BlackRock portfolio manager Russ Koesterich, CFA discusses why earnings trumped rates as the catalyst for September’s poor equity performance.

September lived up to its reputation as a bad month for stocks. Global equity markets declined more than 4%, making September the worst month since the start of the pandemic. Beyond seasonal weakness, many attributed equity losses to higher interest rates. While rates clearly played a part, market patterns suggest that there was more going on than just a negative reaction to higher rates. Instead, investor behavior continues to be driven by an increasing focus on earnings and cash flow. Absent a significant change in either the growth and/or rate outlook, this is likely to continue.

1.50% 10 year ≠ end of the bull market

As I’ve discussed in previous blogs, the historical link between rates and equities is complicated, particularly when rates are low. It is also important to note that rates have been rangebound. Unlike last fall, when long-term rates began a melt-up that resulted in a near tripling of yields, today rates and rate vol are relatively contained. Rate volatility, as measured by the MOVE Index, remains well below the July and February peak. Moreover, the co-movement between rates and stocks in September suggests rates were not the dominant theme; there was effectively a zero correlation between daily changes in U.S. rates and U.S. equities last month.

What Do Investors Want?

While the September sell-off was not all about rates, higher yields did influence investor preferences, albeit in somewhat counterintuitive ways. Looking again at daily moves, defensive (low vol) stocks tended to outperform on days when bonds were selling off. This is somewhat at odds with historical patterns. Typically, low volatility names are the most sensitive to higher rates. Instead, investors seemed to focus on the low-beta aspect of these names rather than their rate sensitivity. Further complicating the picture: Not all cyclicals outperformed last month. Although energy had a stellar month, materials and industrials struggled along with the broader market.

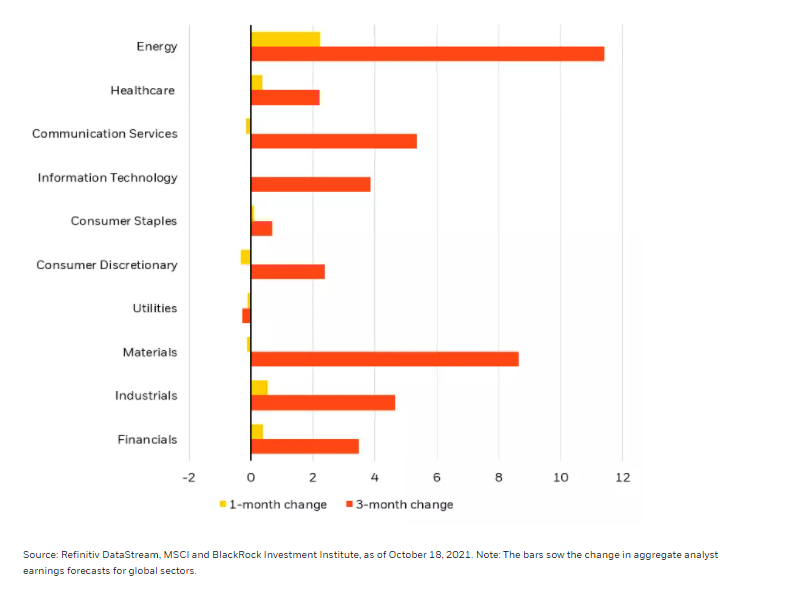

Arguably the missing part of the puzzle is earnings. With valuations drifting lower, earnings have become the driver of performance. This was evident in September. For example, while you could attribute energy’s stellar gains to resilience to higher rates, the simpler explanation is rising oil prices producing spectacular earnings growth (see Chart 1). At the opposite end of the spectrum, the underperformance of utilities arguably had as much to do with a lack of earnings growth rather than the sector’s historical relationship to interest rates.

Global sector earnings momentum

Going forward, I would expect a few key dynamics: modestly higher rates but no melt-up, sticky inflation in the near term and a Federal Reserve (finally) beginning the process of removing accommodation. None of this is a death knell for equity markets. But in the absence of ever easier financial conditions, earnings rather than multiples will continue to drive markets. This suggests less of a focus on rates and more on earnings, cash flow and sustainable margins in an era of rising cost pressure.

—

Originally Posted on October 26, 2021 – It’s Not All About Rates

© 2021 BlackRock, Inc. All rights reserved.

Investing involves risk, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of September 2021 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

The BlackRock Model Portfolios are provided for illustrative and educational purposes only, do not constitute research, investment advice or a fiduciary investment recommendation from BlackRock to any client of a third party financial advisor (each, a “Financial Advisor”), and are intended for use only by such Financial Advisor as a resource to help build a portfolio or as an input in the development of investment advice from such Financial Advisor to its own clients and shall not be the sole or primary basis for such Financial Advisor’s recommendation and/or decision. Such Financial Advisors are responsible for making their own independent fiduciary judgment as to how to use the BlackRock Model Portfolios and/or whether to implement any trades for their clients. BlackRock does not have investment discretion over, or place trade orders for, any portfolios or accounts derived from the BlackRock Model Portfolios. BlackRock is not responsible for determining the appropriateness or suitability of the BlackRock Model Portfolios or any of the securities included therein for any client of a Financial Advisor. Information and other marketing materials provided by BlackRock concerning the BlackRock Model Portfolios –including holdings, performance, and other characteristics –may vary materially from any portfolios or accounts derived from the BlackRock Model Portfolios. Any performance shown for the BlackRock Model Portfolios does not include brokerage fees, commissions, or any overlay fee for portfolio management, which would further reduce returns. There is no guarantee that any investment strategy will be successful or achieve any particular level of results. The BlackRock Model Portfolios themselves are not funds. The BlackRock Model Portfolios, allocations, and data are subject to change.

For financial professionals: BlackRock’s role is limited to providing you or your firm (collectively, the “Advisor”) with non-discretionary investment advice in the form of model portfolios in connection with its management of its clients’ accounts. The implementation of, or reliance on, a Managed Portfolio Strategy is left to the discretion of the Advisor. BlackRock is not responsible for determining the securities to be purchased, held and sold for a client’s account(s), nor is BlackRock responsible for determining the suitability or appropriateness of a Managed Portfolio Strategy or any securities included therein for any of the Advisor’s clients. BlackRock does not place trade orders for any of the Advisor’s clients’ account(s). Information and other marketing materials provided to you by BlackRock concerning a Managed Portfolio Strategy—including holdings, performance and other characteristics–may not be indicative of a client’s actual experience from an account managed in accordance with the strategy.

For investors: BlackRock’s role is limited to providing your Advisor with non-discretionary investment advice in the form of model portfolios in connection with its management of its clients’ accounts. The implementation of, or reliance on, a Managed Portfolio Strategy is left to the discretion of your Advisor. BlackRock is not responsible for determining the securities to be purchased, held and sold for your account(s), nor is BlackRock responsible for determining the suitability or appropriateness of a Managed Portfolio Strategy or any securities included therein. BlackRock does not place trade orders for any Managed Portfolio Strategy account. Information and other marketing materials provided to you by BlackRock concerning a Managed Portfolio Strategy—including holdings, performance and other characteristics—may not be indicative of a client’s actual experience from an account managed in accordance with the strategy. This material is subject to change.

Prepared by BlackRock Investments, LLC, member FINRA.

©2021 BlackRock, Inc. All rights reserved. BLACKROCK is a trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

USRRMH1021U/S-1887176

Disclosure: BlackRock

©2022 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.