Federal Reserve Chairman Jerome Powell’s presentation today comes during a precarious moment for the central bank and investors. During the past 12 months, corporate earnings have been weakening, but expanding equity valuations have driven market performance, a result of growing investor optimism that the central bank is moving closer to backing off its hawkish outlook. This optimism could easily be derailed if Powell maintains that the central bank is keeping the door open to hiking the fed funds rate higher than expected and keeping it elevated for longer than anticipated.

The S&P 500 Index has generated an 18.55% 1-year total return at a time when earnings have been softening and valuations expanding. Analysts believe, however, that a lighter Fed will propel earnings higher in the next 12 months without pushing up inflation. With inflationary dynamics where they are today, a loosening in monetary policy would certainly lead to another leg higher in inflation as the benefits of year-over-year (y/y) base effects will wane this summer. Meanwhile, if the Fed remains hawkish, it’s unfeasible to believe that earnings would grow 10% in the next 12 months. Tighter monetary policy has already led to an earnings recession, and those earnings won’t recover to prior peaks to the extent that the Fed remains on corporate America’s back with restrictive policy. The only avenue to higher earnings before a new trough from here is if the Fed accepts higher inflation, which makes this afternoon’s press conference a pivotal one.

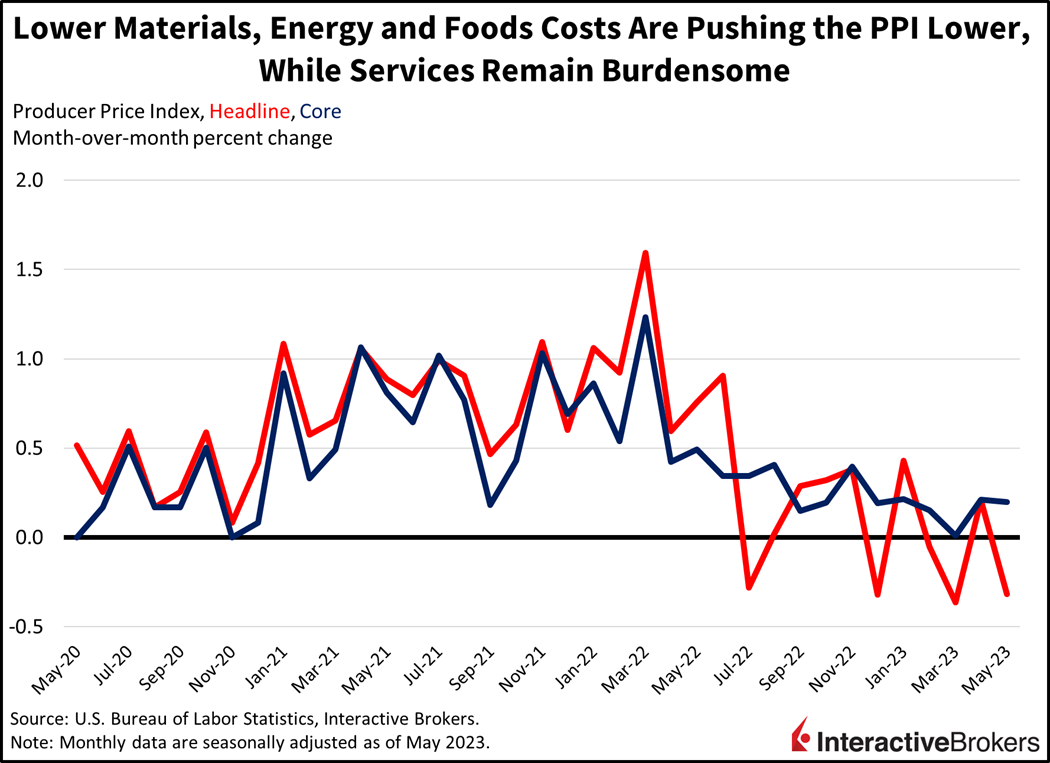

The past two days, however, have provided bulls reasons to believe that the Fed can back off its restrictive stance. Today’s Producer Price Index (PPI) for May reflected further progress on fighting inflation. May producer prices declined 0.3%, better than the consensus expectation of a 0.1% drop and cooling from April’s 0.2% gain. On a y/y basis, producer prices rose 1.1%, well below the 1.5% estimate and the previous period’s 2.3% increase. The Core PPI, which excludes food and energy due to their volatile characteristics, rose 0.2% month-over-month (m/m), the same pace as last month and in-line with projections. On a y/y basis, core PPI came in at 2.8%, below the consensus’s prediction of 2.9% and lower than April’s 3.2%.

Price pressures at the wholesale level were relieved by commodities and goods while services remained the ongoing burden. Energy and food prices declined 6.8% and 1.3% m/m, respectively, goods prices fell 1.6%, and services costs rose 0.2%. Services prices were helped by a sharp decline in transportation and warehousing of 1.4%, but trade services price hikes of 1% supported price increases.

Weaker-than-expected PPI data is weighing on bond yields while equity investors cautiously wait for Powell to arrive at the dock. Treasury yields are down across the curve with the 2- and 10-year maturities declining 7 and 5 basis points (bps) to 4.62% and 3.79%. Lower bond yields fueled by confidence of a lighter Fed are weighing on the dollar, with the Dollar Index down 48 bps to 102.80. The S&P 500 Index is up a modest 0.2% with most sectors participating except for healthcare, consumer discretionary and semiconductors. WTI crude oil is up for its second consecutive day following Monday’s beating, gaining 1.3% to $70.34 on the back of enthusiasm regarding loosening monetary and lending policies in China, the world’s largest oil importer.

In fact, projections that fall short of the marketplace will presumably embolden the bulls while anticipation of tightening exceeding current pricing models are likely to reinvigorate the bears.

Despite yesterday’s Consumer Price Index report showing accelerating core inflation for the second consecutive month driven by quickening increases in the price of shelter, transportation services and food at dining establishments, markets are firmly pricing in a pause at this afternoon’s Fed decision. Important insights will be gathered from the Fed’s Summary of Economic Projections, however, which will exhibit the Fed’s forecasts of the year-end rate as well as expectations of major economic indicators like inflation, unemployment and GDP growth. With investors pricing in one more rate hike for the rest of the year and a cut by year-end, the Fed’s expectations of its own rate path may reconcile differences of opinion. In fact, projections that fall short of the marketplace will presumably embolden the bulls while anticipation of tightening exceeding current pricing models are likely to reinvigorate the bears.

Visit Traders’ Academy to Learn More about the Consumer Price Index and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.