Stocks are having their best week of the year as a plethora of major economic developments went in favor of the bulls. A week of bullish news for market players wrapped up this morning with lighter-than-expected job market data creating a strong boost in market sentiment.

A Week of Encouraging Data

Data on Tuesday showed an easing of inflation in the eurozone. On Wednesday, weaker-than-expected U.S. ISM-Manufacturing and ADP payroll reports pointed to a further easing of inflationary pressures. Additionally, Federal Reserve Chairman Jerome Powell’s presentation on the same day was interpreted by investors as dovish. Investors’ enthusiasm received another boost yesterday with data depicting productivity gains and increases in initial and continuing unemployment claims, which in total portray additional easing of inflationary pressures. After enduring three months of consecutive equity losses, this morning’s news that newly created jobs missed expectations by 30,000 alongside another miss on ISM-Services is empowering bulls who are seeking to preserve this year’s market rally and maybe even add to it.

Hiring Slows in October

Employers added 150,000 jobs last month, according to this morning’s Employment Situation Summary from the U.S. Bureau of Labor Statistics. Analysts had expected jobs to increase by 180,000. Additionally, job growth slowed from September’s downwardly revised 297,000. While 150,000 new jobs would normally be considered strong job growth, this morning’s report offered plenty of weakness under the surface. First, almost all of the net gains were attributed to the non-cyclical education, health services and government sectors, which added 140,000. Second, five of the fourteen sectors lost jobs during the period. Third, the labor force participation rate and the pace of wage gains declined while the unemployment rate ticked up.

Non-Cyclical Employers Lead

Job gains were dominated by the private education and health services category and the government sector which added 89,000 and 51,000, respectively. Construction also contributed to job creation with 23,000 new positions. Other gains occurred in the leisure and hospitality category, which added 19,000 positions and professional and business services, which added 15,000 positions. Wholesale trade, mining and logging, retail trade, and utilities each added below 10,000 jobs. Leading the job losses were the manufacturing, transportation and warehousing, information, finance and other services sectors which reduced headcounts by 35,000, 12,000, 9,000, 2,000 and 1,000.

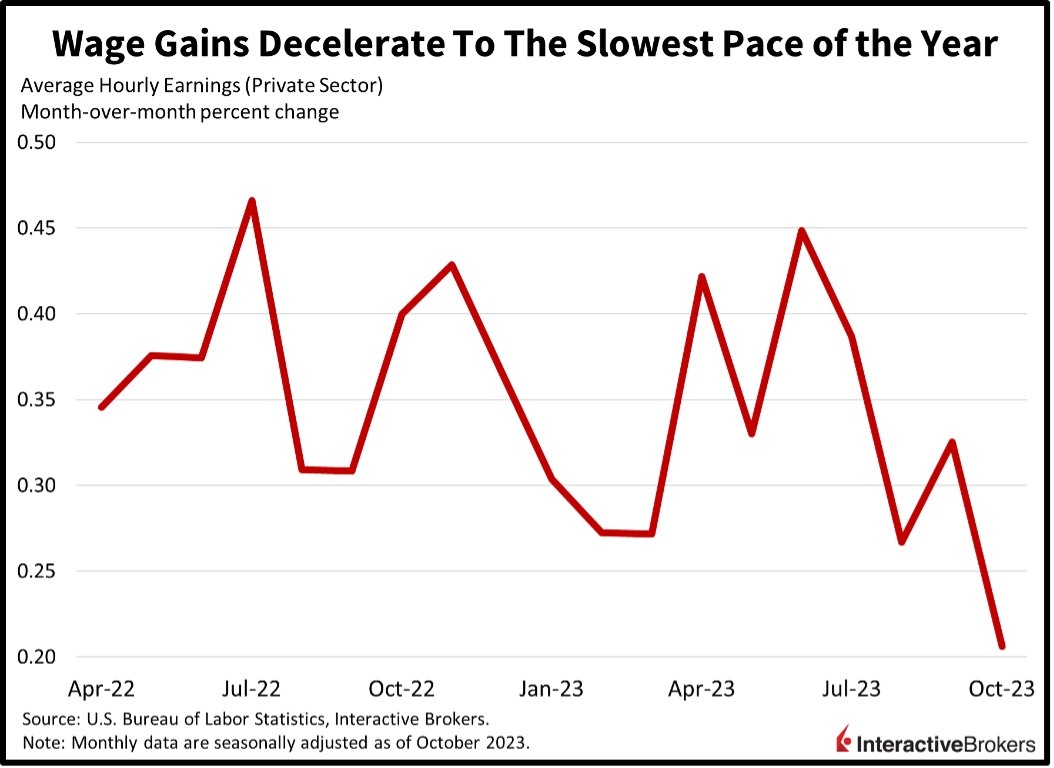

Wage Increases Slow

Easing labor demand led to wage gains slowing to 0.2% month-over-month (m/m) a deceleration from the 0.3% reported for September. Indeed, wage gains decelerated to the slowest pace since February 2022. Meanwhile, some folks appeared to stop looking for jobs and stayed home, as 201,000 people left the labor force. It’s unclear if those individuals were primarily discouraged about potential wages or if they were unable to find work due to mismatches in their skills and the skills employers need. The slowdown in hiring amidst a reduced labor force caused the unemployment rate to hit 3.9%, higher than expectations calling for an unchanged m/m reading of 3.8%.

