Key News

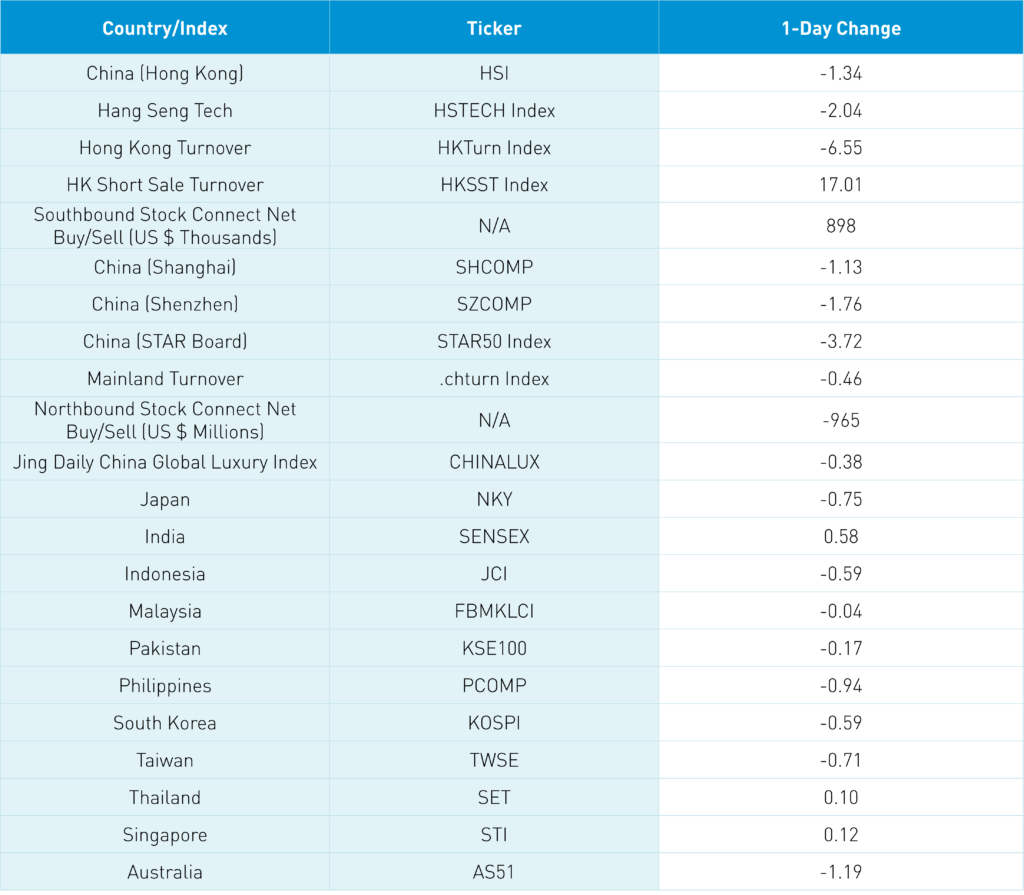

Asian equities were lower overnight, except for India and Thailand.

The Fed pause narrative is struggling as the US economy’s strength, and higher oil prices decrease the odds of a pause, sending the US 10-year Treasury yields higher. This also sent the dollar higher, which weighed on risk assets globally.

