By CRU

The opinions expressed in this report are those of CRU Group and are considered market commentary. They are not intended to act as investment recommendations. Full disclaimers are available at the end of this report.

Copper prices have seen a strong start to the year with COMEX front month up almost 8% in January. This has been driven by several key developments. Firstly, recent weaker economic data, including slowing inflation, has seen the market price in an increased likelihood the Fed is nearing the end of its current tightening cycle, boosting hopes of a soft landing for the U.S. economy. Secondly, China’s abrupt easing of its Zero-Covid policy in December came at least three to four months ahead of market expectations, removing a key uncertainty, which was overhanging the 2023 demand outlook. Thirdly, on the supply side, mine and port disruptions have continued in Peru, Chile, and elsewhere, and refined stocks in exchange warehouses have seen a lower-than-normal seasonal build.

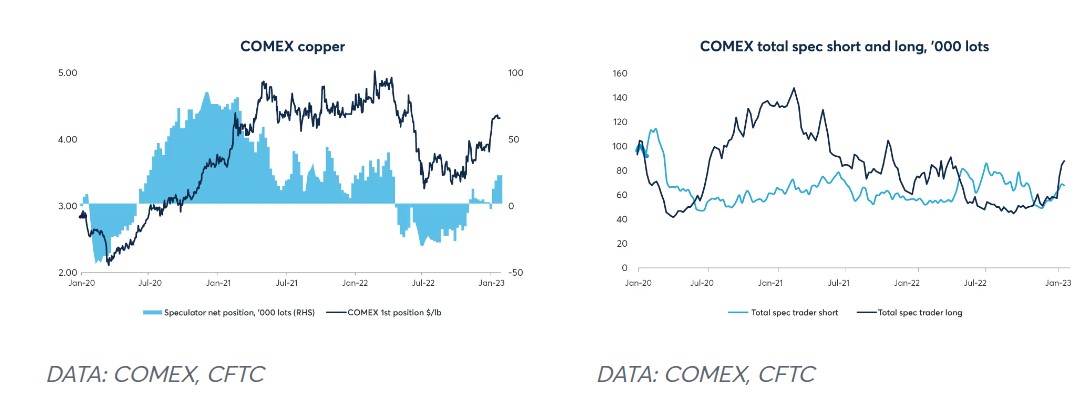

Market sentiment amongst speculators began to shift in early November when positions turned net long copper on COMEX. With the exception of a brief period at the start of this year, this net long position has continued to widen, reaching 20,170 lots in late January. Long speculative positions have seen a significant increase in January rising by around 30,000 lots from late December to 87,941 lots in late January. During the same period, speculative net short positions saw an increase of 10,000 lots to 67,771 lots.

Speculators have increased net long copper positions in recent weeks

Consistent with the broader recovery in risk appetite, the U.S. dollar index, with which copper has a strong negative correlation, has declined by 11% from last year’s 20-year highs. Other assets have also started to recover, with U.S. equities up 6-12% in January, after a difficult 2022, and corporate credit spreads have also rallied since the start of this year.

While the current U.S. company earnings reporting season loomed as a near-term risk to market sentiment, it has so far delivered results and guidance largely in-line with expectations. The global economy (e.g., China) is expected to see slower growth this year. However, we note during periods of economic slowdown or recessions, copper, and other risk asset prices typically bottom and begin to recover well before economic growth and corporate earnings find a floor.

Market optimistic on Chinese demand recovery

Our latest revisions have seen 2023 Chinese refined copper consumption estimates increase from 2.1% to 2.8%. The market is now taking a more optimistic view on Chinese demand recovery with concerns of a second wave of infections diminishing as early data suggest infections failed to increase during the recent CNY holiday period despite the removal of travel restrictions. Longer than usual CNY holiday shutdowns have softened demand early in the year but a return to buying is likely from February. It is worth noting that Shanghai and other major cities in China went into lockdown following CNY last year, which could increase the likelihood of solid y/y growth prints in the coming months.

Optimism on Chinese demand recovery has supported our expectations for global refined copper consumption in 2023, which we now estimate will grow 2.4% y/y. However, economic indicators suggest the near-term demand outlook is more challenging. In Europe, high energy prices and the prospect of disruptions to gas supplies remain a concern for industrial output in the coming months. While major economies continue to battle sticky inflation and corresponding rising interest rates.

