Key takeaways

Recession

We’ve been anticipating a recession for some time, but I believe the US economy is too strong to experience one this year.

Inflation

Core inflation has been stubbornly high, but I expect it to fall as the impact of flattening home prices makes its way into the Consumer Price Index.

Stocks

It’s difficult to predict the market bottom in this bizarre cycle, but I believe US stocks hit bottom back in October 2022.

When you do what I do for a living, you keep adages and statistics in your back pockets to bring out whenever the right situations arise. Then you repeat them in all settings and hope that you don’t end up looking like the one-trick ponies who get lambasted on the “And Now This” segment of Last Week Tonight with John Oliver. My go-to statistic over the past 12 months has been this: “Stocks have advanced, on average, by 17% over the one-year periods following historical peaks in inflation.”1

Admittedly, there have been moments over the past year that have tested my faith in this rudimentary analysis. A 9% decline in the S&P 500 Index in September alone will do that to you.2 However, the “hot take” culture frowns upon people who don’t stand by their provocative comments. Plus, I believed stocks were heading higher because, well, that’s what typically happens as inflation improves.

June 2023 marked a year since inflation peaked. The price return of the S&P 500 Index was +17.6% through the end of last month!3 Good call. As John Oliver would say, “Cool.”

A ‘keep it simple’ strategy

We start with three simple questions.

1. Where are we in the cycle?

Not all calls are prescient. The much-anticipated recession eludes us. The US economy looks too strong to enter a recession this year. I expect this cycle will end as all others do, with too much policy tightening. I just don’t see it happening in 2023.

2. What’s the market telling us about the direction of the economy?

Risk appetite, believe it or not, has improved significantly over the past month. Stocks have been outperforming bonds.4 Credit spreads have tightened.5 The magnitude of this reversal in market sentiment has historically signaled an improvement in growth expectations and a subsequent improvement in economic data.6 It’s reminiscent of late 2022 into early 2023 when a rebound in cyclical markets rightly challenged the notion of imminent recession.

3. What will be the policy response?

One more rate hike? Are we tired of talking about this yet? The US Federal Reserve, after letting inflation out of the bag, is committed to restoring its credibility.

Our view is that a tactical recovery trade has emerged, favoring cyclical, smaller-cap, and value-oriented stocks. The trade is reflective of the ongoing resilience in the US economy and recent improvements across various sectors. However, it does not ignore the likely impact of policy tightening on the economy that is still forthcoming. For now, we make hay while the sun shines. How’s that for another adage from the back pocket?

How’d we do?

Speaking of cooling inflation, let’s revisit an Above the Noise concept from October 2022. Back then, our crack team of advanced mathematicians (ok, it’s just me) calculated that if US inflation remained at its then 0.3% three-month run rate7, that the year-over-year percent change would be 3.2% by the June 2023 reading. Inflation is now at 3% on a year-over-year basis.8 That was some near-Nobel Prize winning math.

