Federal Reserve Chairman Jerome Powell’s recent statements regarding the potential need for the central bank to take more aggressive actions to hamper inflation have been reinforced with stronger-than-expected labor market data from both ADP and JOLTS this morning.

In Congressional testimonies yesterday and today, Powell implied that the Fed may raise rates faster than previously anticipated due to stronger-than-expected economic data. He cited robust hiring, consumer spending, and factory data that illustrate sustained inflationary pressures. Data releases in the next two weeks, such as the Jobs Report, Consumer Price Index, the Producer Price Index, and retail sales, may further reinforce the case for the Fed to raise the fed funds rate by 50 basis points (bps) at its March 22 meeting. In fact, odds of a 50bp hike later this month have risen to 72% while terminal rate expectations jumped to 5.63% for October.

Following yesterday’s sell-off, markets have moved indecisively this morning during Chair Powell’s testimony, trading between gains and losses. Equity markets are up slightly with the S&P 500 and NASDAQ indices up 0.1% and 0.3%. The JOLTS report pulled equities to their daily lows but the dip was quickly bought. Yields have been more of a roller coaster, with the 2 and 10-year trading in a broad range of roughly 10 bps. At the moment, however, the 2-year is roughly unchanged at 5% while the 10-year is down 5 basis points to 3.93% on recession fears. Concerns of a global economic slowdown driven by a tighter fed and as a result a stronger dollar is also pulling down crude oil, its down 1.6% to $76.32 per barrel. The Dollar Index is down 10 bps to 105.50, taking a break from rallying to year-to-date highs yesterday.

Service Sector Jobs Creation Soars

ADP reported this morning that the economy added 242,000 private sector jobs in February, significantly exceeding both the estimate of 205,000 new jobs and the 119,000 jobs added in January. The report reinforces Powell’s comments that the labor market is extremely strong. Additionally, it illustrates that the leisure and hospitality industry, which added 83,000 jobs, or roughly one-third of the new positions during the month, is continuing to benefit from pent-up demand resulting from stay-at-home orders or other policies intended to slow the spread of Covid-19.

Indeed, while the fed is considering hiking the fed funds rate at a faster pace, more Americans are hiking mountains. Dick’s Sporting Goods this morning said same-store sales for its quarter ended January 28 increased 5.3%, more than double analysts’ estimates of 2.1%. Its total revenue of $3.60 billion sailed past the $3.45 billion expected by analysts. Sales of footwear, athletic wear and team sports products were particularly strong. Dick’s CEO Lauren Hobart maintains that consumers are prioritizing fitness and increasingly view fitness products as necessities. As another example of consumers’ strong desires for activities, Dick’s is expanding its stores that offer rock climbing walls, golf putting greens and batting cages. The company has a cautious outlook with expectations of same-store sales growth to range from flat to up 2% during the current fiscal year.

Mixed Job Growth Continues

The ADP report also illustrates that large layoffs in financial services firms may be isolated events. While BlackRock is laying off 500 employees and BNY Mellon and Goldman Sachs are laying off 1,500 and 3,200 workers, respectively, the overall financial services sector added 62,000 jobs last month.

In another disinflation headwind, job creation was also surprisingly strong in manufacturing, which produced a significant 43,000 jobs in February. Today’s data is at odds with ISM, which signaled softer manufacturing employment and weak demand earlier this month. Friday’s Jobs Report will provide further color on manufacturing employment.

Small businesses are continuing to feel the pain of higher financing costs and rising compensation expenses, they’ve shed jobs for six consecutive months. Weakness was also prevalent in the highly compensated professional and business services sector, which lost 36,000 jobs. The recession in real estate has begun to negatively impact construction employment as well, the sector lost 16,000 jobs last month. Falling home prices, sharply higher mortgage rates and the decline in construction activity are lasting headwinds that are unlikely to reverse anytime soon.

