Yesterday was a wild one, with the S&P 500 (SPX) dropping -1.38%, marking its worst day since April 25th. For better or worse, the -2.21% drop in the Nasdaq 100 (NDX) was exceeded as recently as July 20th, however. The Cboe Volatility Index (VIX) awakened from its recent slumber, jumping from 13.93 to 16.09, and bond yields rose across the yield curve. As of this morning, yesterday’s moves hardly seem like a fluke, with all those stocks continuing to fall, and volatility and yields continuing to rise.

Three data releases coming between this afternoon’s close and tomorrow morning’s open have the potential to either reverse or exacerbate the recent swings. After the close today, we expect to hear earnings reports from Apple (AAPL) and Amazon (AMZN), with July’s Nonfarm Payrolls and Unemployment reports arriving before tomorrow’s open. The payrolls report is usually the most closely watched among the gamut of economic reports, while AAPL and AMZN are the US companies with the largest and third-largest market capitalizations. Those two stocks represent a combined 10.5% of SPX and 16.75% of NDX, with AAPL alone representing about 2/3 of those values.

The consensus estimate for Nonfarm Payrolls is an increase of 200,000 jobs, slightly below June’s 209,000, while the Unemployment Rate is expected to be an unchanged 3.6%. Quite frankly, it’s difficult to discern what the market wants if those numbers diverge considerably from expectations. Too strong, and we can worry about the Fed keeping a vigilant stance about rates; too weak, and recession worries can come to the fore. Normally, we could take a look at some basic measures for options expiring tomorrow about probability, implied volatility, and skew to see how the options market is pricing in the various outcomes. But it is impossible to separate out the potential effect of this afternoon’s earnings from tomorrow’s economic reports, so we will need to look at them collectively.

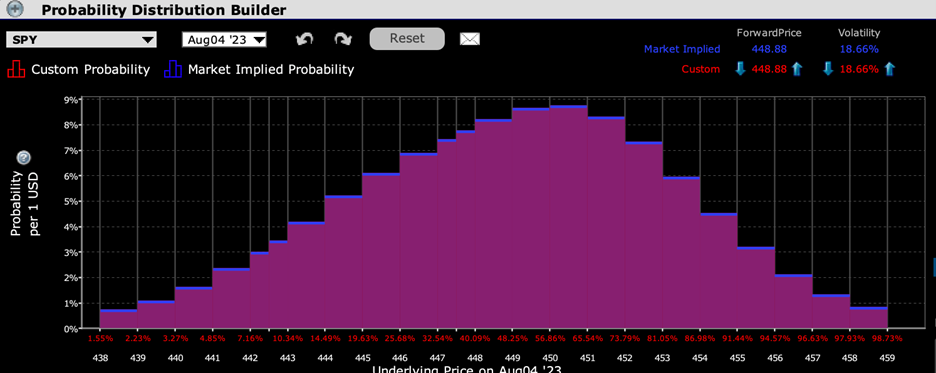

At present, options traders still maintain their generally bullish footing on short-term options. The IBKR Probability Lab for SPY shows a peak in the 450-451 range, above the current price of $448.88:

