Editor’s Note: Inflection Points is a monthly series intended to explore the underlying trends, dynamics and opportunities shaping the thematic investing landscape. Click here to receive future updates via email.

A major sea change is underway as the benefits of investing in innovation are democratized across the economy. For the past decade, big tech yielded disproportionate returns from innovation.1 The big tech companies, defined here as Meta Platforms, Microsoft, Amazon, Apple, Netflix, and Google (MMAANG), were toll takers for the internet, and they reinvested their windfall cash flow to sustain technological leadership. But after a decade of maintaining higher returns on invested capital and growth in capital expenditure, the benefits of innovation are spreading to more players, which should be positive for the economy overall.2 A broader base of winners from technology adoption could propel market gains and the next generation of growth companies even as big tech’s leadership softens.

KEY TAKEAWAYS

- Large cap tech firms captured much of the returns from innovation over the last decade, but that trend has started to shift as productivity-enhancing technology becomes more ubiquitous.

- Companies seem to have learned that investing in innovation is a strategic imperative, and they are yielding greater rewards as capital expenditure (capex) increases rapidly.

- Certain areas of thematic growth potentially offer a way of capturing returns from a broader set of companies involved in the next wave of innovation while helping reduce big tech concentration.

Beyond the Decade of Big Tech Domination

Big tech may well be the most remarkable profit-producing machines in the history of capitalism. Through a combination of investment, innovation, intense competition, and a bit of happenstance, these companies dominated the last decade. Their business models focused on monetizing end users through a diverse revenue mix drawn from product sales, memberships, subscriptions, and advertising.3 These models resulted in network effects where the value of a product increases with the number of users.4 The telephone is a prime example.

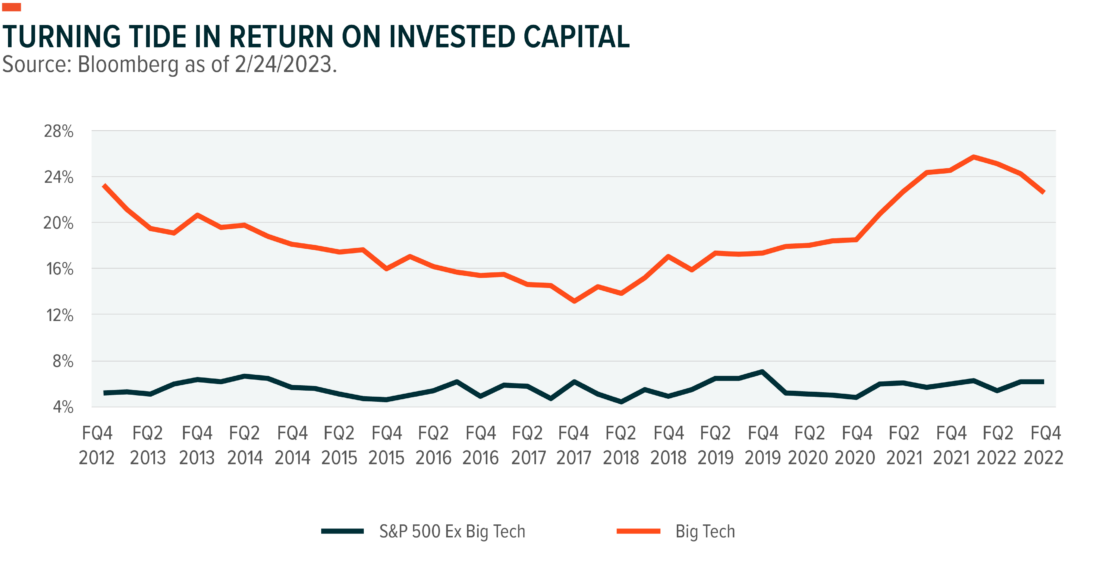

How dominant was big tech? Over the last 10 years, big tech’s returns on invested capital (ROIC) was almost triple that of the other 494 companies in the S&P 500 Index (see chart).5 Those excess returns over the broader S&P 500 were successfully reinvested, generating excess returns for shareholders. The market value of the big tech firms grew at almost 19% annually, compared to the broader S&P 500 at just shy of 10%.6

That dominance, however, is starting to fray. ROIC for the six big tech firms has been in decline since 2020, while that of the S&P 494’s increased. The differential remains meaningful, but the gap is narrowing.

