On a day-to-day basis, one could be forgiven for thinking that all that matters to stock and bond investors is the precise path of future Federal Reserve rate policy. The Fed gets a HUGE amount of attention in financial markets, and bond investors certainly have a reason to follow the Fed closely. After all, the Fed effectively sets the price for part of the bond market (short-term interest rates) by decree, and the rest of the bond market is a function of what the Fed will do in the future (the yield curve), and credit (yields on all non-Treasuries vs Treasuries).

For stocks, Economy > Fed lately

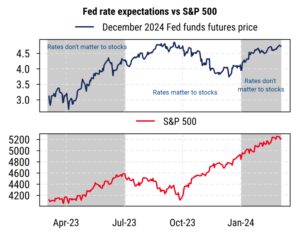

But for stock investors, the Fed is only one of many important variables, and lately has arguably not even been the most important one if you look beyond day-to-day movements. The usual assumption is that higher rates are bad for stocks, and lower rates are good, and that is true up to a point, but depends heavily on the economic backdrop. Indeed, this was the case in the fall of last year, when rising rate expectations put pressure on stock prices in the August-October period, and investors were more worried about inflation.

But for 2024 to date, the stock market has gone up despite the fact that markets now expect higher policy rates than they did at the start of the year. The market’s pricing for the fed funds policy rate at the end of 2024 rose to 4.86% at its peak in October, and then declined to about 3.8% in December/January. That helped stocks rally from their late October lows.

Since then, a funny thing has happened. The fed funds futures markets show expectations of year-end 2024 rates having risen all the way back at 4.74%, about where they were at the peak in October. So stocks should have gone back down, like they did last summer, right? No, the S&P 500 is up 9.5% year-to-date, and up 27% since the October 27th low. So rate expectations made a round-trip (4.8% to 3.8% and back to about 4.8%) and stocks had a huge 5-month gain during that time?

Source: Mill Street Research, Bloomberg

The key has been the economy and earnings, more than interest rates. The US economy has held up remarkably well despite higher interest rates, and investors have now come around to that idea. Also, the Fed has continued to say that it will very likely cut rates at some point this year, with some debate still about exactly when and by how much. But stock investors saw the inflection point in the Fed’s rate outlook back in November (i.e., no more rate hikes expected due to progress on inflation), and while the timing has shifted, the general direction of movement in rates remains “lower” rather than “higher”.

The important thing for the Fed and thus for markets is whether the Fed can break the long-held but erroneous assumption (implicit or explicit) that strong economic growth causes higher inflation. If the Fed assumes (as bond investors often do) that any signs of better-than-expected economic growth means inflation is more likely to rise, then it might hold rates at higher levels for longer (or in the extreme, reverse course and raise them further). This would potentially be a continuation of policy mistakes made in the past. Real growth by itself does not cause inflation, it is mostly supply shocks or occasionally excessive federal government spending.

Fed policy is tight, and the Fed knows it, but not everyone believes it

But if the Fed keeps its focus on actual reported inflation, and other factors influencing inflation like regulatory policy (for housing) or immigration (for labor), then it will likely keep its plans to cut rates this year intact. That is, the Fed likely realizes that monetary policy is indeed quite tight, and thus it does not need to allow policy to get even tighter by keeping rates high even as inflation declines (i.e., even higher real rates). The key features of tight policy are high real rates and low growth in bank lending (as higher rates reduce demand for bank loans). Both of those conditions are currently met.

Source: Mill Street Research, Factset, Bloomberg

The part that throws off many market watchers is the assumption that “if policy were really tight, the economy would be slowing more and stock prices wouldn’t be going up so much”. And while that has been the case at times in the past, it makes the mistake of only looking at Fed policy and ignoring everything else. Over the last few years, “everything else” has clearly overwhelmed the impacts of monetary policy on the economy and markets, so we cannot (and should not) rely on a direct and immediate connection between monetary policy and economic or market outcomes to determine whether policy is in fact tight or not.

The more important factors have been the moderation of COVID, the recovery in supply (both physical and labor), fiscal policy, Russia’s invasion of Ukraine, OPEC, and (as far as we can tell) improved productivity growth. Also, changes in interest rates can have mixed effects on the economy, since they increase both interest expenses and interest income, as we have discussed previously.

Solid economic growth with falling inflation? Stocks can do well without major rate cuts

Basically, if fiscal policy is supportive (as it has been) and productivity growth is reasonably good, the economy can handle rates of 4-5% without breaking. This is what it has done over the last two years, and arguably is what it should do most of the time. Crucially, economic growth has been reasonably good, and with high employment, while inflation has declined.

Source: Mill Street Research, Factset, Bloomberg

So the stock market’s strong gains are less confusing in light of high short-term interest rates and the recent rise in expected rates if you take into account the trends in inflation, productivity, fiscal policy, and the mixed influence of rates on earnings and the economy. If the Fed is really focused on inflation and employment (its official mandate from Congress), then it should be fairly happy with current conditions, and feel more comfortable pulling rates back somewhat from current high levels later this year. Stock investors should also be happy, as 3-5% rates should be considered “normal”, not the near-zero rates we saw for so long, and can support reasonable growth in GDP and corporate earnings. Rate changes of 25 or 50 basis points are not going to make a huge difference to the economy either way.

Bottom line: if earnings are growing and inflation is moderate, stocks are likely to outperform bonds (as they have since late 2020), and stocks do not necessarily need aggressive rate cuts to show strong gains, as the mid/late 1990s showed us. Keep an eye on the Fed, but do not fall into the trap of ONLY watching the Fed.

—

Originally Posted April 4, 2024 – IT’S NOT ALL ABOUT THE FED

Disclosure: Mill Street Research

Source for data and statistics: Mill Street Research, FactSet, Bloomberg

This report is not intended to provide investment advice. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report.

All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Mill Street does not represent that any such information, opinion or statistical data is accurate or complete. All estimates, opinions and recommendations expressed herein constitute judgments as of the date of this report and are subject to change without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mill Street Research and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mill Street Research and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.