1/ What is the Halloween Strategy?

2/ How Does it Perform?

3/ Who Else is Seeing This?

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/ What is the Halloween Strategy?

With Halloween rapidly approaching many traders and investors are caught up in tricks and treats, and few know that there is actually a Halloween strategy. That’s too bad, because it’s a strategy worth paying attention to. Gordon Scott, CMT wrote an article last year all about what it is and why you should use it. Scott tells us the idea is “that stocks perform better from Oct. 31 (Halloween) to May 1 than they do from the beginning of May through the end of October.” The strategy encourages interested investors to buy more in the fall and sell in the spring.

2/ How Does it Perform?

The performance of the strategy is notable. Scott writes, “Results also show that a strategy of selling in May is successful in beating the market more than 80% of the time when employed over a five-year horizon, and more than 90% successful in beating the market when used within a 10-year time frame.” Using the S&P 500 in the graph below we can see the effect in action.

3/ Who Else is Seeing This?

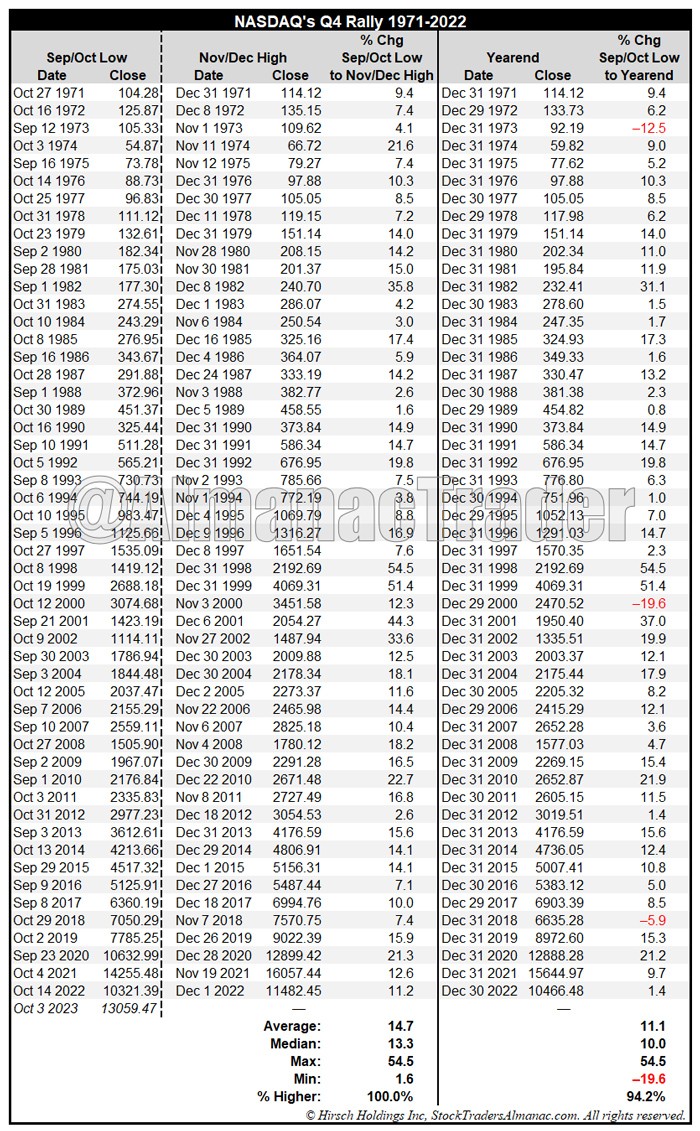

We can’t be certain what causes the Halloween Effect, but the evidence of it is plentiful. And Scott is not the only one to catch on to this hypothesis; just last week Jeffery Hirsch posted his seasonal insights. Hirsch focuses in on the fourth quarter, drawing the same conclusion: fall is the time to buy. Hirsch highlighted in particular the Nasdaq’s Yearend Rally, citing the data below.

Hirsch bases much of his work — including his October forecast — on the legacy left by his father, Yale Hirsch, whose 100th birthday was yesterday. “We lost Yale two years ago at 98, but his legacy lives on. We are reminded of him every day when we track market cycles, patterns, and trends. Back in the 1969 Almanac he first warned us about October volatility and that October is the best time of the year to buy stocks.” Keep an eye on October’s lows this month, perhaps the spirit of Yale Hirsch will inspire the buyers.

—

Originally posted 24th October 2023

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.