Most of us are familiar with the phrase “history doesn’t repeat, but it often rhymes.” It is widely attributed to Mark Twain, though there is no actual evidence of him saying or writing it. In thinking about the equity market’s stellar performance as October comes to a close, I realized that there was a certain familiarity to it.

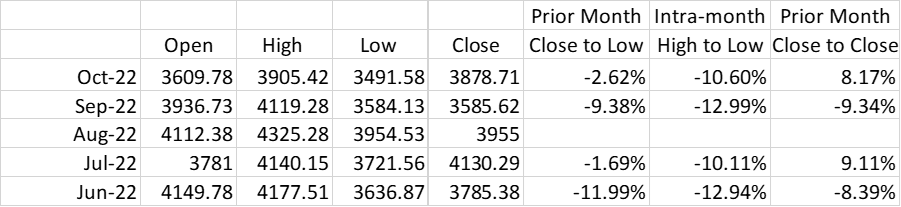

Compare the following periods:

S&P 500, Q2 End / Q3 Start, Q3 End / Q4 Start

Source: Interactive Brokers

The performances of the equity market, as measured by the S&P 500 Index (SPX), in the June-July and September-October periods are remarkably similar. Not only were the monthly falls and rises within one percent of each other, so are the monthly maximum high/low ranges.

This could of course be a coincidence, but I doubt it. Similar factors, economic and emotional, were in place as we ended one negative quarter and began another one with more optimism about earnings and Fed policy.

As we think back to late June and late September it appeared as though institutional managers were moving to lighten their exposures after negative quarters for both stocks and bonds. In June, equities bounced – and many thought they had bottomed[i] – after a positive reaction to the FOMC meeting on June 15th. Although stocks were bouncing, SPX was still down about 20% in the 2nd quarter, leading to cautious institutional positioning ahead of their quarterly reports.

Things were a bit different in the 3rd quarter. The June bounce continued through July earnings season and took another leg higher after the July 27th Fed meeting. The rally ended abruptly in mid-August after Chairman Powell’s terse speech at Jackson Hole squelched the idea of a Fed pivot, and SPX closed at new lows as the quarter ended. As the 3rd quarter ended, we had just seen the UK narrowly avert a meltdown in gilts. Once those worries subsided, there was an opportunity for the dollar to ease and for risk assets to rally.

In October, just as we saw in July, investors took a generally positive view towards corporate earnings. That sentiment propelled equities higher. Not all of them mind you, but enough to push up major indices by removing the direst fears about the effect of inflation and concerns about an undisclosed recession. Market psychology was quite glum as we approached each of the past two earnings seasons, which meant that decent results had a greater than normal potential to push stocks upward.

Now we find ourselves with a fresh set of challenges, one of them unique to the 4th quarter. We have an FOMC meeting on Wednesday. SPX rose 5.3% in the three-day period following the July 27th meeting but fell 4.2% in the three-day period after the September 20th meeting. With a seeming consensus that the Fed might signal a slowing rate cycle, if not a pause (now that a pivot is off the table), all eyes will be on the Fed’s messaging in the statement and the post-meeting press conference. We have payrolls data on Friday, which will of course be too late to impact the week’s FOMC meeting, but closely watched nonetheless. And of course the true outlier is the mid-term election that will be occurring a week from tomorrow. Considering the parlous recent state of polling, it is not clear what to expect from the races for the House and Senate.

It seems that market performance this month has certainly rhymed with that of the prior earnings season. I’ll end with another apocryphal quote, usually attributed tov Yankee great Yogi Berra: “It’s déjà vu all over again.”

Daily Chart Since March 1: SPX (blue/white), 10 Year Treasury Yield (red), US Dollar Index (green), with Vertical Lines at Quarter Ends

Source: Bloomberg

—

[i] We did not, writing on June 27th: “Yes, we’ve had a nice short-term bottom, but I highly doubt that we’ve seen THE bottom.”

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)