The focus in the April 3 week will be on labor market data, just how tight employment remained at the end of the first quarter 2023 and what that means for the economic outlook and monetary policy.

Note that April 7 – Good Friday – is not a federal holiday in the US. However, there is an early close at 2:00 ET that day for the capital markets; the stock market will have a full close.

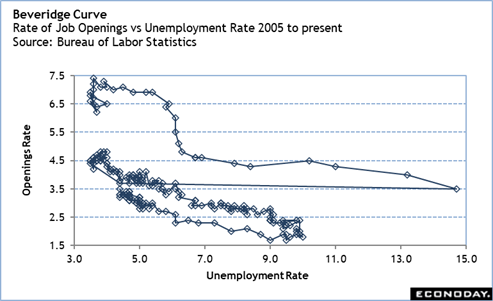

The February JOLTS report at 10:00 ET on Tuesday should reflect the shrinking – but still plentiful – number of job openings. It should also show if the pace of hiring is moderating and if layoff activity is rising. It will almost certainly show the number of people voluntarily quitting a job is declining as the imbalances in the labor market improve.

The ADP national employment report for March at 8:15 ET on Wednesday should indicate where private payrolls are growing. Recent months have shown that leisure and hospitality – which has long been seeking workers – continues to improve. However, tech companies and some financial services may be weaker. Also important to note will be if wage growth is easing up.

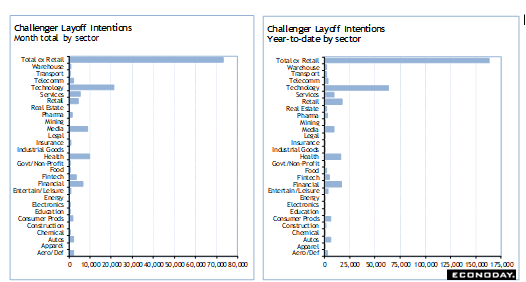

The Challenger report for March at 7:30 ET on Thursday will highlight the sectors where layoffs announcements are taking place. In recent months it has been the tech sector that has dominated the story, but the February report hinted that layoffs are becoming more broad-based due to deteriorating business conditions.

The initial jobless claims report for the week ended April 1 at 8:30 ET on Thursday will include annual revisions. They probably won’t do much to change the tone of the recent data, but the revisions may be enough to require a little extra time to explore and understand the underlying trend.

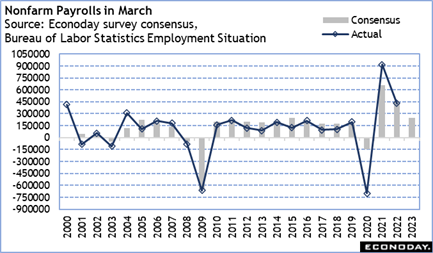

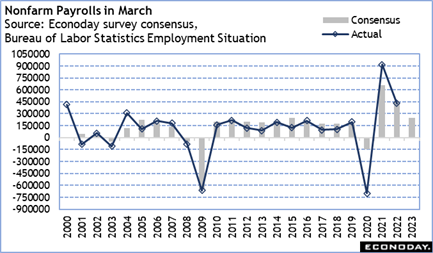

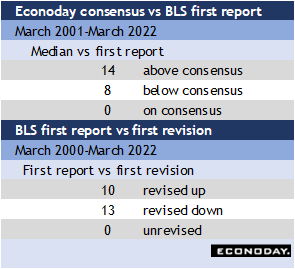

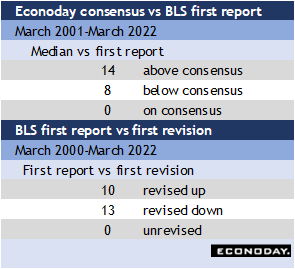

The employment situation for March at 8:30 ET on Friday is expected to show that payrolls continued to rise at a healthy pace, although not as quickly as in January and February. March payrolls can be tricky to seasonally adjust due to the timing of spring breaks for various school systems and the Easter/Passover observances. However, March often comes in above the market consensus. The early consensus for March nonfarm payrolls is roughly 250,000 at this writing.

—

Originally Posted April 2, 2023 – High points for economic data scheduled for April 3 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)