Week in Review

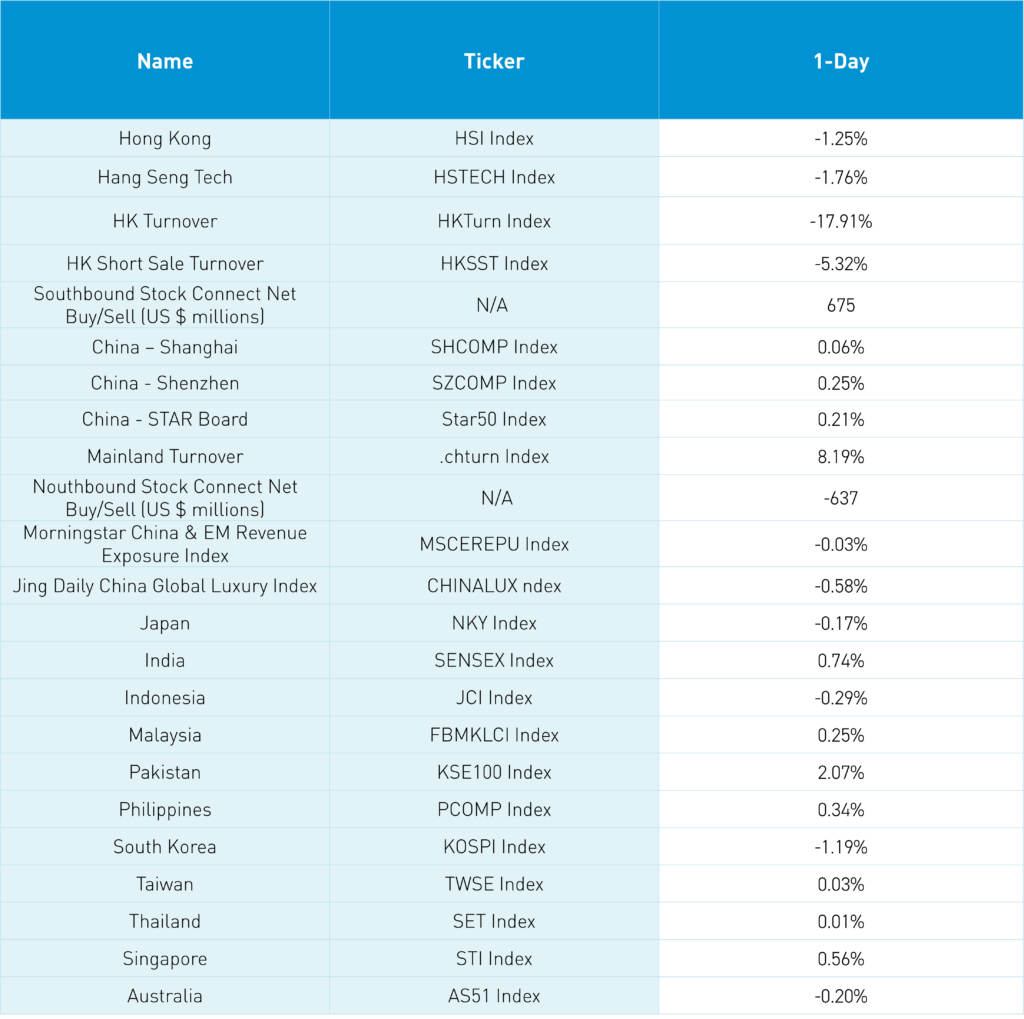

- Asian equities were mostly lower for the week with South and Southeast Asia outperforming Northeast Asia as India and Pakistan were the top-performing markets.

