Concerns about inflation appear to be playing second fiddle behind worries that the economy is moving closer to recession with today’s PPI depicting demand for manufactured goods declining while unemployment claims data points to a labor market that continues to cool.

Just one day after the CPI pointed to weakening inflation for goods and commodities, today’s Producer Price Index (PPI) advanced only 2.7% year-over year (y/y), slightly below the 3% analyst consensus forecast and a substantial decline from the 4.9% and 5.9% advances for the one-year periods ended in February and January. From a longer-term perspective, the 2.7% rate shows that inflation has weakened substantially from the 11.7% y/y increase recorded in March of 2022. The core-PPI, which excludes food, energy and trade, advanced 3.6% in March, also recording progress from February’s 4.8% rise and arriving better than the 3.1% consensus expectation.

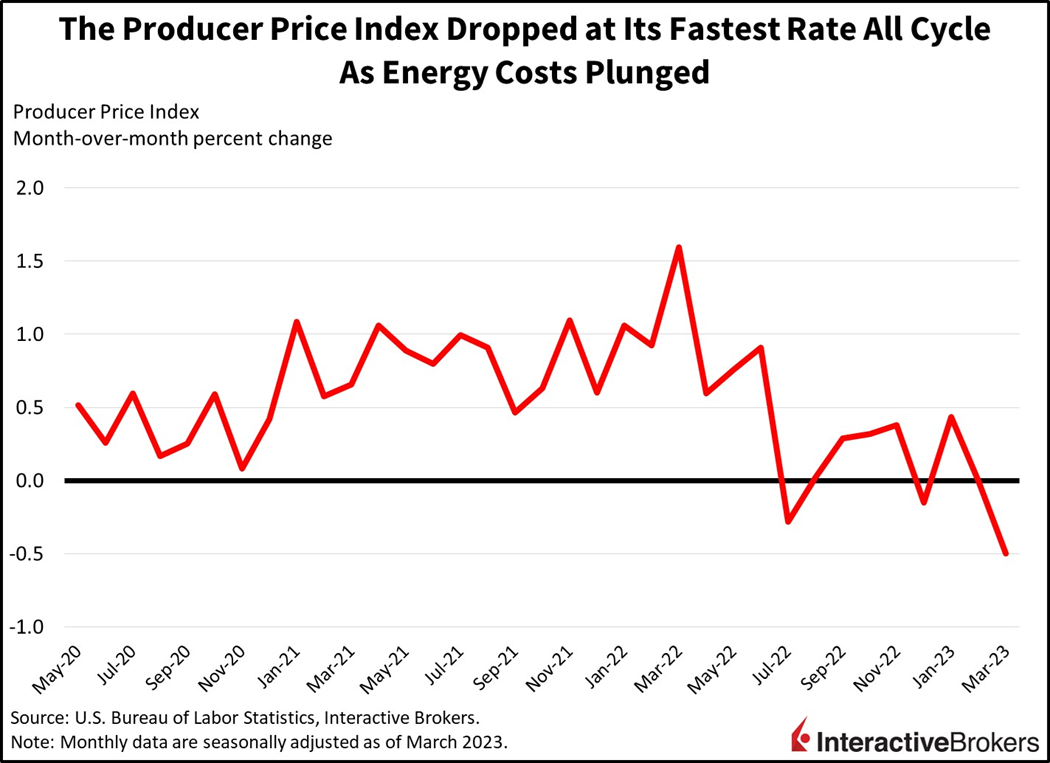

On a month-over-month basis (m/m), the headline PPI declined 0.5% in March, the first decline all year and fastest decline all cycle, with the bulk of the drop attributed to lower prices for gasoline. Also in March, the index for the services category declined 0.3%, the largest decline since April 2020, during the depths of the pandemic recession. The decline in services is encouraging because the sector has demonstrated persistent inflation. Within the services category, transportation and warehousing led the decline, with a m/m drop of 1.3% while trade services dropped 0.9%. California’s Inland Empire, a sprawling complex of warehouses, illustrates the weakening demand for storage and logistics. After hitting a virtually unheard of vacancy rate of 0.4%, the home to more than 570 million square feet of warehouses saw its first-quarter vacancy rate increase to 2.8% and asking rental rates decline by 2.4%, according to real estate brokerage firm Savills. The decline was largely driven by freight volumes dropping 43% y/y at Los Angeles ports.

The S&P 500 and Nasdaq Indices are up 0.7% and 1.4%, respectively, as equity investors eagerly hope for a Fed pause. Yields are relatively unchanged across the curve, however, as bond investors interpret this week’s inflation data as temporary relief rather than a coast-is-clear signal.

Markets are responding positively to this morning’s news after yesterday’s sharp rally abruptly reversed when selling pressure intensified. The S&P 500 and Nasdaq Indices are up 0.7% and 1.4%, respectively, as equity investors eagerly hope for a Fed pause. Yields are relatively unchanged across the curve, however, as bond investors interpret this week’s inflation data as temporary relief rather than a coast-is-clear signal. The dollar is sinking to its lowest levels of the year as the market prices in just one more rate hike—the Dollar Index is down 0.6% to 100.8. WTI crude oil is giving back a portion of yesterday’s massive gains – it’s down 0.5% to $82.83 per barrel.

An Important and Potentially Temporary Assist from Energy

During March, energy recorded the largest price decline of the year as rising U.S. stockpiles, soft China demand and banking fears mounted. It was likely a temporary reprieve from pain at the gasoline pump, however—oil prices have soared from the March average of $73.28 a barrel to nearly $83 following OPEC + announcing that it will increase its production cuts by approximately 1.66 million, bringing the total cuts to 3.66 million. The resulting higher energy costs could stymie economic growth as consumers spend more of their disposable income for gasoline. Higher energy costs are also inflationary as they increase operating costs for businesses.

Labor Conditions May Be Easing

Also this morning, initial jobless claims for the week ended April 8 rose to 239,000, up 11,000 from the prior reporting period and exceeding the analyst consensus forecast of 232,000. The four-week moving average of claims, which evens out some of the weekly volatility, rose by 2,250 to 240,000, roughly the highest level since November 2021. Despite the increase in initial unemployment claims, job creation is still occurring, with 236,000 jobs added last month and the unemployment rate dropping to 3.5%. Participation is also rising as consumer savings dwindle and workers flock back to the labor market. The labor force participation rate notched its fourth consecutive monthly increase in March, rising to 62.6, but still below its 63.3% pre-pandemic level.

Searching for a Soft Landing

As the Fed continues with its monetary policy tightening, the health of the labor market becomes increasingly significant. By striking a balance of labor supply and demand, the Fed can move one step closer to a soft landing that is becoming increasingly unlikely as energy prices soar, goods demand declines and lending standards are tightened.

In the coming months, the impact of higher gasoline prices will be a major factor in the health of the economy, especially as we move into the summer travel season. Consumers who have pent-up demand for travel and entertainment following Covid-19 lockdowns may be willing to dismiss higher gasoline prices and continue to accelerate their shift in spending from goods to services. Disposable income, even when supplemented with consumer debt, has its limits, so the combination of higher energy costs and robust spending on entertainment and travel could cause consumers to further cut back on purchasing goods as manufacturers struggle with higher energy costs, creating a dismal outlook for the sector’s earnings. This trend of weak goods spending is already significant with Apple disclosing on Monday that its first quarter worldwide shipments of Mac computers fell a stunning 40.4% y/y.

Visit Traders’ Academy to Learn More about Initial Unemployment Claims and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)