AT A GLANCE

- Shorter-dated options in oil, soybeans and gold have all experienced record trading volume in the past year

- Lower premiums, more flexibility to respond to market events offer additional advantages to traders

As uncertainty continues to surround commodity markets, traders are in search of ways to navigate an environment with new risks emerging almost daily. More of them are finding their tool of choice in short-term options.

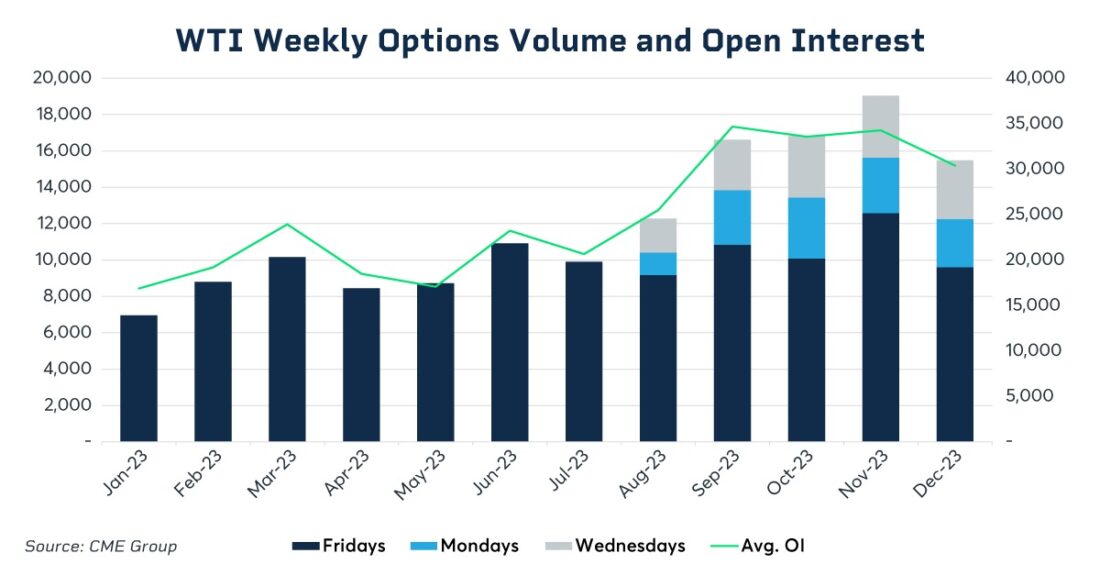

These refer to a class of options with shorter tenors than the conventional options, which typically expire monthly. In the oil market, WTI weekly options have become the fastest-growing energy products at CME Group, reaching record highs in trading volume.

WTI Crude Oil Weekly options volume continues to break records.