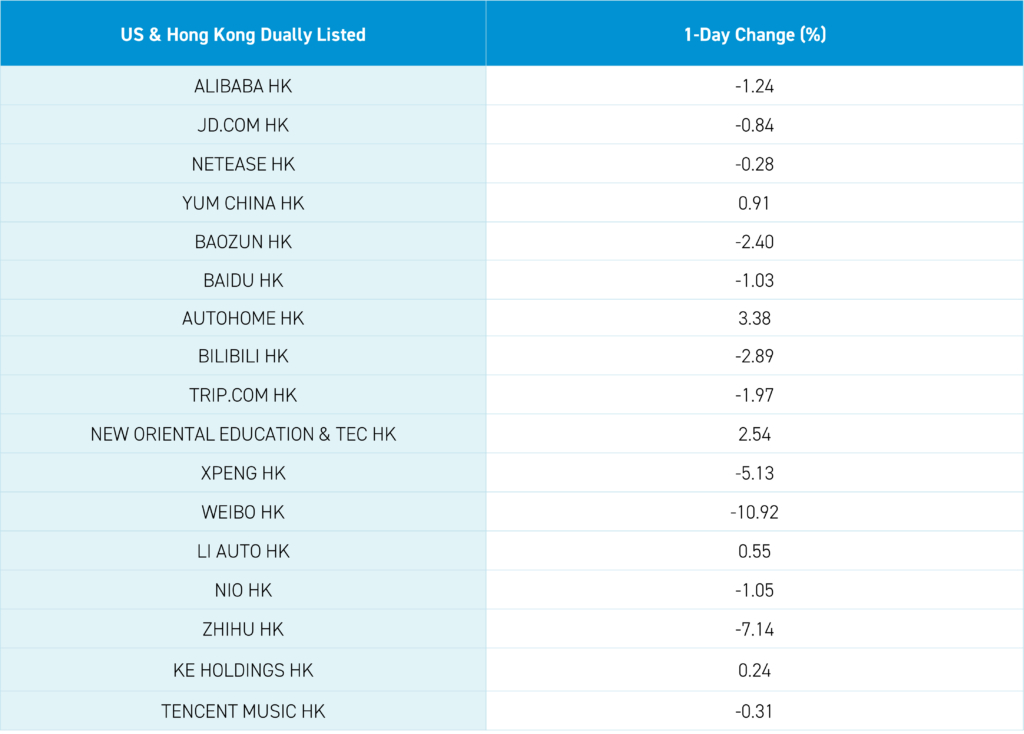

- Internet earnings releases for Q3 this week included Pinduoduo, a strong beat on top and bottom line, Meituan, which was mostly in line with estimates, and Bilibili, which reported net income below estimates.

- President Xi traveled to Shanghai this week, where he met with multiple technology companies and visited an affordable housing complex.

- The PCAOB announced that it will be able to complete audit reviews for all auditors of US-listed Chinese companies, fining some for employees cheating on training exams.

Key News

Asian equities were mixed but mostly lower overnight as Mainland China outperformed Hong Kong.

The Caixin Manufacturing Purchasing Managers’ Index (PMI) for November came in at a higher-than-expected 50.7, indicating an expansion in activity. Consensus estimates had been for a slight contraction at 49.8. This is in contrast with the US’ ISM Manufacturing PMI , which came in at a low 46.7 in November. PMIs are diffusion indexes with readings above 50 indicating expansion and readings below 50 indicating contraction. Positives surprises for China’s economic data continue, though markets appear to have ignored this one.

The US Public Company Accounting Oversight Board (PCAOB) fined PWC Hong Kong and PWC China yesterday for “violating PCAOB quality control standards related to integrity and personnel management.” Both companies agreed to pay the fines of $4 million and $3 million, respectively, and are “…required to review and improve their quality control policies and procedures to provide reasonable assurance that their personnel act with integrity in connection with internal training, and to report their compliance to the PCAOB within 150 days.” The PCAOB’s efforts to protect US investors are to be commended. It is important to note that he penalties and consequences were not due to the quality of the audits, but rather employees cheating on internal training courses. Yesterday’s release reinforces the question as to why the SEC has yet to remove the companies audited by PWC and KPMG from their list of companies identified as potentially violating the Holding Foreign Holdings Accountable Act (HFCAA). As stated in mid-December of 2022, the PCAOB has been granted complete access to auditor reviews. China’s authorities appear to have done all that has been asked of them. When will US authorities reciprocate and remove the delisting risk?

Macau gaming stocks were higher overnight despite a slight decline in activity in November. Real estate developers were lower. All sectors were lower in Hong Kong.

