This morning’s US economic data came in mixed, as consumers reported the strongest optimism in two and a half years. The positive sentiment wasn’t derived from house purchases, however, with the pace of existing home sales plunging to their lowest level in almost three decades. North of the border and across the Atlantic, retail sales in Canada and the United Kingdom sunk significantly, highlighting the US’s economic outperformance relative to global peers. Bifurcated action continues dominating markets during today’s monthly options expiration – equity players are buying while bond traders are selling.

Sentiment Records Broad Gains

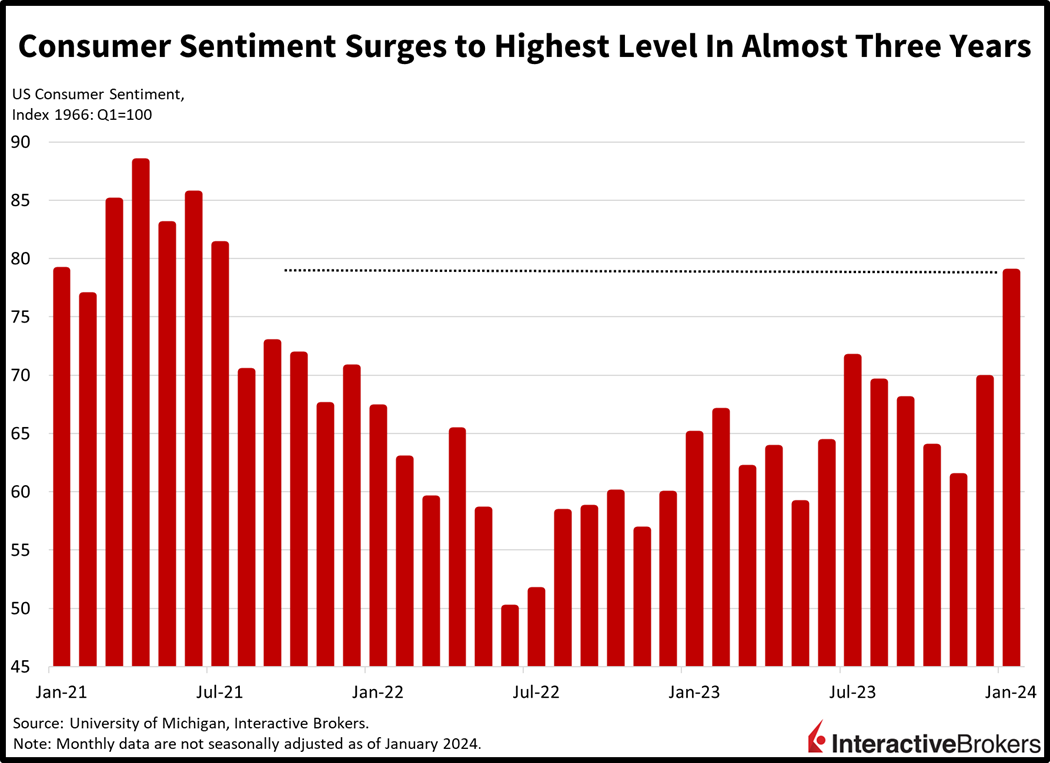

Consumers are feeling great to start off the new year, with sentiment rising to the highest level since July of 2021. The University of Michigan’s Consumer Sentiment Index rose sharply this month to 78.8 from 69 in December. The figure handily beat the median estimate of 70. Indices reflecting current and future conditions rose to 83.3 and 75.9 from 73.3 and 67.4 during the reporting period. Inflation expectations also declined, driven by reduced volatility in gasoline prices, with one- and five-year consumer inflation projections dropping to 2.9% and 2.8% from 3.1% and 2.9%. Households weren’t just pleased with easing price pressures, they also celebrated greater income generation opportunities and of course, higher asset prices.

