Key News

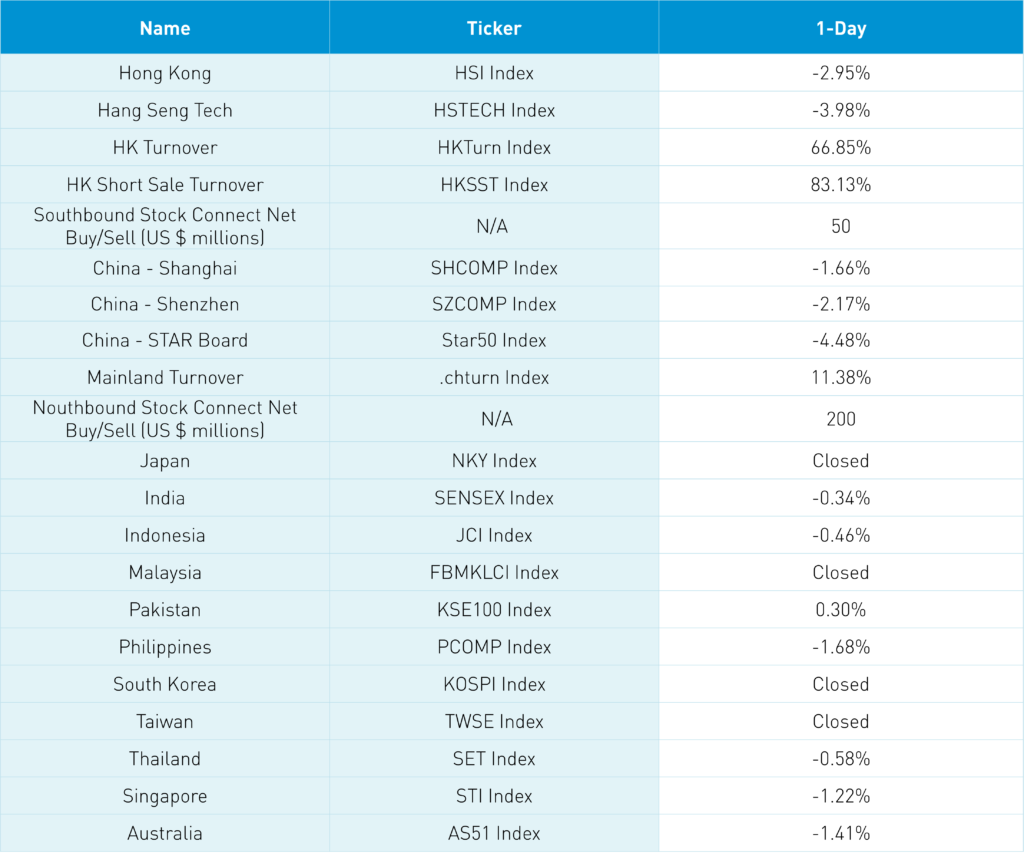

Asian equities were all down following US stocks’ poor performance on Friday following the strong employment release as investors face the reality of further US Fed rate hikes. Several markets missed the downdraft due to market holidays, including Japan, which was off for National Sports Day, Malaysia, which was off for Mawlid-al-Nabi, South Korea, which was of for the Substitution Holiday, and Taiwan, which was off for Double Tenth Day.

