E-mini S&P (December) / NQ (December)

S&P, yesterday’s close: Settled at 3803.25, up 113.00

NQ, yesterday’s close: Settled at 11,640.75, up 355.00

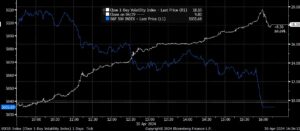

Fundamentals: U.S. equity benchmarks are again on their backfoot. Underlying strength in the U.S. Dollar was reinvigorated at the European open, marking a turning point of sentiment. Yesterday, we discussed how markets hit a brick wall of Fed hawkishness that could no longer be extrapolated and coupled with a deteriorating economic landscape, it invited an easing of financial conditions. This began last week when the U.S. Dollar slipped 4% and the U.S. 10-year yield nearly 50bps from their peaks last Wednesday. Though buyers remained on strike in the equity space through quarter-end, they stepped in with two hands upon Monday’s opening bell, driving a two-day gain of 5.6% gain in the S&P upon yesterday’s close. The domino effect is clear, and every piece fits into the puzzle. Yesterday, we noted that as of last Monday the odds of a 75bps hike at the November meeting was roughly 75%. As the U.S. Dollar and rates topped, and equities remained heavy, these odds closed in on a coin flip with a 50bps hike through Friday’s quarterly close. Yesterday’s action was very directional, the U.S. Dollar Index fell to a two-week low, and the S&P capped off its best two-day gain since March 2020. However, rates levitated from their own two-week low, and specifically the 2-year outpaced the long-end of the curve, meaning the domino effect has now begun in reverse, a re-tightening of financial conditions. As of this morning, the odds of a 75bps hike in November have climbed to 65.4% and the U.S. Dollar Index is +0.75% on the session. The structural issues in the U.K. and Europe have not disappeared. The British Pound fell more than 1% after U.K. Prime Minister Truss failed again to communicate the logistics of her fiscal frivolousness and a non-monetary ECB-EU meeting stoked added concern.

Do not miss our daily Midday Market Minute, from yesterday.

The U.S. economic calendar will have the greatest impact on which way the dominos fall. The first glimpse of September jobs this morning via the private ADP survey showed 208,000 jobs added. Services data will highlight the session with final SPGI Services PMI for September due at 8:45 am CT. The initial read showed less of a contraction than predicted at 49.2 versus 45.0, and an improvement from conditions that were deteriorating in July (47.3) and August (43.7). However, through those months, the more closely watched ISM read for Non-Manufacturing never followed, printing 56.7 and 56.9, respectively. It is expected at 56.0 today. The Prices and Employment components will be watched closely. Stronger than expected data will be seen as a major headwind to risk-assets, whereas Monday’s weaker ISM Manufacturing helped underpin strength. This all leads into Friday’s Nonfarm Payrolls report.

Technicals: After the S&P’s biggest two-day gain since March 2020, there should be some expectation that price action must digest the run technically. A consolidation here is very healthy, as long as it remains constructive. However, given the recent bearish trend, and an achievement of solid resistance associated with the 9/21 settlement and 9/22 gasps for air, we find it appropriate to dial back our more Bullish Bias to cautiously Bullish. Holding construction starts and ends with major three-star support at 3732-3741.75 in the S&P and to a lesser extent 11,358-11,375 in the NQ. However, a break below rare major four-star supports would signal a failure, in the S&P and NQ at … Click here to get our (FULL) daily reports emailed to you!

Crude Oil (November)

Yesterday’s close: Settled at 83.63, up 4.14

Fundamentals: Yesterday was another monster session for Crude Oil, and it is no surprise we are seeing a healthy consolidation ahead of today’s OPEC+ announcement and weekly EIA inventory data. Expectations have mounted for OPEC+ to cut at least 1 mbpd and as much as 2 mbpd. We began the week calling the excitement a potential ‘buy the rumor, sell the news’ event, and now anything less than 1 mbpd would almost certainly encourage heavy selling upon the headline. The White House is not happy with the cartel’s plan after the administration sold off the Strategic Petroleum Reserve to the lowest level since 1984, grandstanding for the midterm elections. At the end of the day Saudi Aramco has notched record profits this year and their ally Russia is heavily reliant on Oil revenues.

Breaking New: OPEC+ JMMC recommends a production cut of 2 mbpd.

As bullish as we are over the intermediate-to long-term, it is important to understand that many OPEC+ countries cannot even produce to their ceiling. The effective production cut really does not change much.

Expectations for today’s EIA data are +2.052 mb of Crude, -1.334 mb Gasoline, and -1.367 mb Distillates. The SPR release will have an impact on the composite results.

Technicals: We remain cautiously Bullish in Bias, but as we noted through this week, we have capitalized on this rally and therefore will let today’s news play out, looking for opportunity to develop. Price action has traded into and briefly exceeded major three-star resistance at 86.54-86.68, but it did not settle above there yesterday. Upon a reversal, we have several layers of strong support, but it is our third wave that is most crucial in holding a constructive technical landscape at … Click here to get our (FULL) daily reports emailed to you!

Gold (December) / Silver (December)

Gold, yesterday’s close: Settled at 1730.5, up 28.5

Silver, yesterday’s close: Settled at 21.099, up 0.510

Fundamentals: The reversal in Gold and Silver can be understood within the context of our S&P/NQ section, financial conditions have begun to retighten. However, markets (and the Fed) will remain very data depended. The U.S. Dollar has rebounded broadly, reinstating pressure on the commodities landscape. Additionally, rates are on the mend from their one-week slide, and this is seen as a major headwind to precious metals. Furthermore, upon the OPEC+ JMMC’s recommendation for a cut of 2 mbpd, Bonds slipped further. Crude Oil will be the tail wagging the inflation narrative at this critical inflection point between $85-90, if the U.S. Dollar remains firm, and we could see a divergence between Oil and Gold in the coming days.

Services data will highlight the session with final SPGI Services PMI for September due at 8:45 am CT. The initial read showed less of a contraction than predicted at 49.2 versus 45.0, and an improvement from conditions that were deteriorating in July (47.3) and August (43.7). However, through those months, the more closely watched ISM read for Non-Manufacturing never followed, printing 56.7 and 56.9, respectively. It is expected at 56.0 today. The Prices and Employment components will be watched closely. Stronger than expected data will be seen as a major headwind to risk-assets, whereas Monday’s weaker ISM Manufacturing helped underpin strength. This all leads into Friday’s Nonfarm Payrolls report.

Technicals: Price action is settling in for Gold but reversing more sharply for Silver. This is ok given the sharp run that began with the U.S. Dollar’s reversal last Wednesday, volatility is to be expected. In order to hold the most construction, Gold and Silver want to battle at our Pivots (detailed below), with Gold holding first key support at 1710.2-1711.2. However, we cannot see a break below rare major four-star support in each at … Click here to get our (FULL) daily reports emailed to you!

—

Originally Posted October 5, 2022 – Understanding the Domino Effect

Disclosure: Blue Line Futures

Futures trading involves substantial risk of loss and may not be suitable for all investors. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results. The information contained within is not to be construed as a recommendation of any investment product or service.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Blue Line Futures and is being posted with its permission. The views expressed in this material are solely those of the author and/or Blue Line Futures and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.