Home Sales Sink to A 28-Year Low

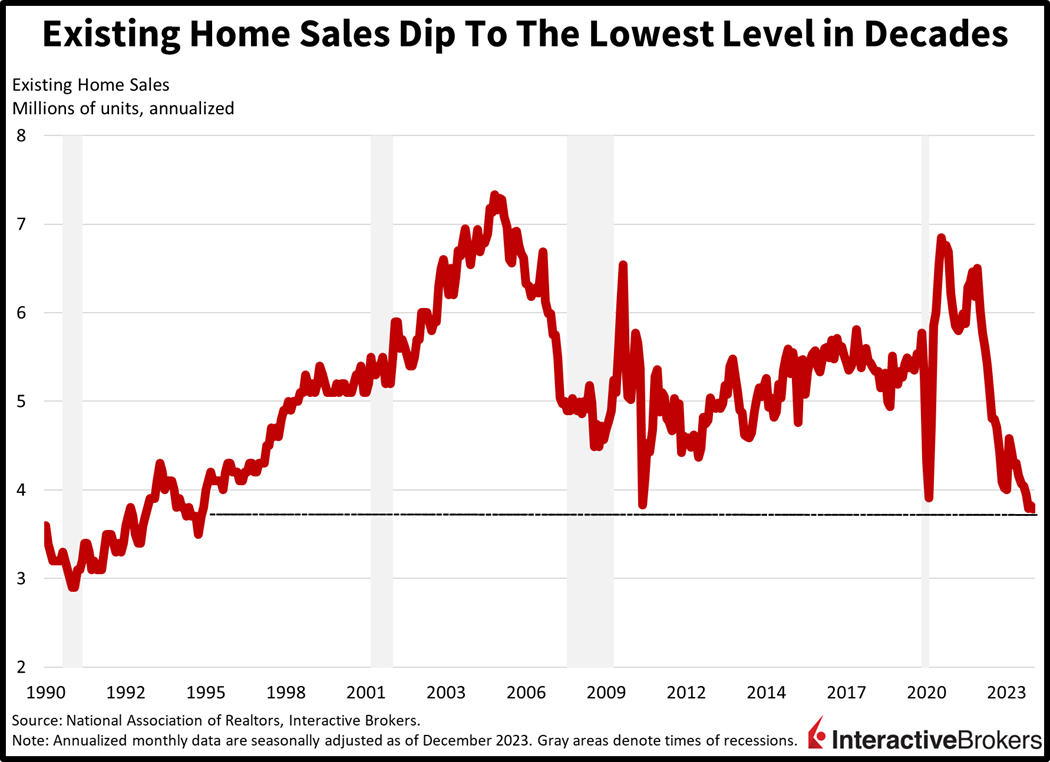

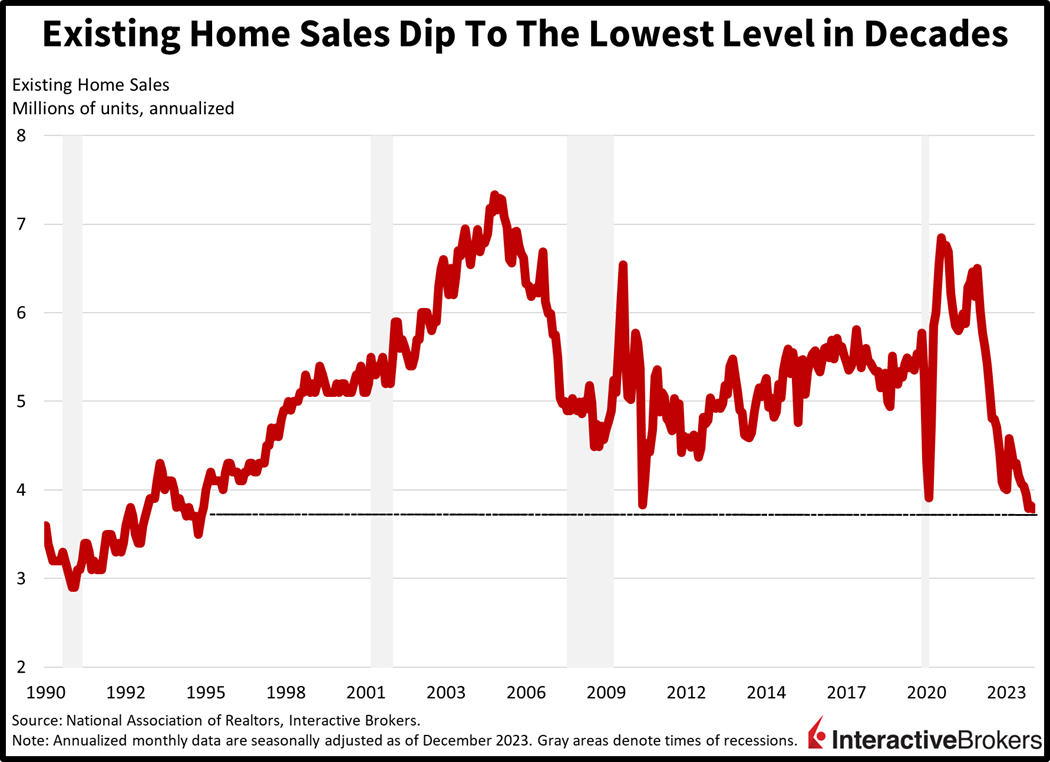

Similar to yesterday’s construction data, existing home sales didn’t receive the benefit of lighter mortgage rates last month, with transactions falling to the slowest pace since 1995. The 3.78 million seasonally adjusted annualized units (SAAU) sold in December dropped from November’s 3.82 million, and narrowly missed estimates calling for an unchanged level. Condominiums and cooperatives, which declined 7.3% month over month (m/m), weighed the most on transactions, while single-family homes slipped by just 0.3%. Across regions, the West was the only gainer, sporting a 7.8% m/m increase in the pace of sales. The Midwest and South descended by 4.3% and 2.8% m/m while the Northeast came in unchanged. Prices rose 4.4% year over year (y/y), meanwhile, as prospective sellers resist discounting.

Logistics Demand Weakens but Aerospace and Auto Industries Thrive

The contracting manufacturing sector is reducing the use of freight services, but strong automobile and aerospace sales are boosting demand for paint and other industrial coatings. Meanwhile, an increase in energy production in foreign markets is supporting demand for oil field drilling services. Those points were highlighted in the following earnings reports:

- J.B. Hunt Transport Services, which is a bellwether logistics company, had a weak fourth quarter due to inflation and declining freight volumes. It produced $153.5 million in earnings, or $1.47 a share, down significantly from $201.3 million, or $1.92 a share, in the year-ago