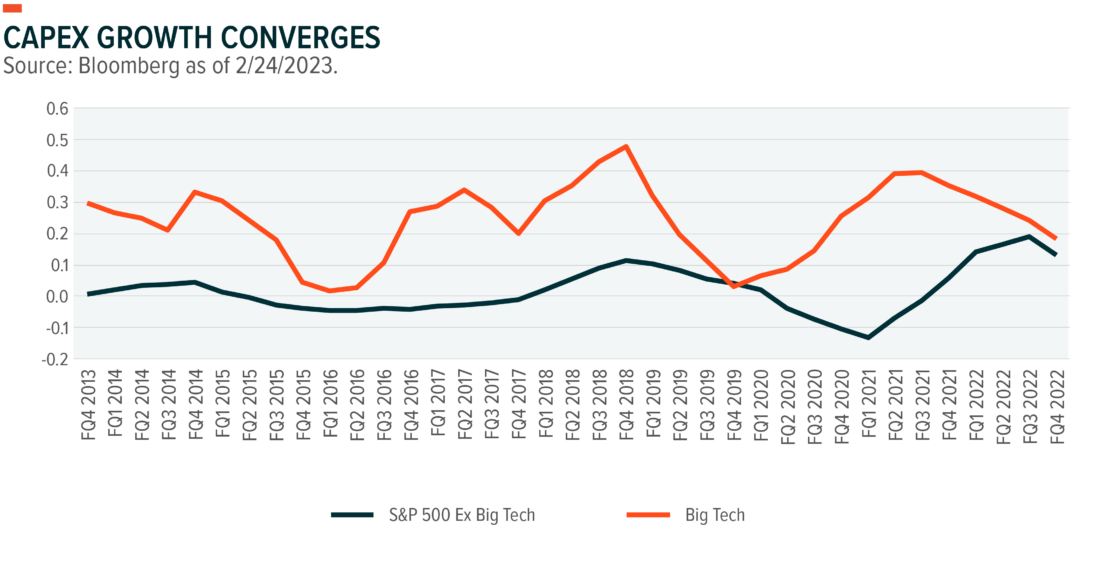

The S&P 494 lagged big tech in reinvestment over the past decade, but that trend is also shifting. Big tech’s average annual capex growth was above 30%, well above the S&P 494’s average growth near 2%.7 That gap started closing during the pandemic and continued to close through the economy’s reopening (see chart). The S&P 494 grew capex relatively rapidly during this period, while big tech slowed spending amid concerns over margins and pulled forward growth. By Q4 2022, S&P 494 capex spending growth was 13% year-over-year, compared to big tech at 18%.8

Old World Companies Embrace New World Tech

Two spending trends are notable. First, many companies increased their capital expenditure during the pandemic to onboard new capabilities like productivity tools, cloud infrastructure, and automation.9 Those investments helped firms sustain margins as costs of labor and materials rose, passing only half of producer price increases along to consumers.10 Potentially even more powerful, companies continued increasing capex despite negative GDP growth in early 2022 and the slowing earnings growth expected in 2023.11

Non-tech companies embrace of new technologies to deliver innovative products and improve their processes crosses industries. Agricultural and construction equipment company Deere & Co., for example, made significant strides in automating tractors for harvesting, integrating drones for crop dusting, and developing a network of satellites to facilitate information sharing.12 Emerson Electric started manufacturing AC motors used in electric fans in 1890, and today the company provides industrial products that integrate sensors and software for industrial automation.13 A new standard for leading consumer appliance companies like Samsung and Whirlpool is integration of sensors and software into ovens and washing machines that can be synched with mobile phones.14

There are numerous examples of process innovation such as traditional retailers use of mobile apps and payment systems to create a seamless customer experience. They also leverage emerging technologies like virtual reality for employee training.15 The real estate, furniture retail, and factory design industries benefit from digital 3D models.16 Delivery companies increasingly rely on advanced algorithms to improve throughput with existing resources.17

