Like it or not, the world is confronting a new age of warfare, marked by escalating conflicts…

NATO, the North Atlantic Treaty Organization, commemorated its 75th anniversary last week, at a time when the 32-member alliance finds itself in an increasingly precarious position. Polish Prime Minister Donald Tusk’s warning that Europe has entered a “pre-war era” underscores the geopolitical challenges going forward and the need to shore up defenses.

Like it or not, the world is confronting a new age of warfare, marked by escalating conflicts (including those involving non-state actors like Hamas and the Houthis), China’s growing influence and the rapid advancement of artificial intelligence (AI) in military applications. Russia’s ongoing invasion of Ukraine has heightened concerns about spillover violence, raising questions about NATO’s long-term military support for Kyiv.

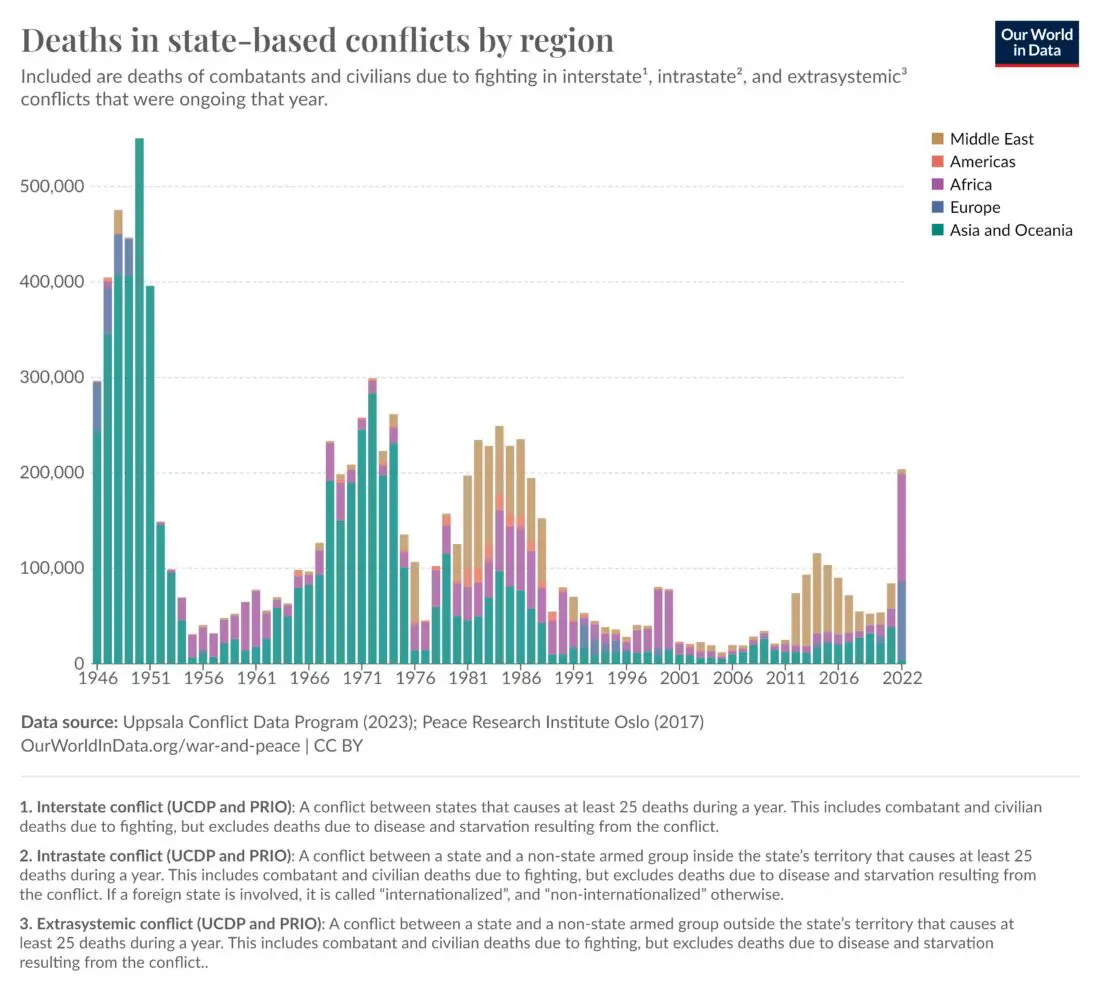

Since the alliance’s founding in 1949, the absolute number of armed conflicts globally, as well as the number of war-related deaths, has significantly declined.

But in more recent years, for reasons that will be historians’ job to unpack, hostilities have escalated. Data provided by Our World in Data shows that the total number of armed conflicts across the globe was higher in 2022 than in any year going back to 1989.

