Escalating geopolitical tensions in the Middle East continue to threaten market stability but investors are breathing a sigh of relief as hostilities on Saturday turned out to be less severe than feared. Stocks are receiving support from positive earnings reports as well as a dip in oil prices that reflects an incremental reduction in regional agitation. The lack of demand for risk-off instruments since last Friday is weighing on bonds though, which are also getting creamed on the back of a much hotter-than-projected retail sales report this morning. The figures are sending yields to the nosebleeds while Fed rate cut expectations dive to the basement.

Another Month, Another Shopping Spree

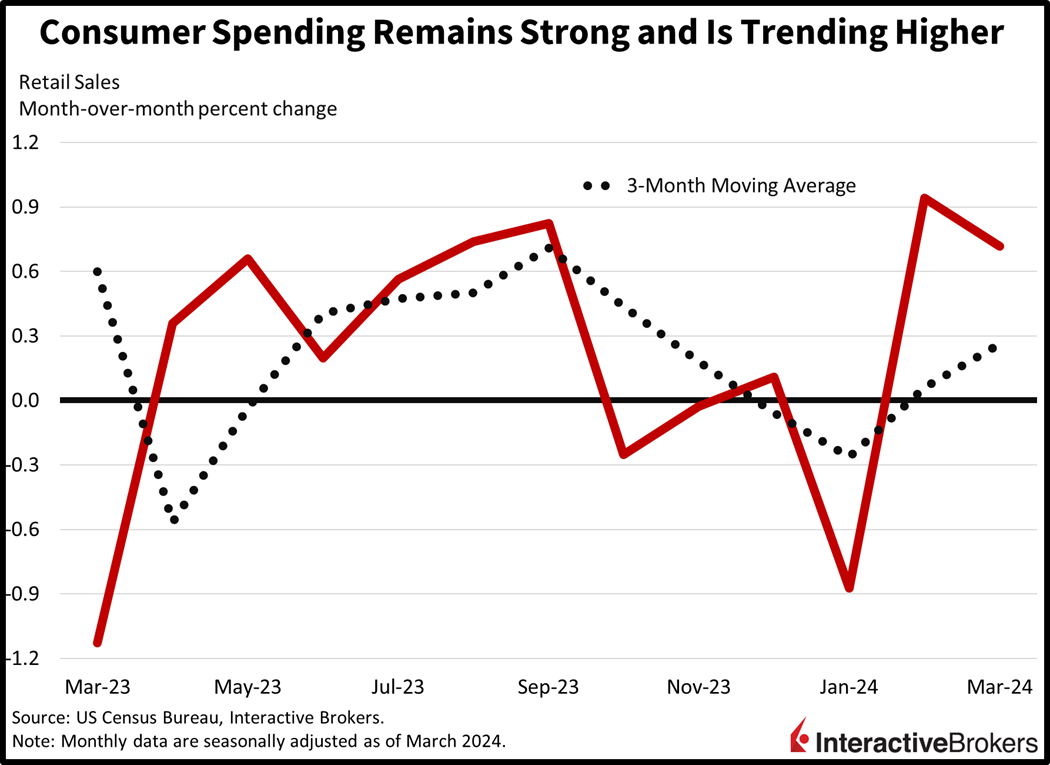

Economic growth shows no sign of slowing as households enjoyed shopping sprees last month. Higher asset prices, elevated job openings and persistent wage gains are indeed underpinning consumption, with March retail sales growing 0.7% month over month (m/m), well above estimates of 0.3% but slightly softer than February’s 0.9% increase. Leading transactions last month were e-commerce, up 2.7%, and gasoline stations, up 2.1%.

Other strong categories and their sales receipts included the following:

- Miscellaneous retailers, up 2.1%

- General merchandise store, up 1.1%

- Building materials suppliers, up 0.7%

Categories with smaller increases included supermarkets, up 0.5%, health and personal care shops, up 0.4%, and restaurants and bars, also up 0.4%.

Meanwhile, sporting goods establishments sales declined 1.8% while apparel store transactions contracted 1.6%. Dollar volumes at electronics and appliance retailers, automobile dealerships and furniture showrooms also dropped with decreases of 1.2%, 0.7% and 0.5% m/m.