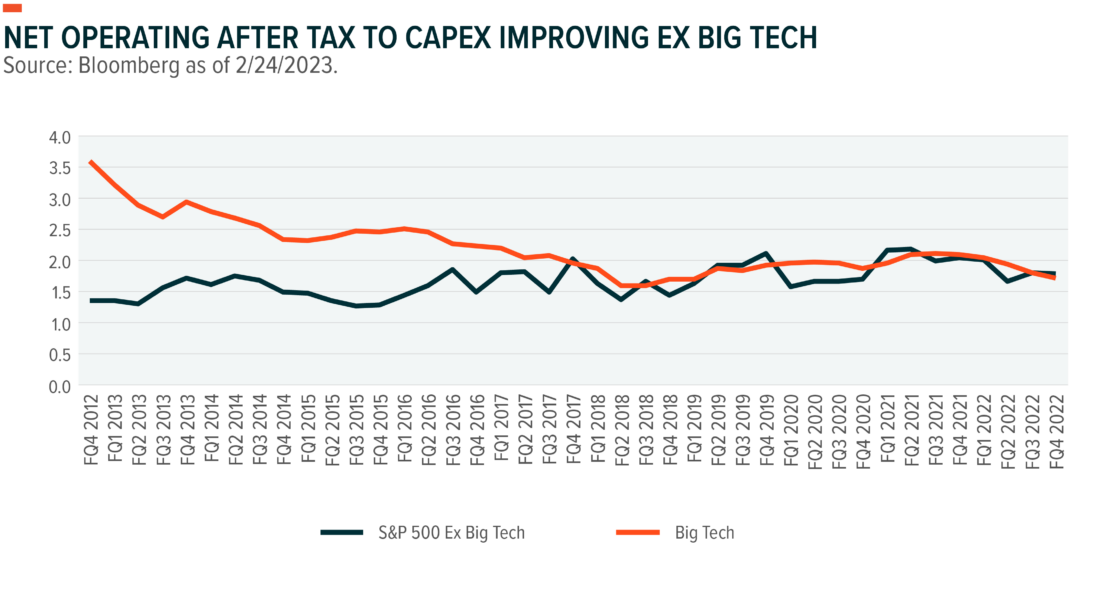

Embracing productivity-enhancing tools is good business. The S&P 494 now generates higher net operating profit after tax (NOPAT) per dollar of capital expenditure than big tech (see chart).18 Ten years ago, big tech generated almost $4 of NOPAT per $1 of capital investment, but by Q4 2022 that was down to $1.71. During that period, the S&P 494 gradually improved from $1.48 of NOPAT per $1 of capital investment to almost $1.80.19 This helps explain why companies beyond big tech have grown their capex more aggressively. They are enjoying a bigger piece of a growing pie.

Positioning for Diffusion of Returns from Innovation

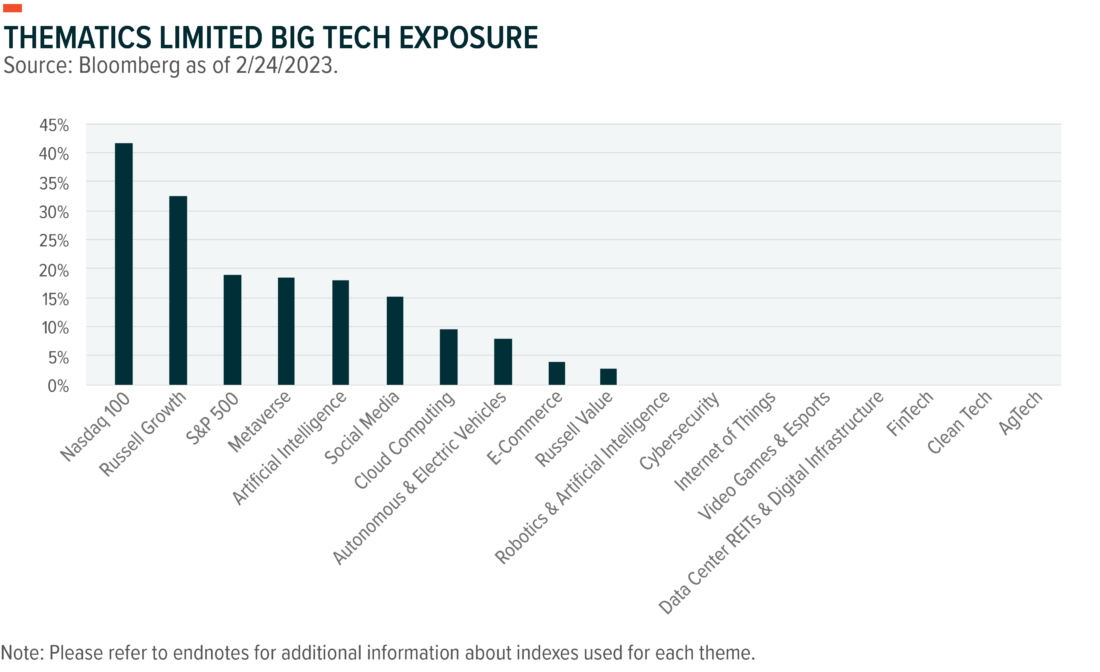

A growing base of corporate investment is good for the economy, and as that grows, investors may want to look at ways that innovation creates new opportunities beyond the big tech names that won the last decade. Thematic options as opposed to some growth indexes may offer greater diversification while still providing exposure to innovative and critical economic segments. Many growth indexes like the Nasdaq 100 and Russell 1000 Growth have significant concentrations in big tech, which would further concentrate investors with exposure to a broad index like the S&P 500 (see chart).20