Half of yesterday’s large net inflow into Mainland stocks from foreign investors via Northbound Stock Connect was reversed overnight with net selling of over -$600 million in the mutual market access program.

Contemporary Amperex Technology (CATL), the world’s largest battery maker and Ford’s partner on electric vehicles, declined only -0.90% and the electric vehicle ecosystem was mixed. This is despite news that the Biden Administration will move to reduce the amount of subsidies available to automakers that use China-based battery technology suppliers. As of now, Ford is still going ahead with its new EV manufacturing plant that will use technology from CATL. Automakers are likely to choose whether to take full advantage of the subsidies while accepting the challenge of sourcing parts elsewhere or to ease their supply chain burden while foregoing some subsidies.

Electric vehicle makers Li Auto and Xpeng reported November vehicle deliveries increased by +172% and +245%, respectively.

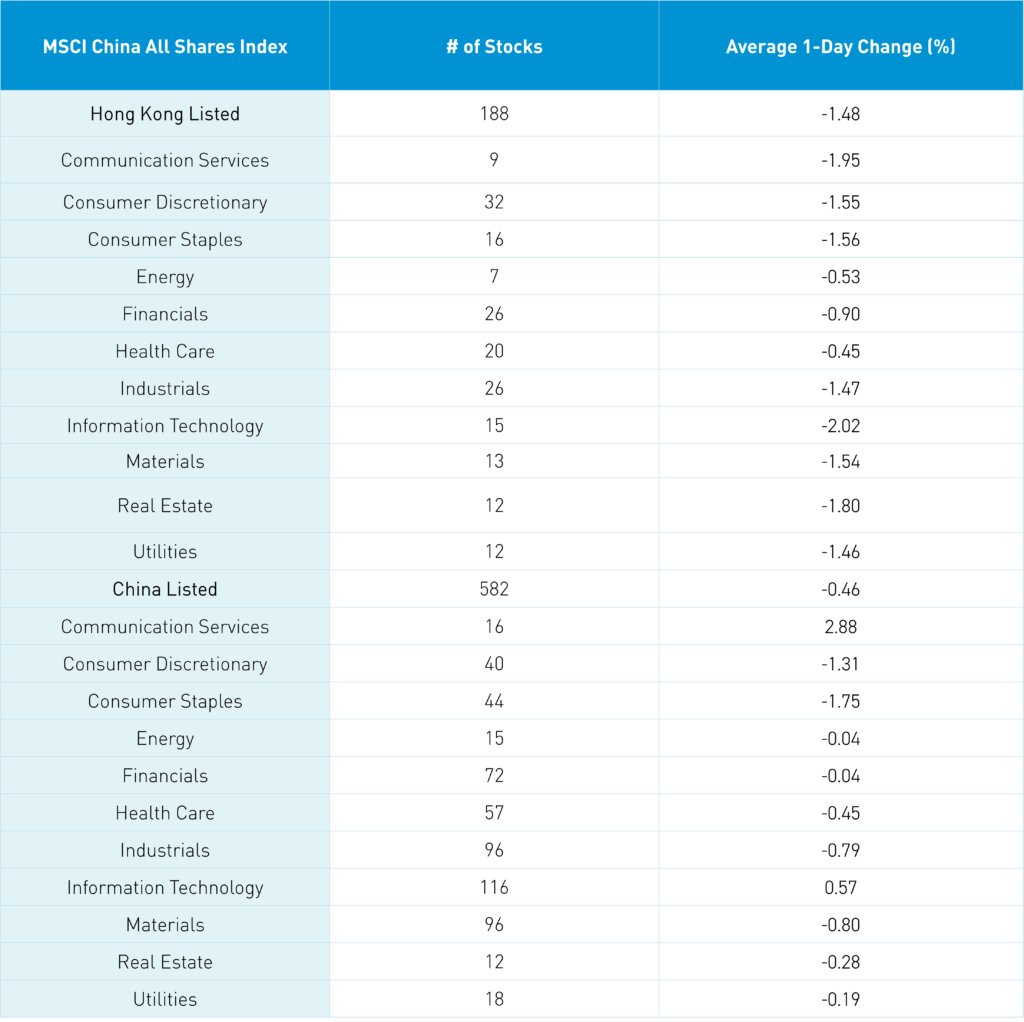

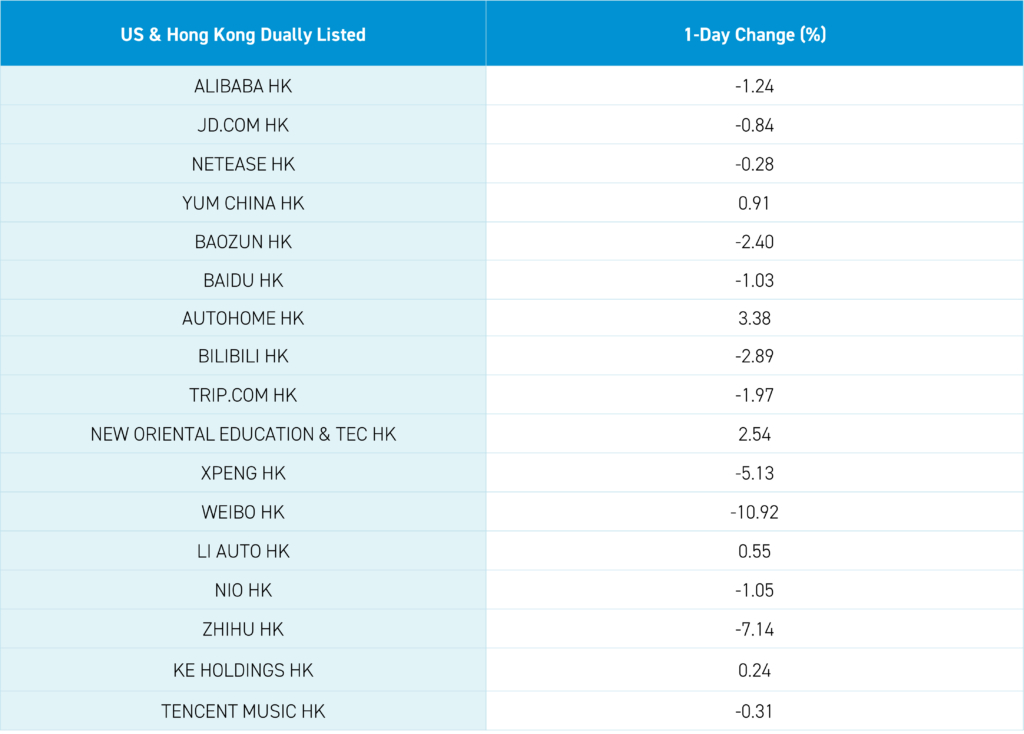

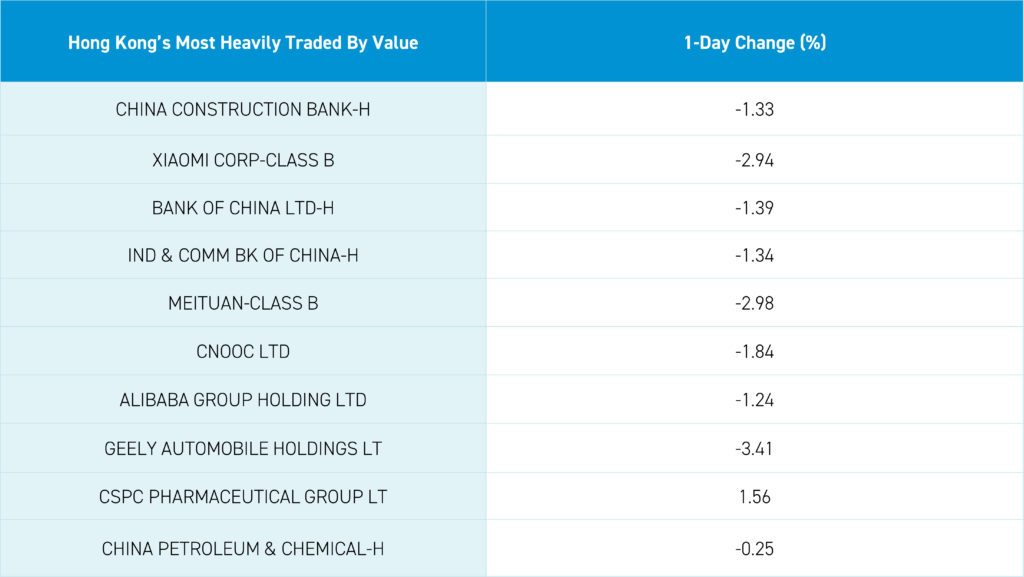

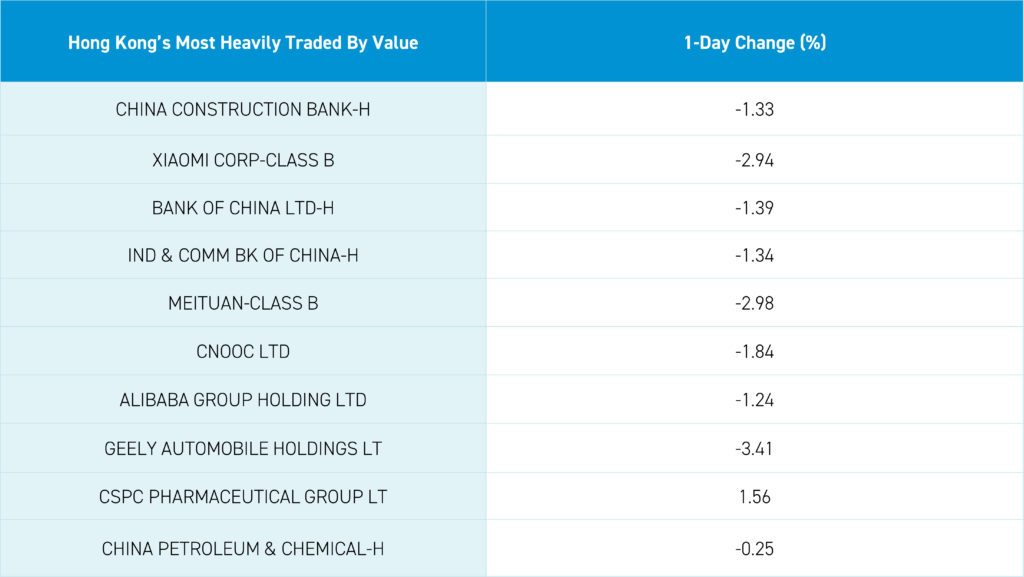

The Hang Seng and Hang Seng Tech indexes both closed lower by -1.25% and -1.76%, respectively, overnight on volume that declined -18% from yesterday. Mainland investors bought a net $675 million worth of Hong Kong stocks overnight via Southbound Stock Connect. The top-performing sectors overnight were Health Care, which fell -0.45%, Energy, which fell -0.53%, and Financials, which fell -0.90%. Meanwhile, the worst-performing sectors were Information Technology, which fell -2.02%, Communication Services, which fell -1.95%, and Real Estate, which fell -1.80%.

