A combination of disappointing tech earnings and fears that a decline in initial unemployment claims may keep the Federal Reserve hawkish is sending equity markets tumbling as bond yields climb. Tech earnings disappointed last night and this morning, as concerns about the future of demand within their goods and services weighed upon investor sentiment. Existing home sales and the Philly Fed’s Manufacturing Index released intraday confirmed the demand slowdown in their respective sectors, as higher rates and lofty prices hamper transaction volumes. The Conference Board’s Leading Economic Index further emphasized an economy-wide macro slowdown.

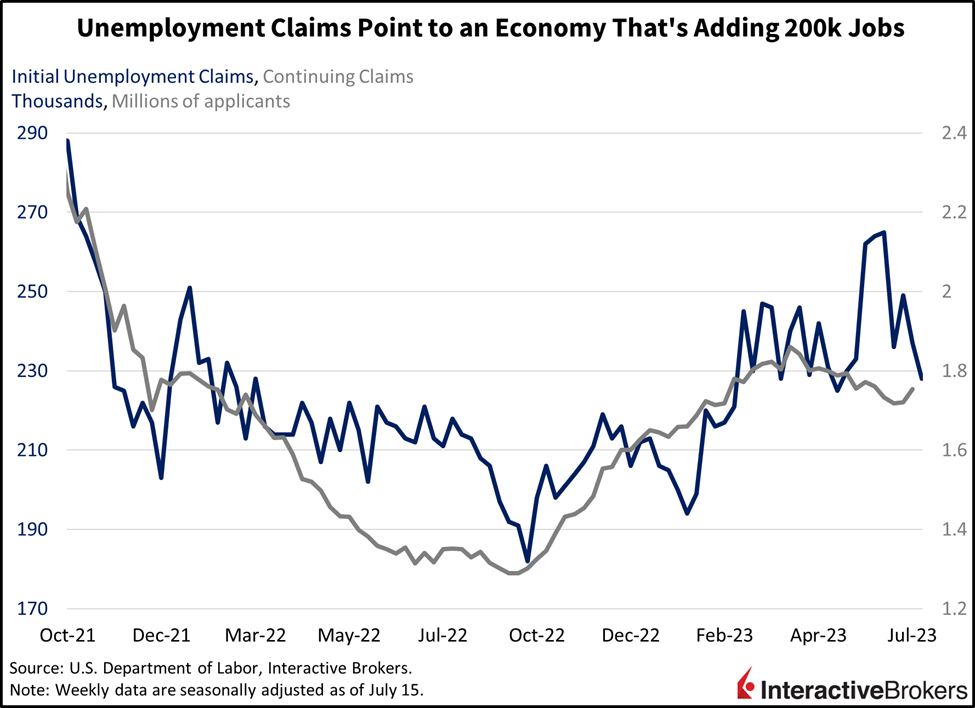

As companies issue weak earnings guidance, initial unemployment claims totaled 228,000 for the week ended July 15, hitting a low not seen since mid-May, fueling concerns that the Fed will keep rates high for an extended period, creating further challenges for corporate profitability. Last week’s claims came in much better than projections for 242,000 and declined from 237,000 claims in the prior period. Continuing unemployment claims for the week ended July 8 climbed to 1.754 million, higher than the 1.729 million expected and from the previous period’s 1.721 million. Still, both initial and continuing claims continue to point to a labor market that is adding jobs north of 200,000 per month, threatening a resurgence in inflation.

Also threatening to drive increased inflation from the commodity side is the recent rise in crude oil and wheat, with the supply outlook pushing up prices. Crude oil has benefited from OPEC+ supply discipline and falling inventories in the U.S. While crude oil has been volatile throughout the year, helping some inflation readings while hurting others, it’s now sitting roughly unchanged on a year-to-date basis while up a whopping 7.6% from the June average. Wheat prices have spiked meanwhile, as the Kremlin threatens ships heading for Ukrainian ports as potential military targets. Wheat prices are up 14.7% during the month but still down 8% from the year-to-date high.

Existing home sales continue losing momentum, meanwhile, with homeowners unwilling to sell their primary residences and trade off a low-rate mortgage for a high-rate one. Homeowner reluctance to incur significantly higher monthly payments led to only 4.16 million existing home sales on an annualized basis in June. June’s read missed the 4.2 million analyst estimate and was lower than May’s 4.3 million. The Philly Fed’s Manufacturing Index and the Conference Board’s Leading Economic Index for July also reflected contractions in excess of economist predictions, with the former coming in at -13.5 while the latter recorded -0.7% in comparison to June’s -13.7 and an unchanged rate of -0.7%. Economists were expecting -10 and 0.6%.

