It’s here – the last FOMC meeting of 2023. While the consensus is clearly that no rate change is expected, today’s rate announcement and subsequent press conference has the potential to be quite consequential.

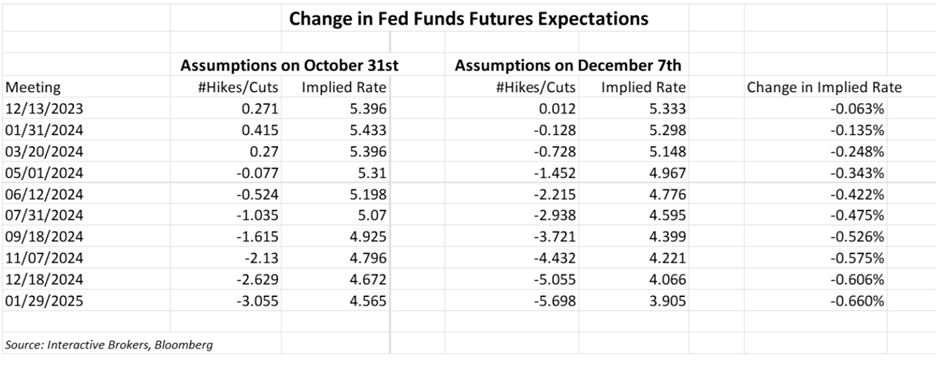

Markets have flipped from nervous to sanguine since the last FOMC meeting on November 1st, and it seems impossible to believe that the decision makers at the Federal Reserve failed to notice this change. Ahead of the prior meeting, stocks had completed their third straight month of declines and 10-year rates had been flirting with 5%. Since then, stocks have largely recouped a quarter’s worth of losses and 10-year rates are heading into the meeting at 4.15%. During that time, Fed Funds futures reflected a drastic turnabout in expectations. They switched from modest expectations for another hike, with cuts starting in June or July, and 2-3 expected during 2024. We now have essentially no likelihood of a further hike, cuts starting in March or May, and 4-5 expected during 2024.

We have questioned whether market expectations have outpaced the Fed’s intentions. We’ll know soon enough whether the FOMC confirms the aggressive cutting cycle that is currently backstopping market expectations.

