Prior to the release of the recent jobs and CPI reports, it seemed all the rage that another “Powell Pivot” could be coming yet again. For those who might not be familiar, the phrase refers to the changing policy stance of the Fed Chair regarding inflation. First up was the shift from inflation is transitory to we need to fight inflation at, essentially, all costs. The current reference was the expectation that the Fed could dial back its aggressive rate hike path due to economic and market-related concerns. Well, the “hotter” than expected September CPI report has basically eliminated the premise of another Powell Pivot any time soon.

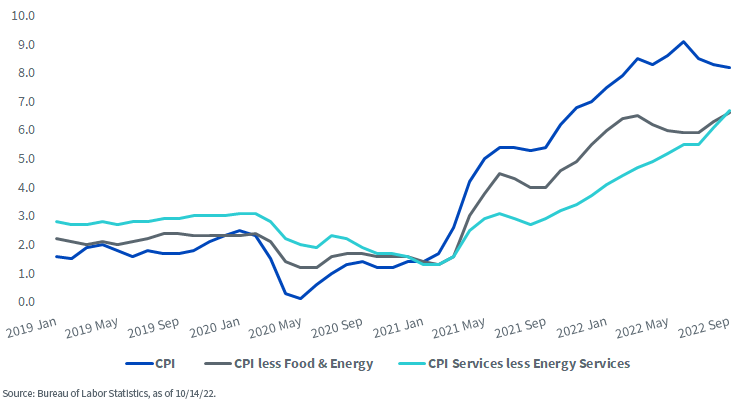

Let’s take a bit of a deeper dive into the latest inflation release. While headline CPI has come down from its annualized peak rate of +9.1% in June, it still resides at the historically high reading of +8.2%. In addition, this very modest deceleration has really been more of a function of lower energy prices than any underlying improvement in price pressures. To provide perspective, energy costs have fallen in a visible fashion over the last three months (-4.6%, -5.0%, -2.1%), reflecting declines in both gasoline and fuel oil.

CPI Data 12-Month % Changes

In fact, goods inflation, overall, has moderated as the emphasis shifted to services in a post-COVID-19 lockdown economy. This is where things get “sticky.” Indeed, core CPI (less food and energy) has actually been rising while the headline inflation reading was coming off its aforementioned peak. Since June, the year-over-year reading for core CPI has risen from +5.9% to +6.6%. This is not a development Powell & Co. were hoping for. In fact, quite the opposite…it’s moving in the “wrong” direction for the policy makers.

Service-related inflation is now the problem for the Fed. Since rate hikes began in March, the “services less energy services” component has seen its annual rate of increase jump from +4.7% to +6.7%, a full two percentage point increase. In addition, the increase has occurred in all three of the major sub-groupings: shelter, transportation services and medical care services.

If service-related inflation adds the “sticky” component to the dilemma, what happens if energy prices reverse course and begin to rise in the months ahead? The widely publicized announcement of oil output cuts from OPEC+ appears to raise the specter of this possibility, another headache for Chair Powell.

Conclusion

When analyzing the inflation numbers, it is important to remember that it is akin to looking backward. The Fed’s hope is that future CPI reports will begin to show that the “Volcker-esque” pace of rate hikes since May will eventually start to tamp down price pressures. However, in the meantime, the persistently “hot” inflation readings will offer Powell no comfort whatsoever and continue to point the policy makers toward another 75 basis point rate hike in November.

I’ve blogged in the past about the track record for Fed Funds Futures as not being all that good, but nonetheless, for those who are counting, the terminal rate for Fed Funds has now moved up into the 4.75%–5% range.

—

Originally Posted October 19, 2022 – No Powell Pivot

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)