This alarming rise in violence has led to a significant surge in defense spending among NATO allies, with as many as 18 member nations expected to allocate at least 2% of their GDP to defense this year, up from just three countries in 2014, according to the group.

Europe Doubling Its Military Imports As Tensions Mount

The changing nature of warfare goes beyond conventional nation-state conflicts, with non-state actors increasingly involved in armed conflicts. The rapid development of AI and machine learning—used in autonomous weapons such as Ukraine’s Saker Scout drone—is also raising concerns about their potential use in cyber, physical and biological attacks.

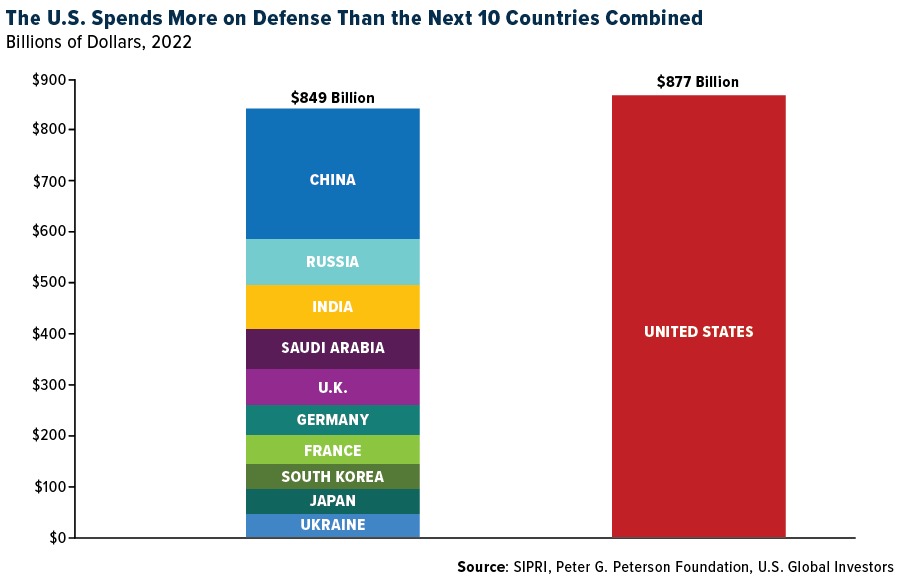

SIPRI, or the Stockholm International Peace Research Institute, reports that European states have nearly doubled their imports of major arms between 2019 and 2023, but the surge is not limited to Europe. The U.S.—which already outspends the next 10 countries combined on national defense—is closely monitoring China’s military modernization efforts. Beijing plans to boost its defense budget by 7.2% this year, focusing on developing advanced technologies such as hypersonic missiles and AI.

A Diverse Investment Landscape With Concentrated Opportunities

For investors, rising defense spending presents a compelling opportunity. In the U.S., over half of the Department of Defense (DoD) spending goes to military contractors, with the total contract spending amounting to approximately $400 billion in 2021, the most recent year of data. While this sum is distributed among thousands of contractors and subcontractors throughout the country, the “Big 5” firms—Lockheed Martin, Boeing, RTX (formerly named Raytheon), General Dynamics and Northrop Grumman—received nearly 30% of all DoD contract dollars.

Meanwhile, the list of U.S. defense industry’s AI suppliers is relatively diverse, with 300 contracts distributed among 249 unique vendors in a recent dataset. Of those, only 36 vendors were awarded multiple contracts, and just eight won three or more contracts, including major players Lockheed Martin and Northrop Grumman, according to the Center for Security and Emerging Technology (CSET). This concentration of AI contracts among a few key players suggests that these companies are well-positioned to benefit from the growing demand for innovative military solutions.

A Positive Forecast For Defense Stocks

Investing in defense stocks, like other areas, carries risks. The sector is heavily influenced by government policies, geopolitical events and public sentiment. Changes in political leadership, shifts in foreign policy and fluctuations in public support for military interventions can all impact the performance of defense stocks. The industry is subject to strict regulations and oversight, which can affect companies’ ability to secure contracts or export their products.

Despite these risks, I believe the long-term outlook for defense stocks is positive. As nations worldwide increase their military spending, companies at the forefront of defense technology and innovation are likely to benefit. The U.S. defense industry, with its strong presence in the global arms trade and its cutting-edge AI capabilities, is particularly well-positioned.

NATO has its detractors, but its role in maintaining stability has never been more vital. For astute investors, this presents a unique opportunity to capitalize on the growing demand for innovative defense technologies, particularly from major U.S. contractors.

—

Originally Posted April 8, 2024 – NATO At 75: The New Age Of Warfare And Rising Defense Spending

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2023): The Boeing Co., General Dynamics Corp.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.