Key takeaways

Markets don’t care about elections

Presidential elections haven’t historically affected markets or the economy, despite who or which party wins.

Stay fully invested

Staying invested during Democratic and Republican administrations did better than investing only during single-party rule.

Policy over politics

Monetary policy has had a greater market impact. Presidents historically were either helped or hurt by Federal Reserve actions.

The 2024 presidential election is less than a year away. As a market strategist, I’m often asked what it may mean for financial markets if a Republican or Democrat is elected. My answer is, “People care about elections. Markets don’t.” Historically, who’s president and which party is in power hasn’t impacted market performance, the economy, or the government. Here’s why.

Markets have performed well under both parties

Neither party can claim superior economic or market performance. The stock market posted positive returns across most administrations, with the rare exceptions of presidencies that ended in deep recessions. The S&P® 500 Index has delivered an average annual return of approximately 10% since it started in 1957 through both Democratic and Republican administrations.1 The US economy also expanded around 3% during that period.2

The stock market’s return was negative for a presidential administration only when the country was in a financial crisis (2008) or experiencing a stagflationary spiral (1973).3

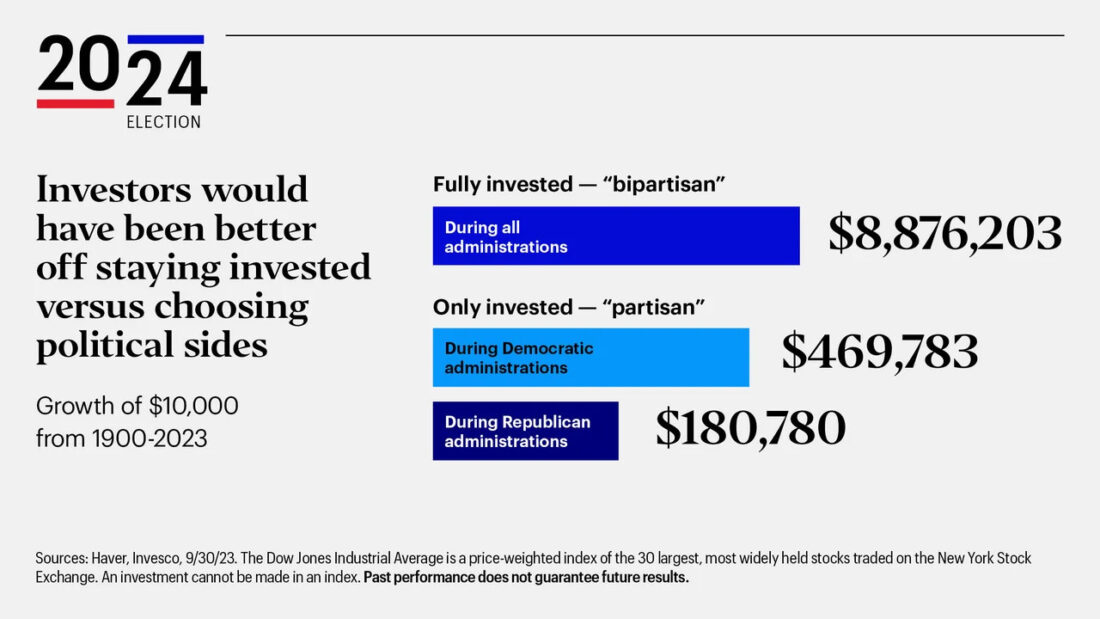

Investors would’ve been better off staying invested

Hypothetically, the best-performing portfolio during the past 123 years was the “bipartisan” one that stayed fully invested during both Democratic and Republican administrations. A “partisan” portfolio, only invested during single-party rule, underperformed by millions of dollars. (See graphic below.) The different results are, in part, because of the US stock market’s consistent rise even during two world wars and major financial crises (the Great Depression and the 2008-2009 Global Financial Crisis). The more time investors spent participating in markets, the better their investments did.