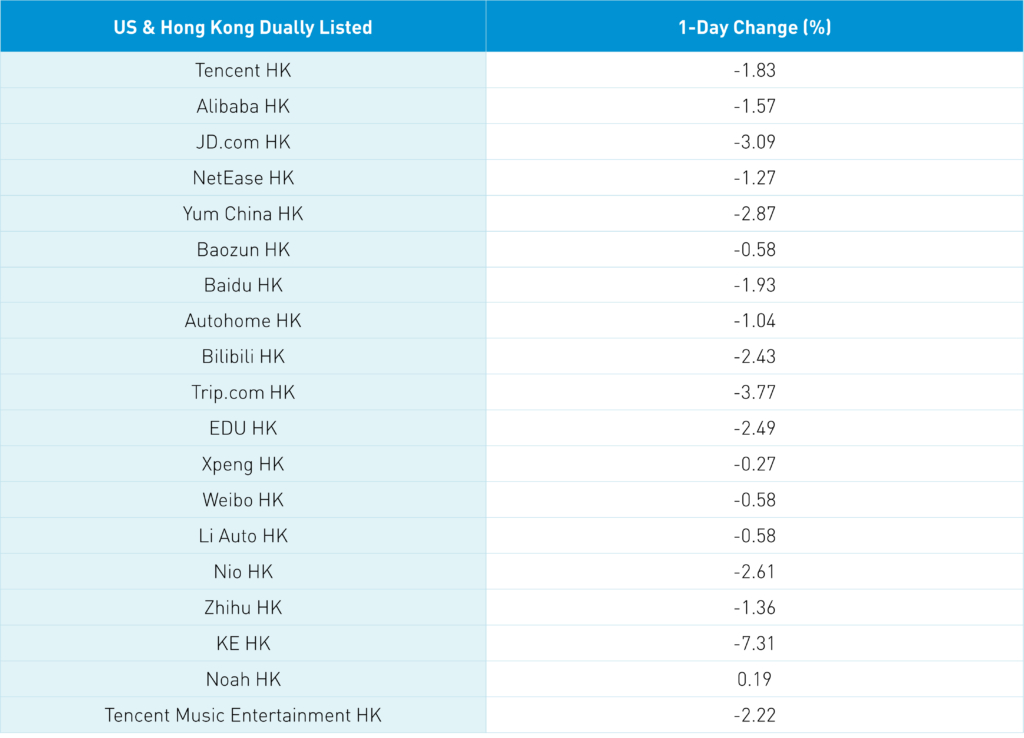

The common narrative that people will tell you on Apple comes from a Wall Street Journal article. “China ordered officials at central government agencies not to use Apple’s iPhones and other foreign-brand devices for work or bring them into the office, people familiar with the matter said.” The emphasis is my own addition. Did China’s government release a statement to that effect? No. I am unable to verify the story and no one inside China has confirmed it either. How many Chinese people are employed by Apple and its suppliers? Foxconn alone employs 200,000. Would putting them out of work make sense to you? Of course not.

Bloomberg News got in on the fun, stating that the ban would be extended to “government-backed agencies and state owned companies.” Bloomberg News’ source for the story was “people familiar with the matter.” Again, is a rumor worth $106 billion in market cap? The “news” whacked Apple’s supply chain across Asia, including Taiwan Semiconductor, which fell -2.47%, losing $12 billion in market cap.

Huawei’s successful new phone launch has folks in DC fired up, which was also blamed for the weakness in Asian stocks overnight. One needs to remember anyone in DC can say anything they want, though it doesn’t make it a law. This doesn’t seem to be widely understood in the US and is less understood outside the US. Due to its veto power, communication from the White House is essential. Alternatively, what if Apple is down because Huawei’s phone is a legitimate challenge to an iPhone?

China’s August trade data release beat expectations. Headlines referencing big declines are quoting the US dollar figures. In Renminbi, the numbers were down year-over-year (exports -3.2% and imports -1.6%) but down significantly less than July’s exports, which fell -9.2%, and imports, which fell -6.9%. The trade data in US dollars showed that exports declined -8.8% and imports declined -7.3%, though the US dollar’s strength/renminbi weakness over the last month -2.6%. While many commodity imports were down in percentage terms, exports of oil and steel were up in tons, similar to those of coal, oil, iron ore, copper, etc. There was very little single stock news as advance/decline breath was very weak, as foreign investors sold Mainland stocks via Northbound Stock Connect.

The Hong Kong government created a task force to study the Hong Kong market’s liquidity and “recommend solutions to the city’s leader as soon as possible.” Cutting the stamp tax is an obvious no-brainer as Hong Kong is a global outlier for its transaction tax, which leads to wider bid-ask spreads and disincentivizes trading. The elimination will not solve the market’s issues. An examination of Hong Kong’s very high short turnover would also benefit shareholders.

Today, 21% of Hong Kong’s Main Board, which is comprised of large caps stocks, was short turnover. From 12/31/2010 to 12/31/2021, Main Board turnover averaged 12%, with only two days (8/26/2019 and 5/29/2020) when short turnover was 20% or more. Since 12/31/2021, there have been 69 days of short turnover at 20% or more of total, with the average since 12/31/2021 at 17% of total turnover. If you want to solve a real issue, solve that one.