quarter. The results missed the analyst consensus expectation for $1.74. The company’s $3.30 billion in revenue fell y/y from $3.64 billion but exceeded the $3.26 billion anticipated by analysts. The nearly 24% drop in profit was driven by increases in wages and healthcare expenses along with higher equipment costs. Additionally, the company experienced lower revenues for truckload volumes and its service that matches freight to trucks. Broadly speaking, retailers have been reducing orders from wholesalers to trim inventory levels, which has cut demand for logistics. Meanwhile, brick-and-mortar retailers are continuing to struggle due to competition from ecommerce, with Macy’s announcing yesterday that it will lay off 2,300 workers, which is 3.5% of its workforce.

- SLB, which is an oilfield services company formerly known as Schlumberger, generated a strong quarter with results that benefited from growing demand and the company’s focus on cost controls. The company’s fourth-quarter EPS of $0.86 exceeded the analyst consensus estimate of $0.84 and climbed 21% from $ 0.71 y/y. However, its revenue of $8.99 billion missed the consensus estimate of $9.00 billion despite climbing 14% y/y from $7.87 billion. The company’s international revenues grew 18% while its North America sales were flat. In the US and Canada, an increase in offshore drilling was offset by a decline in land activity. Without including revenue from acquisitions, international sales climbed 10% y/y. The company maintains that current geopolitical tensions in the Middle East are unlikely to hinder its operations assuming conflicts do not escalate.