Tesla Is Open to More Price Cuts

CEO Elon Musk last night said the economic outlook has been changing dramatically almost daily, so he “doesn’t know what the hell is going on” and signaled that additional price cuts are an option.

In trading that may have been intensified by thrilling excitement, Tesla and Netflix share prices declined after disappointing outlooks from both companies last night. Investors were already weary about Tesla’s future gross profit margins due to the company aggressively cutting prices in response to a weakening economy and growing competition. CEO Elon Musk last night said the economic outlook has been changing dramatically almost daily, so he “doesn’t know what the hell is going on” and signaled that additional price cuts are an option. Tesla’s earnings per share (EPS) of $0.91 beat the analyst consensus expectation of $0.82, but the operating margin dropped to 9.6% due to costs of developing new batteries and price cuts. Netflix, which cracked down on password sharing and created a lower cost, advertising-supported offering after seeing a decline in subscribers last year, produced revenue of $8.19 billion, missing the consensus expectation of $8.30 billion and disappointing investors. Revenue climbed only 2.7% year-over-year (y/y). Netflix’s earnings of $3.29 EPS, however, beat the consensus expectation of $2.86 billion. It also added 5.9 million subscribers during the second quarter, compared to 2.1 million expected, but its average revenue per user declined, in part due to the timing of the company’s launch of lower priced options. Additionally, the company said it’s too soon to generate significant advertising revenues. Netflix’s third-quarter revenue guidance of $8.52 billion missed expectations of $8.67 billion and investors also questioned the impact of a writers’ strike upon the company. While consumers are still cutting back on buying goods, they are continuing to splurge on travel with strong ticket sales pushing United Airlines’ second-quarter adjusted EPS to $5.03 per share, above analysts’ expectations for $4.03. United Airlines yesterday also forecasted third-quarter y/y revenue growth of 10%-13% y/y and adjusted earnings of $3.85 to $4.35, substantially above the consensus of $3.70.

Tech Shares Plunge

Markets are tumbling this morning on fears that reports of a strong labor market alongside weaker earnings, will cause the Fed to remain hawkish and push the country into recession in the name of reaching 2% inflation. Corporate earnings reports are pointing to declining demand against the backdrop. All major U.S. indices are down except for the Dow Jones Industrial Average, which is up 0.8% and extending its winning streak to nine days, the longest since 2017. The Nasdaq Composite Index is leading the way lower this morning, its down 1.1% on lackluster tech earnings. Participation is mixed with all defensive sectors and some cyclical segments higher. Technology, communication services, homebuilders, consumer discretionary and real estate are lower on the session. Higher commodity prices and the persistently tight labor market are propping up inflation expectations, leading to yields higher across the curve and a stronger dollar is a result. Odds of another 25-basis point (bp) hike after July at the September or November meetings are also picking up steam, driving the Dollar Index up 58 bps to 100.86 while the 2- and 10-year Treasury maturities rise 11 bps each to 4.86% and 3.85%. The dollar is also gaining support from a possible ramp up in Chinese stimulus, the world’s largest energy importer. News of possible Chinese intervention is propelling WTI crude, which is up 0.2% to $75.50.

Earnings and Federal Reserve Take the Spotlight

Throughout the current inflationary cycle, investors have consistently bet that the Fed will be less hawkish than what has been implied by policymakers. Against that backdrop, corporations are struggling to generate earnings growth. In the coming weeks, investors will focus on new earnings reports that will be pivotal in shaping market direction. The Fed furthermore is widely expected to increase the fed funds rate 25 bps next week. As Fed Chairman Jerome Powell ascends to the mound, any hawkish comments he makes, including being supportive of a another rate hike after this month, may—or may not—drive market performance. Investors may simply continue to bet against the Fed, in which case earnings reports will be a strong driver of sentiment. If investors accept the potential for the Fed to remain hawkish and push the funds rate higher later this year, they must change their discounting models of corporate earnings, leading to more market volatility. Future earnings reports may also provide insight into the role of a prior equity market savior and justification for high valuations—the expectation that artificial intelligence will result in higher corporate profits. To date, that doesn’t appear to be the case.

Visit Traders’ Academy to Learn about Unemployment Claims and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.