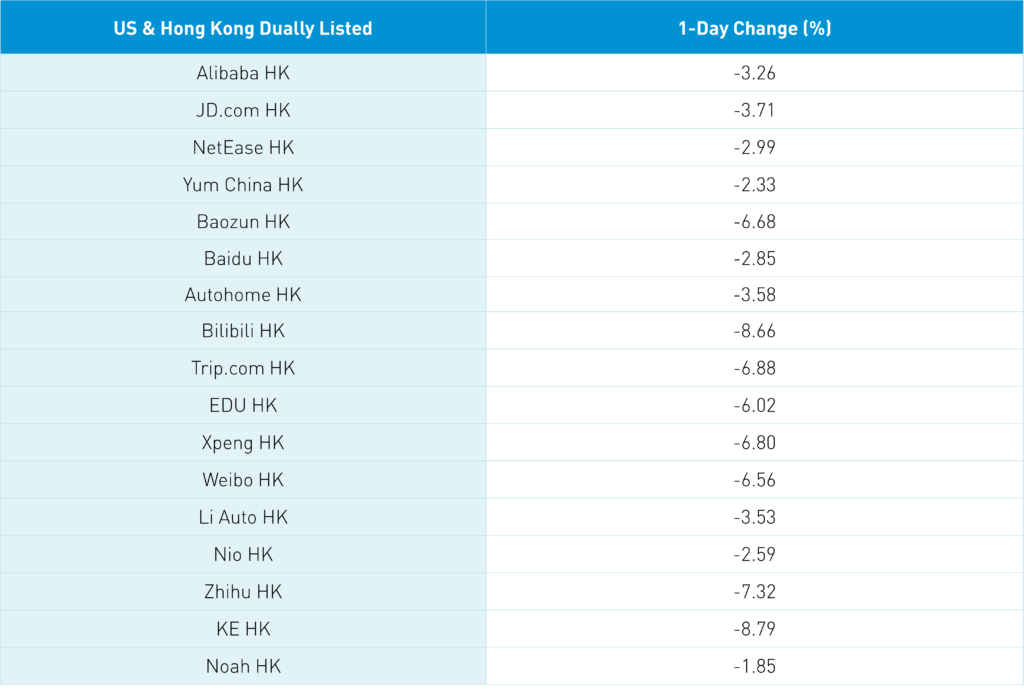

Much of today’s Asia downdraft was anticipated by Friday’s US sell off and reflected in Asian ADRs. Specific to China, last week’s announced expansion of the US export restrictions on semiconductors and chip-making equipment to China weighed heavily on the semiconductor industry and the broader tech sector. I find it ironic and worth pointing out that most US chip makers that will be adversely affected by the export ban are based in California. It is also worth noting that Apple’s supplier ecosystem was down overnight. The US Commerce department also added thirty-one Chinese companies to its “unverified” list, including the company that makes China’s high-speed trains. Head scratcher on that one!

Golden Week travel numbers were down from last year and compared to pre-COVID numbers due to travel restrictions, placing consumer staples and consumer discretionary stocks among the worst performers in both markets. COVID spikes following Golden Week, including stricter measures in Shanghai, did not help sentiment.

September’s Caixin Services PMI came in at 49.3 versus expectations of 54.4 and August’s 55, though the lower-than-expected release was not a factor in market action overnight.

Against this backdrop, Hong Kong short sellers pressed their bets as 25% of the Main Board’s turnover was short. Meituan saw 31% of its volume traded short, Alibaba HK saw 31% short, Tencent saw 11% short, and JD.com HK saw 39% short.

Over the weekend, it was announced that Southbound Stock Connect will now include the Hong Kong primary listings of dual share class companies, in which management’s shares exceed the holdings of other shareholders. Using Bilibili as an example, since it converted Hong Kong to a primary share class last Monday, it would become eligible for Southbound Stock Connect in March of 2023. Bilibili HK’s share class fell -8%, despite it being highlighted. Alibaba anticipates a December approval for Hong Kong to become its primary share class.

Wuxi Biologics was removed from the US’ “unverified” list, though the stock was dragged lower by the market.

The onshore Renminbi (CNY) played catch up to the dollar’s strength, moving from 7.12 CNY per USD to 7.15 CNY per USD. Chinese Treasury bonds had a strong day of trading.