Thematic opportunities in exciting areas like Robotics and Artificial Intelligence, Cybersecurity, Internet of Things, Clean Technology, and U.S. Infrastructure have relatively low big tech allocations. These themes can allow investors to reduce big tech exposure while also providing access to hotbeds of future economic innovation.

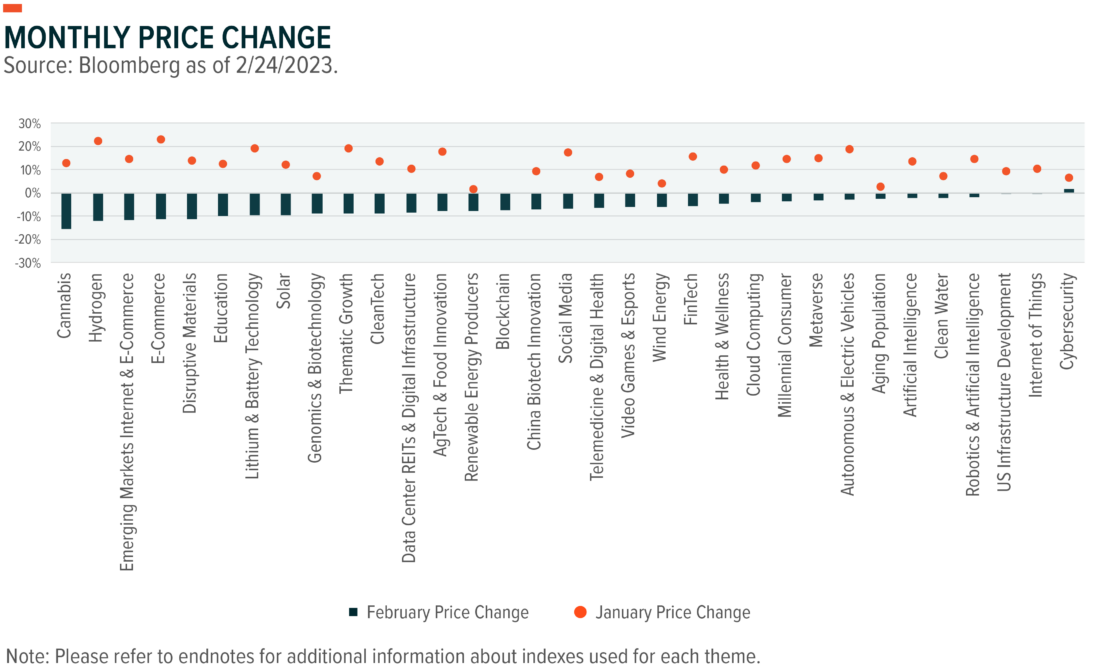

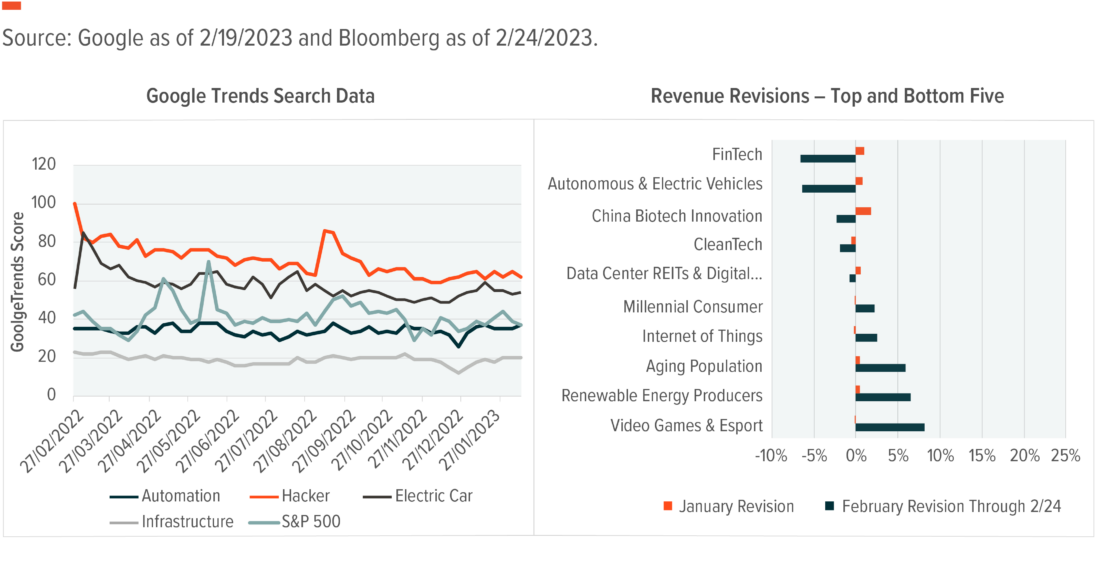

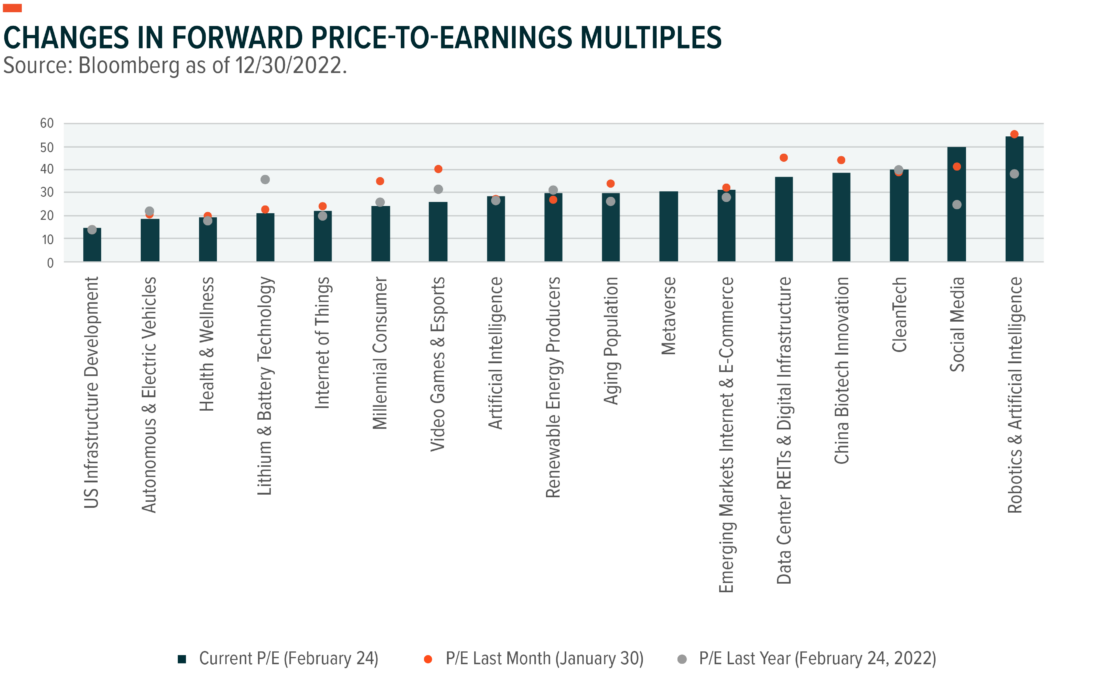

Inflection Point Theme Dashboard

FOOTNOTES

- Global X analysis with information derived from: Bloomberg L.P. (n.d.) [Data set]. Retrieved on February 24, 2023.

- Ibid.

- Gurau, M. (13 July 2020). How Three Of The Biggest Tech Companies Blend Business Models To Create Nonordinary Competition. Forbes. https://www.forbes.com/sites/forbestechcouncil/2020/07/13/how-three-of-the-biggest-tech-companies-blend-business-models-to-create-nonordinary-competition/?sh=531593e1240c.

- Zhu, F. and Iansiti, M. (January-February 2019). Why Some Platforms Thrive and Others Don’t. Harvard Business Review. https://hbr.org/2019/01/why-some-platforms-thrive-and-others-dont.

- Global X analysis with information derived from: Bloomberg L.P. (n.d.) [Data set]. Retrieved on February 24, 2023.

- Ibid.

- Ibid.

- Ibid.

