With Apple Inc. (AAPL) earnings released on February 1st, options traders are keenly focused on the next moves of AAPL options. The post-earnings period is crucial, as it typically involves a repricing of options to reflect the reduced uncertainty following the earnings announcement.

A central question for traders is how quickly and to what extent the implied volatility (IV) will decrease. While the future remains uncertain, historical data can offer valuable insights.

Historical IV Trends Post Earnings

Utilizing MarketChameleon’s tool that meticulously tracks past implied volatility trends post-earnings, we gain a clearer understanding of AAPL’s IV behavior.

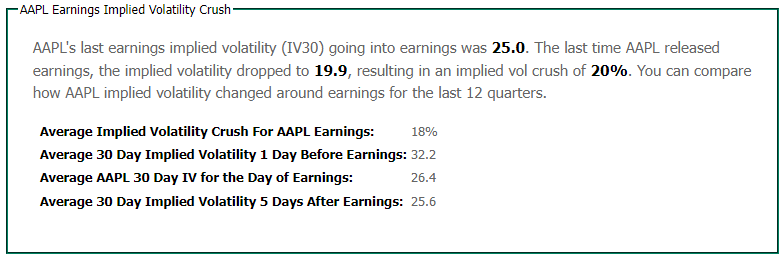

AAPL Earnings Implied Volatility Crush Stats

According to the summary table, on average, implied volatility experiences a significant drop from 32.2 just before earnings to 26.4 by the end of the next trading day—a decline of approximately 18%.

This initial drop is notable, as it signifies the market’s adjustment to the newly released earnings information.

