Every so often we need a reminder that even the most bullish of markets is susceptible to pullbacks. We got one yesterday. The CPI report forced investors to reconsider an over-optimistic rate-cut narrative. And VIX woke up from its stupor.

As we noted yesterday morning, the proximate cause for the decline was a set of higher-than-expected CPI statistics, most notably monthly headline and core readings that were 0.1% above the consensus. By itself, a modestly higher reading in an inflation statistic that is not even the Federal Reserve’s preferred measure (that’s Core PCE, not CPI) should not have caused a significant reaction in a wide range of asset prices. However, the market persisted in expected more rate cuts than the Fed seemed willing to offer. That changed dramatically yesterday.

After the December FOMC meeting, when Chair Powell acknowledged the likelihood for a “pivot”, which was bolstered by a “dot plot” that projected three rate cuts for 2024. Yet Fed Funds futures, which were already pricing in that number of cuts, almost immediately doubled those expectations. As we wrote in mid-January, in a piece entitled “Clues to Solving the Markets’ Key Contradiction”:

Let’s examine the current situation. Fed Funds futures are pricing in at least six rate cuts for 2024, with a roughly 60% chance for a seventh by December. Meanwhile, according to a recent report by FactSet, analysts are projecting earnings growth of 11.8% and revenue growth of 5.5% for the S&P 500 (SPX) for calendar year 2024. Ask yourself whether both predictions can simultaneously be true.

To be sure, rate cut expectations have been diminishing since the January 31st FOMC meeting. Prior to that meeting, there was a 43% chance for a 25bp cut in March, cuts fully priced in for May and June, and between five and six priced in for 2024. On Monday, those expectations had shrunk to 18% for March, 69% for May, a cut fully priced for Jun, and between four and five for the year. By this morning, although a cut remains priced in for June, the March and May expectations have dipped to 11% and 45% respectively, with just under four cuts priced in for 2024.

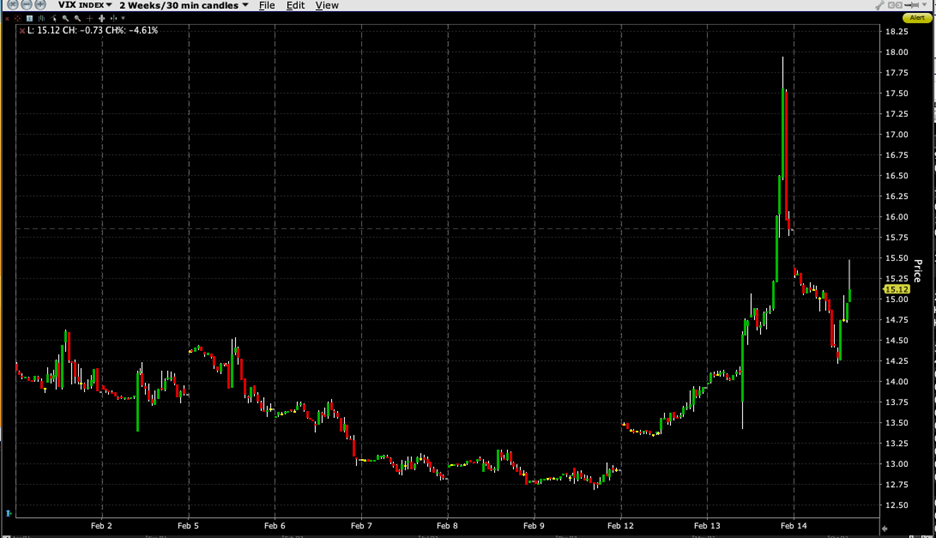

While the jolts to the yield curve and major indices were quite notable yesterday, to my mind, the resurgence in the Cboe Volatility Index (VIX) provided the most interesting reaction. As recently as Monday, VIX was trading below 13. At the time of peak declines yesterday, VIX flirted briefly with 18. This should provide a wake-up call to those who doubt the rationale or the efficacy of hedging. Even though VIX has pulled back from its panicky peak, the fact that it remains above 15 today tells us that institutional investors may have remembered that hedging is sometimes a desirable thing.

VIX Month-to-date 30-Minute Candles

Source: Interactive Brokers

The chart above shows the sideways to downward moves in VIX that had prevailed so far this month – until yesterday. Meanwhile, the chart below shows that despite yesterday’s damage, the S&P 500 (SPX) remains solidly higher on a month-to-date basis. The index bounced off the 4920 level, where the last mini selloff ended, though an early rally today seems to be losing steam.

SPX Month-to-date 30-Minute Candles

Source: Interactive Brokers

With a monthly options expiration this week and Nvidia earnings next week, both of which can bring volatility (especially NVDA), it seems opportune to remember that volatility is no different than any other asset – buying low and selling high tends be a useful strategy.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

sir, i noticed that there were a lot of vix options dated 2/14, which actually expire 2/13 afternoon during normal market hours. there were hundreds of thousands of put options soon to expire. i believe that the vix shot up because of the expiration of those vix put options.

I think there is a very good chance that NVDA’s earnings report will be a “non-event.” There will be a lot of media coverage for sure, and a lot of noise, but the stock really didn’t do much after the last two earnings reports.

Considering the enormous run-up and gain in market cap going into next week’s earnings, it may just stay in a volatile trading range for a while. The way out of the money call options are ridiculously mispriced (much too expensive) in my opinion. There are strikes up to $1490 now for THIS YEAR, $1200 would give it a valuation of 3 Trillion dollars, if it went any higher it would be the biggest company on the planet.

I DON’T SEE THIS HAPPENING.

i had vix 15 calls expiring on 02/14, but had to sell them for a few cents to get something back. Does anyone know what they trade like on 02/13 and what they settled at. thanks.