Will 2023 be the ‘year of artificial intelligence’? It’s looking quite possible.

Whenever a singular topic gains this level of attention, it’s instructive to look at how investors develop different types of tunnel vision. If the wave continues, there is a good chance that the general person may not know what a graphics processing unit (GPU) is, or how it connects to artificial intelligence (AI), but they may know that Nvidia makes them and that Nvidia is the ‘AI company’.

Frequently, we find ourselves trying to step back and think about the broader set of infrastructure that is required for Nvidia’s GPUs to be effective at training and running AI models. Nvidia designs merely one part of a much longer value chain that builds into the AI ecosystem. It is an important part, and Nvidia is able to extract a significant percentage of the overall economic value. But, if the other parts ceased to exist, Nvidia’s GPUs by themselves are not very useful.

Data centres: where are the AI models trained and run?

The software aspect of AI is often conceptualised, but it’s important not to forget the physical aspect. Giant server farms, strategically deployed across the globe, allow the internet to work as we have come to expect, and this compute infrastructure also allows the largest AI models to be trained and run.

Data centres represent the specific, purpose-built real estate that supports this compute infrastructure. There is a constant race to both expand the computational resourcing per square foot in the existing data centres as well as the overall data centre footprint.

Why is this? Well, when was the last time you thought about data storage? We’re all taking more pictures, generating more content and not paying a second’s thought to storage. We just assume that when we need it, more will always be there.

At WisdomTree, we work closely with CenterSquare, an investment management firm that specialises in real estate assets. They recently put out a short briefing note with a focus on data centres.

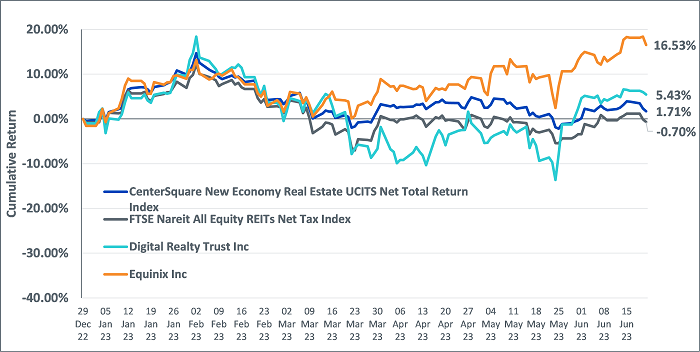

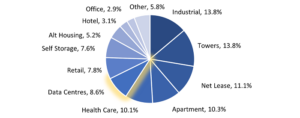

Figure 1 provides important context on what the current real estate market looks like, halfway through 20231:

- Data centres represent 8.6% of the pie.

- Many people would have expected the share of ‘Office’ to be larger, but it was only 2.9%.

- We’d also draw attention to ‘Towers’ at 13.8%. A critical reason to discuss data centres and AI regards the speed with which we can send data to different places. Cell phone towers and the overall upgrade to 5G infrastructure is an important link in this chain.

Figure 1: A snapshot of the current real estate market [US real estate investment trust (REIT) investable universe]

![Figure 1: A snapshot of the current real estate market [US real estate investment trust (REIT) investable universe]](https://ibkrcampus.com/wp-content/uploads/2023/07/06-d-07-nvidia-1.png)

Source: FTSE Nareit All Equity REITs Index, as of 8 June 2023. Subject to change.

Historical performance is not an indication of future performance and any investments may go down in value.

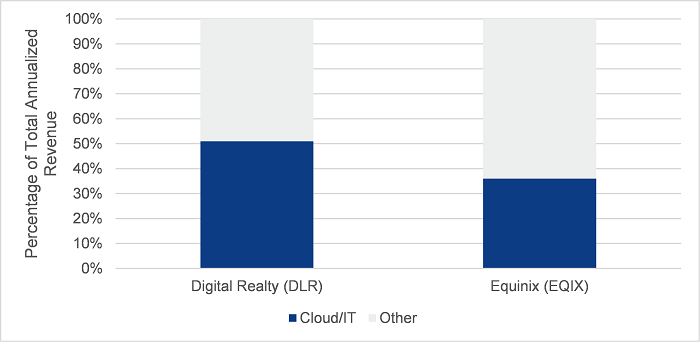

Figure 2 takes the two largest data centre real estate investment trusts (REITs), Digital Realty Trust and Equinix, and looks at the percentage of annualised rental revenue from ‘cloud/IT providers’. The reason CenterSquare wanted to highlight this was from the recognition that it is really these companies that are driving AI, and equity markets, forward. Some of the names would include:

- Amazon.com

- Alphabet

- Apple

- Meta Platforms

- Microsoft

- IBM

- Oracle

If we look at market indices, like the S&P 500 Index or the Nasdaq 100 Index, many of these firms are responsible for the bulk of the performance observed in the first half of 2023. Whether or not that exact trend continues, it’s clear that investors believe that these companies will be central in pushing AI forward. Figure 2 indicates how important these firms are to the revenues from the two largest data centre REITS.

