Investors are flocking to risk-off assets after a US warning about increasing tensions between Iran and Israel underscored growing geopolitical risk. The caution, along with the ongoing Israel-Hamas war and the Ukraine-Russia conflict, has pushed the price of oil to its highest level since October while US consumers struggle with persistent inflation as highlighted in this morning’s weaker-than-anticipated consumer sentiment report.

Consumer Sentiment Weakens

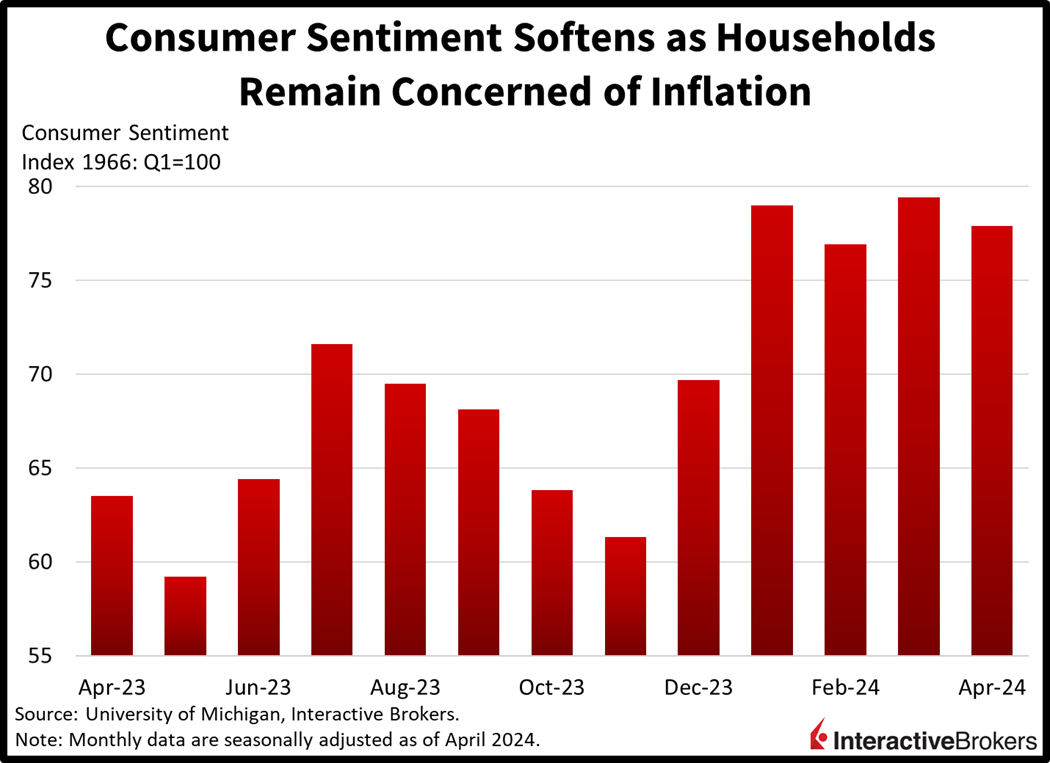

Consumer sentiment softened slightly this month, as concerns over high and rising prices amidst uncertainty over the upcoming election mounted. April’s 77.9 figure from the Michigan Consumer Sentiment report missed the estimate of 79 and declined from March’s 79.4. Both the Current Conditions and Consumer Expectations sub-indices dropped from 82.5 and 77.4 in March to 79.3 and 77. Furthermore, inflation projections climbed with both 1- and 5-year expectations inching to 3.1% and 3% from 2.9% and 2.8%.

Banks Feel the Brunt of Higher Interest Rates

Higher deposit rates are weighing on bank results, while the head of JPMorgan Chase has reiterated his concerns about geopolitical risks and persistent inflation.

- JPMorgan Chase posted first-quarter earnings and revenue that exceeded analysts’ expectations but offered a cautious outlook for the economy and current-year net interest income (NII). CEO and Chairman Jamie Dimon said geopolitical risks and ongoing inflation threaten the economy and that lower income Americans are struggling as illustrated by minor weakness in the bank’s subprime loan business. Dimon said the bank’s average deposit account size declined and that higher deposit rates would result in its 2024 NII, or the difference between interest it pays on savings accounts and what it collects on loans, to likely be flat year over year (y/y). While many investors anticipate that the Federal Reserve will lower rates this year, JPMorgan is preparing for the central bank to potentially increase rates. Shares of JPMorgan Chase declined in early trading.

- Wells Fargo also said its NII is being challenged by having to increase interest rates for deposit accounts, a problem made worse by clients shifting into higher yielding products. Despite its NII declining, the company beat expectations for both earnings and revenue. For this year, it expects NII to decline from 7% to 9% relative to last year. An increase in non-interest income helped support earnings. The company also said the performance of commercial real estate debt and auto loans improved. Its shares were down marginally in morning trading.

- Citigroup’s earnings declined y/y but beat analysts’ expectations while its revenue missed forecasts, largely due to revenue in the year ago quarter being increased by the sale of an overseas business. Earnings were hurt by severance payments and the company paying $251 million to the Federal Deposit Insurance Corp. fund to replenish cash used to shore up regional lenders. An increase in non-conforming loans resulted in credit costs of $2.2 billion. The bank’s shares declined approximately 1% in early trading.

Investors Pivot to Defensive Assets

Markets are trading defensively today as investors clamor for volatility protection and Treasury instruments amidst escalating Middle East tensions. Stocks are down heavily, with all major US equity indices in the red. The Nasdaq Composite, Russell 2000, S&P 500 and the Dow Jones Industrial indices are lower by 1.4%, 1.2%, 1.1% and 1%. Sector breadth is deeply negative, with all sectors down minus energy, which is up 0.5%. Energy stocks are benefitting from the rise in oil prices as supply concerns increase as a result of the potential confrontation between Israel and Iran. WTI crude oil is up 1.9% or $1.66, to $87.14 per barrel. Amongst the lagging segments, technology, consumer discretionary and communication services are suffering the most; they’re down 1.4%, 1.3% and 1.1%. Treasuries are catching a bid across the curve with the 2- and 10-year Treasury maturities trading at 4.89% and 4.5%, 8 basis points (bps) lower on the session for both durations. Geopolitical fears are also pushing market players into the dollar, with the currency’s index up 74 bps to 106.04 as the greenback gains relative to the euro, pound sterling, franc, yuan, and Aussie and Canadian dollars. It is depreciating versus the yen though.

Geopolitical Risk to Replace Fed Concerns?

So far, the economy and corporate earnings have been remarkably resilient as the Federal Reserve refrains from interest rate reductions just yet. Nevertheless, today’s developments illustrate how investor sentiment and high equity valuations are vulnerable to geopolitical conflicts, persistent inflation and oil prices. Wars in the Far East and Middle East could hinder oil production while increasingly pressuring the global supply chain, which could drive transportation costs higher. Against the backdrop, investors have pushed back their expectations for the start of the Fed’s easing cycle, with geopolitics possibly replacing the Fed as one of the market’s top volatility influencers.

Visit Traders’ Academy to Learn More About Consumer Sentiment and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.