Stocks see a lower-than-normal seasonal uplift

Copper stocks on global exchanges have increased by 105,000 t since the end of December. Seasonally, visible copper stocks normally increase by around 300,000 t between November/December and March. However, this year is expected to see an earlier and lower than normal seasonal peak, given the timing of the CNY holiday.

Total Chinese stocks are now 231,000 t, up ~125,000 t since the end of December but still low in historical terms. China bonded stocks are currently around 91,000 t with SHFE non-bonded stocks at 140,000 t. Last year saw USD interest rates move higher than RMB interest rates. This, combined with the continued soft China real estate sector, has put an end to copper inventory financing. This has contributed to lower China bonded warehouse inventories and is unlikely to reverse in the near-term.

In the U.S. COMEX inventories fell 6,700 t in January, to just 25,400 t.

Supply challenges continue, not easy to resolve

Operational and community-related challenges continue to impact supply. In South America, a fire damaged Ventanas port in Chile in December, impacting shipments from mines including Anglo American’s Los Bronces and Codelco’s Andina. We understand port operations resumed in late January but are expected to remain well below capacity for the next three to four months. Social unrest in Peru continues, with Glencore’s Antapaccay, Hudbay Minerals’ Constancia, and MMG’s Las Bambas all impacted.

In December last year, Anglo American downgraded its 2023 copper production guidance range to 840,000 – 930,000 t from 910,000 t – 1.02 Mt previously. In late January, BHP guided to the lower end of its previous FY2023 (y/e June 30) guidance range of 1.08 – 1.18 Mt for Escondida, after delivering 0.51 Mt in the half year ending December 31.

Additionally, there is currently a build-up of cathode stocks in Africa, estimated at over 200,000 t. This includes what we understand is over 100,000 t of material in the DRC, awaiting a resolution to a disagreement between Tenke Fungurume mine owner China Molybdenum Co. (CMOC) and the government. Sicomines, another majority Chinese owned mine in the DRC, is also seeking a resolution with the government.

Outlook: Waiting to see if reality meets improved sentiment

With the CNY holiday period now over, close attention will be paid over the next two to three months to how copper demand recovers in a Chinese economy no longer weighed down by its previous Zero-Covid policy.

The recent retreat in U.S. inflation from four-decade highs has eased one of the key overhangs for the economic outlook and copper prices through much of last year. While we maintain the view Europe and the U.S. will enter mild recessions this year, the market appears to once again be in a position where “bad (economic) news is good news for copper prices,” as it increases the likelihood of a Fed pivot to lower interest rates as well as more fiscal stimulus.

Current supply challenges are likely to take time to resolve and remain supportive of copper prices. While reductions to miner guidance last year lowered the basis for downside surprises this year, supply challenges continue to outpace expectations. Meanwhile mine project approvals and development are progressing at a slower pace than is required to meet medium to longer term requirements.

With refined copper stocks on global exchanges remaining low, this suggests prices are likely to remain volatile this year. However, robust growth in green energy transition related demand could at least partly reduce some of the cyclicality that copper prices would normally be expected to reflect in an uncertain economic environment.

—

Originally Posted March 6, 2023 – Copper prices stage strong recovery on evolving macro

The opinions and statements contained in the commentary on this page do not constitute an offer or a solicitation, or a recommendation to implement or liquidate an investment or to carry out any other transaction. It should not be used as a basis for any investment decision or other decision. Any investment decision should be based on appropriate professional advice specific to your needs. This content has been produced by CRU Group. CME Group has not had any input into the content and neither CME Group nor its affiliates shall be responsible or liable for the same.

CME GROUP DOES NOT REPRESENT THAT ANY MATERIAL OR INFORMATION CONTAINED HEREIN IS APPROPRIATE FOR USE OR PERMITTED IN ANY JURISDICTION OR COUNTRY WHERE SUCH USE OR DISTRIBUTION WOULD BE CONTRARY TO ANY APPLICABLE LAW OR REGULATION.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CME Group and is being posted with its permission. The views expressed in this material are solely those of the author and/or CME Group and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.