- PPG Industries, which manufactures Pittsburgh Paint and other coatings for industrial applications, including aerospace and automobile manufacturing, reported a strong fourth quarter. It experienced robust demand from automotive and aerospace customers while sales in Mexico and Asia-Pacific were an additional tailwind. Additionally, demand in Europe, which has been weakening, stabilized. After adjusting for one-time expenses, the company produced an earnings per share (EPS) of $1.53, surpassing the analyst consensus estimate of $1.50 and climbing from $1.22 in the year-ago quarter. PPG’s revenues of $4.35 billion grew from $4.18 billion y/y and exceeded the $4.27 billion anticipated by analysts. The company’s aerospace sales increased and automobile sales in both the US and China boosted results. Sales of US and Canada architectural coatings, which include Pittsburgh Paints, were also significant, driven by growing demand from contractors that offset softness in the do-it-yourself category. Mexico sales were also strong, a result of the country’s economy growing. PPG anticipates generating an EPS ranging from $8.34 to $8.59 this year compared to its 2023 EPS of $7.67 for 2023.

Stock Bulls Enjoy Upside

Equity bulls are aggressive, while bond traders remain cautious in today’s trading action as the S&P 500 approaches its all-time high at 4818. Most major stock indices are higher with the S&P 500 trading at 4804, up 0.5% in the session. The Nasdaq Composite and Dow Jones Industrial indices are also up 0.5% each while the small-cap Russell 2000 lags with a 0.1% decrease. Notably, the recent market rally lacks broad participation, with small-caps down 5% year to date, while technology and large caps are higher by 4% and 1%, respectively.

Sector performance varies in today’s session with technology, communication services, and financials leading the way with gains of 1.1%, 0.9%, and 0.8%, respectively. On the other hand, materials, consumer staples and utilities are trailing, each recording 0.4% declines. Bond yields are on the rise, driven by expectations of sustained consumer spending strength and the potential for higher inflation as a result. The 2- and 10-year Treasury maturities are trading at 4.39% and 4.16%, with yields on the former rising by 4 basis points (bps) and the latter by 1 bp. The dollar remains relatively unchanged in the session, gaining against the pound sterling and franc but losing value compared to the euro, yen, yuan, and Aussie and Canadian dollars. Crude oil is slightly higher, influenced by ongoing geopolitical tensions in the Middle East. WTI crude is up 0.1%, or 10 cents, reaching $73.91 per barrel. The European Brent benchmark for oil is experiencing a sharper gain amounting to 10 bps relative to its US counterpart, with expectations of Red Sea disruptions affecting markets more significantly across the Atlantic than stateside.

