With just two weeks to earnings, we turned to the marketchameleon opportuntiy alert sytem to help identify potentially lucrative AAPL option spreads.

The system identified the following pre-earnings calendar spread that looks compelling for its limited risk, attractive risk/reward and potential trading edge.

Source: Marketchameleon

The AAPL Pre-Earnings Option Spread Explained

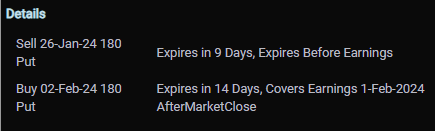

This calendar put spread involves 2 option legs.

Selling the 26-Jan-24 180 Put: This put option expires right before AAPL’s earnings announcement.

Buying the 02-Feb-24 180 Put: This put option expires post the earnings date, covering the crucial announcement on 1-Feb-2024.

As of this alert, the total setup would cost a debit of $1.35.

The core rationale behind this strategy lies in the behavior of implied volatility as earnings approach.

Options encompassing the earnings period typically experience a surge in implied volatility as the date draws near. In contrast, options expiring before the earnings date generally exhibit less volatility. By selling the less volatile, pre-earnings options, you can effectively offset some of the costs associated with this strategy, capitalizing on the differing volatility patterns.

What Needs To Happen?

1. Stock Closes At $180 on Jan 26

Your ideal scenario involves AAPL’s stock price drifting to $180 by the 26-Jan-2024 expiration. This is crucial for two reasons: it renders the option you sold worthless while placing the one you bought at an optimal position for maximized time premium.

2. Increase in Implied Volatility (IV)

A critical aspect of this strategy hinges on the behavior of implied volatility (IV). As we edge closer to AAPL’s earnings date, it’s commonly observed that IV tends to increase. This anticipated rise in IV is particularly beneficial for the longer-dated option you hold, which won’t expire on 26 Jan.

Since the longer-dated option you hold won’t expire on 26 Jan, an increase in its implied volatility (IV) would be beneficial. This rise in IV would enhance the value of your option, playing a pivotal role in the profitability of this strategy.

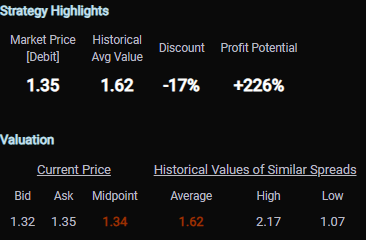

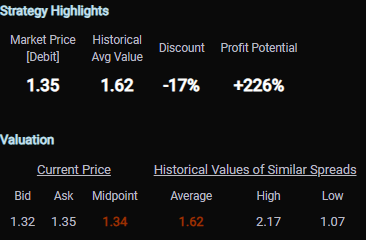

Here Are The Strategy Highlights

Source: Marketchameleon

How Much Can You Make?

Potential +226%

Calculating potential profits of a calendar spread can be tricky since it hinges on AAPL’s IV at the time of expiration. To estimate a potential return, we’ve calibrated our options profit calculator to focus on the January 26 expiration, while also assuming that the IV for the non-expiring option aligns with its historical averages around AAPL’s earnings.

Our calculations indicate that if AAPL hits the target price of $180 and the IV aligns with its average levels seen in past earnings periods, this spread could potentially yield a return of up to +226%.

What Much Can You Lose?

Potenial Loss of $1.35

Your potential loss is the initial cost of $1.35 debit, assuming no unexpected exercise or assignment occurs.

Is There A Theoretical Trading Edge?

Potential Undervaluation

In trading, particularly with options, identifying a theoretical edge can be as important as the strategy itself. It’s about finding that additional leverage or cushion that sets a good trade apart.

Our analysis, grounded in historical data, suggests that the average value of this spread under similar conditions is typically around $1.62. This figure implies that the current market is offering this spread at a -17% discount, a significant deviation from the norm. The historical price range for such spreads has varied between $2.17 and $1.07, placing our current pricing towards the lower end of this spectrum.

Conclusion

The AAPL calendar spread appears to be an attractive opportuntiy, if you have a slighlty negative outlook and expect implied volatility to increase as we get closer to AAPL earnings. It presents an enticing potential return for limited risk and appears to have a historical trading edge using a valuation model appraoch.

However, it is important to remember that while historical data can provide valuable insights, it does not guarantee future results.

—

Originally Posted January 11, 2024 – As AAPL Earnings Approaches, We Found A Calendar Spread Worth A Look

NOTE: Stock and option trading involves risk that may not be suitable for all investors. Examples contained within this report are simulated And may have limitations. Average returns and occurrences are calculated from snapshots of market mid-point prices And were Not actually executed, so they do not reflect actual trades, fees, or execution costs. This report is for informational purposes only, and is not intended to be a recommendation to buy or sell any security. Neither Market Chameleon nor any other party makes warranties regarding results from its usage. Past performance does not guarantee future results. Please consult a financial advisor before executing any trades. You can read more about option risks and characteristics at theocc.com.

The information is provided for informational purposes only and should not be construed as investment advice. All stock price information is provided and transmitted as received from independent third-party data sources. The Information should only be used as a starting point for doing additional independent research in order to allow you to form your own opinion regarding investments and trading strategies. The Company does not guarantee the accuracy, completeness or timeliness of the Information.

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options (with multiple legs)

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by clicking the link below. Multiple leg strategies, including spreads, will incur multiple transaction costs. "Characteristics and Risks of Standardized Options"

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.