By J.C. Parets & All Star Charts

1/ Seasonality Suggests a Break

2/ Building Up Energy

3/ Defensive Sectors Join Participation

4/ BOJ Goes With the Flow

Investopedia is partnering with All Star Charts on this newsletter, which both sells its research to investors, and may trade or hold positions in securities mentioned herein. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice.

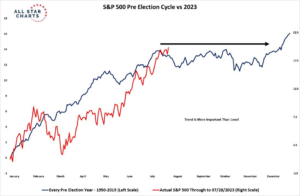

1/ Seasonality Suggests a Break

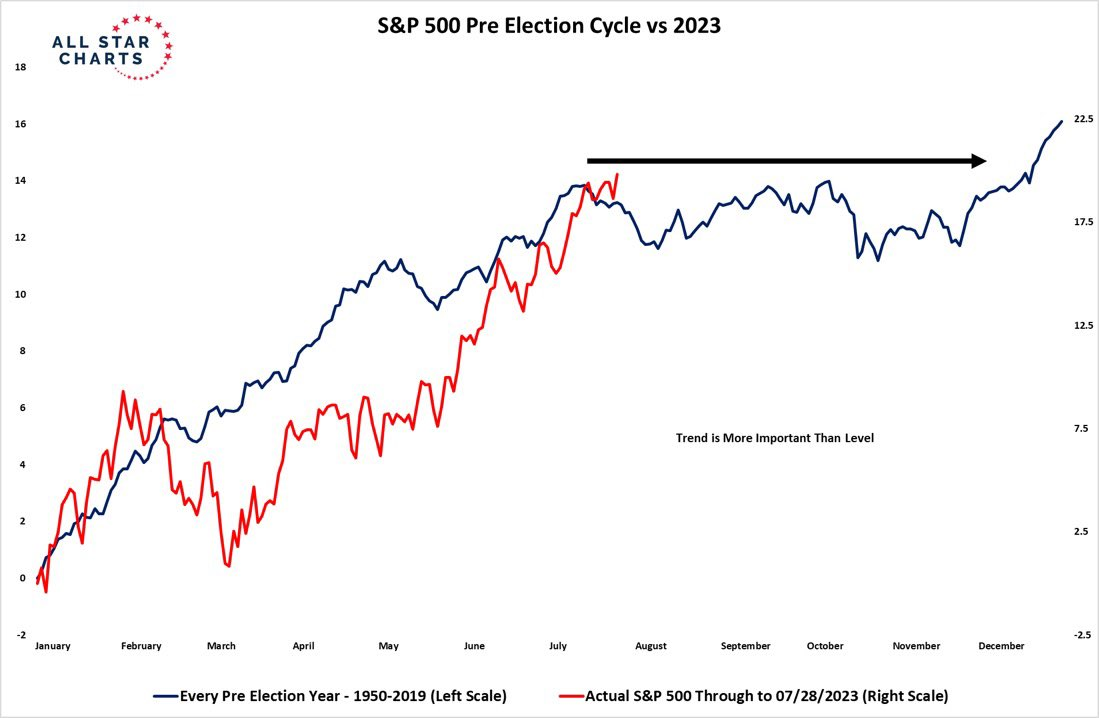

With July in the books, the equity markets delve into a historically slow period for U.S. equities (at the index level at least).

According to the Pre Election Cycle, if the S&P 500 is going to take a breather, this would be a perfectly logical time in the cycle to catch its breath.

As you can see, the current S&P performance (red line) has followed the seasonal trend (blue line) closely over the trailing year.

If it continues, it will mean flat prices for the S&P 500 into the back half of the year. This would make sense as rotation moves down the market cap scale into value-oriented cyclical sectors.

Remember, the stock market is a market of stocks.

