Equity markets sprinted on the sound of the opening bell, on cue with risk-off sentiments in fixed-income. The plunge in bond yields is occurring as Israel is expected to launch a counter-offensive land attack in Gaza. At 10:00 am eastern time, however, equities lost steam following an awful Consumer Sentiment report out of the University of Michigan which missed estimates by a mile and then some.

Sentiment Plunges

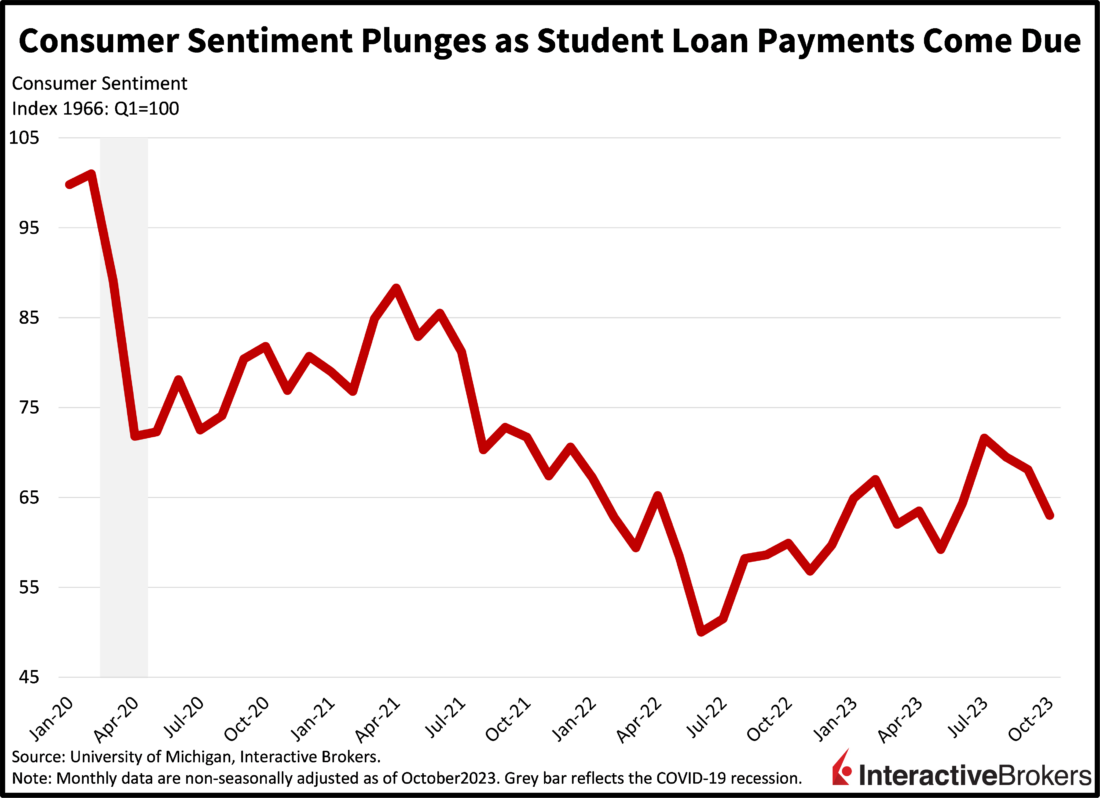

Consumer sentiment plunged this month, a result of worsening personal finances amidst anticipations of intensifying inflation. Expectations for one-year business conditions also hurt results, with consumers’ outlook for income opportunities declining. Indeed, the University of Michigan consumer sentiment gauge fell to 63, plunging from 68.1 in September and reaching the lowest level since May. The figure missed the consensus estimate of 67.2. The current conditions and expectations segments fell to 66.7 and 60.7 from 71.4 and 66 while missing estimates of 70.4 and 65.5. Perhaps most concerning was the rise in inflation expectations. Consumers dialed up their estimates for price pressures over the next year and the next five years from 3.2% and 2.8% to 3.8% and 3.0%.

While it’s worth noting that this survey is notoriously sensitive to gasoline prices, consumer weakness is something we’ve been expecting. Just this week we published a commentary reflecting the worsening state of consumers amidst excess savings that are due to run out this month, the same month in which student loan repayments are due to resume. Indeed, higher prices, elevated financing costs and reduced credit availability are significant headwinds to consumer spending. While fiscal stimulus has been ramped up by the White House, industrial subsidies pale in comparison to the support households were getting through direct checks, enhanced unemployment benefits and the student loan holiday during the pandemic era.

Consumer Weakness Reverses Rally

Relief from softer bond yields is failing to offset equity investors’ concerns about weakening consumers. Stocks were up 0.7% prior to this morning’s report of declining consumer sentiment, but they are now mostly in the red. The only positive major index is the Dow Jones Industrial Average, which is up 0.1% while the Nasdaq Composite, Russell 2000 and S&P 500 indices are down 1.2%, 0.8% and 0.5%. Sectoral breadth has a defensive tilt, with risk-off utilities, consumer staples and health care higher by 0.1% to 0.9% alongside cyclical energy and financials which are up 1.9% and 0.6%, respectively. All other sectors are lower. Despite some sloppy auctions in the last few days, bonds are catching a bid, with yields on the 2- and 10-year Treasury maturities down 3 and 7 basis points (bps) to 5.05% and 4.63%. The dollar is also getting bought up, with global players seeking safe-havens during a time of global uncertainty. The Dollar Index is higher by 16 bps to 106.75 as the greenback appreciates against the euro, pound sterling, yuan and Aussie dollar while it loses value relative to the franc, yuan and Canadian dollar. Crude oil is rallying as Washington issues sanctions on Moscow due to the nation violating the G7’s price lid of $60 a barrel. The price maximum was implemented to provide the globe with sufficient energy supplies while limiting Moscow’s revenue capabilities. A similar action is expected to be issued against Tehran for its role in supporting Hamas’ attack on Israel. WTI crude oil is up 3.77% or $3.15 to $86.62 per barrel on the news.