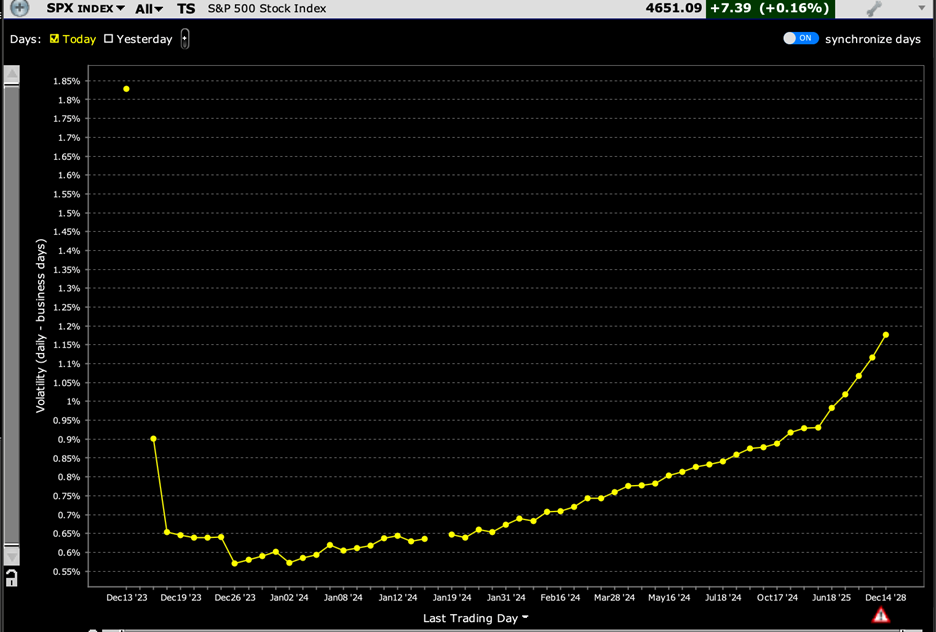

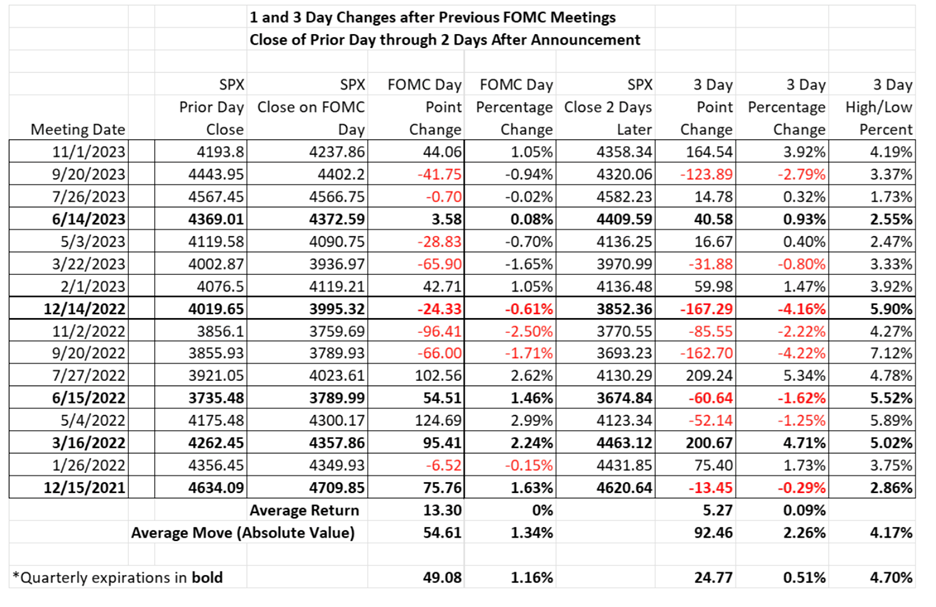

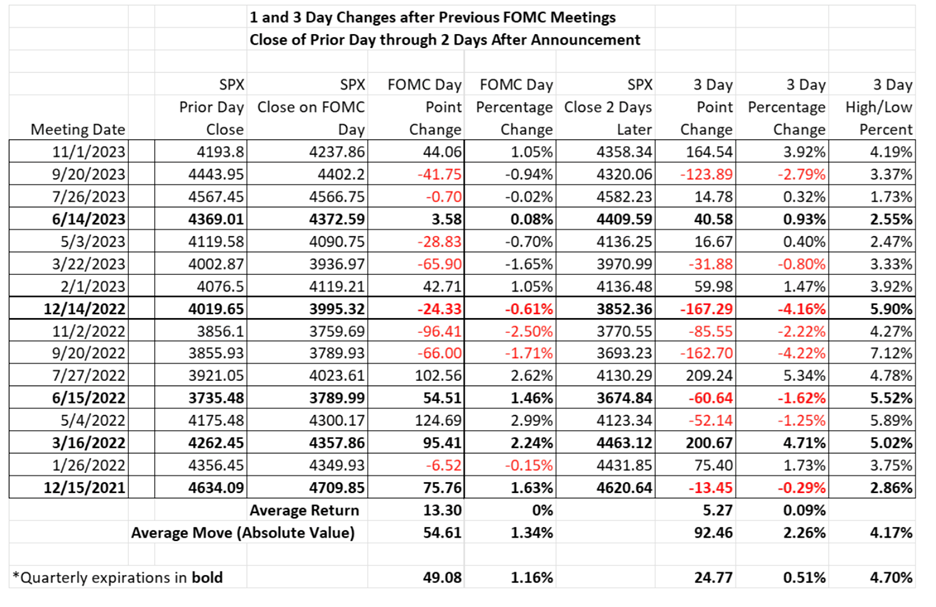

As of now, options markets are showing little concern about that prospect. Seeing VIX trade with an 11 handle yesterday confirmed the lack of demand for volatility protection from institutional investors. Looking at a more granular level, we see some respect for the idea that today’s events could bring some incremental volatility, but little outright nervousness. At-money options in SPX expiring today are pricing in a 1.8% move, but that expectation fades very quickly by Friday. (see the table at the bottom for further context about one- and three-day moves after recent FOMC meetings)

