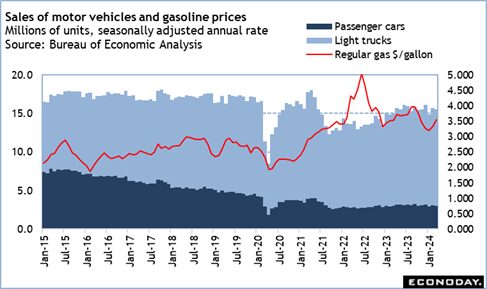

The last economic data report that has the potential to change the tone of the upcoming FOMC meeting on April 30-May 1 is retail and food services sales at 8:30 ET on Monday. Sales were weaker in January and rose modestly in February. How the March number shapes consumer spending for the first quarter depends on a number of factors. Unit sales of motor vehicles were slightly softer in March, but the dollar value of sales may not be much changed. Gasoline prices rose in March, but some of this may be accounted for by seasonal adjustments since modest price rises are typical at this time of year.

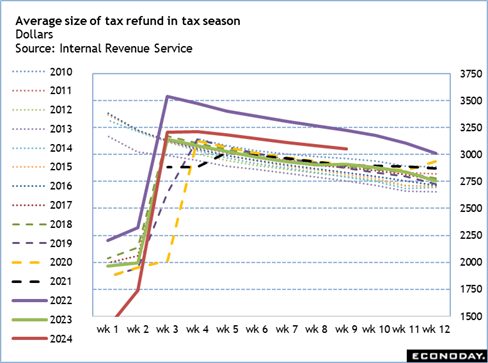

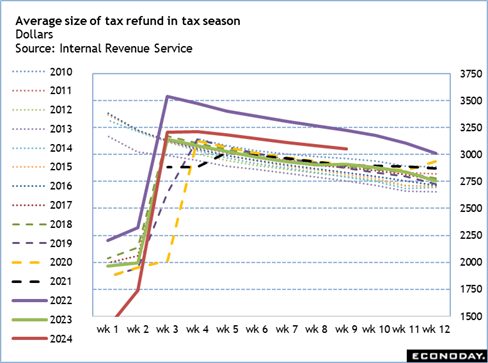

What may be more influential is confluence of the timing of spring break at schools and the Easter observance which fell early this year on March 31. This may have pulled some spending from April travel and celebrations. Additionally, tax refund season shows that the average tax refund ended March at $3,050 which is higher than the $2,910 at the end of March in 2023. Consumers may have a decent sized lump sum to spend, save, or pay down debt. Some at least will be spent, likely on bigger ticket household items and activities associated with spring like home repair and gardening.

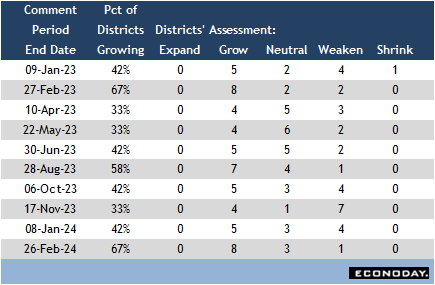

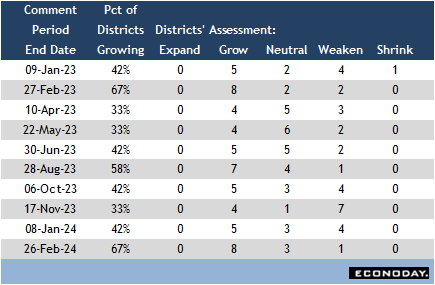

The most recent data on inflation and the labor market has dampened hopes of a rate cut by the FOMC sooner rather than later. The anecdotal evidence about US economic conditions in the Beige Book set for release at 14:00 ET on Wednesday should help solidify those impressions. While the Beige Book is unlikely to paint a picture of a robust economy, the past two reports have pointed to firming in conditions that should be sustained in the period from late February through early April.

The communication blackout period around the next FOMC meeting will go into effect at midnight on Saturday, April 21 and last through midnight on Thursday, May 2. The coming week will be the last opportunity for Fed policymakers to speak in public about their respective outlooks for monetary policy.

—

Originally Posted April 12, 2024 – High points for US economic data scheduled for April 15 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.