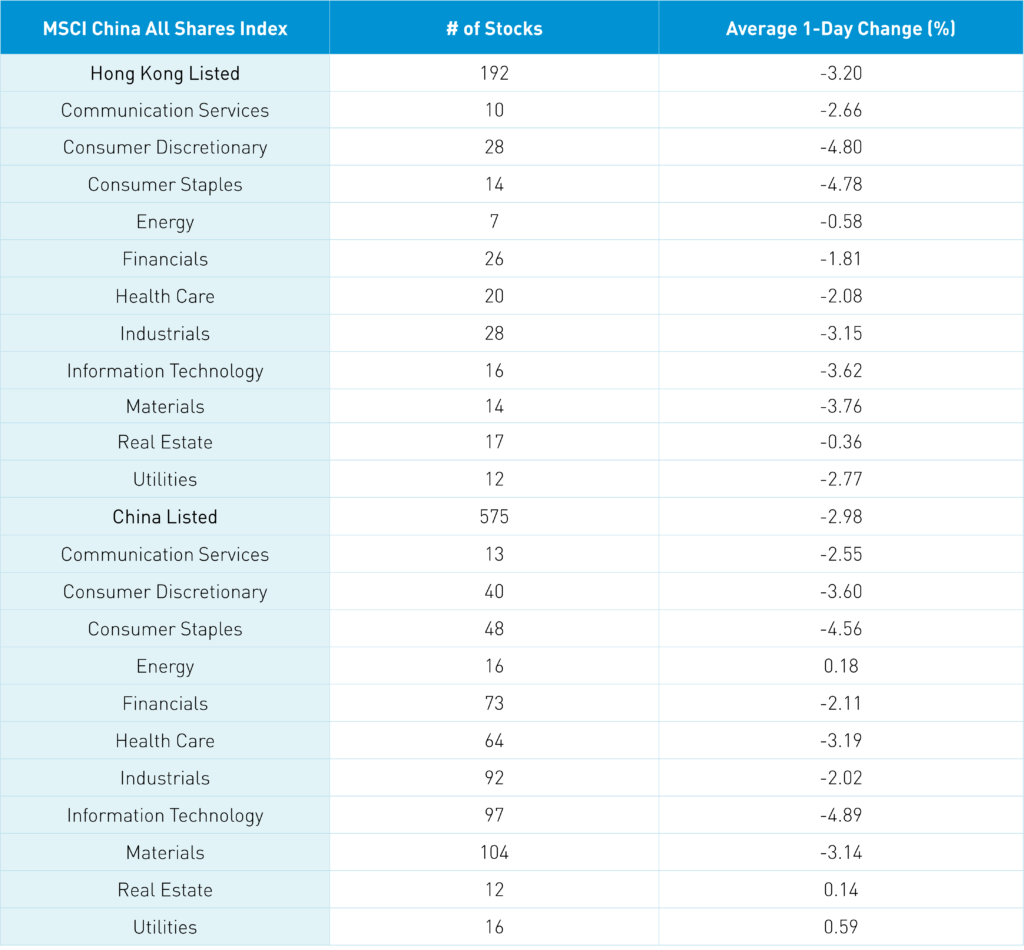

The Hang Seng and Hang Seng Tech indexes fell -2.95% and -3.98%, respectively, as volume surged +66.85%, which is 76% of the 1-year average. 60 stocks rose while 439 declined. Main Board short selling volume increased +83%, which is 109% of the 1-year average, as 25% of turnover was short trading. Value factors outperformed growth factors as small caps “outperformed” large caps. All sectors were negative as real estate off -0.36% while consumer discretionary fell -4.8%, consumer staples fell -4.78%, and materials fell -3.76%. Semiconductors were the worst performing subsector while consumption-related subsectors were also off, including autos, retailers, and liquor. Southbound Stock Connect reopened to light/moderate volumes as mainland investors bought $50 million worth of Hong Kong stocks as Tencent was a small net buy, Li Auto was a moderate buy, and Meituan was a small net sell.

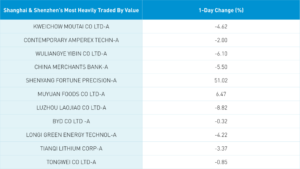

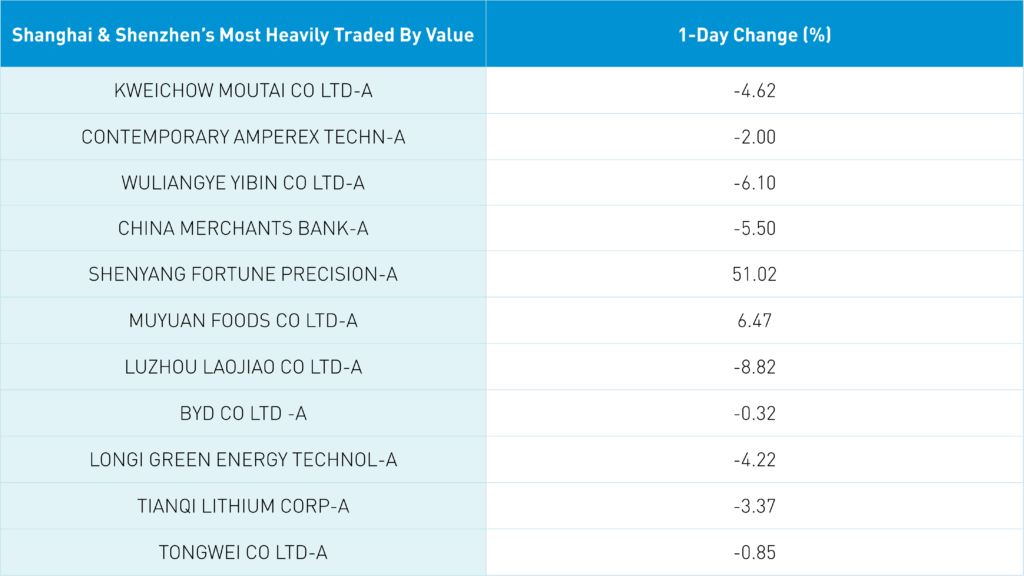

Shanghai, Shenzhen, and the STAR Board fell -1.66%, -2.17%, and -4.48%, respectively, on volume that increased +11.38%, which is 63% of the 1-year average. 895 stocks advanced while 3,670 fell. Value factors outperformed growth factors, while large caps outpaced small caps. Advancing sectors included utilities, which gained +0.57%, energy, which gained +0.16%, and real estate, which gained +0.12% while tech fell -4.91%, staples fell -4.58%, and consumer discretionary fell -3.62%. The top performing subsectors included agriculture, including chicken and pork plays, along with oil, gas, and coal while semiconductors, hardware, and liquor were among the worst. Northbound Stock Connect volumes were moderate/light as foreign investors bought $200 million worth of Mainland stocks. Chinese Treasury bonds had a very strong day, CNY fell -0.47% to 7.15 versus the US dollar, and copper gained +0.38%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.15 versus 7.12 on September 30th

- CNY per EUR 6.94 versus 6.98 on September 30th

- Yield on 1-Day Government Bond 1.40% versus 1.49% on September 30th

- Yield on 10-Year Government Bond 2.74% versus 2.76% on September 30th

- Yield on 10-Year China Development Bank Bond 2.91% versus 2.94% on September 30th

- Copper Price +0.38% on September 30th

—

Originally Posted October 10, 2022 – China Returns From Golden Week Holiday, US Semiconductor Ban Weighs On Technology

Author Positions as of 10/10/22 are KBA, KALL, KCNY, KFYP, KCNY, KEMQ, BZUN, HSBC, KWEB, KHYB, LI US

Charts Source: KraneShares

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.