MSFT Option Straddle Performance: Analyzing Historical Trends

As an options trader or investor, understanding the historical performance of option strategies can provide valuable insights for making informed decisions. Today, we will explore a powerful tool that tracks the performance of at-the-money (ATM) option straddles throughout the days of the week. By examining the data of Microsoft (MSFT) over the past 12 weeks, we can uncover intriguing trends regarding the pricing and profitability of option straddles during specific periods.

Understanding the Option Straddle:

Before diving into the analysis, let’s briefly recap what an option straddle is. An option straddle involves buying both a call option and a put option with the same strike price and expiration date. The strategy profits from significant price movements in either direction, regardless of whether the market goes up or down. By analyzing the performance of option straddles throughout the week, we can gain insights into potential patterns and identify advantageous trading periods.

Analyzing the Data:

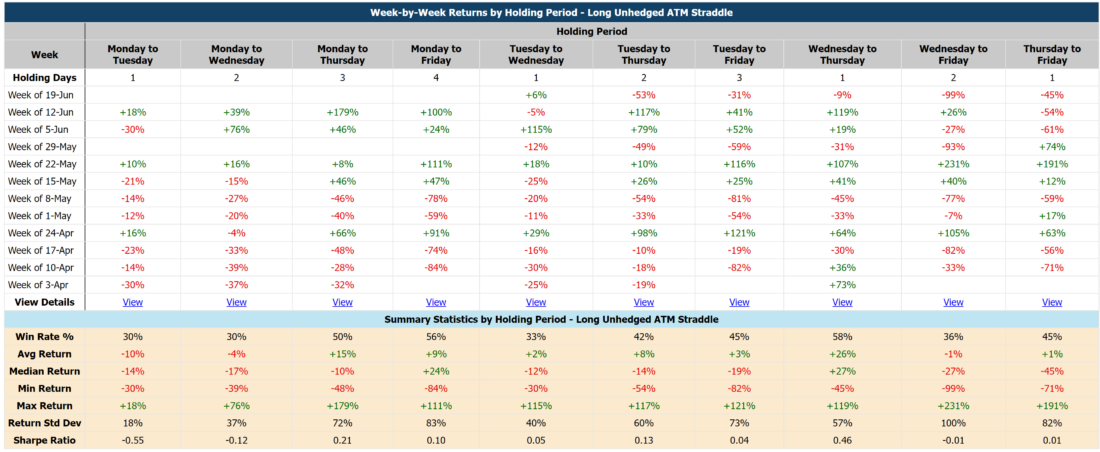

Using MarketChameleon’s tracking tool, we examined the performance of MSFT option straddles during different days of the week over the past 12 weeks. The data revealed some interesting findings:

MSFT At-the-Money Straddle Performance History

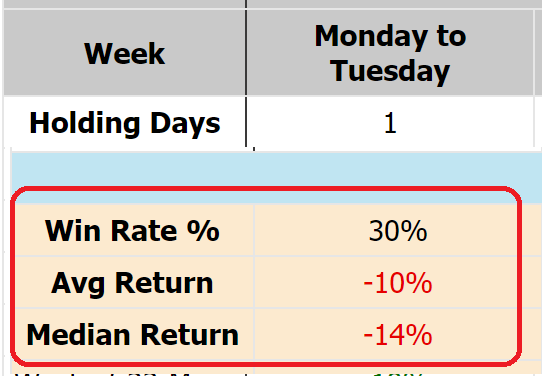

Monday to Tuesday Performance:

- The option straddle from Monday 10 am to Tuesday close tended to lose value approximately 70% of the time.

- The average return of holding the ATM straddle during this period was -10%, with a median return of -14%.

- During this period, the short side of the straddle performed better.

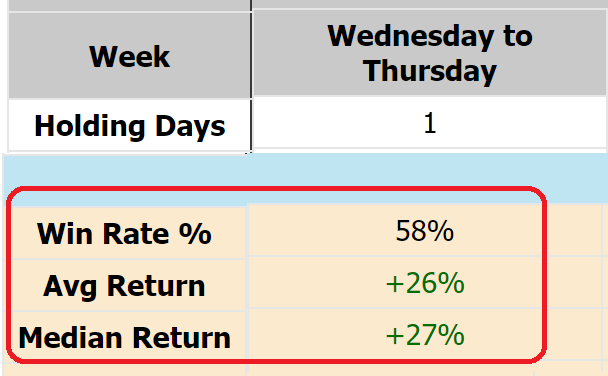

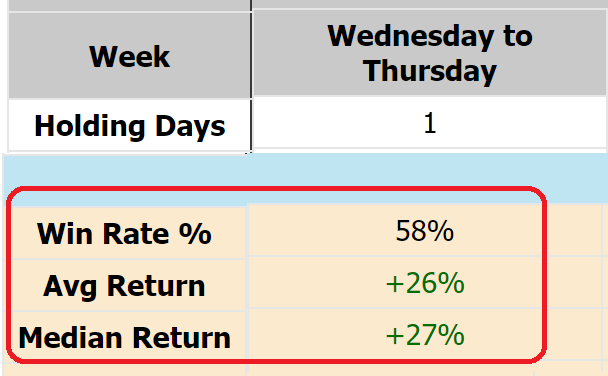

Wednesday to Thursday Performance:

- The best period to hold the option straddle in MSFT was from Wednesday to Thursday.

- The option straddle gained value around 58% of the time, with an average gain of 26% and a median return of 27%.

- This period displayed a more consistent positive performance compared to other days of the week.

Insights and Implications:

Based on the analysis, it is clear that the performance of MSFT option straddles varies significantly throughout the week. These findings provide several insights and potential implications for traders:

- The data suggests that initiating an option straddle on Monday could be riskier, as the straddle tended to lose value more often during this period. On the other hand, entering a straddle on Wednesday and exiting on Thursday provided a higher probability of positive returns.

- Consider Other Factors: While historical data is valuable, it is essential to consider other factors such as market conditions, news events, and volatility levels when making trading decisions. These additional factors can influence the performance of option straddles and should be taken into account.

Conclusion:

By utilizing MarketChameleon’s historical tracking tool, we uncovered valuable insights into the performance of MSFT option straddles throughout the days of the week. The data highlighted the tendency for option straddles to lose value more often from Monday to Tuesday, while Wednesdays to Thursdays proved to be the most favorable period for holding option straddles in MSFT. Armed with this knowledge, traders can make more informed decisions regarding their option straddle strategies.

Remember, historical performance is not indicative of future results, and it is always important to conduct thorough analysis and consider other market factors before executing any trading strategy

—

Originally Posted June 30, 2023 – A Historical Analysis of MSFT Option Straddles for Strategic Traders

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options (with multiple legs)

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by clicking the link below. Multiple leg strategies, including spreads, will incur multiple transaction costs. "Characteristics and Risks of Standardized Options"

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.