Markets are digesting a buffet of economic data this morning, with retail sales, Redbook same-store transactions and industrial production pointing to consumer strain amidst higher interest rates and declining credit availability. Corporate earnings and homebuilder sentiment, however, point to an economy that can continue to manage through tighter monetary policy. Stocks, meanwhile, just reached their highest level since April of 2022 as investor sentiment remains buoyant.

Retail Sales and Manufacturing Data Disappoint

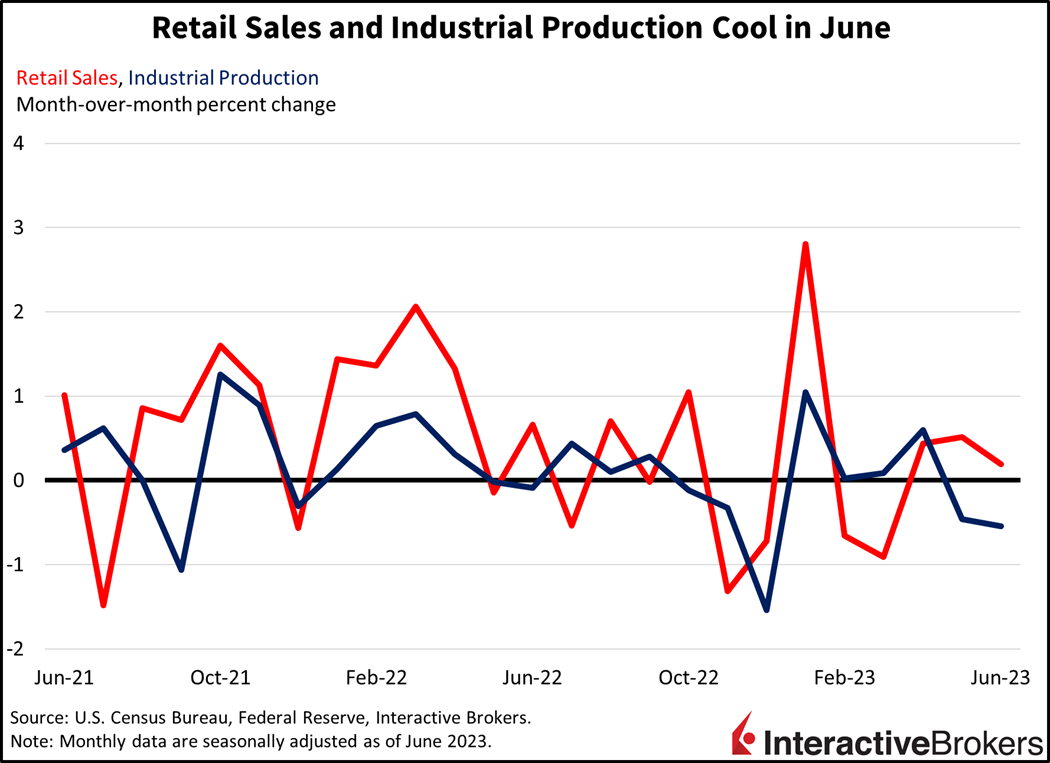

Retail sales performed poorly in June, notching the worst reading of the second quarter with the slowest growth since March, the U.S. Census Department reported this morning. Sales grew just 0.2% on a month-over-month basis (m/m), much less than the consensus estimate of 0.5% and May’s 0.5% increase. On a year-over-year (y/y) basis, retail sales grew 1.5%, below forecasts expecting 1.6% and the previous period’s 2.0%. Redbook’s retail sales data also confirm these weak trends, with weekly y/y sales contracting for the first time since the pandemic.

Sales were helped mostly my miscellaneous store retailers and ecommerce, which experienced gains of 2% and 1.9%, respectively, during the period. Furniture, electronics, and apparel also helped, with increases of 1.4%, 1.1% and 0.6%. Automobiles and parts and dining establishments contributed at more tempered degrees. Weighing on the headline were department stores, gasoline stations, building materials shops, sporting goods retailers, supermarkets and the category of health and personal care stores with declines of 2.4%, 1.4%, 1.2%, 0.7%, and 0.1%, respectively.

Also during June, industrial production contracted significantly, according to data from the Federal Reserve. The decline was driven by reduced consumer demand due to higher interest rates that has pushed manufacturing into a deep freeze state. Production fell 0.5% m/m, much worse than projections anticipating no change. Furthermore, June’s contraction was roughly 8 basis points (bps) deeper relative to May’s and the sharpest decline since December of last year. Under the hood, the manufacturing index fell 0.3% while mining and utilities fell 0.2% and 2.6%.