SPX Volatility Term Structure

Source: Interactive Brokers

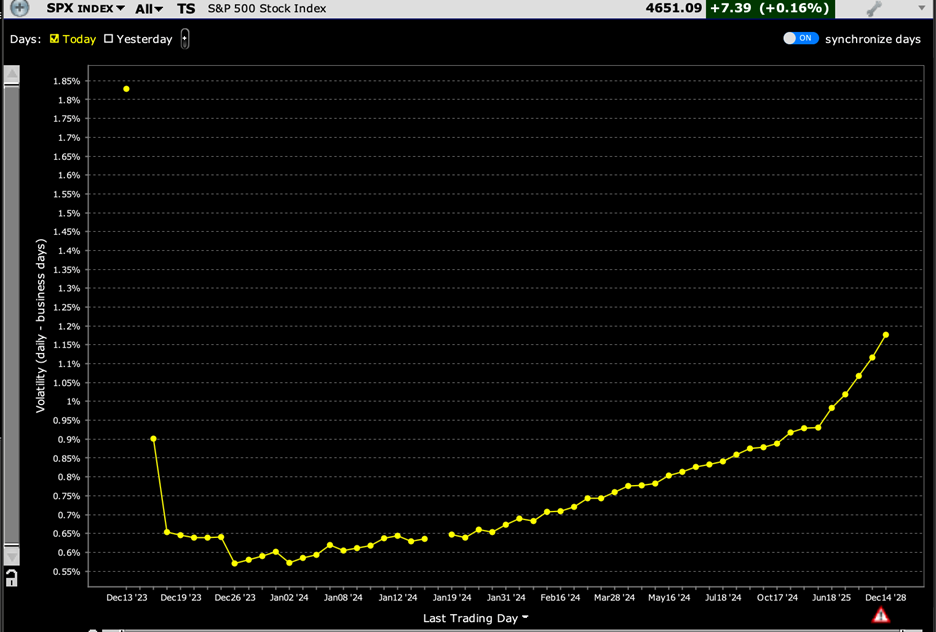

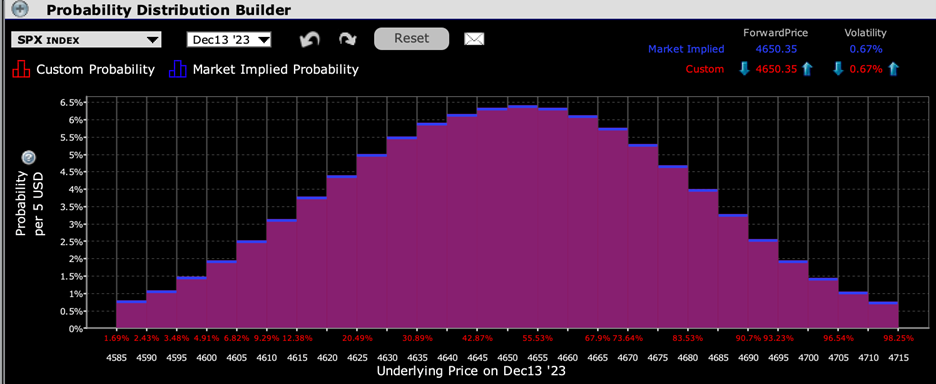

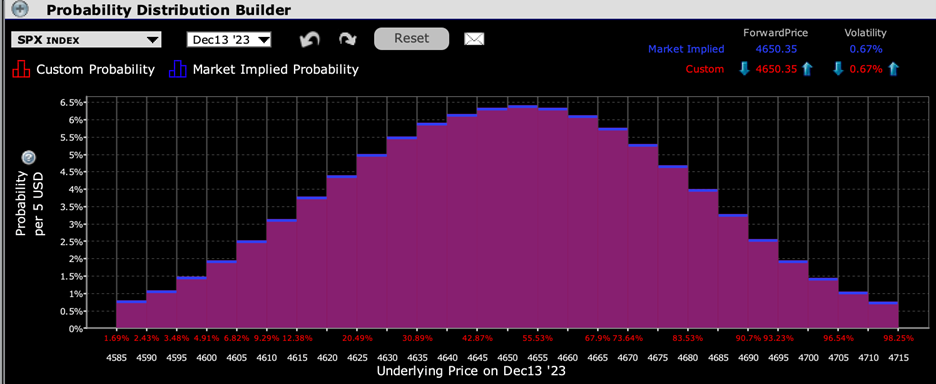

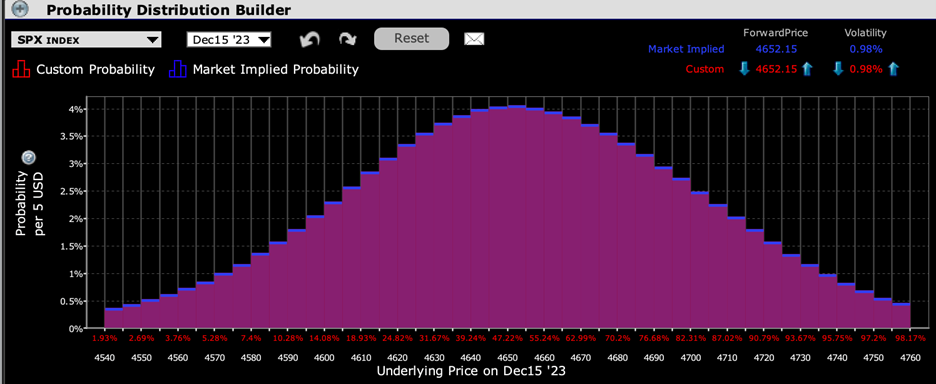

