By J.C. Parets & All Star Charts

1/ Near-Term Breadth Improves

2/ Structural Downtrends Persist

3/ Dr. Copper Diverges

4/ Sugar Craves Out a Potential Top

Investopedia is partnering with All Star Charts on this newsletter, which both sells its research to investors, and may trade or hold positions in securities mentioned herein. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice.

1/ Near-Term Breadth Improves

When we look beneath the surface for signs of market health, we notice a slight improvement in internals.

As you can see below, the percentage of new 21-day highs for the S&P 500, S&P 600, and S&P 400 have increased significantly in recent weeks, hitting their highest levels since the summer.

This type of breadth improvement is constructive for stocks and an early sign that the market could be making a durable bottom.

Although bulls still have work to do, we’re looking for a thrust in 63-day highs in the near future. This could be the best confirmation of the shorter-term readings that have taken place in the last few weeks. After all, we need new short-term highs before we can get new long-term highs. For now, things may be headed in the right direction.

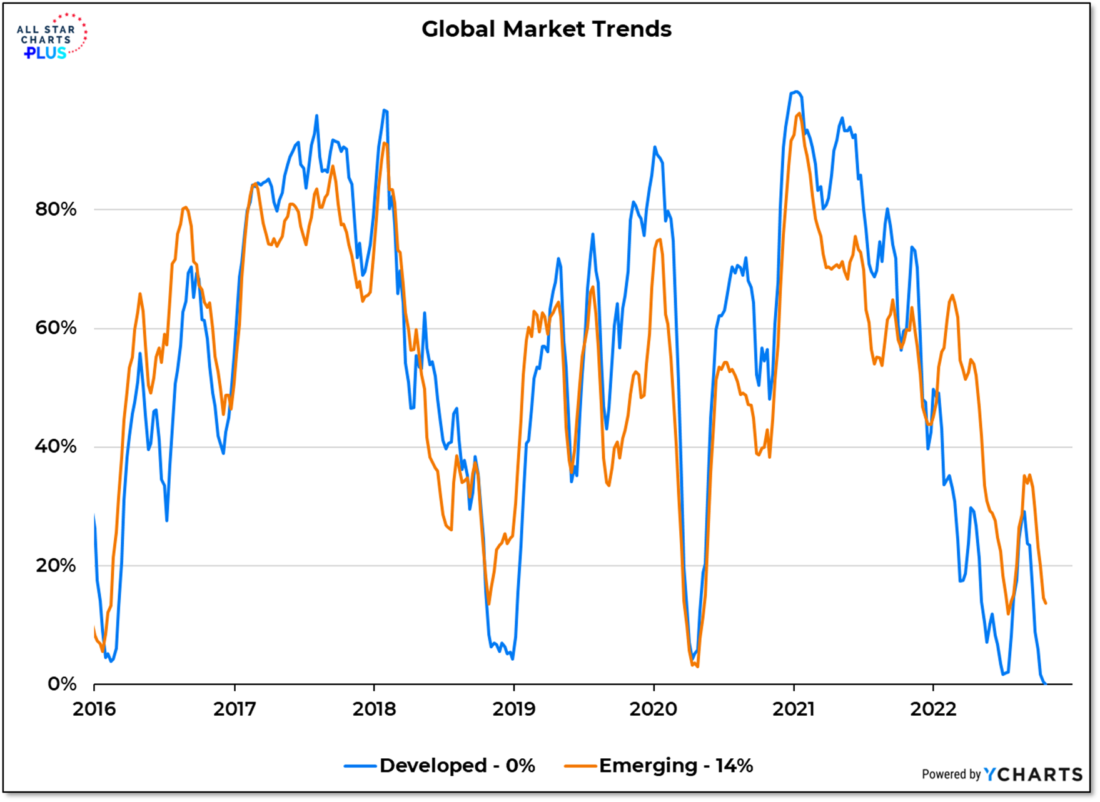

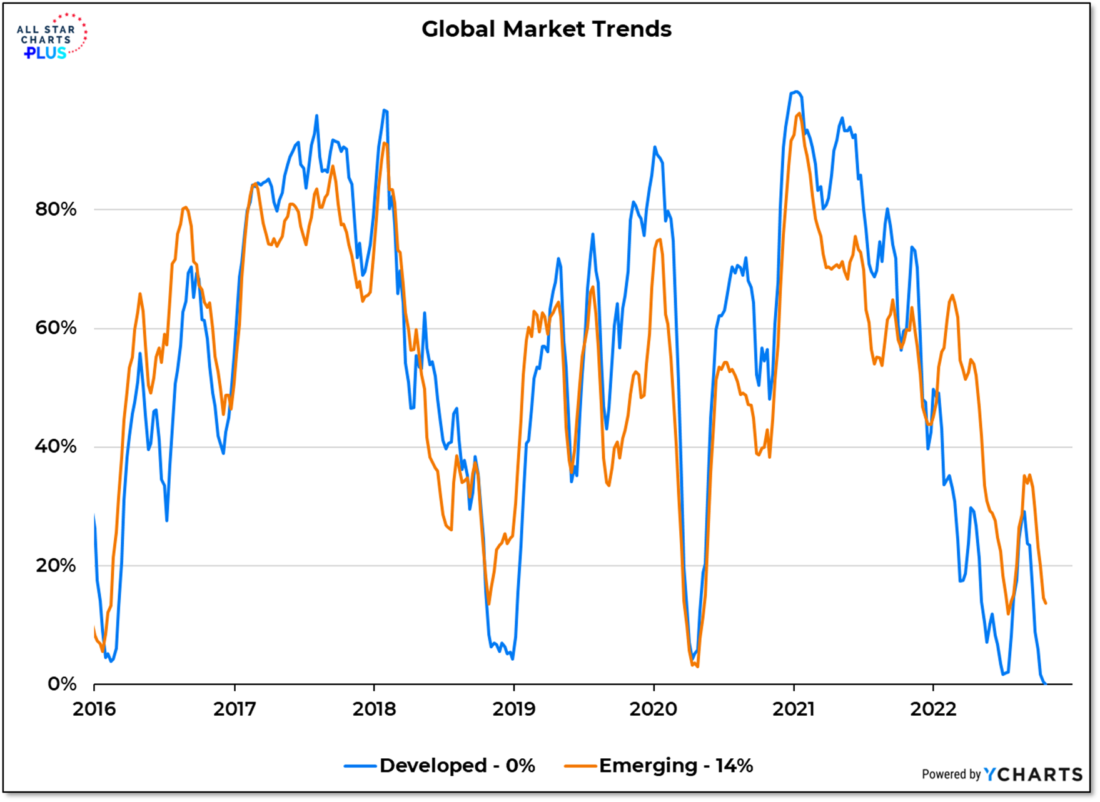

2/ Structural Downtrends Persist

Despite burgeoning strength in the U.S., the outlook for global markets remains bleak.

Interestingly, emerging markets—shown by the orange line—are faring better than their developed market counterparts—shown by the blue line, as the chart below highlights.

The outperformance from emerging market economies makes sense given the rising rate environment.

It’s no wonder cyclical value sectors such as industrials, energy, and materials have been the strongest sectors in recent months. These are the types of stocks and companies most prevalent in emerging markets.

