AT A GLANCE

- Since launching 40 years ago, WTI crude oil futures have gone from a nascent contract to setting the agenda for the entire commodity suite

- U.S. exports have gone from virtually zero in 1983 when WTI launched, to a current rate of over 4 million barrels per day

Let me take you back to 1983. Amazingly, that’s 40 years ago now, even though it doesn’t seem that long ago for some of us.

1983 was the year when Michael Jackson released Thriller, and I also remember waiting in a huge line to watch Return of the Jedi at the cinema. 1983 was also a big year for technology: Nintendo released the first games console, Motorola released the first mass-appeal mobile phones, and a standard Internet Protocol was adopted for the first time.

1983 was also a very important year for the global oil markets. The Iran-Iraq war was raging but there was still too much oil on the market, and prices were hovering just below $30 per barrel.

At that time, the oil price had been relatively stable for some years, but it was starting to become more volatile as OPEC’s control of the world oil markets diminished.

It was amid this backdrop, that the New York Mercantile Exchange (NYMEX), now part of CME Group, launched its Light Sweet Crude Oil futures contract in March 1983. This futures contract has become best known as WTI, which is short for West Texas Intermediate, a grade of domestic U.S. crude oil.

The Most Significant Commodity Contract on the Planet

Since that launch, 40 years ago, WTI has established itself as the most significant commodity contract on the planet. Nowadays, the price of WTI crude oil sets the agenda for the entire commodity suite.

Changes in the price of WTI can literally move economies. But back in 1983, it took some time for the new oil contract to establish itself. WTI did not take off immediately, and just 3,000 contracts changed hands in its first month of trading.

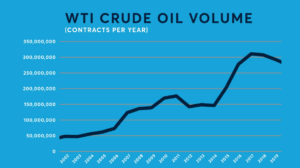

WTI futures trading volume continues to grow 40 years later.

It took another year for WTI to breach more than 100,000 contracts in a single month, but after that its growth was explosive. By the end of the 1980s, WTI was regularly trading more than two million contracts per month and in recent years we have seen plenty of trading sessions when WTI trades over one million contracts per day and even more.

40 Years of Economic Booms and Busts

This dramatic surge in trading activity over the past four decades reflects the awareness that oil prices are unlikely to ever go back to being stable and predictable.

The last 40 years have seen multiple geopolitical events that have affected the supply of oil, whether it has been wars in the Middle East or more recently in Ukraine. On the demand side, key consumer areas have experienced repeated cycles of economic booms and busts, and more recently consumer demand has been impacted by pandemic lockdowns and by the growing take up of electric vehicles.

The great uncertainty surrounding oil prices, which are so crucial for so many companies, made it more and more important for firms to try to manage their exposure to oil prices by hedging with futures.

This trend towards greater awareness of risk management has been a key theme of the last four decades – WTI crude oil futures have helped firms take out “price insurance” to avoid downside risks if they are a producer, or upside risks if they are a consumer.

How Did We Get Here?

A 40th birthday is often an opportunity for some self-evaluation: how did we get to this point and where are we going next? Certainly, much has changed since WTI was launched at the height of disco fever and the Cold War.

When WTI first launched 40 years ago, the U.S. oil markets looked very different. U.S. oil was not exported, and it was widely believed that U.S. production was on a one-way downward spiral.

The shale oil revolution changed all of that by unlocking vast new supplies of crude oil.

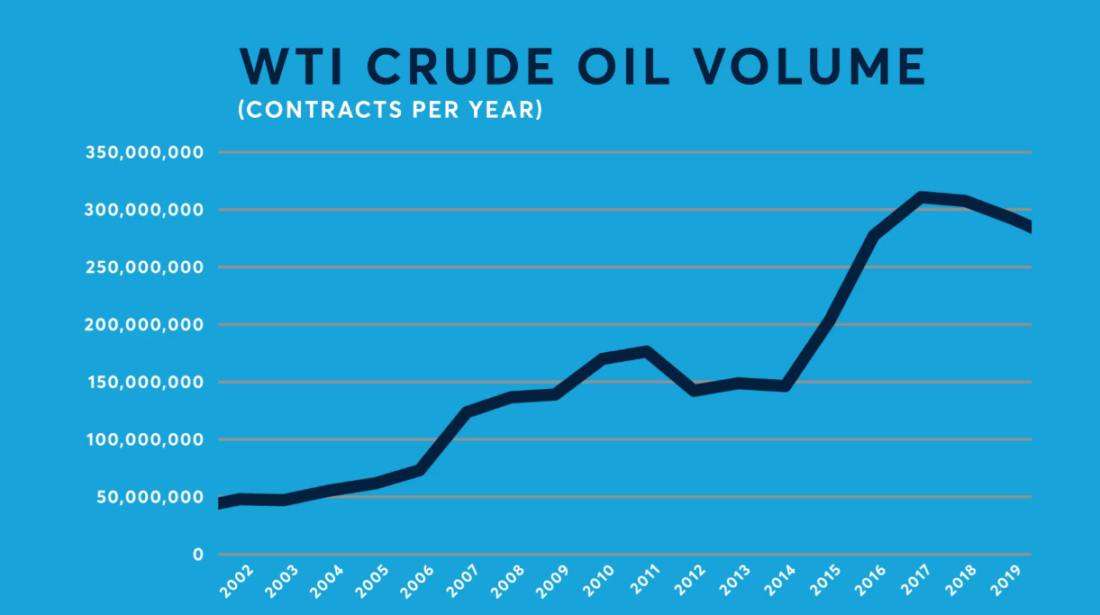

In recent years, U.S. production has surged once more, from 8.7 million barrels per day in 1983 to its current giant level of 12.4 million barrels per day. At the same time, U.S. oil exports have soared to record levels – from virtually zero when WTI launched to a current rate of over 4 million barrels per day.

In recent years, WTI’s importance has also extended way beyond its U.S. heartland. A major buildout of pipeline and port infrastructure has linked WTI’s delivery point of Cushing, Oklahoma to the world via the export terminals of the U.S. Gulf Coast.

The growing role of the U.S. as a major exporter has made WTI ever more relevant to the global markets, and WTI-linked grades now play a key role in supplying Europe and Asia.

As it hits middle age, WTI shows no sign of slowing down. Despite growing environmental awareness, oil demand is expected to continue to grow over the coming years as countries industrialize. Ensuring the need for a reliable price benchmark and for risk management has never been greater.

—

Originally Posted March 20, 2023 – How WTI Became the Most Important Commodity Contract on the Planet

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CME Group and is being posted with its permission. The views expressed in this material are solely those of the author and/or CME Group and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)