2/ Building Up Energy

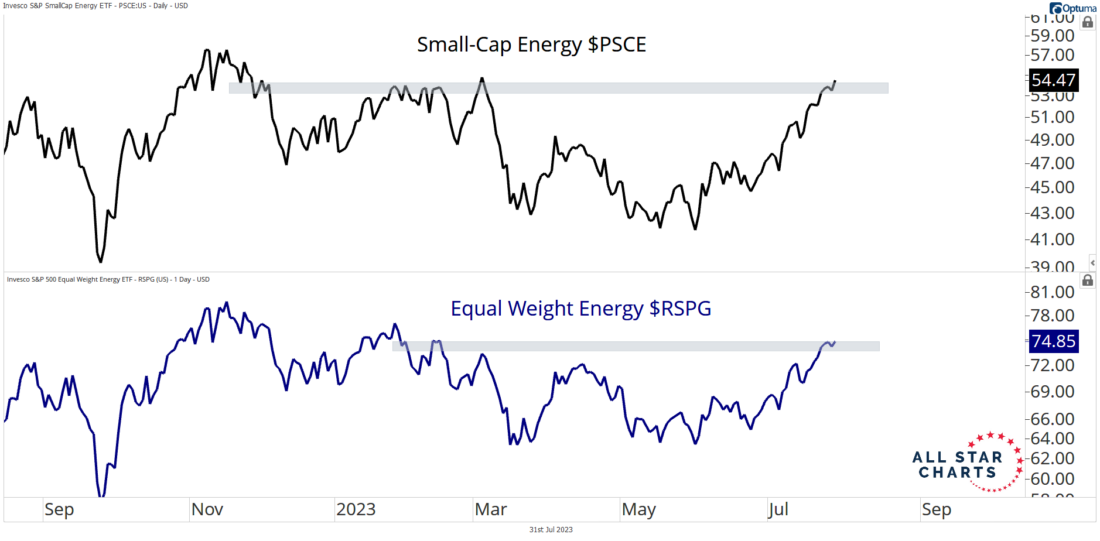

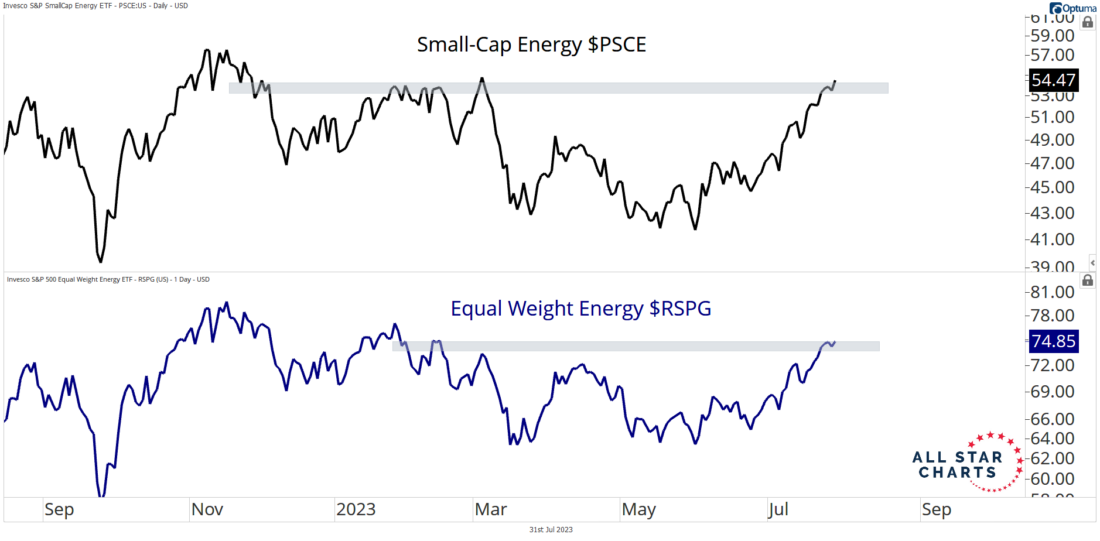

Energy stocks have made absolutely no progress for more than a year now. The equal-weight large-cap and small-cap indexes peaked in early June of last year and have been trapped in a sideways range ever since.