IBKR Probability Lab for SPY Options Expiring August 4th, 2023

Source: Interactive Brokers

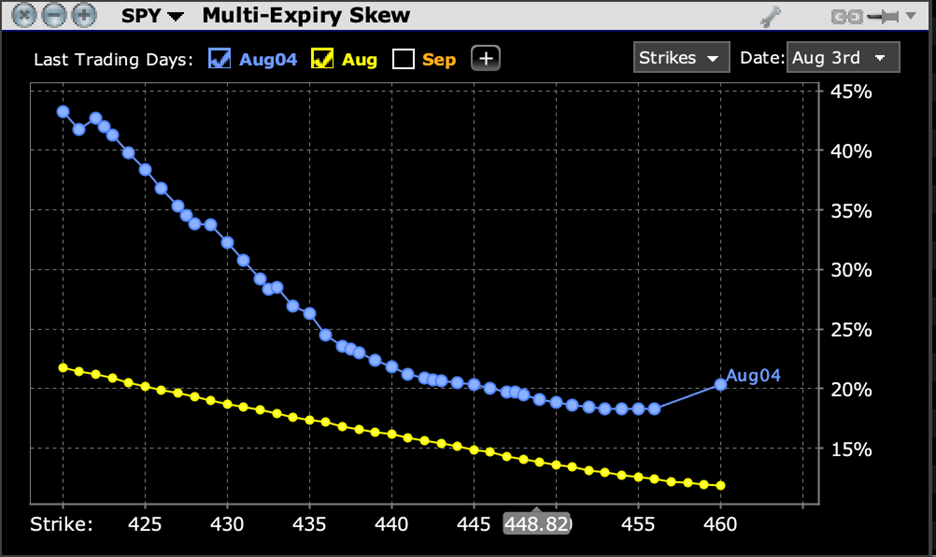

Although the downside skew for SPY options expiring tomorrow is quite steep, especially when compared with the relatively linear skew for monthly options expiring on August 18th, at-money implied volatility is a fairly robust 20%, which translates into about a 1.25% daily expected move:

SPY Multi-Expiry Skew for Options Expiring August 4th (blue), and August 18th (yellow)