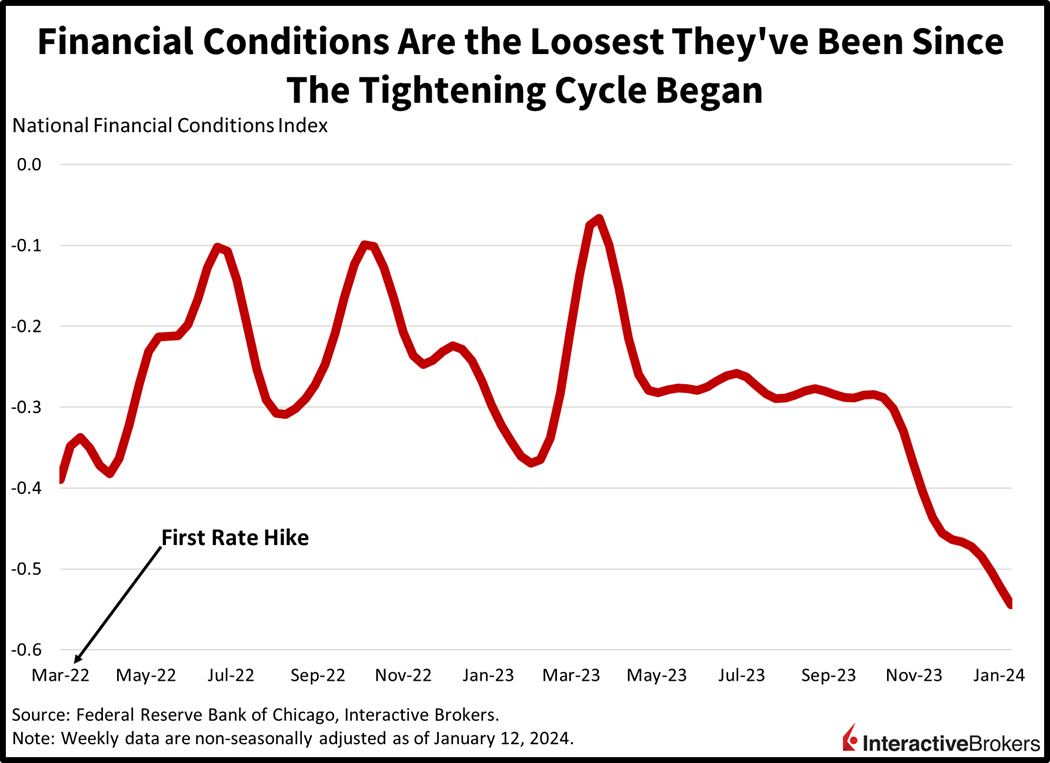

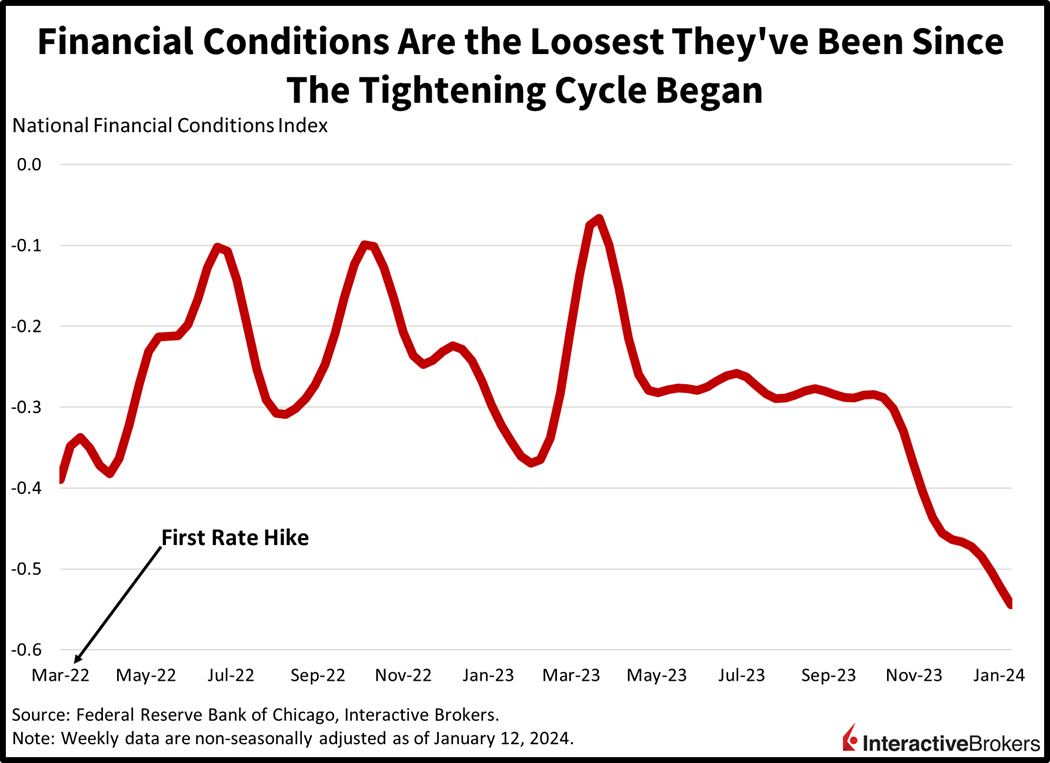

Loosening of Financial Conditions Creates Challenges

The recent loosening in financial conditions has undeniably played a role in generating stronger economic data, potentially pushing back the Federal Reserve’s initial rate cut from March to May. The prevailing risks lean toward inflation in light of the central bank’s dual mandate, given the low unemployment rate and robust job growth coupled with indicators of price pressures surpassing the Fed’s targets. I’m expecting a continued increase in yields at both the short and long ends of the yield curve. However, the latter is expected to experience a more pronounced upward trajectory throughout the year due to substantial Treasury deficits, increased issuance, and growing debt. Against this backdrop, the outlook suggests a challenging year for stocks despite the euphoric sentiment of the present.

Visit Traders’ Academy to Learn More About Existing Home Sales and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.