When we zoom out on these trends, things look much better. Energy stocks remain in a structural uptrend, as the sector enjoyed big gains in 2020 and 2021 and was the clear market leader when stocks corrected in 2022.

When we zoom in on the chart, things also look much better. Since late June, the Invesco Small-Cap Energy ETF (PSCE) has returned roughly 23%. The Equal-Weight (large-cap) Invesco Energy ETF (RSPG) is up about 17%. While PSCE is making fresh eight-month highs, RSPG isn’t far behind as it challenges year-to-date highs.

The near-term strength and improving internals from energy stocks, combined with a strong long-term uptrend, suggest this is an area that should benefit from the current sector rotation.

As long as crude oil and large-cap energy indexes are above their 2018 highs, the bias is higher for the entire group, and the oil field could present bullish opportunities in the second half of 2023.

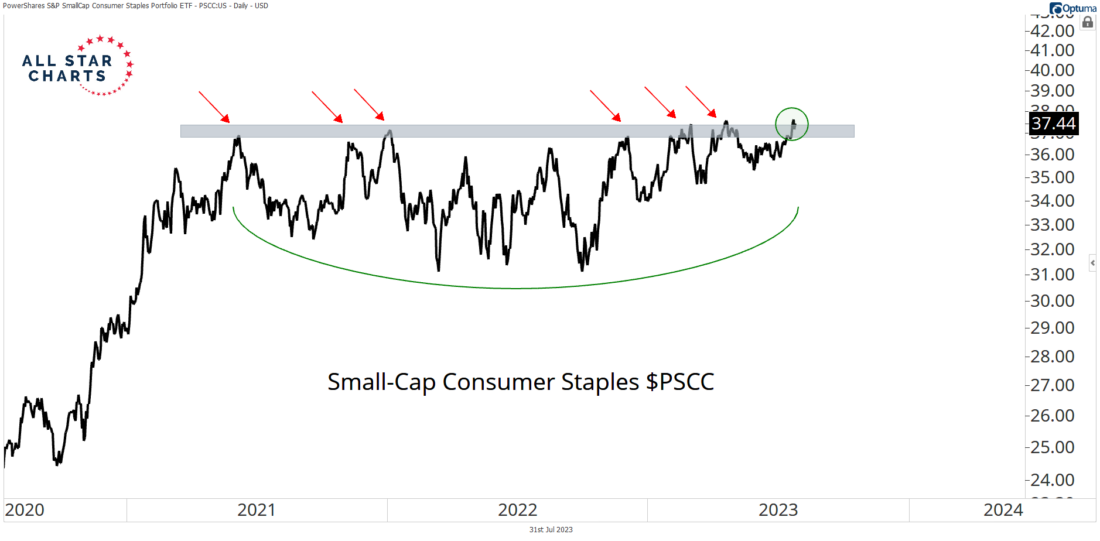

3/ Defensive Sectors Join Participation

The bulls remain in control.