- The Economist. (8 December 2020). The pandemic could give way to an era of rapid productivity growth. https://www.economist.com/finance-and-economics/2020/12/08/the-pandemic-could-give-way-to-an-era-of-rapid-productivity-growth.

- Global X analysis with information derived from: Bloomberg L.P. (n.d.) [Data set]. Retrieved on February 24, 2023.

- Ibid.

- Woods, B. (2 October 2022). How John Deere plans to build a world of fully autonomous farming by 2030. CNBC. https://www.cnbc.com/2022/10/02/how-deere-plans-to-build-a-world-of-fully-autonomous-farming-by-2030.html

- (9 August 2022). Emerson Electric profit jumps 47% on strength in automation unit. https://www.reuters.com/business/retail-consumer/emerson-quarterly-profit-rises-strength-automation-unit-2022-08-09/.

- Haas, S., Loughlin, R., Quinn, B., and Roth, E. (22 April 2022). The next frontier in consumer goods: Digitally enabled innovation. McKinsey. https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/the-next-frontier-in-consumer-goods-digitally-enabled-innovation.

- Sisson, P. (15 November 2018). In Walmart’s virtual reality simulation, Black Friday never ends. Vox. https://www.vox.com/the-goods/2018/11/15/18092456/walmart-virtual-reality-black-friday-vr.

- Nicoara, B. (20 December 2022). How this technology will transform commercial real estate in 2023. Entrepreneur. https://www.entrepreneur.com/starting-a-business/this-tech-will-transform-commercial-real-estate-in-2023/440197.

- Shields, N. (20 July 2018). UPS is turning to predictive analytics. Business Insider. https://www.businessinsider.com/ups-using-predictive-analytics-algorithm-2018-7.

- Global X analysis with information derived from: Bloomberg L.P. (n.d.) [Data set]. Retrieved on February 24, 2023.

- Ibid.

- Ibid.

GLOSSARY

Theme Dashboard – Reference index for each theme:

Blockchain – Solactive Blockchain Index

Disruptive Materials – Solactive Disruptive Materials Index

Lithium & Battery Technology – Solactive Global Lithium Index.

FinTech – Indxx Global FinTech Thematic Index

Cloud Computing – Indxx Global Cloud Computing Index

Robotics & AI – Indxx Global Robotics & Artificial Intelligence Thematic Index

China Biotech Innovation – Solactive China Biotech Innovation Index

Artificial Intelligence – Indxx Artificial Intelligence & Big Data Index

Cybersecurity – Indxx Cybersecurity Index

Millennial Consumer – Indxx Millennials Thematic Index

E-commerce – Solactive E-commerce Index

Genomics & Biotechnology – Solactive Genomics Index

Data Center REITs & Digital Infrastructure – Solactive Data Center REITs & Digital Infrastructure Index

Social Media – Solactive Social Media Total Return Index

Solar – Solactive Solar Index

Autonomous & Electric Vehicles – Solactive Autonomous & Electric Vehicles Index

Education – Indxx Global Education Thematic Index

Telemedicine & Digital Health – Solactive Telemedicine & Digital Health Index

Hydrogen – Solactive Global Hydrogen Index

Internet of Things – Indxx Global Internet of Things Thematic Index

Emerging Markets Internet – Nasdaq CTA Emerging Markets Internet & E-commerce Net Total Return Index

U.S. Infrastructure Development – Indxx U.S. Infrastructure Development Index

Cannabis – Cannabis Index

CleanTech – Indxx Global CleanTech Index

AgTech & Food Innovation – Solactive AgTech & Food Innovation Index

Health & Wellness – Indxx Global Health & Wellness Thematic Index

Renewable Energy Producers – Indxx Renewable Energy Producers Index

Aging Population – Indxx Aging Population Thematic Index

Metaverse – Global X Metaverse Index

Clean Water – Solactive Global Clean Water Industry Index

Wind Energy – Solactive Wind Energy Index

Video Games & Esports – Solactive Video Games & Esports Index

Green Building – Solactive Green Building Index

—

Originally Posted March 6, 2023 – Inflection Points – March 2023: Beneficiaries of Innovation Beyond Big Tech

Information provided by Global X Management Company LLC.

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

Disclosure: Global X ETFs

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s full or summary prospectus, which may be obtained by calling 1-888-GX-FUND-1 (1.888.493.8631), or by visiting globalxfunds.com. Read the prospectus carefully before investing.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Global X ETFs and is being posted with its permission. The views expressed in this material are solely those of the author and/or Global X ETFs and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.