It may be confirmation bias, but …

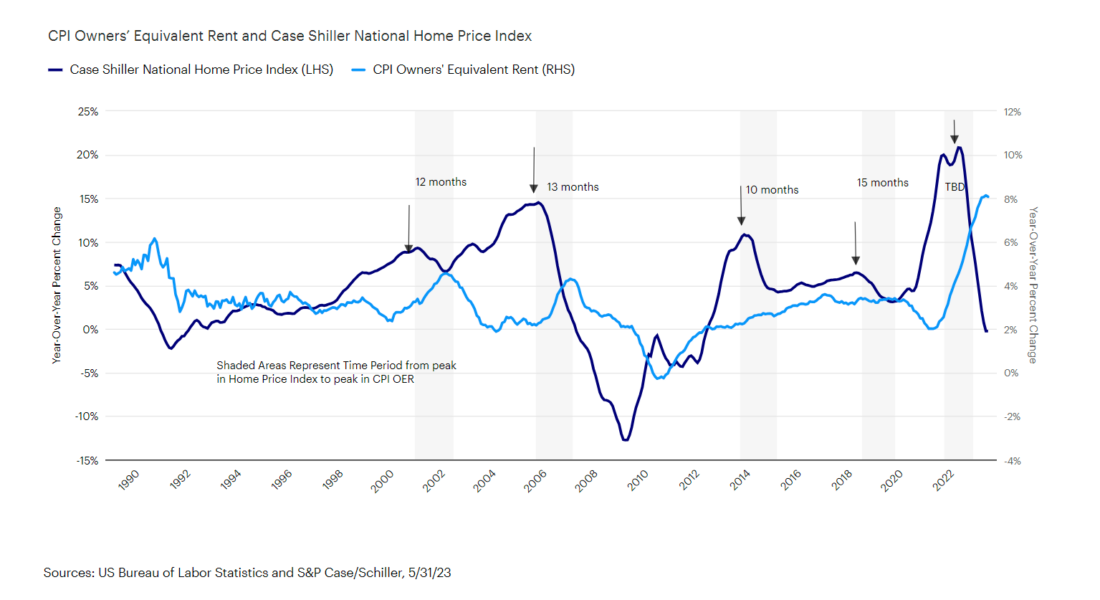

… I expect core inflation, which has been remained stubbornly elevated, to follow the Consumer Price Index (CPI) lower. Shelter is a large weighting of the core CPI (which excludes food and energy), but unfortunately, shelter costs are calculated in a manner that causes them to significantly lag current conditions.

The Bureau of Labor Statistics (BLS) can survey tenants and update the CPI when their rents change, but that only tends to happen when leases expire. By then, the BLS is telling us what we already know. We know that US home prices have already flattened9, and that the apartment rental market is soft.10 As shown in the chart below, CPI Owners’ Equivalent Rent has tended to peak roughly 10 to 12 months after the peak in the S&P Case/Shiller National Home Price Index. And the home price index peaked in April 2022.11 I’ll take the under on core CPI in the coming months.

It takes about one year for home price trends to be reflected in inflation data

Since you asked

If US stocks typically bottom in a recession, and the recession hasn’t happened yet, then why do I believe that the market has already bottomed?

Let me explain my thinking.

- In past periods of hyperinflation (1970, 1974, 1980, and to a lesser extent 1991), inflation peaked during the recession.12

- In each of those instances, the market bottomed around the inflation peak, which again occurred during the recession.13

So, which event drives the market bottom? The recessions or the inflation peaks? It’s hard to know because in the past both have occurred simultaneously. But today, we’re in a rare cycle in which inflation is well past its peak, but the economy hasn’t yet entered a recession. So the distinction takes on more importance.

Do I need to be bearish simply because in this bizarre COVID cycle, the timing between the peak in inflation and the recession didn’t align? I think not. Put me down for the market having bottomed last October.

I’ll take solace knowing that last year’s peak-to-trough 25.4% decline in the S&P 500 Index, which occurred from Jan. 4, 2022, through Oct. 13, 2022, is historically consistent with market returns associated with the more mild recessions of the past, including 1980 and 1991.14

Hamlet’s Queen Gertrude might accuse me of protesting too much, but there is method in’t.

It was said

“Nobody works. ‘Just give it to me. Send me money. I don’t want to work …’”

– Bernie Marcus, co-founder of Home Depot, from a December 2022 interview in The Financial Times.

I hear this type of rhetoric all the time. I take personal offense from it as I hail from a generation that was said to be destined to sit in coffee shops all day listening to Nirvana records. The “nobody wants to work” idea gained traction in the early post-COVID period. It even got a name: The Great Resignation.

The problem is that it simply isn’t true. The US labor force participation rate for Americans ages 25-54 is now 83.5%, greater than it was before the pandemic and the highest it has been in over 20 years.15 Sometimes the numbers get in the way of a good story. Now, if you need to find me, I’ll be finishing this commentary in a Starbucks while listening to In Utero.

Phone a friend

You may have noticed the highly anticipated post-COVID surge in Chinese economic growth hasn’t materialized. What happened? I posed the question to David Chao, Invesco’s Global Market Strategist for Asia Pacific. His response:

China’s economy has lost momentum, the result of lackluster consumer demand and tepid private investment sentiment.16 The initial burst in pent-up spending by the Chinese consumer following the abrupt economic reopening has proved fleeting. Consumer confidence appears sapped with youth unemployment high, and the property market challenged.17 Instead of a sharp V-shaped, consumption-led recovery, we think the recovery could be more U-shaped.

All eyes are now on the policymakers. While the government has consciously veered away so far from stimulating the economy through infrastructure investment and support for the property market, the recent sharp deceleration in growth could force their hand back to the historical playbook.

On the road again

My travels took me to Kansas City, where my personal focus was on getting good barbeque. Kansas City has no shortage of great places, but I went with the one that the late Anthony Bourdain had listed as “one of the 13 places to dine before you die”. That’s an endorsement I don’t take lightly. Apparently, others had the same idea. The 1:30 lunch line was out the door and around the block, confirming my view that there will be no recession in 2023. As for the burnt-ends and the baked beans, they didn’t disappoint!

Please slow down summer!

Footnotes

- Sources: US Bureau of Labor Statistics and Bloomberg, L.P, 6/30/23. Based on the returns of the S&P 500 Index in the one-year periods following the peak in the Consumer Price Index. Inflation peak dates are Feb. 1970, Dec. 1974, Mar. 1980, Dec. 1990, and July 2008.