Big Banks Benefit from Higher Interest Rates

The following three large banks posted better-than-expected third-quarter results but also reported a concerning uptick in loan defaults and higher consumer debt levels.

- JPMorgan generated $13.5 billion in income, exceeding the $9.74 billion from the year-ago quarter. At $4.33 a share, its income exceeded the analyst consensus expectation of $3.95. Its revenue jumped to $39.87 billion, up 22% year-over-year (y/y), exceeding the consensus expectation of $39.63 billion. The bank’s net interest income, which is the difference in what it earns on loans and what it pays as interest on deposits, climbed 30% y/y to $22.73 billion. Net interest income may be challenged going forward because the bank has had to increase its deposit rates to attract customers.

- Citibank profit reached $3.55 billion, or $1.63 per share, a 2% y/y increase and substantially above the expectation of $1.23 per share. The bank’s revenue hit $20.14 billion, up 9% and beating the analyst expectation of $19.27 billion. Revenues grew broadly across the bank’s business units.

- Wells Fargo generated $5.77 billion in earnings, up from $3.59 billion y/y, a 61% increase. In the year-ago quarter, Wells Fargo took a $2 billion regulatory charge. For the most recent quarter, the bank’s $1.48 earnings per share (EPS) beat the expectation of $1.24. Its revenue of $20.86 climbed 7% y/y and beat the expectation of $20.09 billion. Rising interest rates helped boost the bank’s net interest income 8% from $13.11 billion y/y. The bank also increased its full-year guidance for net interest income growth from 14% to 16%.

Loan Losses and Consumer Debt Increase

Meanwhile, auto loan delinquencies rose, hitting approximately 1.1% at JPMorgan Chase and 2.6% at Wells Fargo, exceeding levels experienced in 2019. As auto loans underperformed, consumers piled on more debt, with the following banks reporting the noted increases in credit card spending: Wells Fargo, 14%; JPMorgan, 16%; and Citigroup, 11%. Consumers are also carrying over larger credit-card debt levels each month.

Also during the third quarter, Wells Fargo added $333 million to its existing $949 million allocation for covering loan losses. The increase was needed, in large part, to cover losses on debt tied to office buildings and credit cards. JPMorgan, while noting an increase in bad loans during the third quarter, signaled that it may have been optimistic about debt obligations going forward when it eliminated its allocation to cover bad loans.

UAW Refrains from Expanding Strike

After extending its current strikes against the Big Three automotive companies to Ford’s Louisville, Kentucky truck plant Wednesday night, UAW president Shawn Fain this morning said the union has no immediate plans to further escalate its actions. In his presentation, he responded to Ford’s claim that the union’s decisions to have 8,700 worker members walk off the job at the Louisville facility was a surprise, saying Ford failed to improve its latest contract offer.

Hamas-Israel War Creates Energy Angst

The Hamas-Israel conflict continues to escalate as Israel is urging approximately 1 million occupants of the northern portion of the Gaza strip to flee the region in anticipation of increasing hostilities in the area. Electricity, water, food and fuel are currently unavailable or in very short supply in the Gaza region. Observers are watching carefully to see if the conflict expands to neighboring countries while Iran’s foreign minister has warned that the hostilities could open new fronts in the war, including drawing the resistance movement into the feud. The movement, which opposes the state of Israel, includes Hezbollah and armed groups in Syria, Iraq, and Yemen. In the meantime, the International Energy Agency says the conflict poses no immediate physical risk to oil markets, but says oil traders are understandably nervous about the possibility of the war escalating and hindering energy production.

Never Mind Gridlock: Congress is Paralyzed

House Republicans faced another setback in seeking to elect a house speaker after Majority Leader Steve Scalise withdrew from the race after facing hardened opposition from the party’s conservative members. It’s unclear if the Republicans can secure 217 votes needed to secure a house speaker, with the conservative faction opposing moderate candidates and Democrats opposing everyone in the GOP. The paralysis is increasing fears that the House will continue to be in disarray into the near future and therefore fail to negotiate a budget, which could lead to an extended government shutdown.

Spending on Services Likely to Weaken in Coming Quarters

With third quarter economic growth expected to come in super strong, the outlook for future quarters is of the essence. With the consumer spending fuel tank running on E heading into next month, GDP growth in future quarters is likely to slow. Throughout this year, we’ve seen folks spend the bulk of their incomes on services while goods ordering has been anemic. Next year, high rates are likely to keep the pressure on goods spending while consumers will be compelled to trim their services spending. Combing through earnings reports and company outlooks will be a significant consideration against this backdrop.

Visit Traders’ Academy to Learn More About Economic Indicators.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.