19 restrictions lifted, commodity demand bounced back strongly.

In 2022, the Ukrainian invasion presented a supply shock, restricting energy and agricultural product supplies and further supporting commodity prices. Whilst many developed world central banks tightened monetary policy in the first half of 2022, inflationary pressures became the most extreme since 1981.

Commodities proved again to be one of the best asset classes to hedge this extreme inflation. After arguably falling behind the curve, developed world central banks sought to get ahead and became the most hawkish since the early 1980s. Commodities emerged as a refuge in the storm.

Figure 1: Asset performance over the past decade

Source: WisdomTree, Bloomberg, data until 31/12/2022. All returns are in USD; 10 Yrs returns are annualised from 31/12/2012 to 31/12/2022. Data: Equity – MSCI World, Bond – Bloomberg Barclays Agg Sovereign TR Unhedged, Real Estate – EPRA/NAREIT Global, Commodity – Optimized Roll Commodity Total Return Index, Cash – US three-month t-bill.

Historical performance is not an indication of future performance and any investments may go down in value.

Cyclical headwinds have emerged

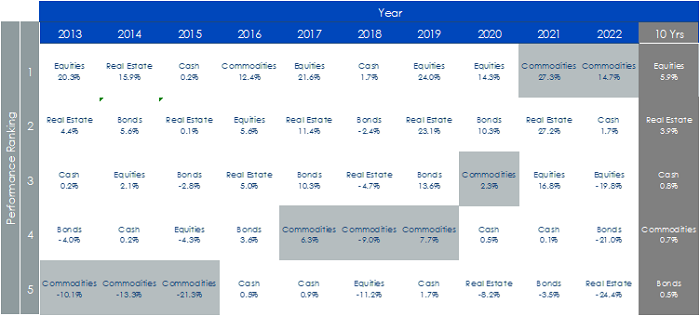

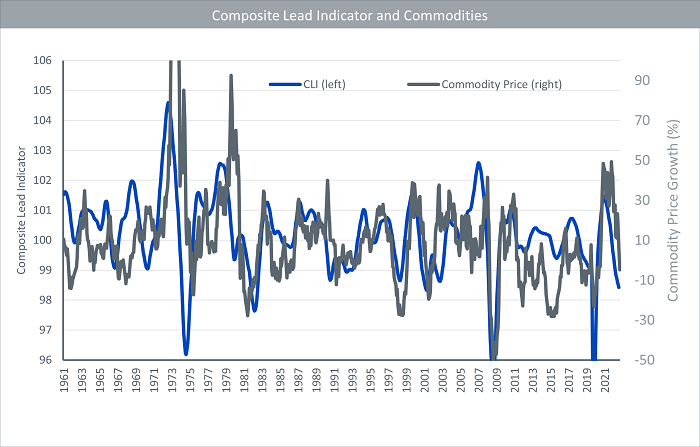

Commodities, often seen as a late-cycle asset performer, struggled in late-2022. Energy prices, which had been propelling the asset class, declined by Q3 2022, joining metals, which had been weak since Q1 2022. Economic deceleration resulting from monetary tightening in developed nations weighed on the asset class. Composite lead indicators (CLIs)—designed to provide early signals of turning points in business cycles—turned decisively even before 2022 started (Figure 2). Commodity performance peaked later in 2022. CLIs are still declining, indicating the cyclical headwinds faced by commodities are still present.

Figure 2

Source: WisdomTree, Bloomberg, OECD, June 1961 to February 2023. Commodity price based on Bloomberg Commodity Total Returns Index. The composite leading indicator (CLI) is designed to provide early signals of turning points in business cycles showing fluctuation of the economic activity around its long-term potential level. CLIs show short-term economic movements in qualitative rather than quantitative terms. CLI is amplitude-adjusted; long-term average = 100.

Historical performance is not an indication of future performance and any investments may go down in value.

China reopening to counter economic headwinds elsewhere

The global economic rebound experienced in 2021 and 2022, and the accompanying commodity rally, occurred largely without China’s contribution. Chinese policy makers pursuing a zero-COVID policy up until November 2022 hamstrung their economy, and growth was disappointing. Although Chinese exports remained relatively strong due to international demand for Chinese goods, constant supply disruptions restrained export volumes during the zero-COVID period.

