U.S. companies have notched some of the best earnings results in years. Tony DeSpirito, CIO of U.S. Fundamental Equities, discusses why investors need not fret too much about an inevitable slowdown.

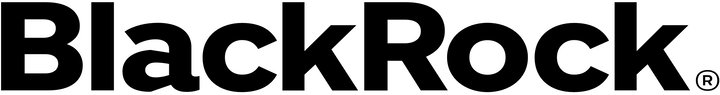

No question … company earnings have been impressive. The S&P 500 recorded the highest year-over-year earnings growth in over a decade in the second quarter. In fact, company earnings have been the key driver of index returns this year, accounting for the lion’s share of S&P 500 total return, as shown in the chart below.

Earnings powering total return – S&P 500 Index sources of return, 2011-2021

This leads some to worry that an earnings downshift in the quarters ahead will weigh on market performance. We remain optimistic in our medium-term outlook for U.S. stocks and would offer three considerations when it comes to the earnings outlook:

This is not a normal cycle. The switch on the economy went from off to on, with an anomalous effect on earnings comparisons. Broad shutdowns amid the COVID-19 crisis in 2020 were followed by a powerful economic restart in 2021. Year-over-year comparisons were easy, and beats exceeded expectations as activity picked up. A slowdown is expected, even inevitable. Yet it does not forbode a market collapse.

A look at seven decades of historical data reveals market performance has not dropped off a cliff once economic growth and earnings slow. We looked at earnings patterns in years when real gross domestic product (GDP) growth exceeded 4%, and S&P 500 performance in the 12 months that followed. What did we find? The average index return in the ensuing year was a not-too-shabby 7%, based on a review of data back to 1948.

Market reaction matters. While the vast majority of companies surprised to the upside and by a wide margin in the second quarter, the market reaction to the historically large earnings beats was comparatively undersized. Stock performance, especially among cyclicals, did not pop at a magnitude consistent with the beat. This suggests some skepticism among investors while also affirming that blockbuster results don’t necessarily receive bigger rewards from the market.

Company resilience is on display. Recent results demonstrate corporate dynamism: Companies successfully managed costs in the throes of the COVID crisis. They have weathered recent inflation equally well.

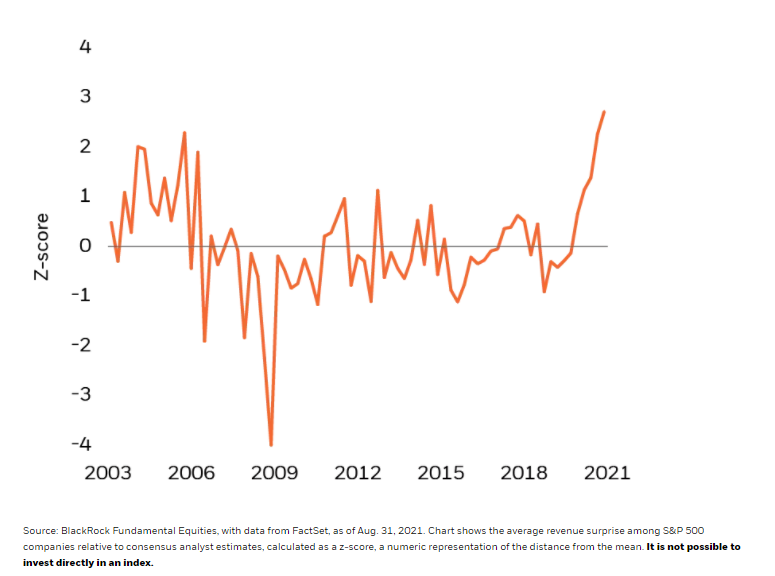

Consider that companies have beat analyst expectations on both earnings per share (EPS) and revenue growth. But the latter has been particularly strong. The chart below demonstrates the magnitude of the sales surprise. This suggests to us that even as inflation has been driving an increase in input costs, companies have the pricing power to offset it. They have been able to raise prices and push higher costs on to the end consumer, a reflection of pent-up demand and consumer willingness to pay. We’d expect cost pressures to abate in most areas of the economy as pandemic-dented supply rebuilds and demand normalizes.

Beating by a historically wide margin – Average revenue surprise, 2003-2021

Bottom line: Yes, economic growth will slow. Likewise for earnings growth. Peaks are inevitable, but they don’t necessarily herald a cycle’s end.

Headlines can be unnerving, but we see strong underpinnings for equities in the months ahead: Company fundamentals are sound and equity valuations are still attractive relative to bonds in a low-rate world. The main risk to our constructive view, as it has been for 18 months, are the vagaries of COVID-19. We advocate a focus on quality and believe deep research and active selection can be particularly advantageous in an environment of economic and market transition.

—

Originally Posted on October 13, 2021 – Company Earnings In The Spotlight

© 2021 BlackRock, Inc. All rights reserved.

Investing involves risk, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of October 2021 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results.

You should consider the investment objectives, risks, charges and expenses of any BlackRock mutual fund carefully before investing. The prospectus and, if available, the summary prospectus contain this and other information about the fund and are available, along with information on other BlackRock funds, by calling 800-882-0052 or from your financial professional. The prospectus should be read carefully before investing.

Prepared by BlackRock Investments, LLC, member FINRA.

©2021 BlackRock, Inc. All rights reserved. BLACKROCK is a trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

USRRMH1021U/S-1871180

Disclosure: BlackRock

©2022 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.