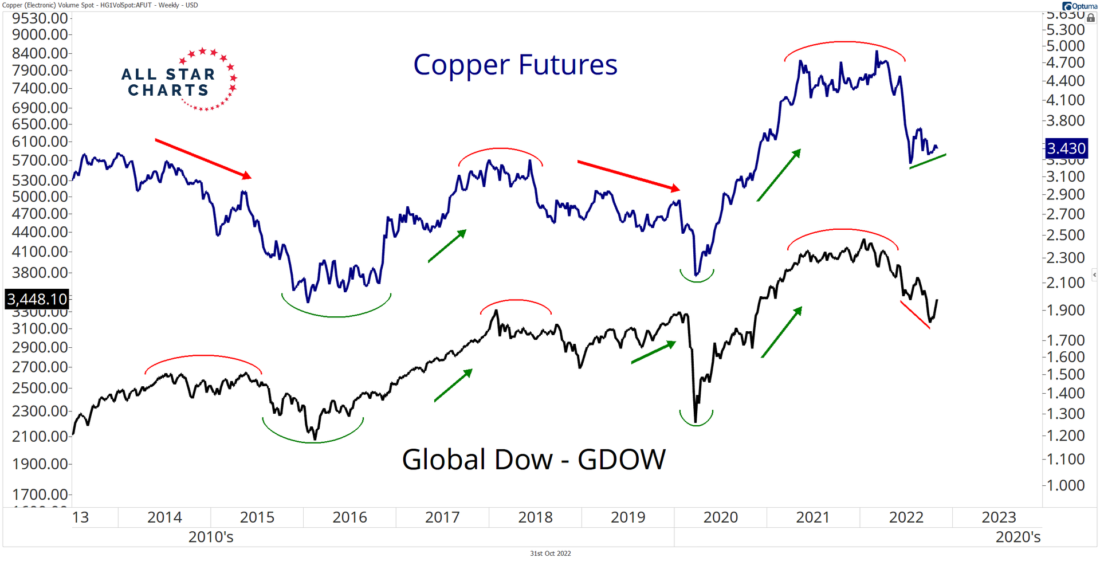

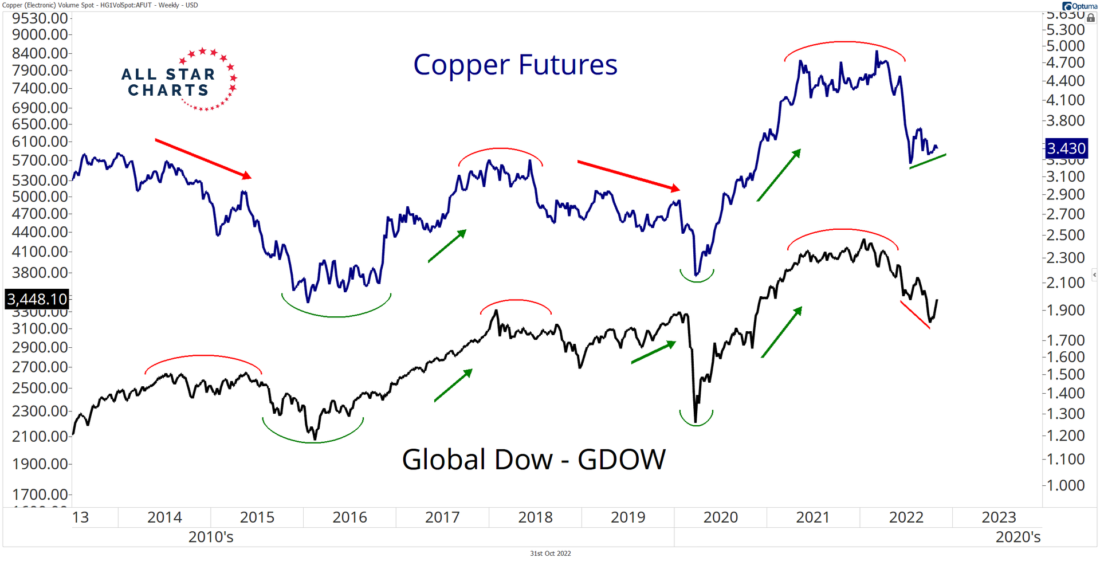

3/ Dr. Copper Diverges

As global markets fall under increased selling pressure, a key economic bellwether—copper—has diverged. Instead of making fresh lows along with the Global Dow, copper put in a higher low as it coils above its prior-cycle highs.

This is a noteworthy development, given copper’s tight correlation with global equities and its role as a leading indicator for the global economy.

If copper can find support at its former 2018 highs and catch higher, this could bode well for international equities and risk assets in general. On the other hand, more pain could lie ahead for stocks and commodities if copper breaks down from its current consolidation.

Stock market bulls worldwide would want to see copper dig in and find a floor.

4/ Sugar Craves Out a Potential Top

The March 2023 sugar futures contract is forming a classic head and shoulders topping pattern. It appears that last month’s breakdown was simply a false start.

Earlier in the month, buyers pushed price back toward the high of the left shoulder, adding a degree of symmetry to the pattern.

It’s constructive to see a topping pattern have balance, suggesting strong hands continue to distribute their shares, or in this case, contracts.

Also, it’s best to see an abbreviated right shoulder when it comes to these formations, as the shorter the duration, the stronger the selling pressure.

The last thing sugar bears would want to see is price action chopping around the neckline, failing to break down.

—

Originally posted 31st October, 2022

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.