For those looking for a summer respite for the bond market in August…think again. Based on trading activity as I write this, the U.S. Treasury (UST) market had something else in mind, specifically what has transpired for the UST 10-Year yield. This is a topic I blogged about a couple of weeks ago from a portfolio duration perspective. However, for this post, I wanted to get into the root causes of the recent increase in the 10-Year yield and whether it is reasonable to expect a reversal any time soon.

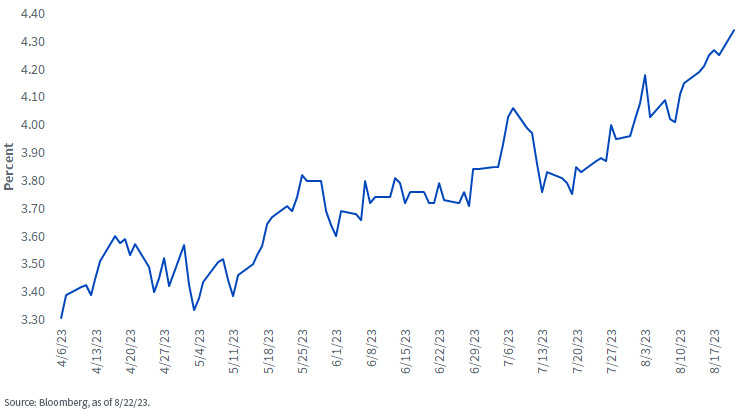

U.S. Treasury 10-Year Yield

Although there’s been somewhat of a seesaw pattern, the rise in the UST 10-Year yield really began back in early April. Since hitting its post-SVB low-water mark of 3.30%, the 10-Year reached as high as 4.34%, as of this writing, marking an incredible 100-basis point move to the upside, and eclipsing the prior high point of 4.24% that was printed back in October.

With the UST 10-Year yield now at its highest level in roughly 16 years, investors are wondering what comes next. In order to answer that question, we need to take a look at the reasons for this most recent move to the upside.

One does need to begin the process with the Fed. Although Powell & Co. are at, or close to, the end of this rate hike cycle, the policy makers continue to leave the door open for rate hikes. More importantly, the money and bond markets have now completely ruled out rate cuts for this year, pushing the timing for the potential first Fed Funds decrease to the end of Q1 next year, at the earliest. After much resistance from the money and bond markets, they have finally embraced the ‘higher for longer’ scenario.

Next up is the resiliency of the U.S. economy, especially the labor markets, where a widely expected recession for 2023 has essentially been removed from the equation, at least for this year. Along the same lines, even though inflation continues to cool overall, core price pressures have remained above the Fed’s 2% threshold. Add to these macro factors increasing supply concerns for Treasuries from trillion-dollar deficits, and voila, the next thing you know, the UST 10-Year yield expereinced a technical breakout to the upside utilizing Fibonacci retracement levels.

So back to the title of this blog post. In order for the UST 10-Year yield to fall on a sustained basis from here, you have to peck away at the aforementioned factors. To begin with, the economy needs to show definitive signs of heading for a downturn (look to labor market data), with some added cooling in inflation. This could potentially push the Fed into a more friendly narrative on just how long rates have to stay in restrictive territory. Unfortunately, the supply issue is not going away any time soon and could get worse as Treasury announced that more increases in coupon auction sizes could be coming in October.

Conclusion

Considering the recent momentum to the upside for the UST 10-Year yield, some consolidation could be expected in the near term. However, the path of least resistance, at this point, seems for the 10-Year yield to remain elevated.

—

Originally Posted August 23, 2023 – Does What Goes Up Have to Come Down?

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.