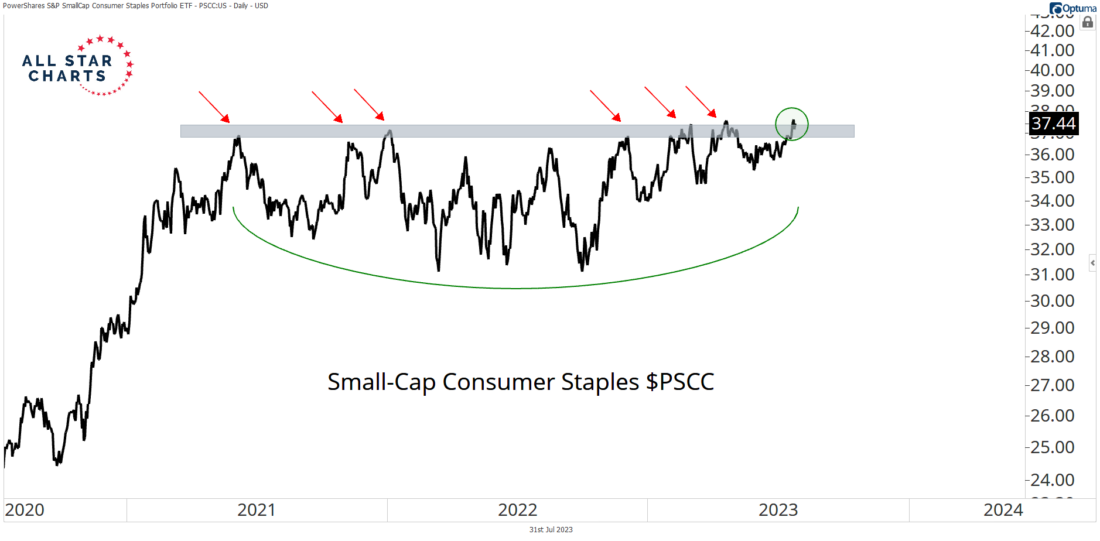

It doesn’t matter where you look, as even some of the defensive sectors are catching a bid.

Check out the Small-Cap Consumer Staples ETF (PSCC) pressing against new all-time highs.

After two years of consolidating in a well-defined range, price has resolved to the upside. It only took seven attempts!

As we like to say here at All Star Charts, “The more times a level is tested, the higher the likelihood that it breaks.”

Seeing defensive sectors break higher in absolute terms speaks of broadening participation and risk appetite—two healthy bull market characteristics we can check off our list.

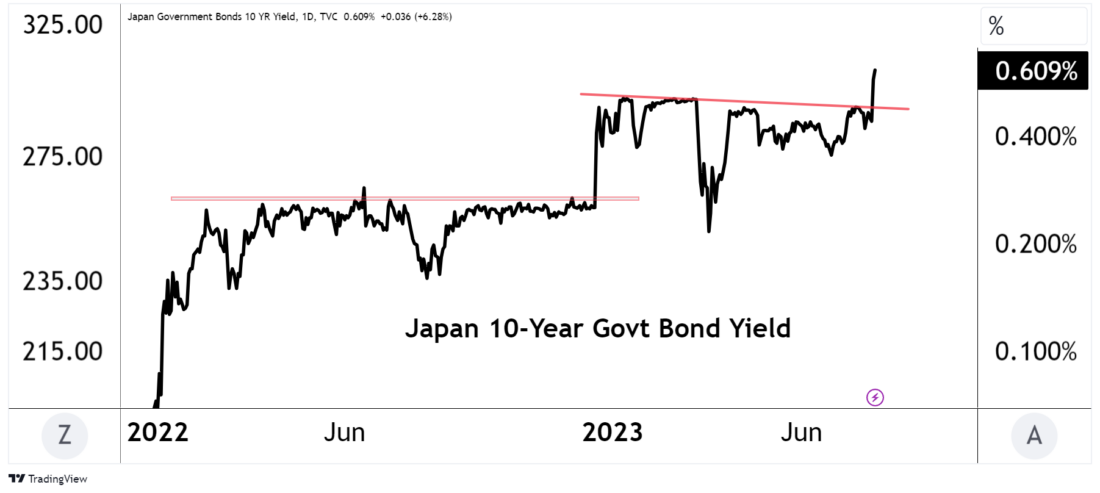

4/ BOJ Goes With the Flow

The Bank of Japan (BOJ) adjusted its yield curve control policy last week, allowing the 10-year Japanese Government Bond (JGB) yield to rise 1% from 0.5%.

While the decision shocked global investors and caused a spike in the JGB benchmark rate, markets seemed unfazed, especially foreign exchange (FX) markets.

The Japanese yen (the chief casualty of recent BOJ policy) continues to fall against other developed market currencies despite last week’s shift. But the recent policy change has more to do with acceptance than affect.

The BOJ’s actions reveal an unwillingness to fight the unrelenting rise in global interest rates and lingering inflation, supporting our rising rate regime thesis.

—

Originally posted 31st July 2023

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.