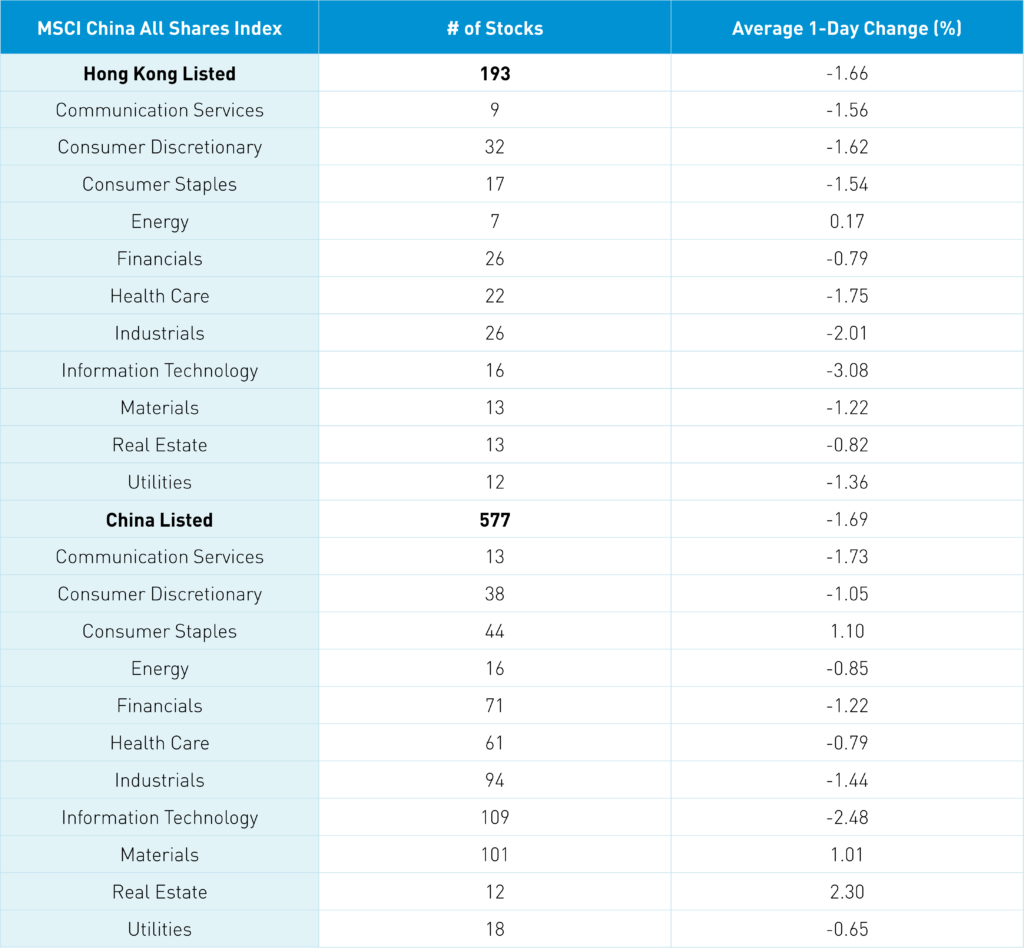

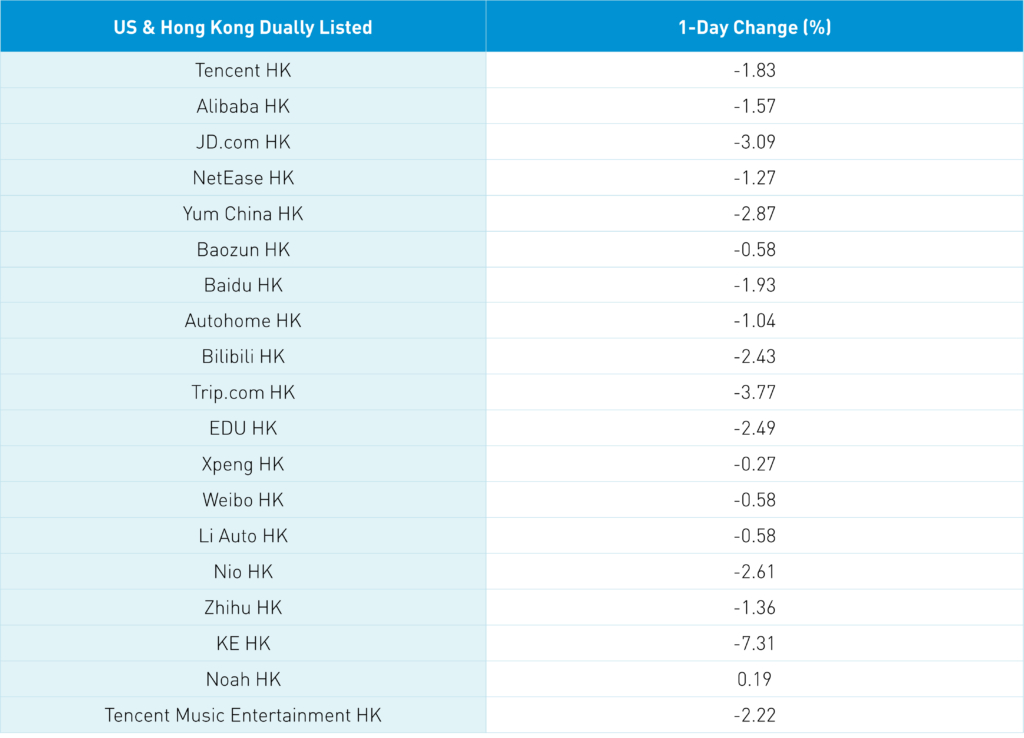

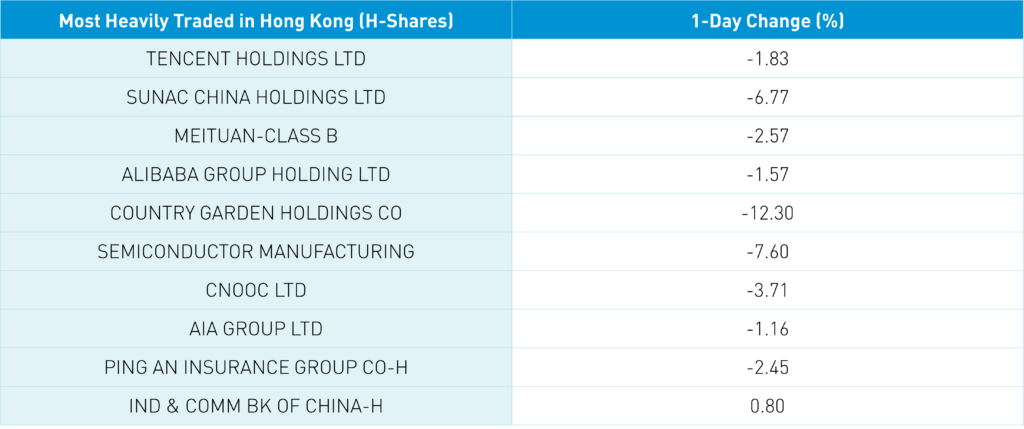

The Hang Seng and Hang Seng Tech fell -1.34% and -2.04%, respectively, on volume that decreased -6.56% from yesterday, which is 75% of the 1-year average. 94 stocks advanced, while 399 fell. Main Board short turnover increased +17.07% from yesterday, 96% of the 1-year average, as 21% of turnover was short turnover. The value factor “outperformed” the growth factor as large caps fell less than small caps. Energy and utilities were the only positive sectors +1.09% and 1%, while real estate -2.48%, materials -1.81%, and discretionary -1.73% were the worst performers. The top sub-sectors were energy, telecom services, and utilities, while semis, real estate, and food were the worst. Southbound Stock Connect volumes were moderate/high as Mainland investors bought a healthy $898mm of Hong Kong stocks and ETFs, with the Hang Seng Tracker seeing a very large net buy, CNOOC, ICBC, PetroChina, Sunac, SMIC and Country Garden all small net buys while Tencent and Meituan were small net sells.