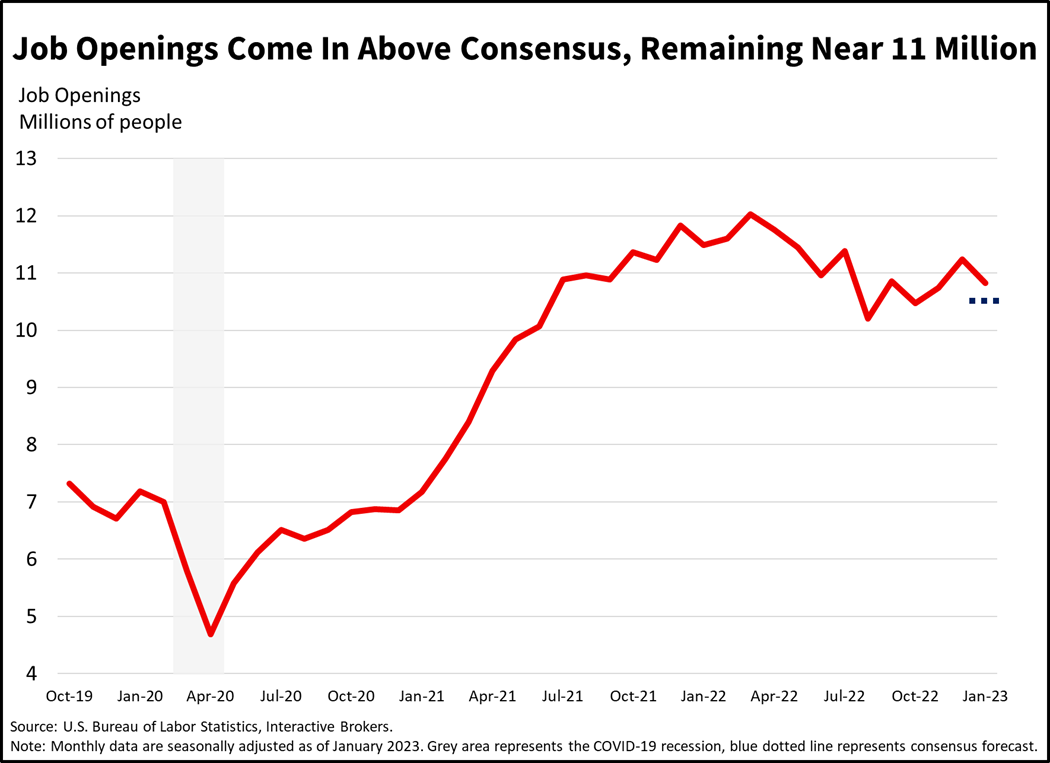

JOLTs Report Further Jolts Investors

Overall job openings remained elevated with some weakness beneath the surface. The rate of job separations or quits fell, possibly leading to an environment of slower wage growth ahead as workers become increasingly risk averse in terms of changing jobs.

Also this morning, the Bureau of Labor Statistics reported that U.S. job openings declined from 11.23 million in December to 10.8 million in January. Even with the decline, the January figure exceeded the 10.5 million available positions expected by a consensus of analysts, according to Refinitiv. Overall job openings remained elevated with some weakness beneath the surface. The rate of job separations or quits fell, possibly leading to an environment of slower wage growth ahead as workers become increasingly risk averse in terms of changing jobs. Openings fell the most in the construction sector, accommodation and food services and finance and insurance with declines of 240,000, 204,000 and 100,000. While part of the data shows some progress on the wage inflation front, the overall data still points to a Fed that has a significant amount of work to do before it cools down the economy.

It’s Soup Time

Busy workers are increasingly seeking the convenience of prepared foods and are willing to pay higher prices for heat-and-eat products, salty snacks, and sweets, with Campbell Soup reporting strong revenues. Sales for the company’s snacks division, which includes Goldfish crackers, Pepperidge Farm cookies, and Kettle Brand potato chips, rose by 12%, while sales for its meals and beverages unit, which includes soups, Swanson broth, and Prego pasta sauces, increased by 15%.

With 2023 featuring significantly higher costs of capital alongside high and persistent inflation, the next few economic data releases are key to the direction of the Fed and financial markets as a result. Softer data may lead to a pleasant surprise in March, as the Fed may decide to take it easy with a 25 bp hike. Our in-house inflation and employment models point the other way: we expect payrolls and CPI to surprise to the upside, albeit modestly. Such an event will likely weigh on financial assets, propel bond yields and generate downside momentum for consumer spending which is living on borrowed time and borrowed money.

Visit Traders’ Academy to Learn More about Payroll Employment, ISM Manufacturing and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)