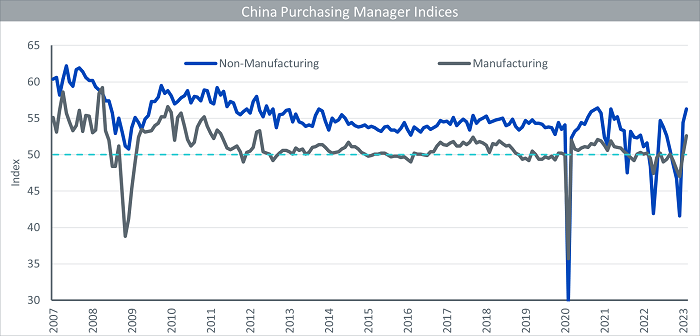

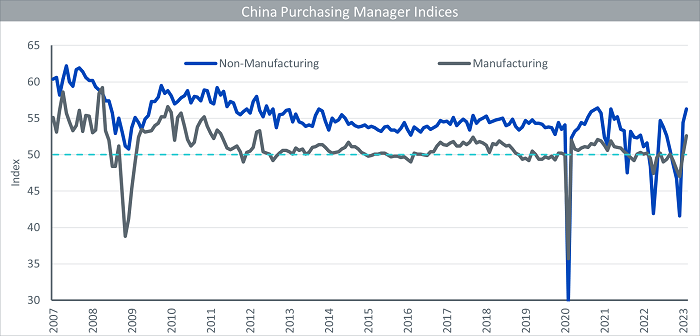

Now that China has abandoned its zero-COVID policies, domestic economic activity is picking up strongly. In fact, the January and February prints of Purchasing Manager Indices (PMIs) in 2023 look encouraging (Figure 3). Both manufacturing and non-manufacturing PMIs rose clearly above 50 (the demarcation between growth and contraction). The February figure (released on 01/03/2023) showed manufacturing PMIs hitting levels not seen since 2012, underscoring that the domestically driven recovery is reaching industry as well as services (manufacturing is more commodity-intense than services, so that is arguably the most important of two indicators).

Figure 3

Source: WisdomTree, Bloomberg, January 2007 to February 2023. Index above 50 indicates expansion. Index below 50 indicates contraction. Dotted line marks that demarcation.

Historical performance is not an indication of future performance and any investments may go down in value.

What about the commodity supercycle?

We believe commodities should see long-term structural support from an energy transition and an infrastructure spending rebound. Furthermore, these catalysts could drive another supercycle in commodities. Supercycles coincide with periods of industrialisation and urbanisation when the supply of commodities failed to keep up with the growth in demand. The last supercycle occurred after China joined the World Trade Organization in 2001, which turbocharged development as barriers to commerce were removed. After two strong years of commodity market performance (2021 and 2022), could we be on the cusp of another supercycle? We believe there are some strong structural underpinnings but, for now, business cycle dynamics (including a rising risk of recession) could dominate price behaviour in the short term.

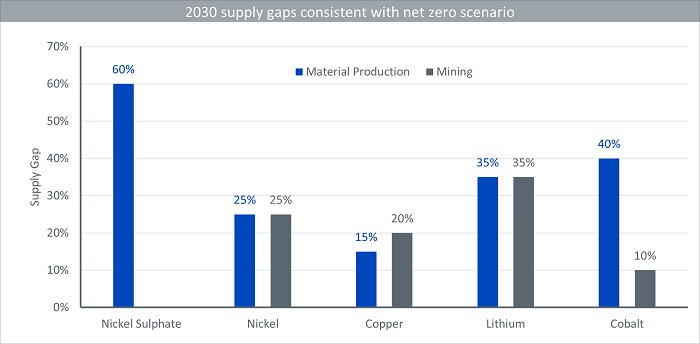

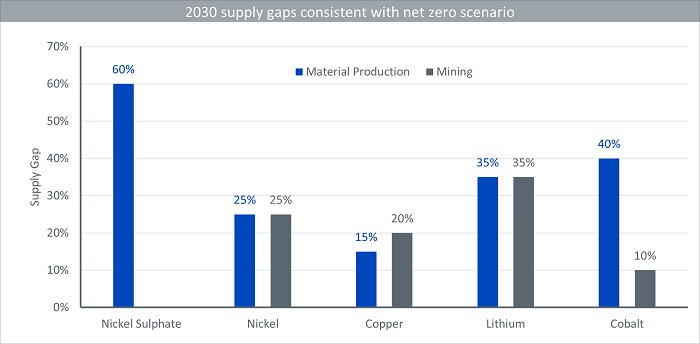

Energy transition

In a scenario where net zero emissions are targeted by 2050 in order to limit temperature increases to 1.5 degrees Celsius above pre-industrial levels, we should see a significant rise in demand for metals. Metals are critical for the manufacture of batteries, electrification of power energy consumption, electrolysers, heat pumps, and other technologies needed for the energy transition. International Energy Agency data indicates that, in a net zero emissions scenario, supplies of critical materials are going to be woefully short of demand, both in terms of mining and material production (Figure 4).