Figure 2: Companies driving AI forward are major data centre customers

Source: Green Street, as of 30 May 2023. Subject to change.

Historical performance is not an indication of future performance and any investments may go down in value.

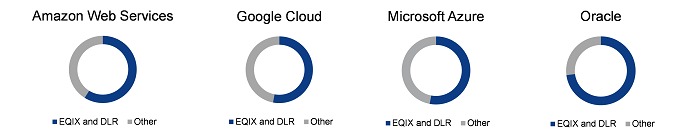

Figure 3 addresses the fact that, for the hyperscale (that is, most capable, best compute infrastructure), cloud providers depend on Equinix and Digital Realty Trust for the majority of their connectivity. It is a similar idea to considering a key trend in semiconductors, where many firms depend on Taiwan Semiconductor Manufacturing Co. (TSMC) to fabricate the most advanced chips. Space and prime locations for data centres are not unlimited and, even if the degree of specialisation is not the same as the case of TSMC, there are benefits to these companies being able to plug into existing infrastructure from firms that specialise in exactly that, as opposed to building each and every data centre on their own.

Figure 3: The hyperscale cloud providers have a major reliance on Equinix and Digital Realty Trust

Source: CenterSquare compiled available data from cloud provider websites as of December 2022 and also from Equinix as of 8 May 2023 to create this image.

Figures should be noted as estimates based on the best available public data. Subject to change.

Historical performance is not an indication of future performance and any investments may go down in value.

Bottom line: new economy real estate represents an alternative way to think about artificial intelligence in 2023

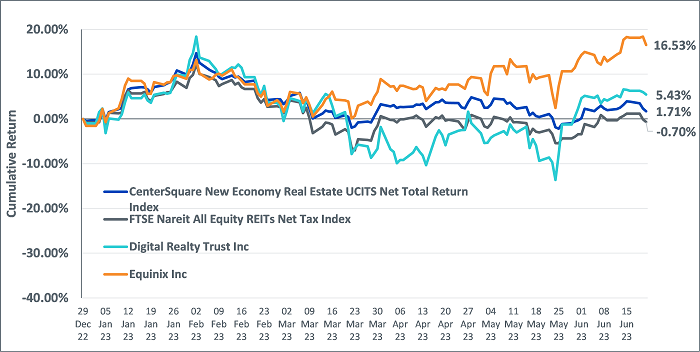

If we start looking under the hood at how certain stocks, like Equinix and Digital Realty Trust, have performed, we see in Figure 4 that they have not moved to anywhere near the same extent as other stocks associated with AI during the first half of 2023. On the one hand, we’d note that there is no reason to expect them to move as much as companies like Nvidia, a ‘picks and shovels’ AI play, or a Meta Platforms, an example of a firm building large language models. But we’d also say that the function that they provide does become more valuable if we know we need to dramatically expand computational resources and infrastructure.

The CenterSquare New Economy Real Estate UCITS Net Total Return Index represents a broad array of ‘technology oriented real estate opportunities’. It does have exposure to data centre REITS, and it also has exposure to cell phone tower REITS. Computational resources need to be placed somewhere, and data needs to be transmitted if we are going to see the dramatic expansion of AI that we expect. Finally, we see how that Index compares to that of the FTSE Nareit All Equity REITs Net Tax Index, a way to look even more broadly at publicly investable real estate assets.

In the first half of 2023, many investors went to the picks and shovels. If AI continues to expand in its importance, where might it go next?

Figure 4: Cumulative return of specified REITS & indices (year-to-date as of 21 June 2023)

Source: Bloomberg. Data from 31 December 2022 (year-end) to 21 June 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

Sources

1 Source: FTSE Nareit All Equity REITs Index as of June 8, 2023.

—

Originally Posted Amidst the frenzy for Nvidia, don’t forget the data centres

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Disclosure: IBKR Tax Disclosure

Interactive Brokers does not provide tax advice, does not make representations regarding the particular tax consequences of any investments, and cannot assist clients with tax filings. Investors should consult with their tax professional about the tax implications of any investment.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.