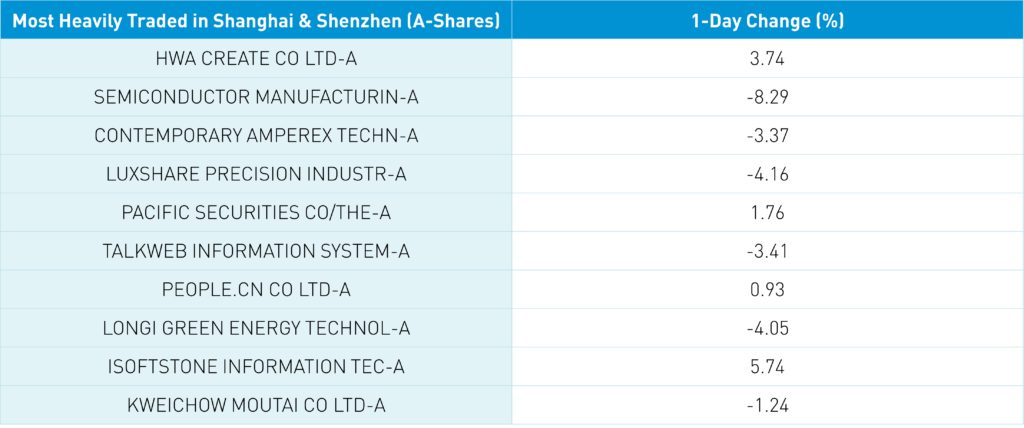

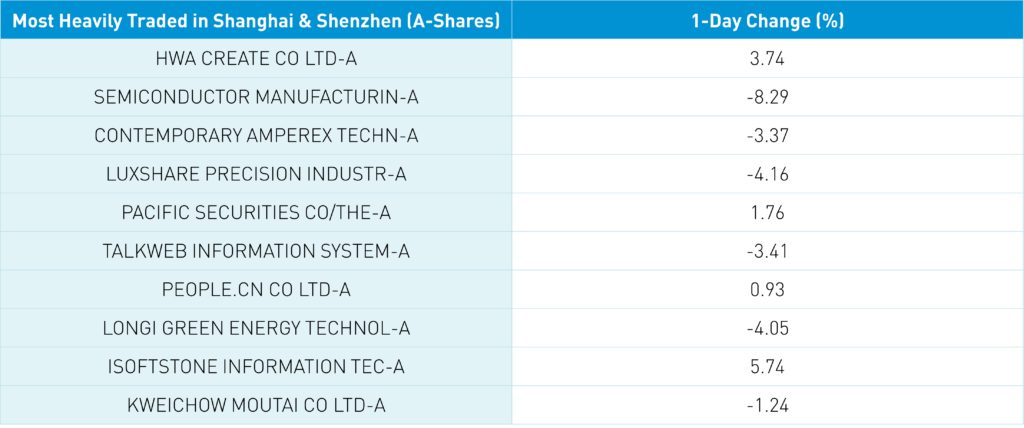

Shanghai, Shenzhen, and the STAR Board fell -1.13%, -1.76%, and -3.72%, respectively, on volume that decreased -0.46% from yesterday, which is 87% of the 1-year average. 473 stocks advanced, while 4,321 declined. The value factor fell less than the growth factor, while large caps fell less than small caps. Energy was the only positive sector, while tech -3.07%, industrials -2%, and healthcare -1.73% were the worst performers. The top sub-sectors were education, oil, and highways, while semis, computer hardware, and fine chemical industry were the worst. Northbound Stock Connect volumes were light as foreign investors sold a healthy -$965mm of Mainland stocks with CATL and BYD moderate/small net buy while Kweichow Moutai was a moderate net sell, LXJM and Longi small net sells. CNY and the Asia dollar index fell versus the US dollar. Treasury bonds were bought while copper and steel were off.

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.32 versus 7.30 yesterday

- CNY per EUR 7.84 versus 7.84 yesterday

- Yield on 10-Year Government Bond 2.63% versus 2.63% yesterday

- Yield on 10-Year China Development Bank Bond 2.77% versus 2.77% yesterday

- Copper Price -0.55% overnight

- Steel Price -0.50% overnight

—

Originally Posted September 7, 2023 – Trade Data Exceeds Expectations, Headlines Cost Apple Shareholders $100 Billion

Author Positions as of 9/7/23 are KLIP, KBA, KALL, KCNY, KFYP, KCNY, KEMQ, BZUN, HSBC, KWEB, KHYB, LI US

Charts Source: KraneShares

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.