Continued Decline in IV

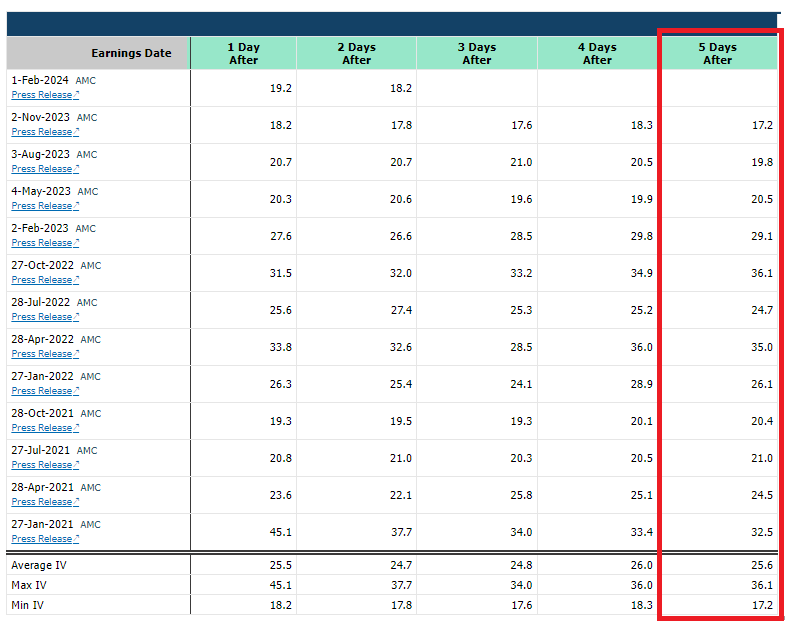

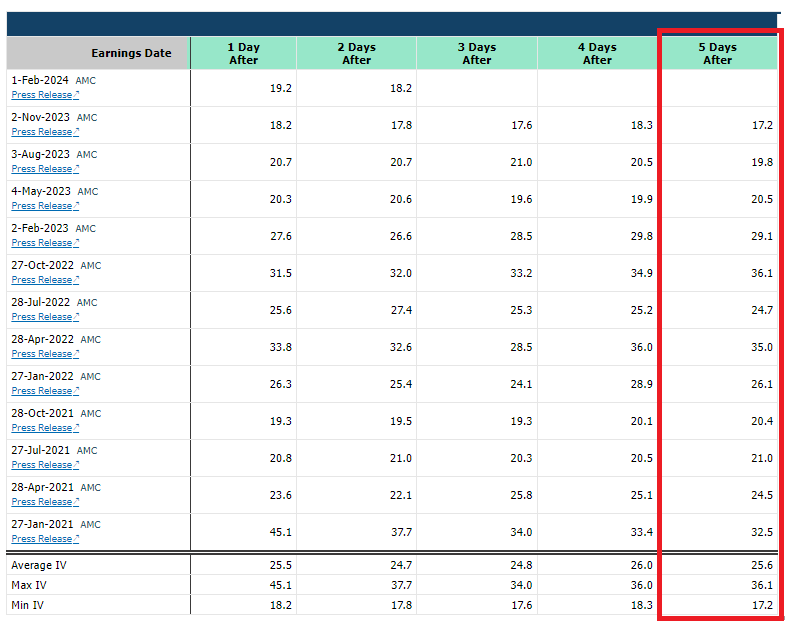

Extending the observation to five days post-earnings, the data reveals that the decline in IV doesn’t halt but rather continues, albeit at a slower pace. On average, IV further decreases to 25.6, marking an additional 3% reduction.

This trend underscores the gradual stabilization of market sentiment and the assimilation of earnings information into AAPL’s stock price and options.

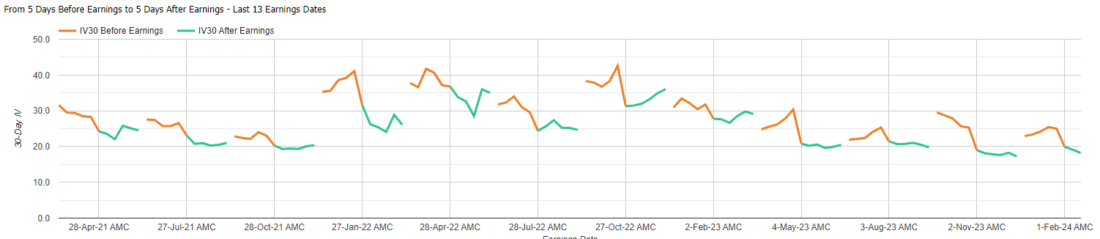

IV Trend Analysis Across Earnings

A closer examination of the IV trends from five days before to five days after earnings over the last five releases unveils a pattern of decreasing IV levels from one earnings announcement to the next.

APPL IV Chart 5 Days Before and 5 Days After Earnings

The five-day post-earnings IV has varied significantly, ranging from 36.1 to 17.2.

Source: Marketchameleon

This wide range not only highlights the inherent risk and variability associated with options trading but also emphasizes the importance of considering historical volatility trends in strategic decision-making.

Conclusion

Historically, AAPL has exhibited a tendency for a continued downward trend in implied volatility following earnings announcements, with an average additional drop of 3% over a five-day period. While historical data cannot guarantee future outcomes, it serves as a foundational tool for traders.

By leveraging these historical IV trends and ranges, traders can better strategize their options trading and manage risk with a more informed approach.

In the dynamic and often unpredictable world of options trading, such insights are invaluable for navigating post-earnings movements in AAPL options.

—

Originally Posted February 6, 2024 – AAPL Post Earnings IV Trends: A Historical Perspective

NOTE: Stock and option trading involves risk that may not be suitable for all investors. Examples contained within this report are simulated And may have limitations. Average returns and occurrences are calculated from snapshots of market mid-point prices And were Not actually executed, so they do not reflect actual trades, fees, or execution costs. This report is for informational purposes only, and is not intended to be a recommendation to buy or sell any security. Neither Market Chameleon nor any other party makes warranties regarding results from its usage. Past performance does not guarantee future results. Please consult a financial advisor before executing any trades. You can read more about option risks and characteristics at theocc.com.

The information is provided for informational purposes only and should not be construed as investment advice. All stock price information is provided and transmitted as received from independent third-party data sources. The Information should only be used as a starting point for doing additional independent research in order to allow you to form your own opinion regarding investments and trading strategies. The Company does not guarantee the accuracy, completeness or timeliness of the Information.

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.