US economy isn’t radically re-engineered

Investors are often concerned that elected officials will radically re-engineer the economy. In fact, the composition of the US economy has been consistent for decades. Even single-party rule periods didn’t result in significant change. The percentage of “substantive” bills by Congressional term hasn’t increased when one party controlled the executive and legislative branches.4

Neither party can claim fiscal responsibility

Federal spending has outpaced taxes and other sources of government revenue in most years and across most administrations.5 No party can claim fiscal responsibility. It hasn’t been a significant issue for a variety of reasons, including the US having the world’s largest reserve currency and nominal economic growth outpacing the interest expense as a percent of gross domestic product (GDP). Currently, interest outlays as a percent of GDP are below 2%, a low bar for growth to surpass.5

Monetary policy matters more

For all the focus on the executive branch, I’d argue that it’s monetary policy that matters more. The old adage holds true: Don’t fight the Fed. Historically, presidents have been hurt or helped by monetary policy conditions. For instance, both Presidents Reagan and Clinton benefited from consistently falling interest rates. Both Presidents George H.W. Bush and George W. Bush were hurt by Fed tightening, an inverted yield curve, and a recession. President Obama benefitted from a benign rate environment (minus a brief moment in 2015-2016) during his term, and President Trump was the unfortunate recipient of tighter policy during his first two years.6

Markets don’t care if you don’t like who’s president

Investors don’t have to love what is going on in Washington, DC, to prosper in the markets. In fact, the S&P 500 historically performed the best when the president’s approval rating was in the low range — between 35 and 50. 7 That means the market had delivered some of its best returns during periods when half or more of the country didn’t approve of the job the current administration was doing! Still, it’s hard to discern any direct relationship between a president’s popularity, the health of the US economy, and the performance of financial markets.

Investment opportunities continue despite who’s president

Investors should be less interested in politics and more interested in private-sector business leaders who are going to harness artificial intelligence and robotics. They may be able to help cure debilitating diseases, evolve the nation’s energy sources, and develop new technologies and industries that aren’t even on the radar. History suggests that innovations — and investment opportunities — will continue irrespective of who wins a presidential election. For instance, since the 2008 election, many innovations were introduced during the tenure of both Democratic and Republican presidents. (See graphic below.)

Innovations since the 2008 election

For illustrative purposes only.

—

Originally Posted December 5, 2023 –

People care about elections. Markets don’t. by Invesco US

Footnotes

- Sources: Bloomberg L.P., 11/22/23. Stock market performance is defined by the S&P 500 Index total return from 3/4/1957 to 11/22/23. The S&P 500® Index is a market-capitalization-weighted index of the 500 largest domestic US stocks. An investment cannot be made in an index. Past performance does not guarantee future results.

- Sources: Haver, Invesco, 9/30/23. Real GDP data is from 12/31/2016‒6/30/2023 because GDP is reported with a lag. Gross domestic product (GDP) is a broad indicator of a region’s economic activity, measuring the monetary value of all the finished goods and services produced in that region over a specified period of time.

- Source: Bloomberg L.P., 11/22/23. Financial crisis was George W. Bush presidential term from 1/19/2001-1/20/2009. Stagflationary crisis was Richard Nixon presidential term from 1/20/1969-08/08/1974.

- Sources: US Bureau of Economic Analysis, 9/30/23 and PEW Research Center, 6/30/23. Substantive bills are defined by PEW as those that have some real-world impact, such as spending bills and setting policy, as opposed to ceremonial bills, which are intended to recognize an individual, group, or cause.

- Source: US Department of Treasury, 6/30/23. Gross domestic product (GDP) is a broad indicator of a region’s economic activity, measuring the monetary value of all the finished goods and services produced in that region over a specified period of time.

- Sources: Goldman Sachs, Bloomberg L.P., 9/30/23.

- Sources: Bloomberg, L.P. and Gallup, 9/30/23. S&P 500 market returns from 1/1/1961 – 9/30/23. An investment cannot be made in an index. Past performance does not guarantee future results

Disclosure: Invesco US

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial advisor/financial consultant before making any investment decisions. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

All data provided by Invesco unless otherwise noted.

Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s Retail Products and Collective Trust Funds. Institutional Separate Accounts and Separately Managed Accounts are offered by affiliated investment advisers, which provide investment advisory services and do not sell securities. These firms, like Invesco Distributors, Inc., are indirect, wholly owned subsidiaries of Invesco Ltd.

©2024 Invesco Ltd. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Invesco US and is being posted with its permission. The views expressed in this material are solely those of the author and/or Invesco US and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.