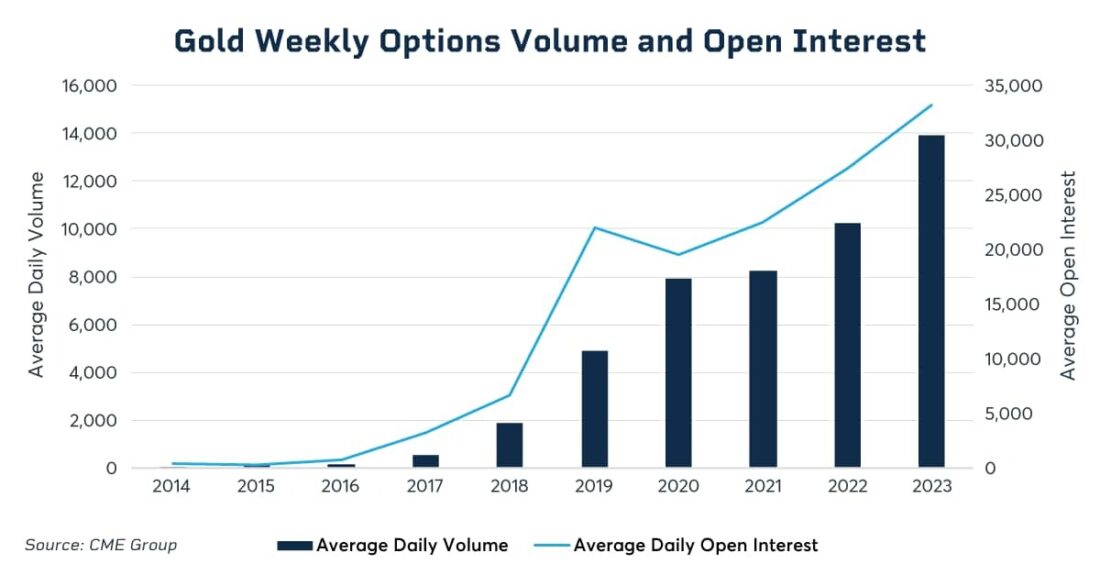

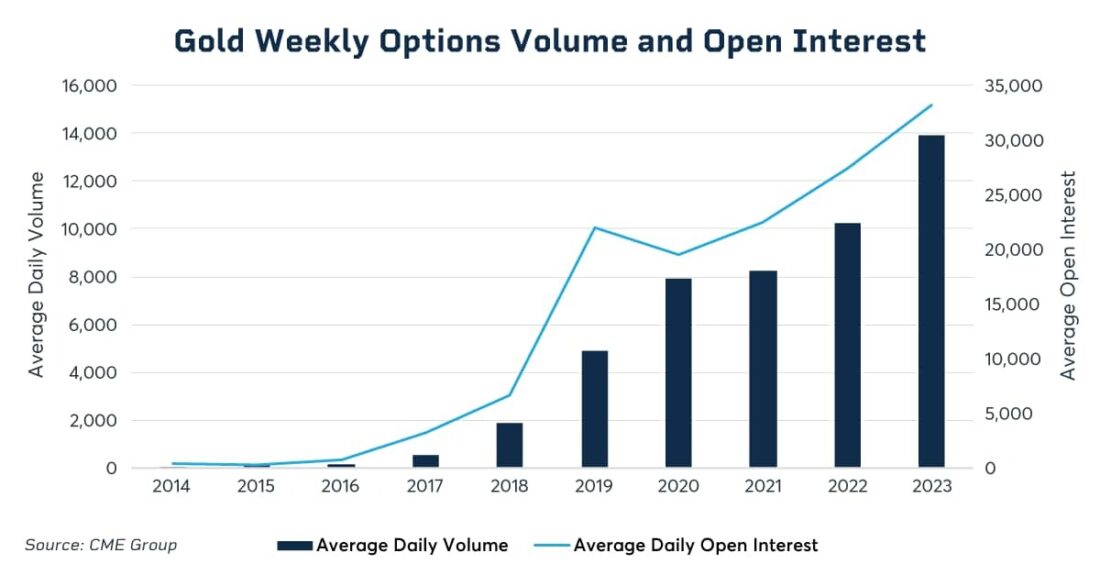

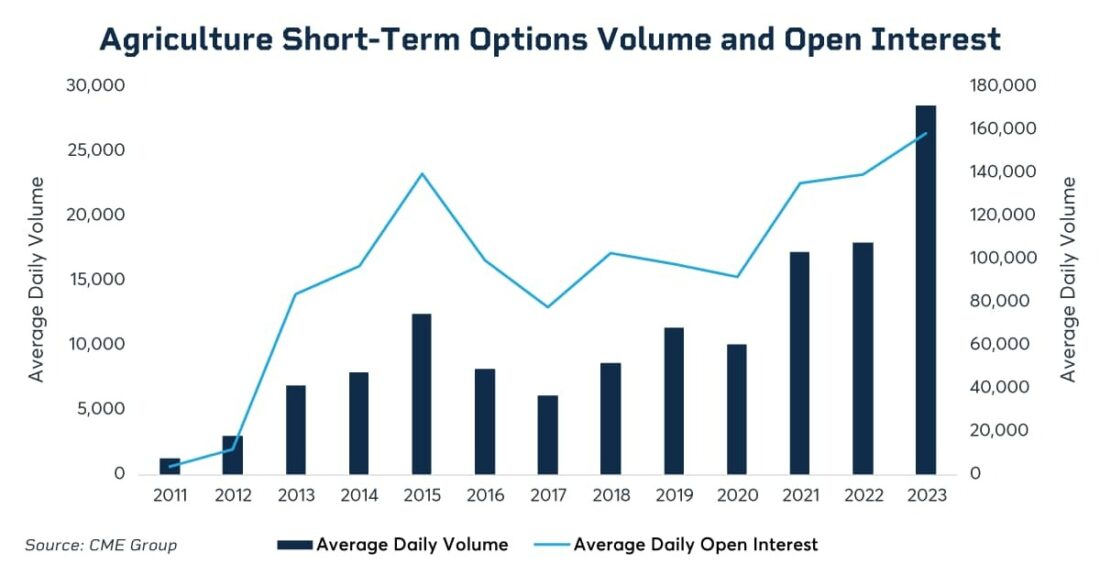

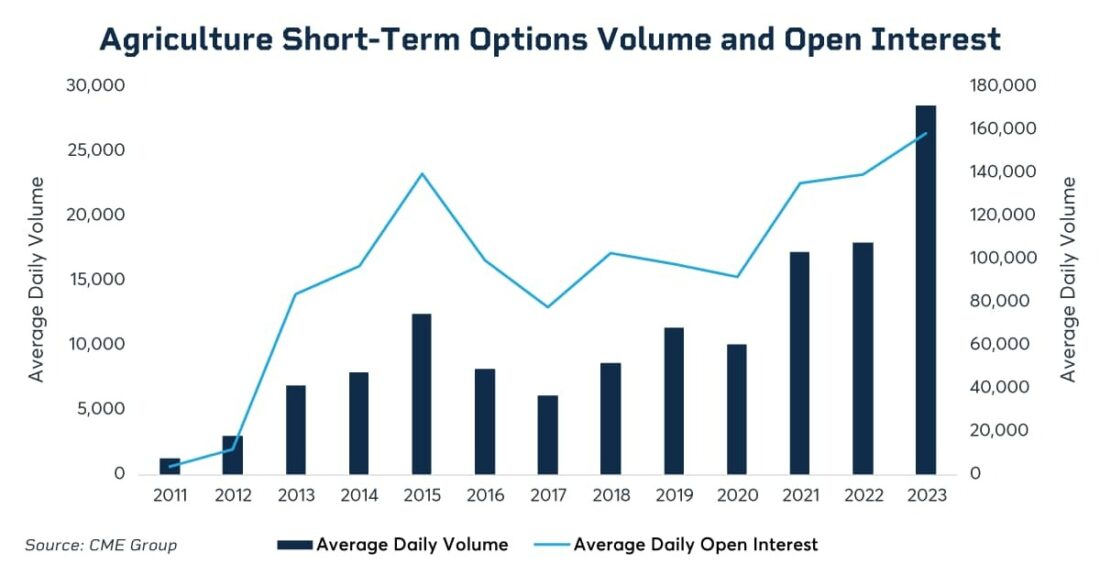

Agriculture weekly options surged by 52% in 2023 relative to the first half of 2022 while Gold weekly options are up 33% year over year. Traders are finding these short-term tenor options low cost and versatile tools to insulate their portfolios from specific types of risk that are inherently embedded in commodity prices. In addition, these options allow market participants to express their short-term views related to both macro and commodity specific events.

Gold weekly options reached new highs in 2023

Agriculture Short Term Options volume continues to reach new records

Why Have Short Term Options Become Popular?

The short tenor provides more flexibility to traders to adjust their portfolios more frequently in response to sudden market events regardless of their time horizons. In addition, short-term options have lower premiums because there is less time for market conditions to change. The increased interest and fast adoption of short term options are attributed mainly to these reasons:

Rising Interest Rates: The current economic environment is characterized by a high degree of uncertainty. Central banks around the world have embarked on increasing interest rates to curb inflationary pressure which has subsequently discouraged investment and consumer spending. Also,high debt levels are adding another layer of uncertainty to the economic picture. These market conditions have increased volatility of commodities prices.