- Source: Bloomberg, 6/30/23. Based on the returns of the S&P 500 Index in Sept. 2022.

- Sources: US Bureau of Labor Statistics and Bloomberg, L.P., 6/30/23. Based on the returns of the S&P 500 Index from June 2022 to June 2023.

- Source: Bloomberg, L.P. As represented by the one-month performance ended 6/30/23 of the S&P 500 Index and the Bloomberg US Treasury Index.

- Source: Bloomberg, L.P., 6/30/23. As represented by the option-adjusted spread of the Bloomberg US Corporate Bond Index.

- Sources: Bloomberg, L.P., Invesco Investment Solutions research and calculations, from Jan. 1, 1992, to Jun. 30, 2023. Based on the Global Leading Economic Indicator, a proprietary, forward-looking measure of the growth level in the economy, and the Global Risk Appetite Cycle Indicator, a proprietary measure of the markets’ risk sentiment.

- Source: Bureau of Labor Statistics, 6/30/23. Based on the average monthly change in the US Consumer Price Index from July 2022 to September 2022.

- Source: Bureau of Labor Statistics, 6/30/23. Based on the year-over-year percent change in the US Consumer Price Index.

- Source: S&P CoreLogic Case-Shiller, 6/30/23. The S&P CoreLogic Case-Shiller National Home Price Index declined 0.24% over the one-year period ended June 30, 2023.

- Source: Reis, Inc. 3/31/23

- Sources: Bureau of Labor Statistics, S&P CoreLogic Case-Shiller, and Invesco, 6/30/23

- Sources: US Bureau of Labor Statistics and National Bureau of Economic Research, 6/30/23

- Sources: Bloomberg, L.P., US Bureau of Labor Statistics, and National Bureau of Economic Research, 6/30/23. Based on the S&P 500 Index.

- Source: Bloomberg, L.P., 5/31/23. Based on recession dates defined by the National Bureau of Economic Research: Aug. 1957 – Apr. 1958, Apr. 1960 – Feb. 1961, Dec. 1969 – Nov. 1970, Nov. 1973 – Mar. 1975, Jan. 1980 – Jul. 1980, Jul. 1981 – Nov. 1982, Jul. 1990 – Mar. 1991, Mar. 2001 – Nov. 2001, Dec. 2007 – Jun. 2009 and Feb. 2020 – Apr. 2020. It is unknown if 10/13/22 will be the market trough of this cycle.

- Source: Bureau of Labor Statistics, 6/30/23

- Source: National Bureau of Statistics of China, 3/31/23

- Source: Bloomberg, L.P., 6/30/23

—

Originally Posted July 20, 2023

Above the Noise: Making sense of a bizarre market cycle by Invesco US

Important information

NA3005429

Past performance is not a guarantee of future results.

This does not constitute a recommendation of any investment strategy or product for a particular investor.

Investors should consult a financial professional before making any investment decisions.

All investing involves risk, including the risk of loss.

An investment cannot be made directly in an index.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

Stocks of small and mid-sized companies tend to be more vulnerable to adverse developments, may be more volatile, and may be illiquid or restricted as to resale.

A value style of investing is subject to the risk that the valuations never improve or that the returns will trail other styles of investing or the overall stock markets.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

The Consumer Price Index (CPI) measures changes in consumer prices. Core CPI excludes food and energy prices while headline CPI includes them.

The S&P 500® Index is an unmanaged index considered representative of the US stock market.

The Bloomberg US Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

The option-adjusted spread (OAS) is the measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is then adjusted to account for an embedded option, such as calling back or redeeming the issue early.

The Bloomberg US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury.

S&P Case/Shiller Home Price Index tracks changes in the value of US residential real estate.

CPI Owners’ Equivalent Rent measures the rate of change in the amount an owner would need to pay in order to rent on the open market.

Monetary policy tightening is used by central banks to help control inflation.

Credit spread is the difference in yield between bonds of similar maturity but with different credit quality.

The opinions referenced above are those of the author as of July 17, 2023. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

Disclosure: Invesco US

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial advisor/financial consultant before making any investment decisions. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

All data provided by Invesco unless otherwise noted.

Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s Retail Products and Collective Trust Funds. Institutional Separate Accounts and Separately Managed Accounts are offered by affiliated investment advisers, which provide investment advisory services and do not sell securities. These firms, like Invesco Distributors, Inc., are indirect, wholly owned subsidiaries of Invesco Ltd.

©2024 Invesco Ltd. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Invesco US and is being posted with its permission. The views expressed in this material are solely those of the author and/or Invesco US and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.