Source: Interactive Brokers

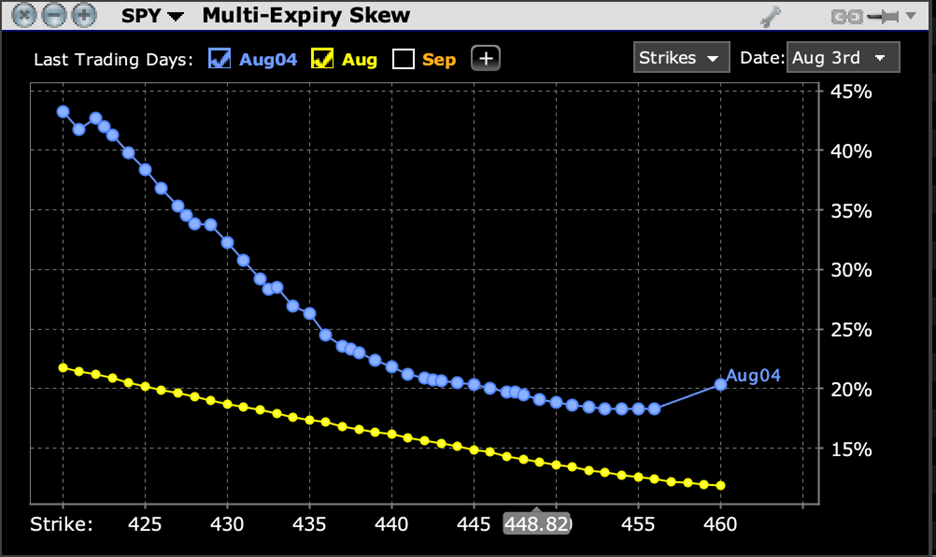

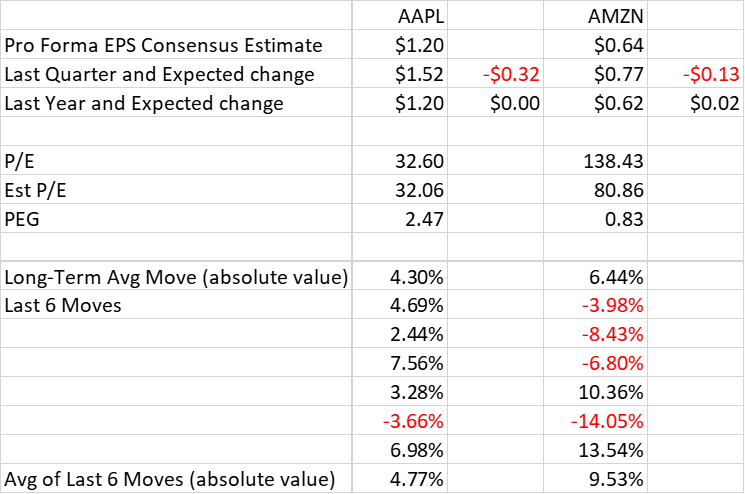

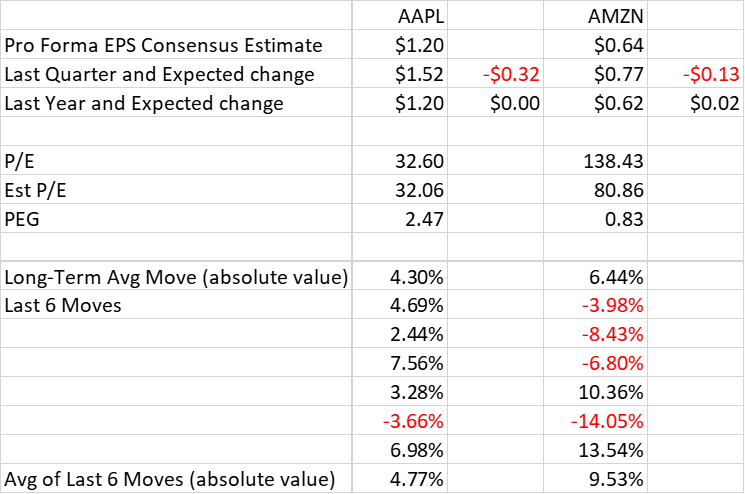

Looking at the two key individual options, here are some key metrics to keep in mind for both AAPL and AMZN:

Source: Bloomberg, Interactive Brokers

It is quite obvious that AMZN tends to be much more volatile than AAPL after earnings. It also carries a much higher Price/Earnings ratio, though there are also expectations for much faster growth shown in its P/E based upon estimated earnings. As a result, AMZN has a surprisingly low PEG ratio, especially in comparison to the amount that investors are paying for a relatively slow-growing AAPL.

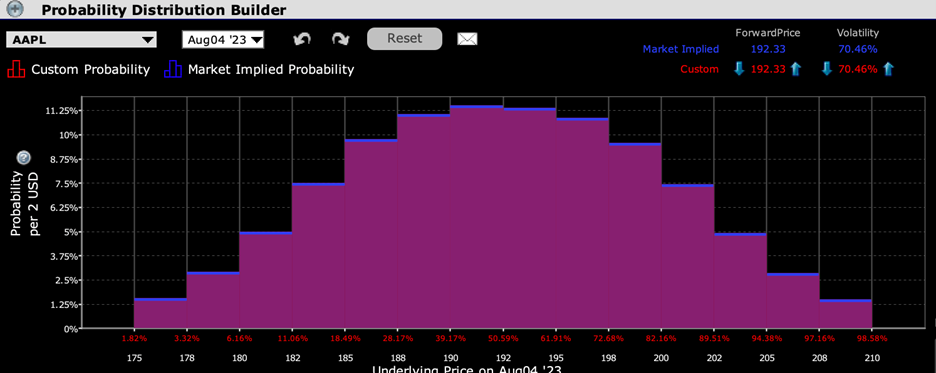

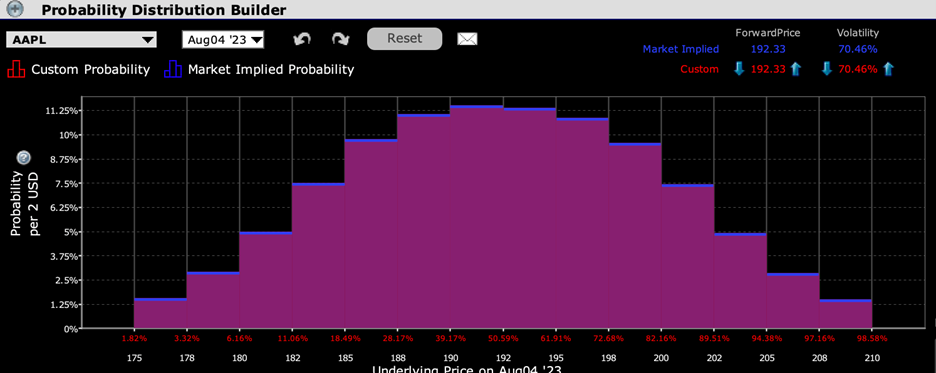

In AAPL’s case, the peak probability is displayed in at-money options:

IBKR Probability Lab for AAPL Options Expiring August 4th, 2023

Source: Interactive Brokers

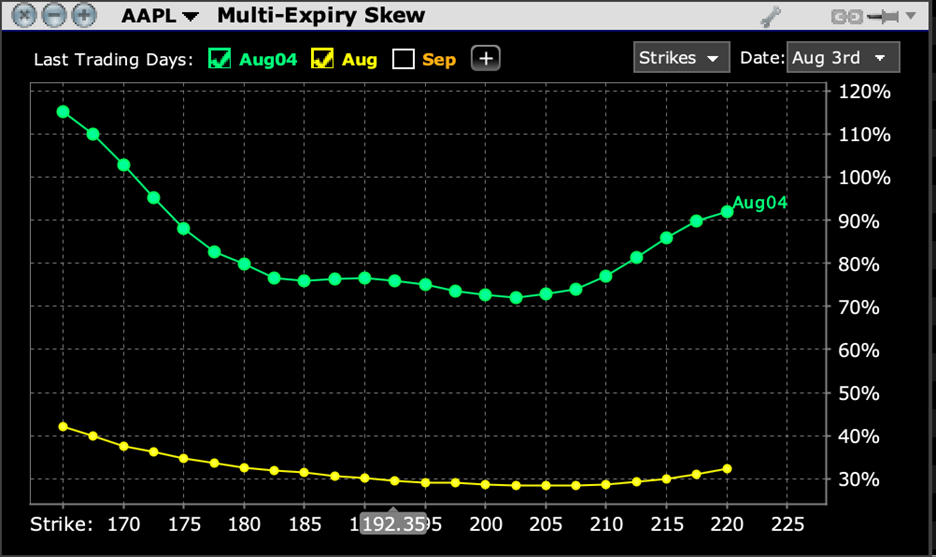

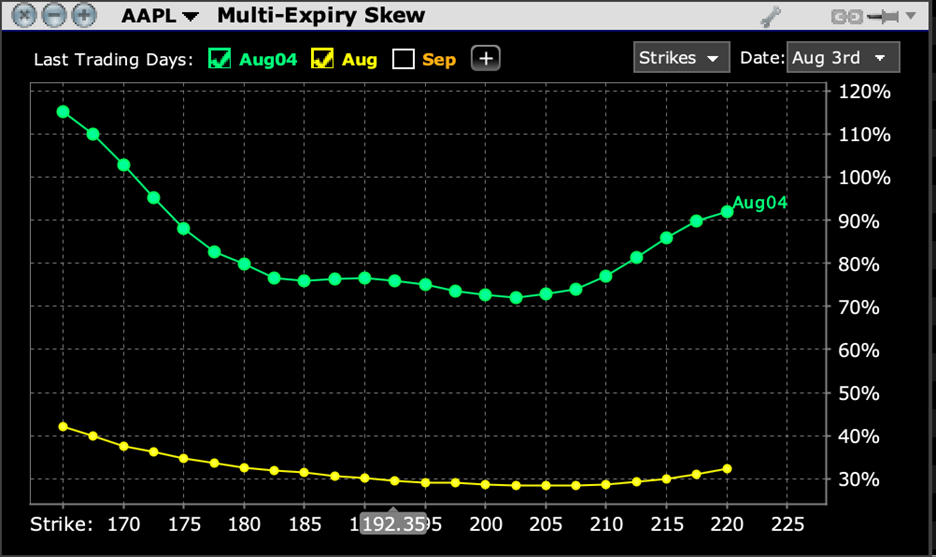

Meanwhile, implied volatilities for options within a +/- 6% range around the current price have implied volatilities in the 75-80% range, implying nearly 5% daily moves:

AAPL Multi-Expiry Skew for Options Expiring August 4th (blue), and August 18th (yellow)