Middle East Fears Ease Slightly

Fears of a potential escalation of hostilities in the Middle East spiked on Saturday when Iran launched a drone and missile attack against Israel. Today, however, many investors are viewing the conflict and the potential aftermath of the strike as not as bad as originally anticipated. While Tel-Aviv says roughly 99% of the approximately 300 drones and missiles were shot down by missile defenses, the development is significant because it is the first attack on Israel carried out directly by Tehran rather than through proxies in recent history. Secondly, Israel says the matter isn’t finished and is believed to be planning a counterattack, which could potentially lead toward the overall Middle East falling into a widespread conflict. President Joe Biden reacted to the event by telling Israel that he will not support an attack on Iran and the United Nations has urged Iran and Israel to use restraint to avoid sparking a full-scale conflict. On a positive note, some observers believe the event could motivate countries in the Middle East to work on peace accords.

Corporations Tap Capital Markets

Businesses increased their capital raising efforts during the first quarter, which provided a tailwind for Goldman Sachs. However, M&T Bank faced the brunt of higher interest rates and the ongoing commercial real estate debacle. The two firms provided the following first-quarter highlights:

- Goldman Sachs posted strong results that benefited from trading volumes of fixed-income and equities exceeding analysts’ expectations. Investment banking, after slowing down during the Fed’s tightening campaign, also increased, with volumes for both debt and equity issuances climbing. Optimism during the first quarter about a potential soft landing resulted in more businesses raising capital. Additionally, Goldman generated record-high levels of fees from its asset and wealth management services. The company’s first-quarter profit jumped 28% year over year (y/y).

- M&T Bank’s earnings were hit by a doubleheader of higher deposit costs and having to increase reserves for non-performing loans. Like many banks, especially regionals, M&T has increased the interest rates it pays depositors to prevent customers from shifting into higher yielding money markets. The higher rates caused the bank’s net interest margin, or the difference between what the bank pays depositors and what it collects on loans to narrow, resulting in income declining 8% y/y. The bank also increased reserves for non-performing commercial real estate loans by 66% with a glut of commercial real estate space causing turmoil. First quarter earnings declined y/y and missed the analyst consensus expectation while revenue was higher than anticipated.

Investors Focus on Yields and Economy

Markets are mixed as traders increasingly focus on loftier yields and hot economic data versus a slightly better geopolitical outlook. For stocks, all major US equity indices are higher except for the rate-sensitive, small-cap Russell 2000 Index; it’s down 0.4%. The Dow Jones Industrial, S&P 500 and Nasdaq Composite indices are well off this morning’s highs and are now trying to hold on to gains of 0.3%, 0.2% and 0.2%. Sectoral breadth is positive though with 7 out of 11 sectors in the green, led by healthcare, financials, materials and industrials; they’re up 0.7%, 0.6%, 0.5% and 0.4%. Real estate, utilities, technology and consumer discretionary are lower, however, with prices down by 0.6%, 0.2%, 0.1% and 0.1%. In the fixed-income universe, rates are jumping in bear-steepening fashion, with the 2- and 10-year Treasury maturities trading at 4.95% and 4.63%, 5 and 10 basis points (bps) higher on the session. Inflation expectations and much lighter Fed easing projections are also pushing up the dollar, with the greenback’s Index gaining 19 bps today as it trades at 106.21. The US currency is up against all of its major, developed market counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Oil is lower, meanwhile, on a reduced war premium with WTI crude declining 0.6%, or $0.52, to $84.88 per barrel.

A Mixed Inflation Outlook

At the beginning of this year, investors anticipated seven rate cuts prior to 2025, but consistently hot economic data has pushed that number down to a little over one. Higher oil prices resulting from the Middle East and Far East conflicts have contributed to higher-than-anticipated inflation figures this year, leading to traders dialing down their hopes for rate reductions while dumping Treasuries. Market participants are hoping that simmering Middle East tensions will continue to weigh on the cost of oil, a key input to many of the services and goods consumed globally. Lower oil prices may indeed pave the path forward for slower inflation readings in coming months while providing Wall Street with rate relief and perhaps a resumption of the equity market’s rally. Continued quarrels, however, will likely support the price of oil, and pose a severe challenge to the Fed’s disinflationary objective.

Visit Traders’ Academy to Learn More About Retail Sales and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.