TLDR:

The rally is too narrow. It moved up too fast. Stocks are not paying attention to macro fundamentals. Stocks have disconnected from micro fundamentals. There are just so many reasons why a rally should not have happened – and yet here we are. On the verge of a … wait for it … bull market.

A bull market is an arbitrarily defined 20% rise in a benchmark index. There have been many, many 20% moves since 1929 and there is little reason to endow the 20% with a particularly special meaning. But there is some evidence that after a rise of that magnitude, the market won’t revisit its lows.

So maybe 20% is really the amount of “healing” investor psyche needs before they can contemplate getting back into stocks?

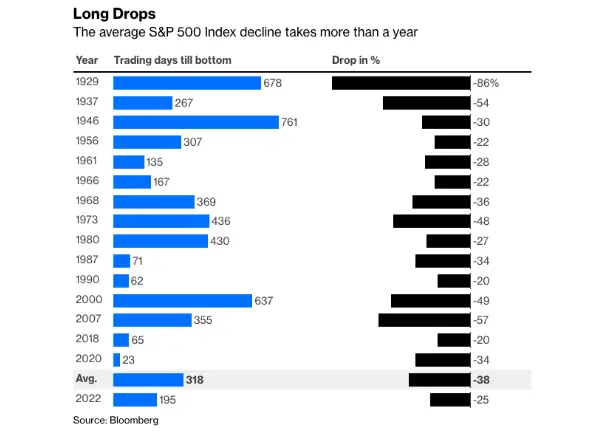

So, is this it? Has the market low been put in? The lowest point of this cycle was Oct. 12 at 3,577.03. As John Authers points out in his always excellent blog, at just shy of 200 days, this would make it one of the shorter bear markets in a – pretty long history of the S&P 500.

More to the point, he writes, at 236 days and counting since that low it would be very, very unusual for the stock market to go back to its low after levitating above it this long.

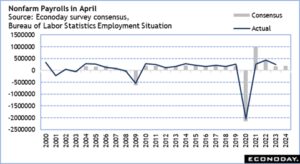

The market broke a 12-month streak of negative year-over-year returns in April. The market has been up a year after breaking the streak every time that’s happened.

The bulls can breathe a sigh of relief (if they’re long, otherwise it’s a major FOMO moment).

What stocks are doing well today?

This section is powered by Open AI connected to TOGGLE AI

Thanks for all your feedback! This section is still paused but an enhanced version is on the way (we promise)!

Aggregated Leading Indicators!

Subscribe to Pro here to receive our pre-market Leading Indicator newsletter and access all Leading Indicators online!

Learn more about the Leading Indicators in the Learn Center!

Earnings Highlight: Casey’s General Stores reports tomorrow

Historical data shows that despite beating EPS expectations, on average, CASY stock tends to see downside thereafter. Click here to dig into the data. Click here to dig into the data.

Discover how other companies could react post earnings with the help of TOGGLE’s WhatIF Earnings tool.

Asset Spotlight: Jet, set, Apple

TOGGLE observed 10 similar occasions in the past where volatility indicators for Apple reached a recent low and historically this led to a median increase in price over the next 3M, except in June 2015. Read full insight!

General Interest: The fusion race continues

For the good part of the last 80 years, governments have been the sole runners in the race to fusion.

For decades, technology was not quite there yet but governments plowed ahead, pouring billions in research to achieve the ultimate goal of free clean energy. And now, finally, that investment seems to be paying off.

Dozens of startups, armed with billions of VC dollars, are building “on the shoulders of giants“ and racing to deliver, finally, the first commercially viable fusion solution.

Read the full story here on notboring.co.

—

Originally Posted June 6, 2023 – Why stocks won’t retest the lows

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.