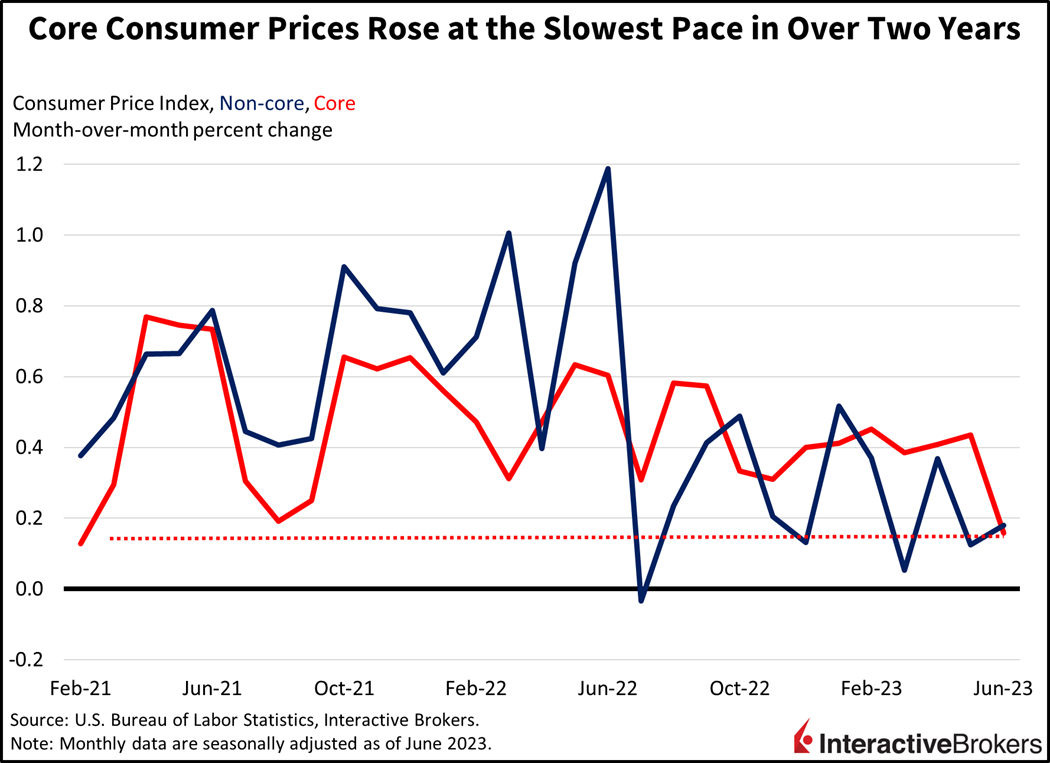

In great news for the economy and markets, inflation declined further in June. Equities are rallying while yields plunge as investors cheer favorable incoming data against the backdrop of a data-dependent Federal Reserve. Indeed, core consumer prices rose just 0.2% during the period, a trend which if maintained, points directly at the Fed’s 2% target. While recent Fed commentary points to further monetary policy restraint, more incoming data releases like this morning’s are likely to reinvigorate the doves.

Consumer prices rose 0.2% in June, higher than May’s 0.1% rate but better than projections for 0.3%. Core prices, which exclude food and energy, also rose 0.2%, better than the consensus estimate of 0.3% and an improvement from 0.4% in the prior period. In fact, the core segment rose as the slowest pace since February 2021, over two years ago. On a year-over-year basis (y/y), overall consumer prices rose 3% while core increased 4.8%, driving an overall improvement from May’s 4% and 5.3%. June y/y figures also came in better than expectations of 3.1% and 5.0%.

Used Vehicle Prices Decline

Driving much of the increase last month were gasoline, electricity, food at dining establishments and shelter, registering gains of 1.0%, 0.9%, 0.4% and 0.4%, respectively. While most categories reflected reduced price pressures relative to the previous month, gasoline and energy services ticked up, driving the overall acceleration in prices. The deceleration in core prices, however, was driven by a -0.5% decline in prices for used automobiles and trucks, the only price reduction in the core segment. The unchanged month-over-month (m/m) prices of food at the supermarket, new automobiles and medical care services alongside the modest 0.1% m/m rise in transportation services costs also served to relieve price pressures.

Investor Optimism Surges

Markets are ripping higher today, as optimism regarding the Fed being near the end of its tightening campaign thrives. Equities are jumping with all major U.S. indices higher by about 1%. Every sector is higher as well, with regional banks and homebuilders leading the way; they’re up over 2%. Semiconductors and the Nasdaq Composite Index are not far behind, up 1.8% and 1.3% to their highest levels of the year. Bond yields are plunging across the duration curve driven by lighter Fed expectations and weaker inflation expectations. In fact, chances of reaching the Fed’s terminal rate of 5.63% according to its dot-plot fell to 28% in November, with this month’s anticipated 25-basis point (bp) hike priced as the last one of the cycle. The 2- and 10-year Treasury maturities are down 17 and 11 bps each to 4.73% and 3.88%. Lower yields amidst a rosier outlook for monetary policy are hammering the dollar as well, with its index down 1.04% to 100.60, nearing important support at 100. Risk-on sentiments and rising odds of a soft landing are also extending to energy markets despite a sharp weekly increase in U.S. inventories, with WTI crude oil up 1.1% to $75.67 per barrel.

Investors Focus on Corporate Pricing Power

With earnings season kicking off this week on the heels of another favorable inflation reading, the bar is elevated amidst high rates and contractionary liquidity conditions as the Fed’s balance sheet remains $41 billion below its pre-SVB failure level.

With earnings season kicking off this week on the heels of another favorable inflation reading, investors will be closely watching how companies have managed declining pricing power. Companies reporting an increase in efficiencies amidst stable margins will likely be celebrated while companies suffering revenue declines absent cost efficiencies that when taken together weigh on the bottom line will probably yield disappointment. The outlook for future quarters will also be of the essence, as market players analyze the extent to which weaker consumer spending is the primary factor weighing on inflationary pressures. With equities at fresh year-to-date highs and certain sectors like industrials and homebuilders at and near all-time highs, the bar is elevated amidst high rates and contractionary liquidity conditions as the Fed’s balance sheet remains $41 billion below its pre-SVB failure level.

Visit Traders’ Academy to Learn More about the Consumer Price Index and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.