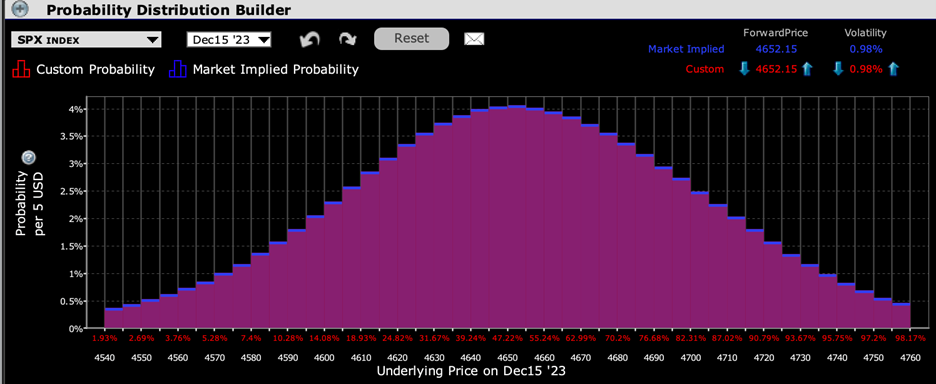

The IBKR Probability Lab shows symmetrical outcomes for SPX options expiring both today and Friday. Note that the peaks are just about at-money:

IBKR Probability Lab for SPX Options Expiring December 13th

Source: Interactive Brokers

IBKR Probability Lab for SPX Options Expiring December 15th

Source: Interactive Brokers

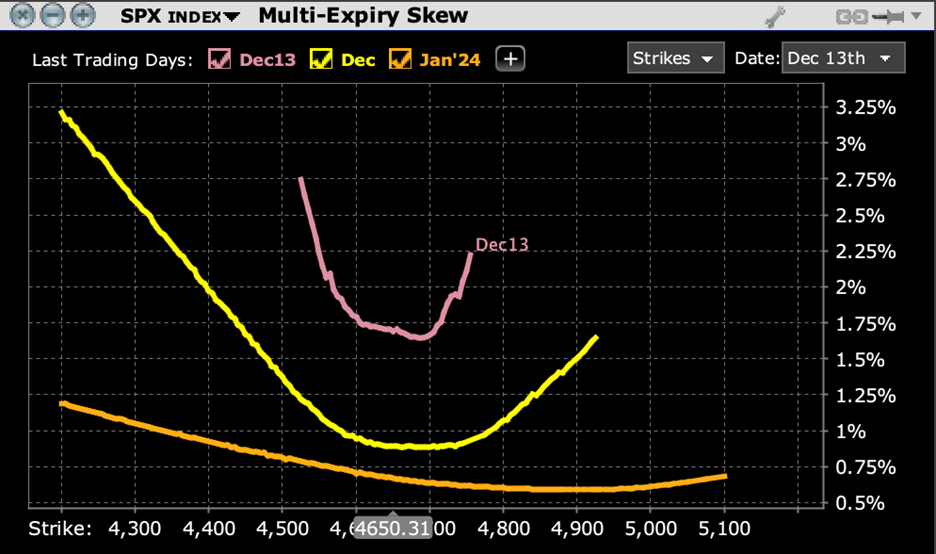

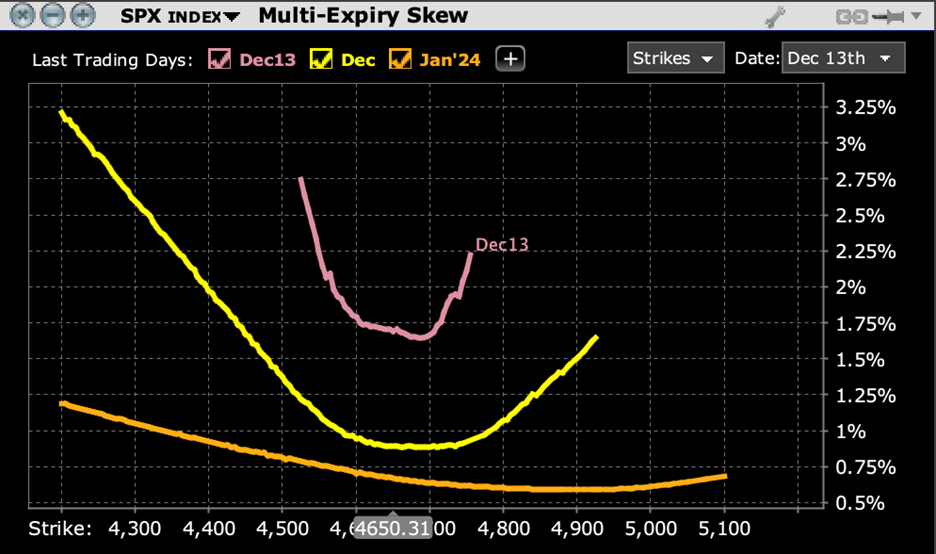

Finally, we see that skews are relatively typical, with a bias to the downside, though they are understandably quite steep in the short-term:

Volatility Skews for SPX Options Expiring December 13th (pink), December 15th (yellow), January 19th (orange)

Source: Interactive Brokers

We are coming into today’s FOMC meeting with a high level of enthusiasm and few concerns about its sustainability. SPX is at a 52-week high, accompanied by the sort of RSI readings that have indicated overbought markets – until late last month. Despite this, few traders seem concerned.

SPX, 1-Year Candles (top) with 9-Day RSI (bottom)

Source: Interactive Brokers

There is often a “secret word” or phrase that traders fixate upon during Chair Powell’s press conferences. It’s been “disinflation”, “neutral”, and most recently “balance of uncertainties.” It’s impossible know in advance what today’s trigger might be. My bets would be placed upon either “neutral”, as in a reminder that Fed has still not yet acknowledged anything other than a tightening bias; or “target” as in a reminder that while we have made excellent progress towards the Fed’s 2% target inflation rate, we’re not there yet. When might we arrive at that target and how long might it need to persist before the Fed can consider cutting?

Additionally, we will leave you with a reminder that the FOMC may set the tone for today’s press conference with the so-called “dot plot”:

The November meeting did not feature a “dot plot,” the colloquial name for the FOMC’s Summary of Economic Projections (SEP). In September, the median Fed Funds rate projection for the end of 2024 was 5.125%. That hardly squares with the 4.26% that is currently estimated by futures markets. (Though it is indeed up from last week’s 4.07%) A dot plot that falls well short of current projections could certainly spook markets, and unless Powell is willing to disavow his colleagues’ projections, he will need to spend a fair amount of the press conference explaining why the FOMC’s views are so far off the market’s.

Ask yourself, which has the greater likelihood? That the FOMC and Powell will reaffirm the market’s rosy assumptions about rate cuts, or whether they will reassert that while we have made great progress against inflation, we have not yet achieved the 2% objective, and thus it is premature to consider rate cuts until that occurs. If the former, then by all means remain sanguine about risk assets. If the latter, perhaps some risk aversion seems prudent.

Buckle up. We’ll know how things transpire soon enough. And remember, the first move is often the wrong one.

Source: Interactive Brokers

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

“sufficiently restrictive”………or the absence thereof

The markets are aggressively pricing in rate cuts to start in March-May. The ink has hardly dried on the Fed’s rate hike efforts and it’s very premature to start talking about rate cuts. I believe that rate cuts won’t come until there is some sort of a financial panic. The markets have digested this rate hike cycle pretty well and it looks like the Fed may just have achieved that illusive soft-landing.