Source: Interactive Brokers

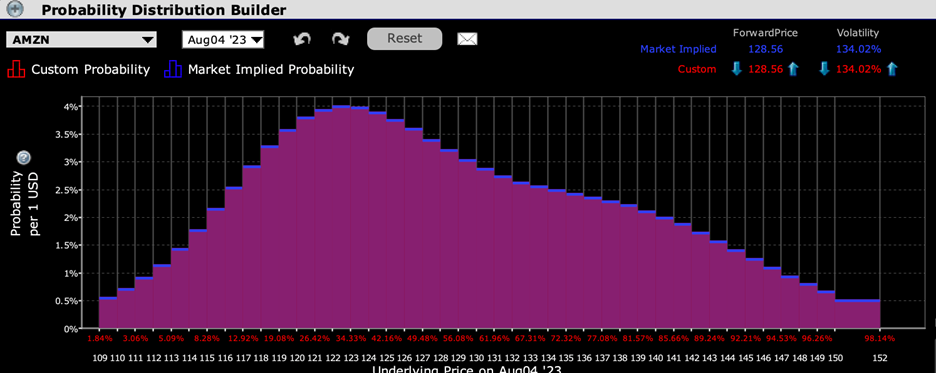

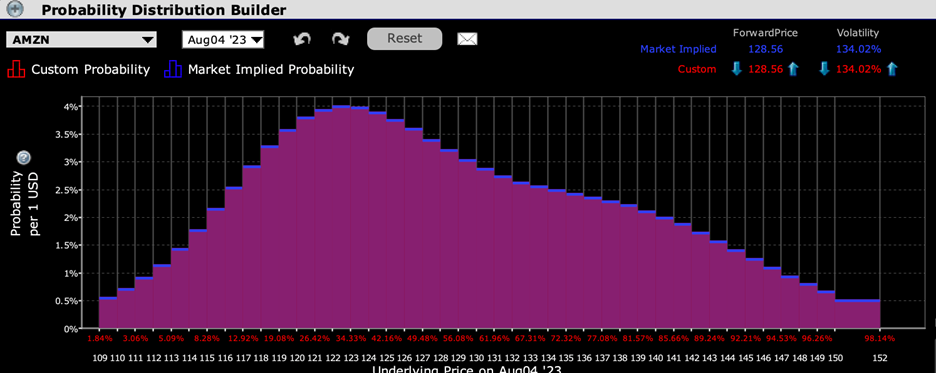

On the other hand, AMZN options show considerably more risk aversion, which is not surprising because the stock has fallen after each of its last three reports and 4 of the last 6. The peak is in the 122-123 range, which is about 5% below the current stock price:

IBKR Probability Lab for AMZN Options Expiring August 4th, 2023

Source: Interactive Brokers

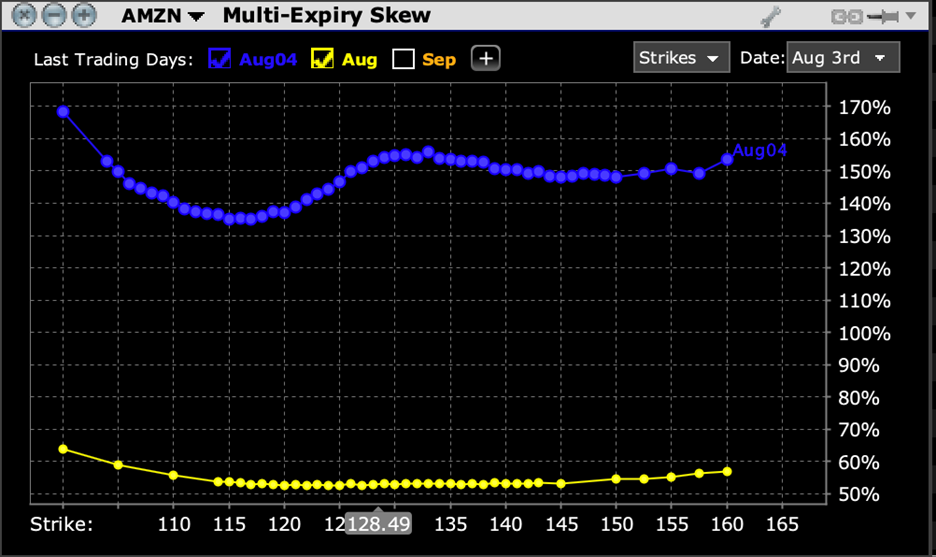

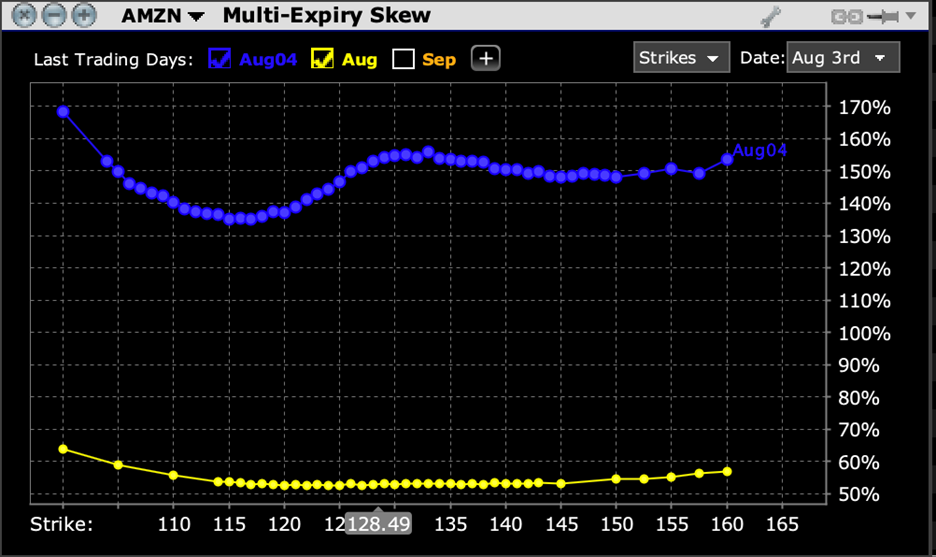

That said, the skew for this week’s expiration is relatively flat, with a notable dip in implied volatility around the $115 range. The 150% implied volatility for at-money options indicates expectations for a daily move of about 9%, well above the average post-earnings move for AMZN:

AMZN Multi-Expiry Skew for Options Expiring August 4th (blue), and August 18th (yellow)

Earlier during this earnings season, just before Microsoft (MSFT), Alphabet (GOOG, GOOGL) and Meta Platforms (META) reported, we proposed the following:

Although it is still too early in this earnings season to draw definitive conclusions, my early hypothesis is that better performing stocks have higher earnings day hurdles than relative underperformers. We wrote about this on Thursday, when high-flying Tesla (TSLA), Netflix (NFLX) and Taiwan Semiconductor (TSM) all beat their consensus expectations for earnings per share (EPS) but fell sharply nonetheless when investors focused on the totality of their reports. Meanwhile, Goldman Sachs (GS) missed its number and has rallied ever since, and Zion’s Bancorp (ZION) rose 10% after a 2 cent beat. If this pattern holds, it raises the stakes for the remaining mega-cap tech companies that have powered major US indices.

In general, I still believe that this hypothesis holds water, even if META proved to be a huge exception. Although both are off their recent highs, AAPL is up about 48% this year and AMZN is up 53% year-to-date. There is a reasonable likelihood that the market could react similarly to MSFT, TSLA, NFLX, etc., where EPS beat estimates, but traders focused on other items. Handset sales for AAPL and cloud computing for AMZN are but two possibilities.

By the way, although the common narrative is that earnings season has been generally successful, a quick glance at major indices indicate otherwise. Earnings season is assumed to have started on July 14th, when JPMorgan (JPM) and other large banks reported. Measuring from the close of July 13th through yesterday’s close, SPX had risen from 4,510.04 to 4,513.39. That’s a rise of a mere 0.07%. Yet that is better than NDX’s performance over that time. That index fell from 15,571.98 to 15,370.74, a decline of 1.29%. We’ll know soon enough whether tomorrow’s numbers improve the earnings narrative or not.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Nice summary. Very informative

Thank you for commenting! We hope you’ll continue to follow Traders’ Insight.