Homebuilder Optimism Grows

While manufacturing remains surrounded by wintry cold conditions, the real estate sector is bouncing back as prospective home buyers turn to the new construction market for inventory solutions that the existing home market can’t solve. Homebuilder sentiment rose for the seventh consecutive month in July, according to the National Association of Home Builders/Wells Fargo Housing Market Index. Low mortgage rates enjoyed by existing homeowners amidst high mortgage rates for buyers is weighing on sales because the low rates are incentivizing existing homeowners to stay put. Homebuilder sentiment rose to 56 in July, exactly as expected and higher than June’s 55 level. Builders are cautious, however, with higher mortgage rates from here likely to derail the sector’s recovery. Still, builders haven’t had to resort to incentives as frequently to close sales, with only 22% of them providing concessions in July, a reduction from June and May’s levels of 25% and 27%.

Optimism About Consumers Continues

Banks continue to believe that consumers are keeping healthy finances. During an earnings call this morning, Brian Doubles, CEO of consumer credit card and banking services provider Synchrony Financial, said the organization’s provision for credit losses increased from $724 million a year ago to $1.38 billion in the second quarter due to a higher rate of net charge offs on loans. He maintains that the increase is a result of consumers continuing to move back to pre-pandemic norms and the shift is occurring at a pace that the bank has anticipated. With a tailwind of rising net interest income, the company’s earnings per share of $1.32 exceeded the consensus expectation of $1.22. Also this morning, Bank of America CEO Brian Moynihan said the economy is healthy but growing at a slower pace. The bank’s consumer banking division grew its revenues 15% to $10.5 billion, underscoring the financial health of consumers despite the company’s credit card loss increasing slightly as consumers struggle with higher card balances and higher interest rates. The bank reported second-quarter earnings of $0.88 a share, beating projections of $0.84.

Logistics Activity Appears to Sag

Meanwhile, Prologis, which is the world’s largest operator of warehouses and other industrial properties, says its occupancy rate dropped slightly to 97.5% in the second quarter from 98% during the first three months of this year, potentially signaling weakening demand for warehouses. Its second-quarter earnings of $1.83 a share exceeded the consensus expectation of $1.68 a share and the company increased its full-year earning guidance.

Investors Bet on Less Hawkish Fed

Markets are reacting positively to slower economic data that may allow the Federal Reserve to avoid another 25-bp hike in September or November. Well received earnings are also supporting hopes for the soft-landing narrative, as investors bet that economic data can continue weakening slow enough without the country slipping into a recession, thereby supporting higher profits in the medium-term. The S&P 500 Index reached another recent high today, with prices up 0.6% to 4,547. Participation has been broad based, with all sectors higher except for real estate and technology. Energy is leading, with shares higher by 1.7% on the back of WTI oil prices leaping 1.5% to $75.27 per barrel. Technology is the laggard, with the Nasdaq Composite Index down 0.2% while all other major U.S. indices are higher. Softer economic data are also weighing on yields and the dollar, with the 2- and 10- year maturities down 3 and 4 bps to 4.7% and 3.75%. The Dollar Index, meanwhile, is down 7 bps, as investors feel that the need for more Fed tightening is dwindling.

Corporate Margins Face Stiff Headwind

With inflation serving as a revenue tailwind for corporates, disinflation serves as margin compressor, with companies faced with the challenge of maintaining margins as revenues weaken amidst sticky costs.

The risk of continued softness in economic data points to deteriorating pricing power, compelling companies to cut prices on goods and services. With inflation serving as a revenue tailwind for corporates, disinflation serves as margin compressor, with companies faced with the challenge of maintaining margins as revenues weaken amidst sticky costs. The most recent example occurred just this week, when Ford announced a $10,000 discount on its new F-150 electric truck. The news weighed on shares by about 6% because investors became concerned that the company won’t maintain margins by offering discounts on some of their most popular products. Corporates that don’t need to discount to maintain sales volumes are likely to be rewarded by this market while others may be reexamined by investors.

Visit Traders’ Academy to Learn about Retail Sales and Other Economic Indicators.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

I am the stockholder and i have someone trying to impersonate me and my investments

Hello Camy. If you believe that your account has been hacked or compromised it is critical that you contact your local Client Service Center immediately so that we may verify your identity and take the necessary actions to protect your account. These actions will generally include imposing restrictions upon the placement of new opening orders, a freeze upon funds withdrawals and asset transfers, issuance of a new password and a review to ensure that all account users are 2-factor protected while the incident is investigated. In addition, you will need to review your account to identify any unauthorized trades, withdrawals, or information changes. A review of your account activity including login history will be then conducted by IBKR’s Compliance Department and you may be required to file a police report.