Figure 4

Source: WisdomTree, International Energy Agency, Energy Technology Perspectives 2023.

Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties

Infrastructure rebound

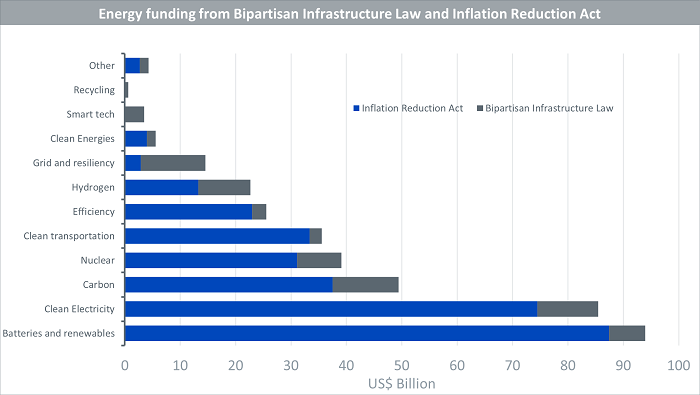

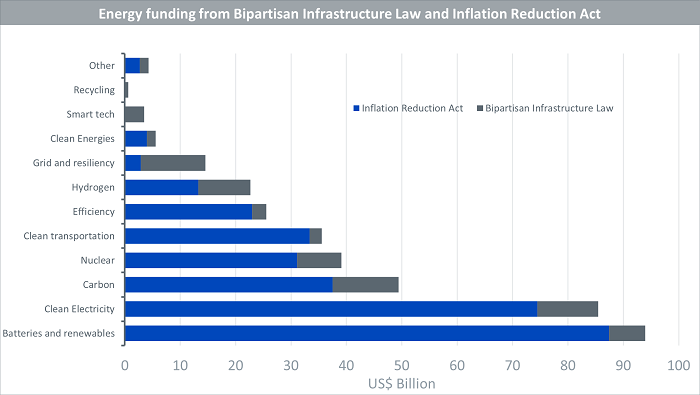

In the US, three Acts with partially overlapping priorities – the Bipartisan Infrastructure Bill (2021), the CHIPS and Science Act (August 2022), and the Inflation Reduction Act of 2022 (IRA, August 2022) – have a combined budget of close to US$2 trillion in federal spending and the infrastructure intensive projects are only just starting.

Just looking at the energy funding from the Bipartisan Infrastructure Bill and the Inflation Reduction Act, a total of US$370 billion is earmarked to be spent over the next 5 to 10 years, primarily to facilitate the clean energy transition (Figure 5). The IRA encourages the procurement of critical supplies domestically. In order to meet the supply chain requirements, we expect large infrastructure spending on mineral extraction, processing and manufacturing.

Figure 5

Source: McKinsey: ‘The Inflation Reduction Act: Here’s what’s in it’, October 2022.

Historical performance is not an indication of future performance and any investments may go down in value

The European Union’s REPowerEU plan—designed to wean the economic bloc off Russian hydrocarbon dependency—will also require a large spend on energy infrastructure. The EU is already building liquified natural gas capacity at breakneck speed, aiming to expand capacity by one-third by 2024.1 The EU estimates that delivering the REPowerEU objectives will require an additional investment of €210 billion between 2022 and 2027.

The green industrial ‘arms race’ takes off

After decades of underspending for the climate policy goals governments have signed up to, we may be witnessing a tipping point. Some of the protective features of IRA (regional sourcing requirements) may propel tit-for-tat policies that drive local sourcing elsewhere. Many nations recognising China’s dominance in critical materials had already been designing policies to mitigate the risk of overreliance on the country. This process is likely to drive an upsurge in ex-China green infrastructure spending globally.

Conclusions

After several years of commodity market outperformance, the asset class is already experiencing cyclical headwinds. However, a China reopening is likely to mitigate some of these pressures, and we are seeing tentative evidence of China’s economy rebounding. Commodities are likely to be underpinned by global policy support for an energy transition. Whilst general infrastructure spending may also face cyclical headwinds this year, green infrastructure spending is likely to lead to a new ‘arms race’ as countries compete to support their industries and maintain energy/resource security.

Sources

1 https://www.eia.gov/todayinenergy/detail.php?id=54780

—

Originally Posted March 13, 2023 – Commodity Outlook: Cyclical pressures vs structural strengths

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)