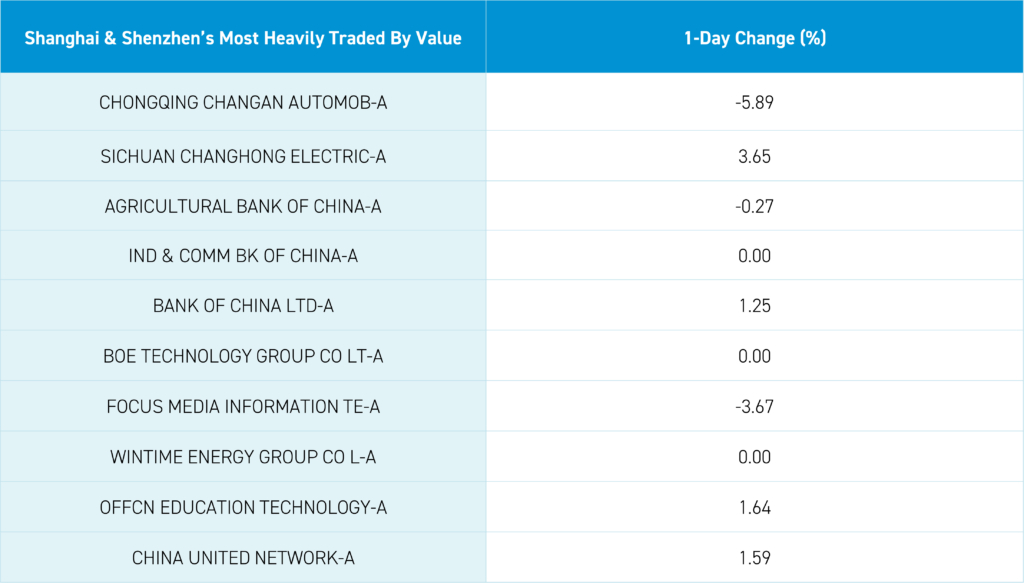

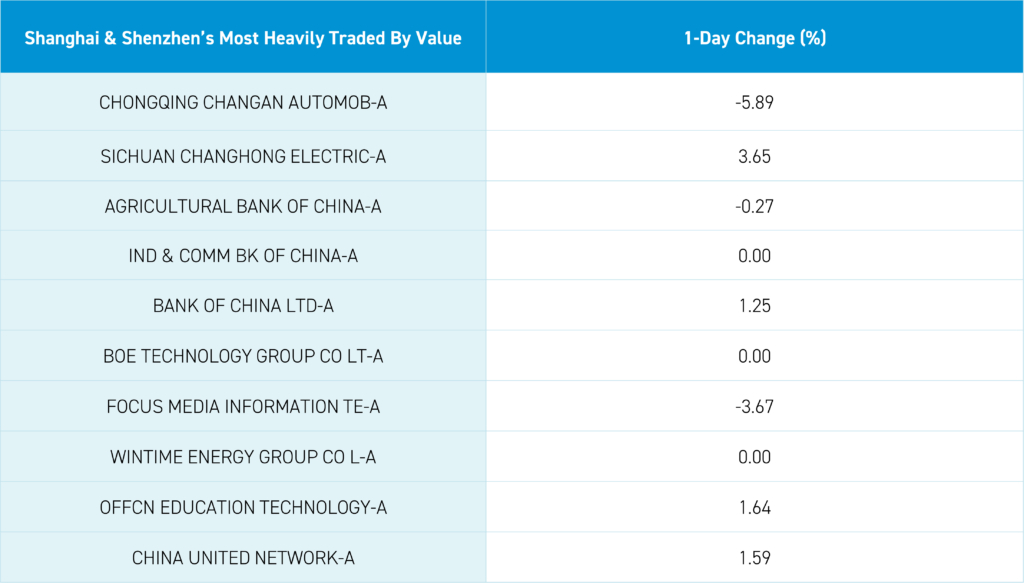

Shanghai, Shenzhen, and the STAR Board all closed slightly higher by +0.06%, +0.25%, and +0.21%, respectively, on volume that increased +8% from Friday. Foreign investors sold a net $637 worth of Mainland stocks overnight via Northbound Stock Connect. The top-performing sectors overnight were Communication Services, which gained +2.88%, Information Technology, which gained +0.57%, and Information technology, which gained +0.57%. Meanwhile, the worst-performing sectors were Consumer Staples, which fell -1.75%, Consumer Discretionary, which fell -1.31%, and Materials, which fell -0.80%. Government bonds were slightly higher, copper gained, and steel fell.

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.14 versus 7.14 yesterday

- CNY per EUR 7.75 versus 7.77 yesterday

- Yield on 1-Day Government Bond 1.38% versus 1.60% yesterday

- Yield on 10-Year Government Bond 2.66% versus 2.67% yesterday

- Yield on 10-Year China Development Bank Bond 2.77% versus 2.77% yesterday

- Copper Price +0.69% overnight

- Steel Price -0.13% overnight

—

Originally Posted December 1, 2023 – November Manufacturing PMI Higher Than Expected, Week in Review

Author Positions as of 12/1/23 are KLIP, KBA, KALL, KCNY, KFYP, KCNY, KEMQ, BZUN, HSBC, KWEB, KHYB, LI US

Charts Source: KraneShares

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.