This morning’s payroll data is painting a mixed picture of a tight labor market that appears to be cooling slightly. Job growth fell below expectations and the average weekly hours worked declined in July, helping to support optimism that labor-market tightness may be easing. This optimism, however, is being held in check by a decline in the unemployment rate, ongoing wage increases and a decline in the prime-age labor force participation rate.

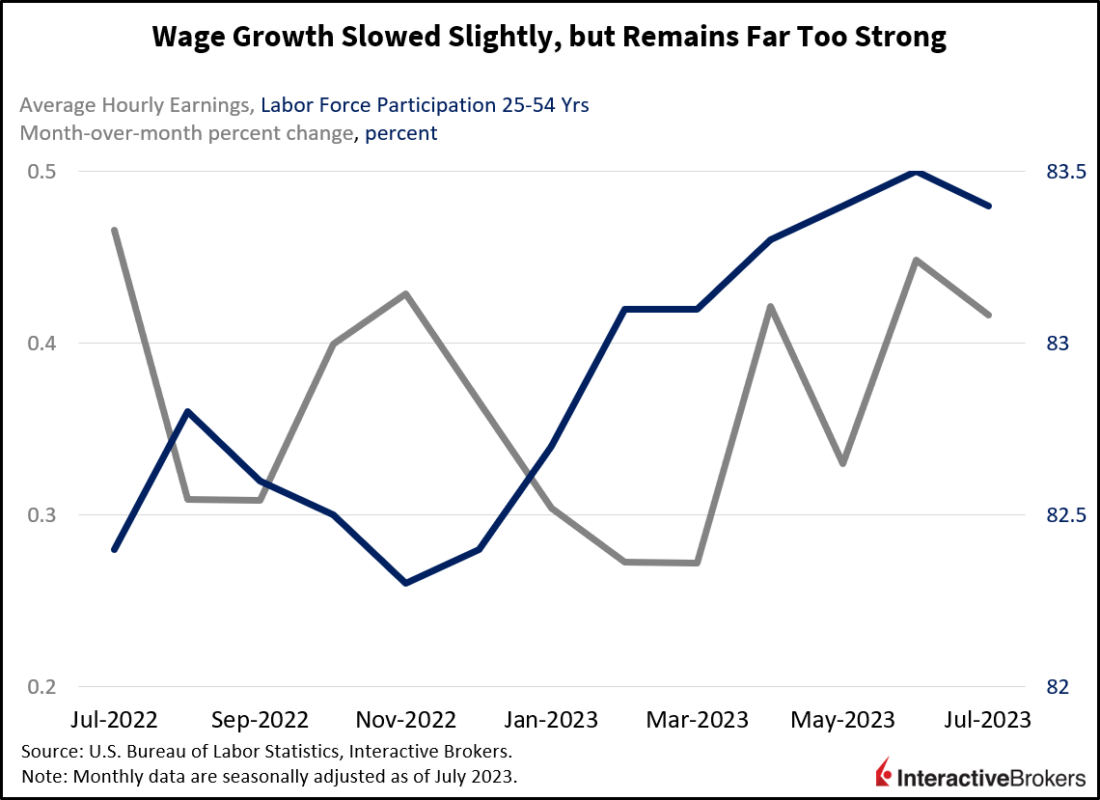

Employers added 187,000 workers while the unemployment rate dipped to 3.5% in July. Job growth was slightly below economists’ expectations of 200,000 and occurred at a similar pace to June’s downwardly revised 185,000. The unemployment rate meanwhile dropped from 3.6% to 3.5%, driven partly by a modest decline in prime-age labor force participation. The increased tightness in the labor market influenced rising compensation, with average hourly earnings increases rising 0.4%, an upside surprise with the Street projecting an unchanged rate of 0.3%. Employers trimmed hours to hedge the impact of higher wage pressures—the average hourly workweek sunk to 34.3, matching the cycle low from May.

Education and Health Services Snatch Workers

Job gains were not broad based and mostly concentrated in education and health services, with a gain of 100,000. The other services, construction, financial activities, wholesale trade, leisure and hospitality, government, retail trade and mining helped at more tempered levels, however, with additions of 20,000, 19,000, 19,000, 17,900, 17,000, 15,000, 8,500 and 1,000 respectively. The information, transportation and warehousing, professional and business services, manufacturing and utilities sectors lost 12,000, 8,400, 8,000, 2,000 and 200 jobs.

