TLDR:

It was another whiplash day. Treasury 10-year yields slipped as much as five basis points to a one-week low after reaching the highest since 2007. 5% seems easily achievable (and crossable). Like gold, bitcoin is on a tear, too and crossed $35,000. So where do tech earnings figure into all of this?

We get Microsoft and Alphabet today, then Meta on Wednesday and Amazon on Thursday. But stocks haven’t looked this overpriced in 20 years, one Wall Street economist wrote this past week. That view referenced Treasury yields hitting 5% and compared them with the “earnings yield” of the S&P 500 index (think the P/E ratio upside down) also near 5%.

But but but … since 1945, the correlation between rising real yields and falling P/E ratios has been weak, and negative.

So yields at 5% aren’t sufficient for an indictment of stocks.

So what kind of upside can we see even if earnings are strong?

The Technology Select Sector ETF is down just over 9% from its record high, hit in late July but that is mainly because rising long-dated bond yields have clobbered every risky asset in sight.

It’s also automatic if you’re into DCF analysis: higher yields make future profits less valuable in current terms, which means investors aren’t willing to pay as much for the earnings fast-growing tech companies are expected to pump out years from now.

Here is the reason for optimism.

Five tech companies in the S&P 500 that had reported third-quarter earnings through Friday turned in higher profits than expected. What’s even more encouraging is this: their sales were more or less in line with estimates. But EPS was up about 6% higher than anticipated.

That is very good news because it means profit margins are growing. If profits are well ahead of forecasts while sales are just in line, profitability is improving for these companies. And investors like that.

What’s happening in the markets?

This section is powered by Open AI connected to TOGGLE AI

META has emerged as a standout performer in the stock market this year, with its value surging by an impressive 150%. The anticipation is palpable as the company gears up to release its earnings report tomorrow after the market closes, a pivotal moment that will heavily influence its future price trajectory.

Analysts are forecasting that META will disclose earnings per share (EPS) of $3.57 and reveal revenues totaling $33.4 billion for the quarter.

The historical data indicates that if META surpasses these EPS projections, the stock typically experiences substantial returns in the following week. Conversely, if it falls short of these expectations, it curiously tends to exhibit the lowest average returns a month later.

An intriguing observation by Toggle shows that noteworthy shifts in analyst revisions and trading volume have historically resulted in positive movements for META stock over the subsequent three months. However, it remains imperative to await the earnings report’s verdict to determine if this pattern will persist.

