With AAPL’s stock having recently experienced notable declines, our attention shifts towards the options skew markets. Through examining the options skew, we seek to uncover insights into how traders might be responding to these declines and gauging their sentiments.

AAPL’s Recent Performance

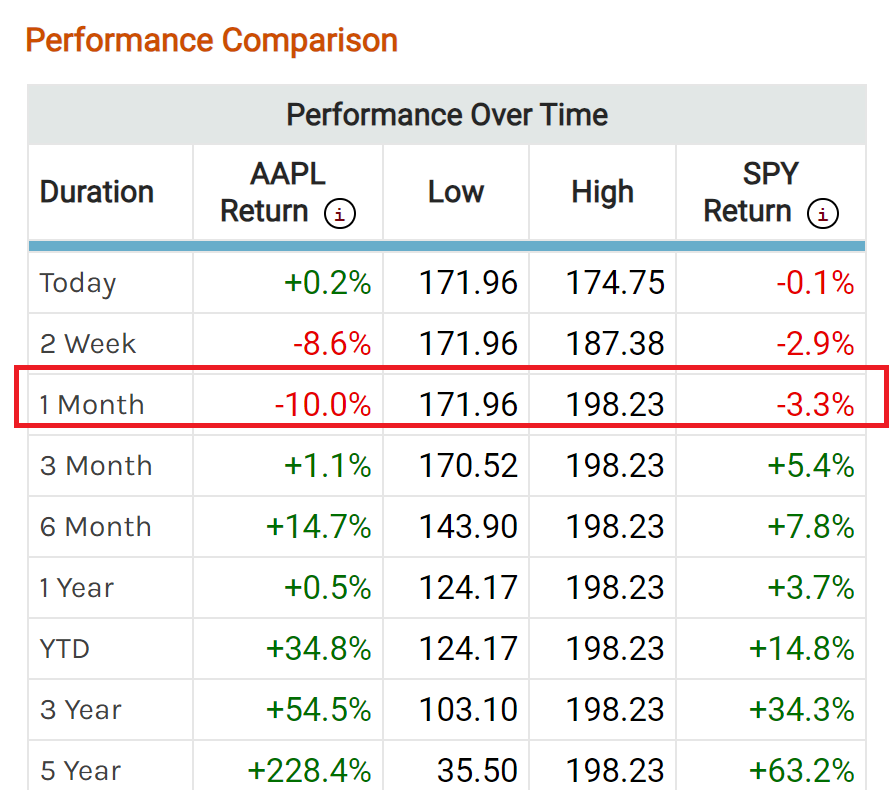

AAPL’s recent performance serves as a backdrop for our investigation. With a decline of 10% in just a month, AAPL has diverged from the broader market’s more modest 3.3% fall during the same period. Given AAPL’s recent performance, we turn to the options markets skew to gain insights into how traders maybe feeling about the stock’s outlook. This will help us understand how traders are pricing bearish puts in comparison to bullish calls.

Measuring AAPL Option Skew: The Risk Reversal Strategy Benchmark

AAPL Risk Reversal Strategy Benchmark

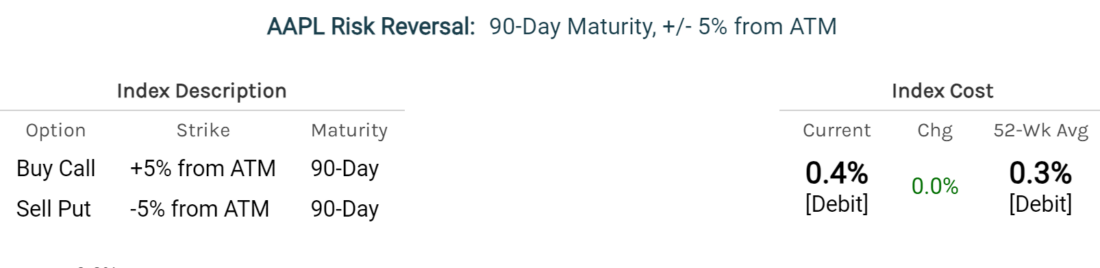

To understand option skew, we adopt an approach that compares the premium of an OTM put option, positioned 5% below the at-the-money (ATM) strike, with the premium of an OTM call option, placed 5% above the ATM strike. Our focus is on the 3-month option (90 Days), which offers a meaningful timeframe for analysis.

Consider a trading strategy that involves purchasing a call option while simultaneously selling a put option – a strategy known as a risk reversal. By comparing the premiums of these two options, we can infer the market’s sentiment toward bullish and bearish positions.

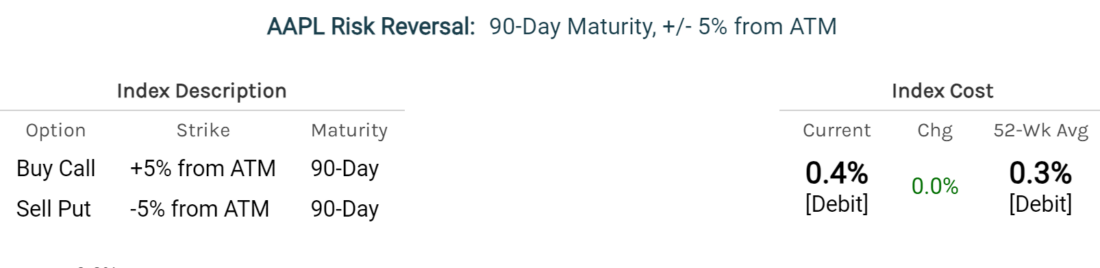

If the net result of this comparison is a credit, it implies a relatively higher demand for bearish puts, indicating potential downside concerns. Conversely, a net debit suggests a stronger inclination towards bullish calls, potentially signifying optimism in the market. In AAPL’s context, the current net debit stands at 0.4%, with a rising trend (as you can see from the chart below), indicating a growing preference for bullish calls.

Risk Reversal Benchamark Chart: A Rising Trend Towards Bullish Calls

Importantly, this shift doesn’t necessarily denote a straightforward bullish perspective. It’s possible that the rise reflects a heightened demand for upside calls, which could serve as a hedge for short positions. Moreover, traders might be strategically employing bullish options strategies as substitutes for direct stock investments, contributing to increased demand for bullish calls.

Conclusion

While AAPL’s share prices have experienced a notable decline, significantly underperforming the market, an interesting contrast emerges from the options markets. Despite this decline, the options markets aren’t indicating a continuation of bearish sentiment. Instead, they seem to be positioning prices in a way that suggests a potential rebound on the upside. This intriguing dynamic highlights how options traders perceive a possible turnaround, offering a distinct perspective amidst the backdrop of recent market performance.

—

Originally Posted August 18, 2023 – AAPL’s Option Skew: Traders’ Sentiments in the Face of Recent Price Movements

Disclaimer

The information provided in this blog post is intended for informational and educational purposes only. It is not intended to be construed as financial advice or a recommendation to engage in any trading or investment activities. The content presented here does not consider individual financial situations, risk tolerances, or investment goals, and it should not be used as a substitute for professional financial advice.

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.