Positive Investor Sentiment Extends Across Markets

Markets are reacting positively to job growth slightly missing expectations, while choosing not to worry about the lower unemployment rate and wage pressures. Among equities, every sector is higher except for technology, which is being weighed down by disappointing Apple earnings with the company’s shares down 3% intraday. All major U.S. equity indices are up, with the Dow Jones Industrial Average leading by climbing 0.6%. Treasuries and the dollar are marching to the beat of the risk-on tune, with the 2- and 10-year maturities down 8 and 9 basis points (bps) to 4.82% and 4.10% while the Dollar Index is down 55 bps to 101.92. Crude oil prices are climbing from an extension of Saudi Arabia’s voluntary 1 million barrel per day production cut through September and significant declines in U.S. inventories with WTI crude oil up 0.9% to $82.27 per barrel, its highest level since April.

Consumers Venture Abroad

Weak job creation in leisure and hospitality resulted, at least in part, from consumers flocking to non-U.S. destinations rather than a broad decline in spending. For Airbnb’s second quarter, the average daily rate for short-term rentals done through the company’s booking platform increased 1% globally, but in North America, the rate declined 1% as consumers jumped on the ability to travel internationally following the lifting of stay-at-home orders or other policies to slow the spread of Covid-19. A strong dollar is also enticing consumers to travel abroad. The number of cross-border nights booked increased 16% while bookings in the U.S. were virtually flat. The company’s second-quarter adjusted earnings per share (EPS) of $0.98 substantially beat the $0.77 EPS expected by a consensus of analysts.

Computer Sales Languish, but Shoppers Splurge Elsewhere

Apple’s second quarter device sales declined as consumers rein in goods purchases, while Amazon.com said its e-commerce sales and digital advertising revenues improved. Apple’s quarterly revenue declined approximately 1% year-over-year (y/y) to $81.8 billion, but still beat the consensus expectation of $81.69 billion. After cutting costs, including laying off employees, Apple’s EPS of $1.26 increased 5% from the year-ago quarter and exceeded the $1.19 consensus expectation. iPhone and Mac computer sales declined 2% and 7% y/y, respectively, while iPad sales, which faced tough comparisons due to product launches last year, dropped 20%. Apple’s services such as streaming TV, advertising, warranties and payments grew 8%, in large part due to the company monetizing users of digital devices. Amazon.com generated an EPS of $0.65, exceeding the consensus expectation of $0.35 and the company’s overall revenue of $134.4 billion grew 11% from the year-ago quarter. Advertising revenues totaled $10.8 billion and grew 22% y/y while sales from the company’s online sales increased only 4% to $53 billion. The company’s AWS cloud computing revenues grew 12% y/y after growing 16% in the first quarter.

A Thorny Challenge for the Fed

Investors are viewing today’s data with a glass-half full perspective, even as these wage pressures combined with a potentially hot CPI next week could lead to a close call regarding increasing the fed funds rate at the September Fed meeting.

While workers are benefiting from wage increases as a strong labor market illustrates that the consumer can still thrive, this morning’s jobs report underscores the challenges that Federal Reserve Chairman Jerome Powell and policymakers face with slowing inflation to the central bank’s 2% target. After bumping the fed funds rate 25 bps to a 22-year high range of 5.25% to 5.50% in July, Powell said reaching the 2% goal will require the labor market to soften and he emphasized that the Fed has a long way to go to hit the target. Just one day after Powell’s comments, the Bureau of Economic Analysis reported that second-quarter GDP grew at an annualized seasonally-adjusted rate of 2.4% in excess of inflation, exceeding the 2% analyst consensus expectation and pointing to continued strength of consumer spending and business investment. While the July Institute for Supply Management’s PMI Index for Manufacturing and real-time retail sales point to an economy that is slowing, today’s labor report and the surprisingly strong GDP growth underscore that Powell and his fellow policymakers have a challenging road ahead in fighting inflation. In the meantime, investors are viewing today’s data with a glass-half full perspective, even as these wage pressures combined with a potentially hot CPI next week could lead to a close call regarding increasing the fed funds rate at the September Fed meeting.

Visit Traders’ Academy to Learn More about Payroll Employment and Other Economic Indicators.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.