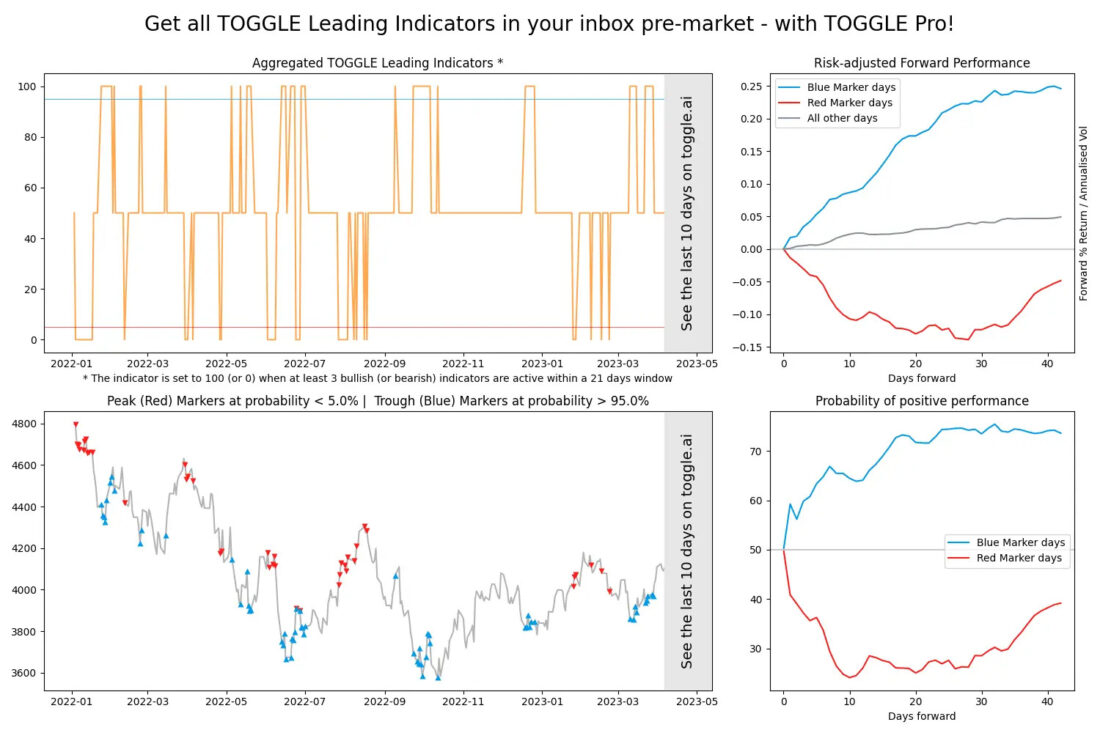

Aggregated Leading Indicators!

Subscribe to Pro here to receive our pre-market Leading Indicator newsletter and access all Leading Indicators online!

Learn more about the Leading Indicators in the Learn Center!

Earnings Update: Visa reports tonight

Last quarter, the payment processor reported its smallest jump in quarterly profits as months of high inflation and rising borrowing costs weighed on consumer spending. Will we see the same this quarter too?

Discover how other companies could react post earnings with the help of TOGGLE’s WhatIF Earnings tool.

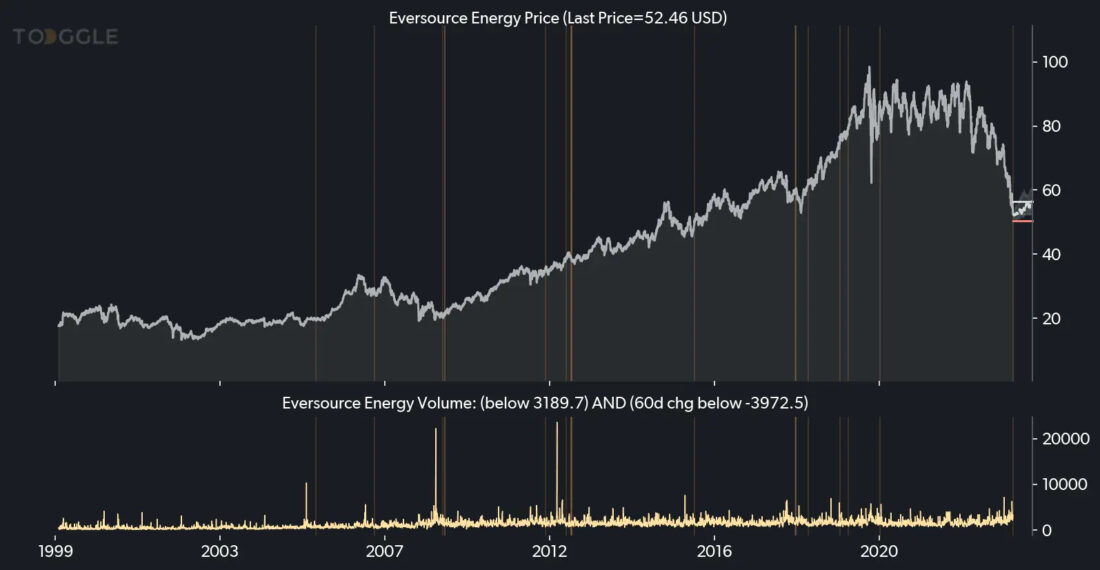

Asset Spotlight: Drop in Eversource Energy Volume

Toggle analyzed 14 similar occasions in the past where Eversource Energy’s volume dropped and historically this led to a median increase in the stock’s price over the following 6M. Read full insight!

General Interest: What makes a quantum computer more powerful than a classical computer?

The title of this section is a surprisingly subtle question that physicists are still grappling with, decades into the quantum age.

Quantum computers are like fusion power. Every now and then you read an article that makes it look like they’re right around the corner – and then nothing for another year.

It’s been more than 40 years since the physicist Richard Feynman pointed out that building computing devices based on quantum principles could unlock powers far greater than those of “classical” computers.

“Nature isn’t classical, dammit, and if you want to make a simulation of nature, you’d better make it quantum mechanical.”

Feynman aside, it’s mathematicia Peter Shor that 30 years ago came up with the first potentially transformative use for quantum computers: cracking cryptography.

In the intervening time we managed to develop quantum-safe cryptography, but proper quantum computers are still eluding us.

Read more here on Quanta.

—

Originally Posted October 24, 2023 – Here we go, tech earnings

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: TOGGLE Relationship with IBKR

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.