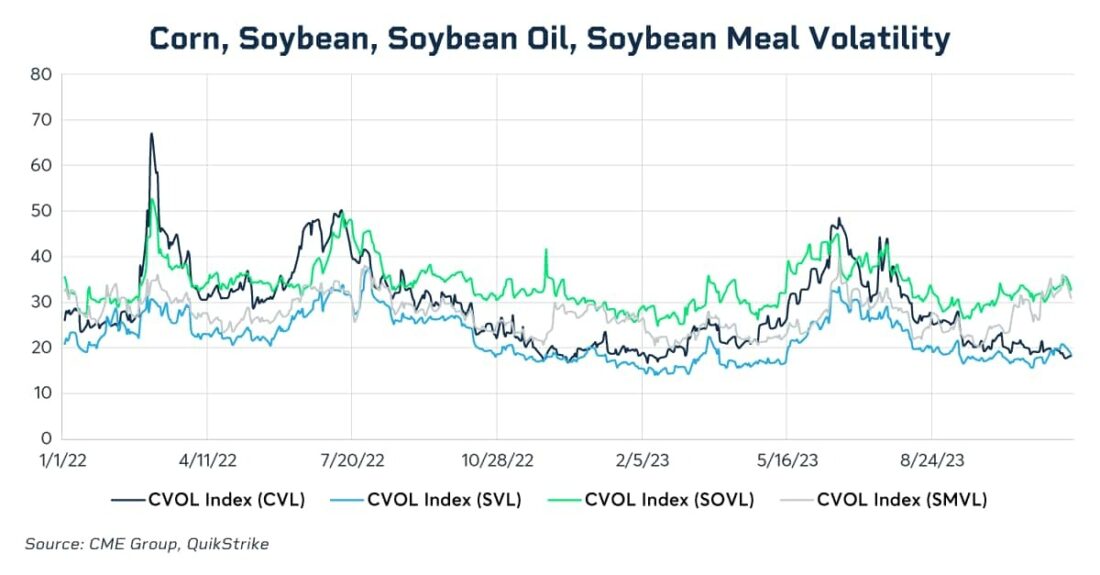

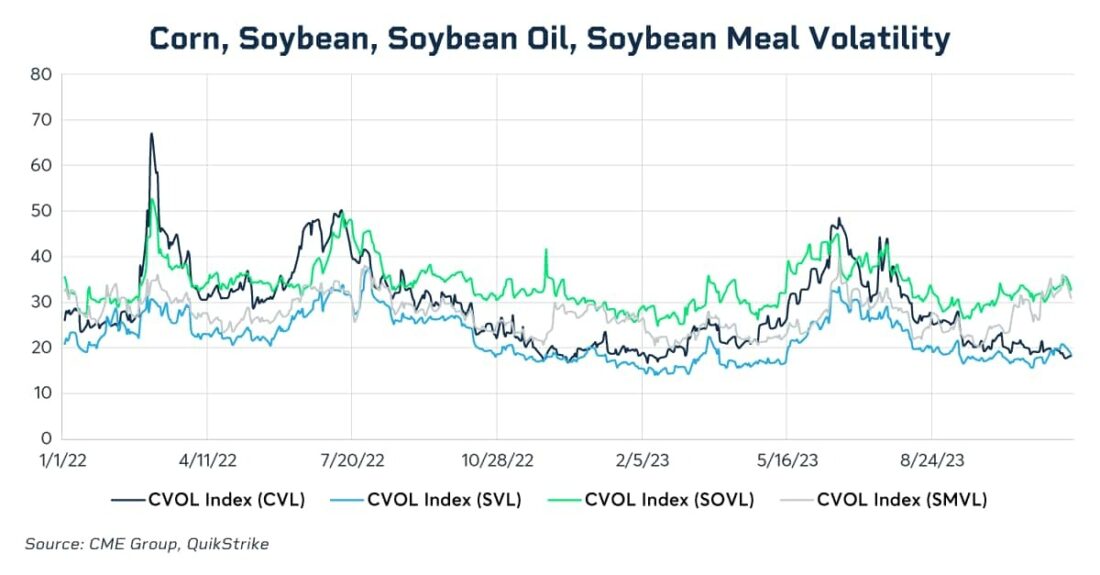

Weather Events: Weather has heightened the volatility of certain commodities, especially the soybean market, where drought impacted both the 2023 U.S. harvest and the 2024 Brazil harvest. For illustration, the chart below shows the heightened volatility of the soybean market, reflected in the CME Group Volatility Index known as CVOL. This tool measures the expected volatility implied from options prices based on the collective market sentiment of future price movements.

Drought and weather events in key soybean-producing regions have induced volatility in these markets.