U.S. Services Sector Slows

In another sign of easing economic activity, the growth in the U.S. services sector slowed last month with the Institute for Supply Management’s (ISM) Purchasing Managers’ Index for services weakening to 51.8 from September’s 53.6 level. Economists expected a number closer to 53. Servicers are attempting to do more with less, as employment declined sharply to 50.2 from 53.4 while new orders and backlogged orders grew from 51.8 and 48.6 to 55.5 and 50.9. Perhaps most concerning, however, was the 58.6 figure on prices, which only slowed marginally from 58.9, pointing to persistent services sector inflation. The good news, however, is that goods and commodity inflation appear to be well contained at the moment.

Canada’s Job Market Also Weakens

North of the U.S. border, jobs also came in below estimates. Canadian job growth totaled 17,500 in October, weaker than the 22,500 estimate and September’s 63,800. In a sign of weakness under the surface, the private sector lost 1,400 jobs while the public sector added 18,900. Also, job growth was entirely carried by part-timers, with full-time employment declining by 3,300 while part-time employment grew 20,800.

Easing Fears of Hawkish Fed Drive Strong Market Gains

Markets are soaring today with all major U.S. equity indices higher while bond yields and the dollar tumble as financial conditions loosen. The small-cap Russell 2000 Index is leading with a 2.6% gain while the S&P 500, Nasdaq Composite and Dow Jones Industrial indices are up 0.7%, 0.7% and 0.5%, respectively. Bond yields are tumbling across the Treasury curve, with the 2- and 10-year maturities down 13 and 14 basis points (bps) to 4.86% and 4.53%. Lower yields and lighter Fed tightening expectations are pushing down the dollar, with the greenback’s index down 92 bps to 105.19. The Federal Reserve’s currency is down against the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Crude oil is lower on the session as traders focus on weaker demand conditions while dialing down risks of a wider Middle East conflict. The weaker greenback is also hurting the commodity which is dollar denominated. WTI crude oil is down 0.6% or $0.49 per barrel to $81.96.

Streaming and Traveling Shine as Global Trade Contracts

Consumer spending on services, such as streaming entertainment and traveling remains strong, while international trade is weakening as the global economy slows, as illustrated by the following examples:

- Apple’s third-quarter sales dropped for the fourth-consecutive quarter despite strong results for its services. Apple executives, furthermore, said the trend of declining sales may not reverse this quarter. Apple’s third-quarter earnings per share of $1.46 beat the analyst consensus expectation of $1.39 and climbed year over year (y/y) from $1.29. Apple has implemented cost control measures, including CEO Tim Cook taking an approximately 40% cut in his target pay from his 2022 compensation of $84 million. Unlike other large tech firms, Apple also refrained from increasing its hiring during the Covid-19 Pandemic. Cost containment helped offset the impact of the company’s decline in revenues upon earnings with Apple’s third-quarter sales of $89.9 billion declining 3% y/y. Apple’s services revenue of $22.31 billion set an all-time high record for the company and beat the analyst consensus expectation of $21.35 billion. IPhone sales of $43.81 billion matched analysts’ expectations and climbed 2% y/y, however, the recent quarter included only one week of sales of the company’s iPhone 15 and its results were better than the first week of sales for the iPhone 14 in the third quarter of 2022.

- Expedia, which is one of the largest online travel booking companies, reported strong y/y growth that exceeded the analyst consensus expectation, resulting in the company’s stock price climbing more than 14%. Expedia generated a third-quarter EPS of $5.41 compared to the analyst expectation of $4.99. In the year-ago quarter, the company generated an EPS of $4.05. The company’s $3.93 billion in revenue climbed 9% y/y and exceeded the analyst revenue expectation of $3.86 billion. In a sign of strong travel volumes, the number of room night bookings climbed 9% and set an all-time third-quarter high.

- A.P. Moller Maersk reported third-quarter results that reflect weakening international trade as the global economy slows. The shipping and logistics giant said its third-quarter profits fell to $521 million compared to the $8.88 billion that the company generated in the year-ago quarter. Maersk said the pandemic driven boom in cargo has ended, resulting in a surplus of ships and a steep decline in shipping rates. It plans to lay off 10,000 workers, which will save $600 million in 2024. In the third quarter, revenue for the company’s core shipping business declined more than 50% from the $7.9 billion that Maersk generated in the year-ago quarter.

Soft, Stable Data Is Key

This week’s economic data provided market players with non-recessionary deceleration, allowing rates to plunge while economic activity continues growing. A concern going forward is that loosening financial conditions could ignite a renewed surge in inflationary pressures, like they have in the past. Another risk is that economic data will fall off a cliff in the first quarter of next year. For now, however, financial and economic outcomes depend on soft, stable data, not too hot, not too cold.

Visit Traders’ Academy to Learn More About Payroll Employment and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.