Most traders I know embrace volatility. Investors are more mixed – it depends on their asset class and mandate. Corporate treasurers often go to great lengths to avoid volatility, with many spending significant time and money trying to minimize its impact via hedging activities. If your business is selling services or widgets, you generally want some degree of certainty about how sales translate into profits — especially if you receive revenues in a range of various currencies. Cryptocurrency advocates often state the case for its ultimate adoption as a means of exchange. A quick look at bitcoin’s eye-popping volatility vis-à-vis established currencies makes that look highly unlikely in the near future.

Much was made of Tesla’s recent announcement that it would no longer accept bitcoin as a means to purchase its autos. While this appears to be a repudiation of bitcoin as a medium of exchange, it was my contention at the time (and ever since) that the move was made primarily in response to nascent regulatory concerns. The subsequent news that the Treasury intends to require reporting of all crypto transactions larger than $10,000 (as it does for cash transactions) seems to provide evidence of my theory. Yet despite the appearance that one of crypto’s biggest boosters turned about face on utilizing it as a means of exchange, I believe that there is a more basic reason for the lack of acceptance of bitcoin and others for normal transactions. The table below should make that evident:

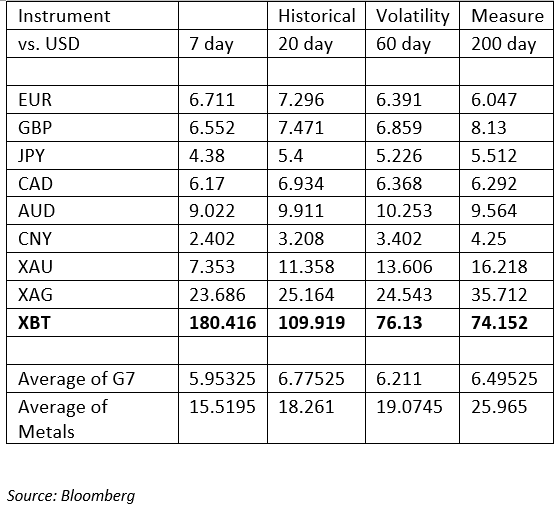

Historical Volatilities of Various “Currencies” vs. US Dollar, Annualized %

The chart includes the G7 currencies at the top, along with other notable selections. I included the Australian dollar because of its perceived dependence upon commodity prices and the Chinese renminbi because of that country’s role in global commerce. Gold and silver were included because they were historically utilized as currencies. It doesn’t take much to see the clear outlier, does it?

It is important to keep the “Rule of 16” in mind here. Dividing by 16 allows us to quickly convert the commonly displayed annualized measures of implied volatility into daily moves. The 6% annualized volatility that we see as a rough average for G7 currencies translates to an average daily move of about 0.375%. Even the relatively high readings for the Australian dollar translate to about a 0.625% move. Volatility increases dramatically when we move away from fiat currencies into so-called hard currencies like gold and silver, where we see volatility measures in the 0.5%-1% and 1.5%-2% ranges respectively. Other than a few hardcore believers, there are not many folks advocating for the use of gold and silver as a means of exchange, and their volatility relative to fiat currencies is one probable reason.

How then do we put bitcoin into context? The current 7 day volatility of bitcoin does encompass some of the most epic moves that we have seen in any financial product in recent memory, so extrapolating the 11.25% equivalent daily volatility into the future does seem unfair. But with the readings for 60 and 200 day volatility both implying roughly 4.75% daily moves, this makes the daily volatility of bitcoin greater than the annualized volatility of the renminbi and nearly that of the yen! We assert that daily volatility of bitcoin is uncomfortably high for any company that desires consistency in their revenues and bottom line.

When we consider the lengths to which CFO’s go to hedge exposures to currencies with only modest volatility, why would they want to introduce the risk of exposing themselves to a “currency” that would subject them to eye-popping fluctuations? I can’t imagine any company other than the most ardent supporter of crypto currencies taking a flyer on that sort of volatility. The paradox for crypto advocates is that the widespread adoption would require a sustained period of low volatility, yet that period of low volatility would likely make trading bitcoin and its peers far less exciting.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.