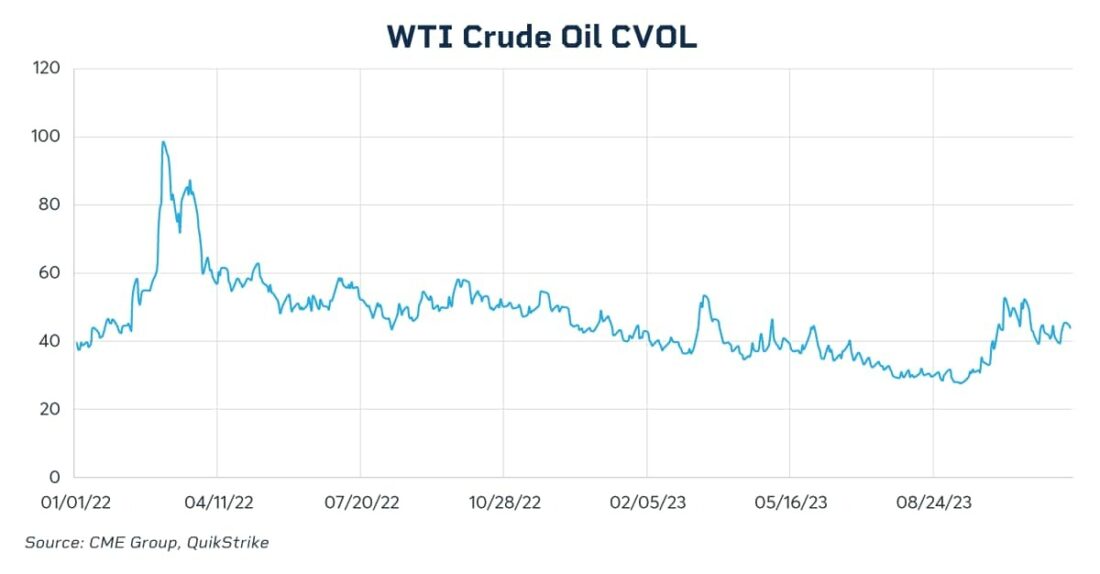

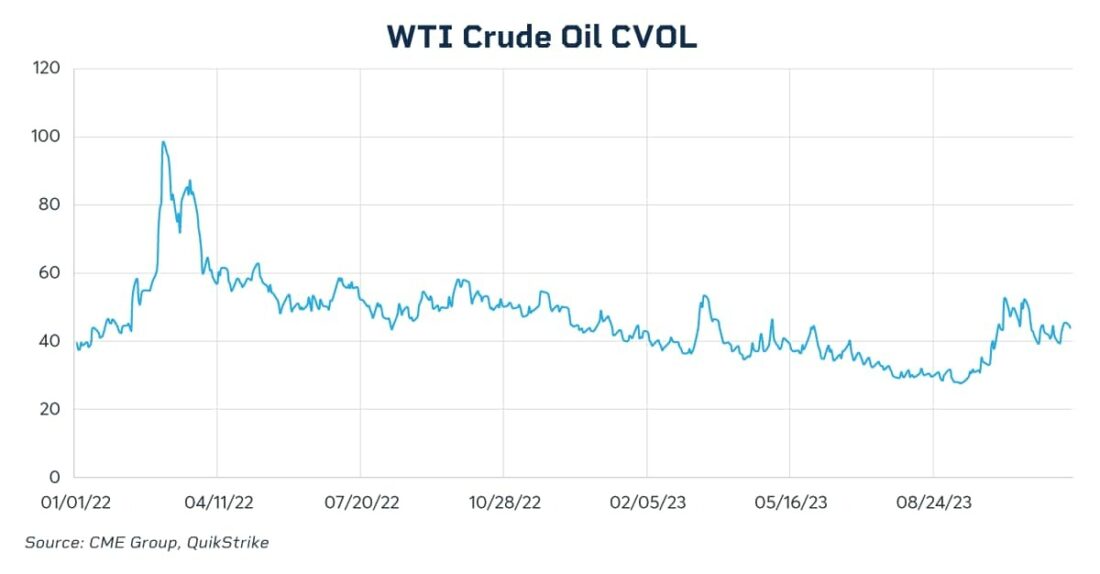

Elevated geopolitical risk: The Russo-Ukrainian war has considerably impacted commodities and caused supply disruptions in oil, natural gas, corn and wheat. For example, oil prices reached $120 per barrel in March 2022 and wheat rose to $12 per bushel while corn spiked to $8 per bushel in March 2022. Prices have since fallen, but they are still higher than prior to the war. On the other hand, the Israeli-Palestinian conflict and Red Sea attacks are increasingly destabilizing the region and impacting oil prices.

WTI CVol jumps, signaling traders braces for more turbulence in the oil market

Listing of new set of expiration dates: The expansion of short-dated options has offered greater customization opportunities for traders. This optionality allows traders to mitigate short-term risks of either macro- or commodity-specific market events in a precise fashion. The extensive listing has attracted a wide range of market participants with different risk profiles and trading strategies. In addition, more frequent listing of expirations enhances market efficiency and price discovery function because the market has more data points to determine the fair price.

In the trading world, uncertainty creates the need for flexibility. With plenty of risks to manage across commodities, activity in short-dated options should continue to be a gauge on how traders are viewing commodity markets.

—

Originally Posted March 7, 2024 – Short-Term Options Have Become Popular in Commodities

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CME Group and is being posted with its permission. The views expressed in this material are solely those of the author and/or CME Group and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.