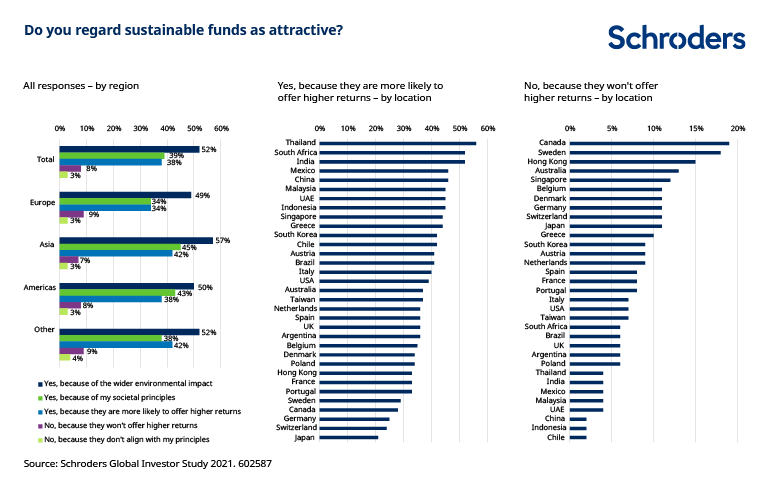

Although the potential for higher returns matters, the main driver of retail interest in sustainable funds is environmental impact.

We have all heard the story: sustainable funds are in high demand. By the middle of 2021, their assets had reached an unprecedented $2.3 trillion, mainly driven by continued growth in the European fund market (Source: Reuters).

Net sales in the first half of 2021 had already overtaken those in 2020, which in turn were more than double those in 2019, which were more than double those in 2018.

Such spectacular growth could be driven by a number of things, such as strong performance (particularly in 2020), new fund launches or existing funds being repurposed to add a sustainability tilt. The fund sales numbers would indicate that it is not just a function of increasing supply. Retail investors genuinely want to buy more sustainable funds.

So what makes people attracted to sustainable funds? To what extent is this driven by return expectations? Our flagship Global Investor Study can offer several insights.

Insight 1: Returns matter to people, but not as much as environmental impact

The results are clear: the most important driver of interest in sustainable funds is the environmental impact they could have. The potential for higher returns matters, but it comes further down the pecking order.

This is consistent across regions, but notably investors in Europe, which has the largest sustainable fund market around the world, are less likely to be influenced by return expectations than other regions. This is consistent when we look at countries within each region, for example, Germany and France compared with the US and China.

In all regions and most countries, only a small percentage of people are put off sustainable funds because of performance concerns. Interestingly, performance scepticism is higher in a number of countries which have been more traditionally associated with sustainability, such as Sweden, Denmark and Germany. US and Chinese individuals, in contrast, seem to be less put off by worries about performance.

Other Global Investor Study results have shown that younger investors and investors with higher levels of expertise are more inclined towards sustainable investing generally. Consistent with this, they are also more likely to view the potential for higher returns as a positive for sustainable funds.

Click here to read the full article

—

Originally Posted on October 21, 2021 – How Do Retail Investors Feel About Returns from Sustainable Investing?

The views and opinions contained herein are those of Schroders’ investment teams and/or Economics Group, and do not necessarily represent Schroder Investment Management North America Inc.’s house views. These views are subject to change. This information is intended to be for information purposes only and it is not intended as promotional material in any respect.

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.