Natural gas prices have been in a nosedive for the past five weeks, as relatively mild temperatures and record dry gas production have boosted US gas storage levels. Even after a larger than expected draw of 117 billion cubic feet (bcf) last week, EIA gas storage was still 7.3% above a year ago and 6.7% above the five-year average. The EIA reported that the US ended the injection season on October 31 with the largest amount in storage in three years.

One factor that has contributed to the buildup in supply has been a plateau in exports. US exports reached a total of 650.8 bcf in March, and they ranged from 607.3 to 634.5 bcf from April through September. These readings were still among the top 12 on record. The five largest monthly pipeline export totals (gas shipped to Canada and Mexico) have occurred since March.

Since March 2021, most US gas exports have been in the form of liquified natural gas (LNG). LNG is formed by cooling natural gas to minus 260 degrees Fahrenheit. The resulting liquid is 600 times smaller in volume than the gaseous form. This allows natural gas to be shipped to areas that are inaccessible by pipeline. There are some shipments by truck, but most LNG is shipped by specially designed tanker ships.

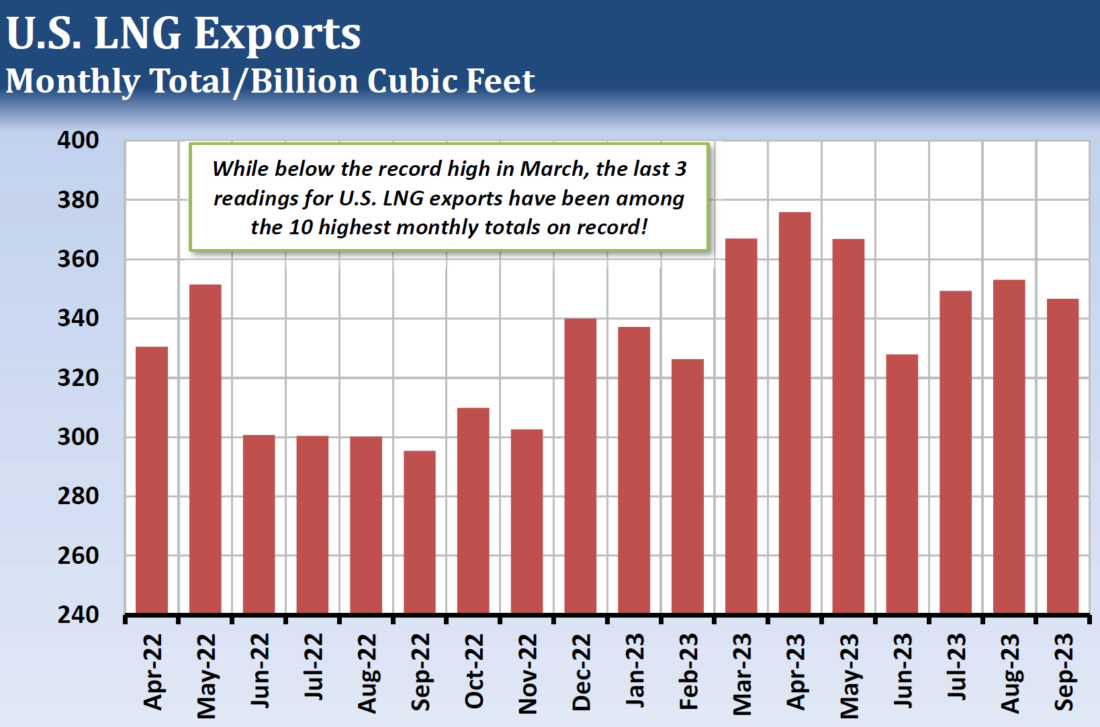

There was a sharp decline in US LNG exports during 2022 after a fire at the Freeport export terminal in Texas took a significant portion of export capacity off-line. Even with the setback, LNG maintained a larger share of US gas exports than pipeline gas exports. The Freeport terminal restarted operations in February, and in October, the US Federal Energy Regulatory Commission approved a request that would allow them to return to full capacity.

There are four US LNG plants currently under construction that are expected to start operations within the next five years, and another two plants have had their construction projects approved. The US has already overtaken Qatar to become the world’s largest LNG exporter. Once the new plants come online, US LNG exports could increase more than 50% from current levels.

—

Originally Published December 8, 2023

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Any investment recommendations on this sector?

Cheniere (LNG)