Key Takeaways

- Gold’s strong recent rally bodes well for silver given the strong correlation between the two.

- Investor sentiment towards silver has improved notably and the metal still has a long way to go before it catches up with gold.

- Some of silver’s structural drivers from the energy transition may also be providing the metal an additional boost.

Silver often finds itself in a race with gold. It’s a contest that tends to attract bets from investors. In recent weeks, the competition appears to be creating just the dynamic that brings people to the edge of their seats.

As of 27 March, silver is up 7.9% month-to-date, outpacing gold, which has gained 7.0%. Notably, silver has picked up pace relatively recently as it still trails gold in terms of year-to-date performance (gold up 6.1% while silver is up 2.9%)1.

Why might this be an interesting situation for investors? What does history tell us about the relative behaviour of the two metals as they compete? And might some of silver’s structural drivers also be playing a role?

Lagged but leveraged

Silver has a high correlation of almost 0.92 with gold historically2. This means that when gold has a strong run, investors expect silver to do the same. Interestingly, there can often be a slight lag between gold’s ascent and silver’s subsequent rise.

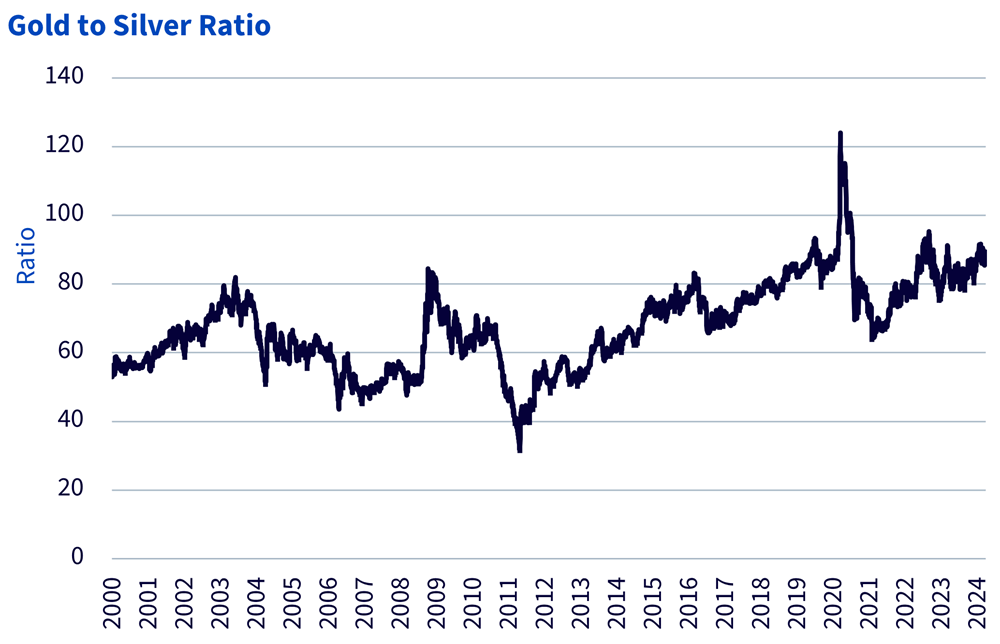

Historically, the gold-to-silver ratio tends to trend upwards and then correct sharply. This means that gold outperforms silver until silver suddenly catches up. And when it does so, it often leaves gold behind for a while. Most recently, this happened in 2020. Now, it is hard to say if there are early signs of a potential repeat of 2020. But what is true, however, is that gold has reached record highs recently and silver still has a long way to go. The gold-to-silver ratio currently stands at around 89, well above the historic average of around 523.

Source: WisdomTree, Bloomberg, data as of 27 March 2024. Historical performance is not an indication of future performance and any investments may go down in value.

An improvement in sentiment

Net speculative positioning in silver futures is a useful metric for measuring investor sentiment. The chart below shows how net positioning has improved sharply in recent weeks but remains below previous highs seen at the start of 2020. That peak in speculative positioning was followed by silver’s strong rally in 2020.

Source: WisdomTree, Bloomberg, data as of 19 March 2024. Historical performance is not an indication of future performance and any investments may go down in value.

Structural drivers at play

Beyond the correlation with gold, which tends to be the largest driver of silver’s price movement, the metal also has an important role in industrial applications. At WisdomTree, we are optimistic about silver’s prospects in the energy transition given its role in electric vehicles and solar energy.

Global plug-in electric vehicle sales have started 2024 on a very strong note with over 1 million units sold in January. This represents a 63% increase compared to the same period last year and is the ninth consecutive month of seven-digit sales of plug-in electric cars worldwide4. The uptake of electric vehicles globally is a very good sign for many metals including silver.

At this year’s United Nations Climate Change Conference (COP28), world leaders have pledged to triple global renewable energy capacity by 2030. This is an audacious goal which will only be achieved using large quantities of energy transition commodities. Silver has an important role to play given its use in photovoltaic cells.

Closing word

Silver appeals to both tactical and strategic investors. Right now, its correlation with gold and pickup in sentiment may also be receiving an additional boost from some of the strategic drivers. All eyes are now on silver to see if it will beat its precious metal cousin in the race this year.

Sources

1 Source: Bloomberg.

2 Source: WisdomTree, Bloomberg, data as of 27 March 2024 going back to March 1990.

3 Source: WisdomTree, Bloomberg, data as of 27 March 2024 going back to 1949.

4 Inside EVs, data as of March 2024.

—

Originally Posted March 28, 2024 – What’s Hot: Will Silver Take the Gold Medal Again?

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.